On November 1, 2020, Company S, a US GAAP preparer, was acquired by Parent. Parent reports under IFRS Accounting Standards. For purposes of Parent group reporting, Company S’s assets and liabilities were converted to IFRS Accounting Standards and fair valued in the purchase accounting performed at acquisition date. The following table illustrates the fair value adjustments applied to carrying amounts at the acquisition date and the goodwill recognized. Adjustments from US GAAP to IFRS Accounting Standards and deferred tax effects are ignored in the table for simplicity.

| Asset / (Liability) | Closing balance sheet for Company S stand-alone US GAAP reporting | Fair value adjustments and goodwill recognized in purchase accounting | Opening balance sheet for Parent reporting under IFRS Accounting Standards |

| Inventory | $30 | $5 | $35 |

| Lease right-of-use (RoU) asset | $20 | $5 | $25 |

| Property, plant, and equipment | $500 | $200 | $700 |

| Intangible asset (patent) | $50 | $150 | $200 |

| Goodwill | $0 | $50 | $50 |

| Lease liability | ($22) | ($3) | ($25) |

| Other assets and liabilities | ($300) | ($0) | ($300) |

| Net assets | $278 | $407 | $635 |

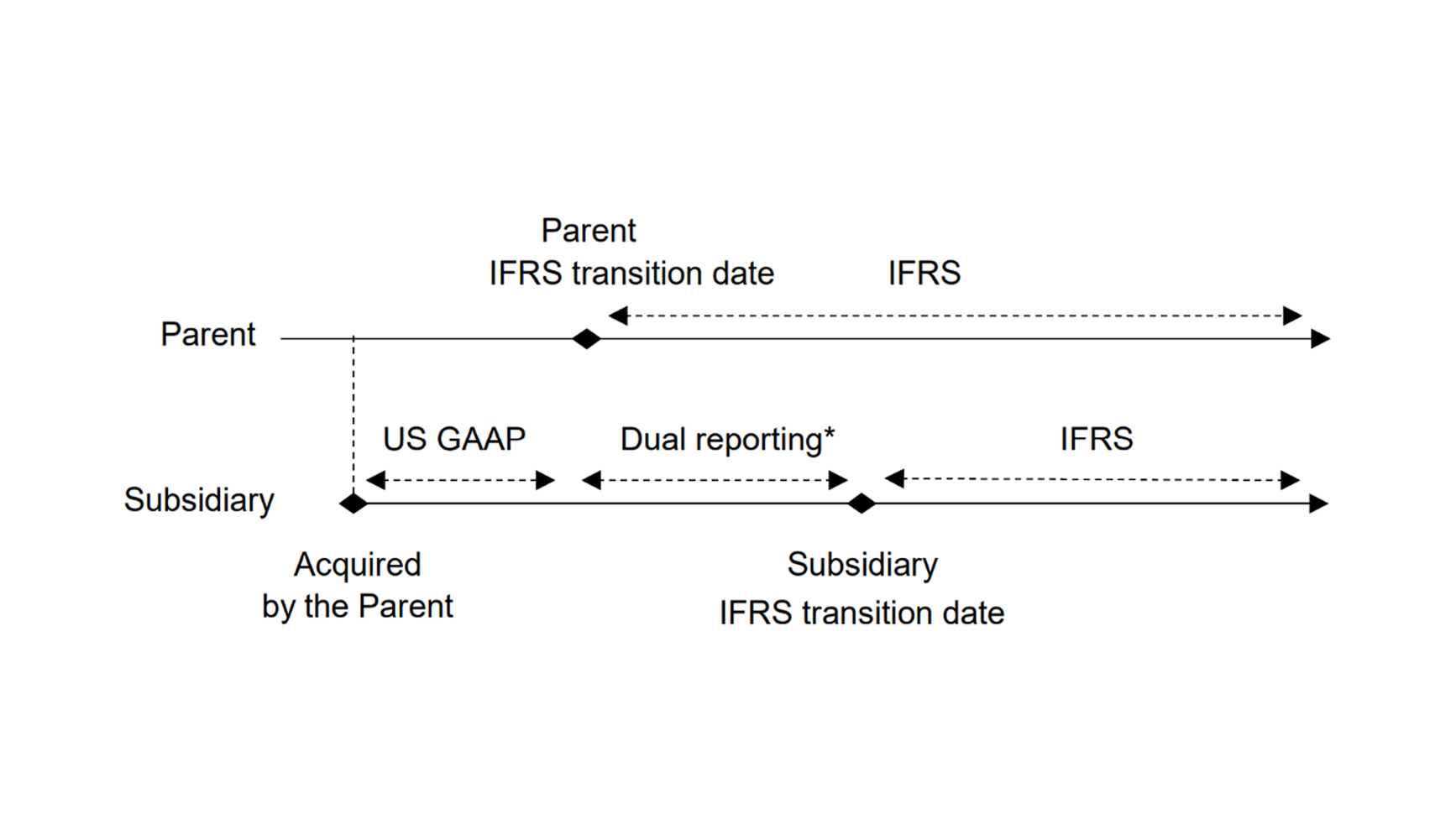

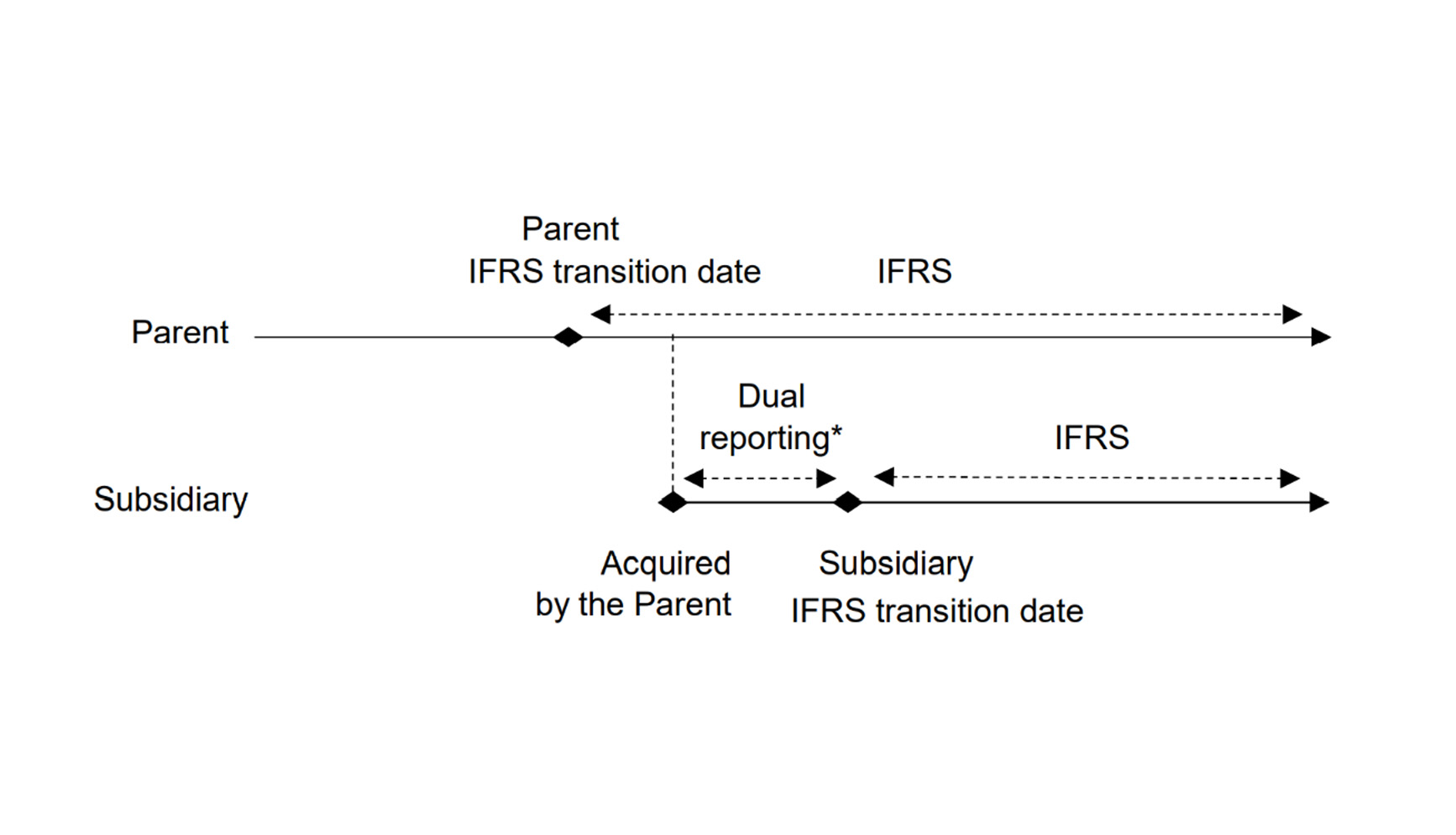

Company S prepared stand-alone US GAAP financial statements until December 31, 2021 but has not elected pushdown accounting. It considers converting to IFRS Accounting Standards as of December 31, 2022 (i.e. the date of transition would be January 1, 2021 to ensure a one-year comparative period).

For purposes of preparing the opening balance sheet on January 1, 2021, Company S analyzes which measurement options are available to limit differences in basis between its stand-alone financial statements prepared under IFRS Accounting Standards and its parent’s reporting.

| Asset / (Liability) | Measurement retained at the date of transition | Difference in basis | Comments |

| Inventory | $30 reduced for the inventory sold before the date of transition | Yes, but will disappear once inventory is sold | There is no available IFRS 1 exemption that would allow Company S to retain Parent’s stepped up basis of $35. However, because inventory turns quickly that difference may no longer exist by the date of transition or the date of first-time adoption (December 31, 2022). |

| Property, plant, and equipment | New fair value calculation | Generally yes, but materiality may vary | Company S can elect using fair value at the date of transition as deemed cost. It may be able to demonstrate that, in the circumstances, this amount is not materially different from the fair value determined two month prior. |

| Intangible asset (patent) | $50 | Yes | The patent meets the IAS 38 criteria for recognition but not for revaluation, because there is no active market. Therefore, the fair value at acquisition date cannot be used as deemed cost. |

| Goodwill | $0 | Yes | Internally generated goodwill is never recognized as an asset in accordance with IAS 38, so Company S cannot recognize goodwill related to its own acquisition by Parent in its stand-alone financial statements. |

| Lease liability | New calculation required | Generally yes, but materiality may vary | For purposes of its acquisition opening balance sheet, Company S had recalculated the present value of the remaining lease payments using Parent’s incremental borrowing rate as of November 1, 2020 and reset the related RoU asset to match the lease liability – i.e. $25.

IFRS 1 allows Company S to recalculate the lease liability as of January 1, 2021 using its own incremental borrowing rate at that date. If the rate is similar to that of Parent’s, the amounts of lease liability in both sets of books may closely align.

Further, Company S can elect to reset the RoU asset at the carrying amount of the lease liability (with some adjustments).

|

| Lease RoU asset | Equal to lease liability |

In summary, Company S is able to reduce differences with Parent’s accounting records by strategically choosing the most beneficial IFRS 1 optional exemptions available in the circumstances. However, differences with respect to intangibles assets and goodwill will remain going forward.