FRB Reports: Supervision and Regulation; Financial Stability

Increasing supervisory findings and declining ratings at banks of all sizes; focus on governance/controls and IT/operational risk

KPMG Insights:

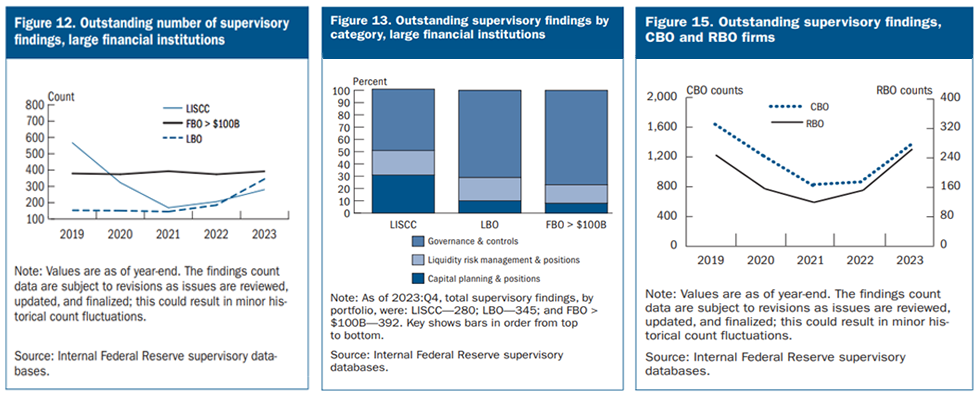

- Regulatory Findings Increase: There are increasing numbers of outstanding supervisory findings for institutions of all sizes. Only about one-third of the large financial institutions have satisfactory ratings across all three rating components: 1) capital planning and positions, 2) liquidity risk management and positions, and 3) governance and controls.

- Span of Findings: Approximately two-thirds of large institution's outstanding findings relate to governance and control issues (including operational resilience, cybersecurity, and BSA/AML compliance). For CBOs and RBOs, the top outstanding findings relate to IT/operational risk and risk management/internal controls.

- Market Challenges: The FRB acknowledges challenges due to changes in depositor behavior, higher funding costs, reduced market for investment securities, and increased commercial real estate and consumer loan delinquencies.

_______________________________________________________________________________________________________________________________________

May 2024

The Federal Reserve Board (FRB) issues the semiannual reports on Supervision and Regulation and Financial Stability.

1. The Supervision and Regulation Report assesses current banking conditions and transparency into the FRB's supervisory priorities and actions. For institutions of all sizes, highlights include:

- Increasing numbers of outstanding supervisory findings.

- A supervisory focus on liquidity, interest rate, and credit risk management.

- Declining numbers of institutions with satisfactory ratings.

2. The Financial Stability Report presents FRB's current assessment of the stability of the overall U.S. financial system, noting:

- Increasing asset valuations, improving financial conditions for households and businesses, sound levels of overall leverage, and ample liquidity in the financial system.

- Concerns around interest rates and inflation, geopolitical tensions and policy uncertainty, and deteriorating real estate market conditions, particularly around commercial real estate (CRE).

Details of the reports are outlined below.

1. Supervision and Regulation Report

Highlights of the FRB's Supervision and Regulation Report follow.

Banking System Conditions. The FRB states, "The banking system remains sound and resilient. Most banks continue to report capital and liquidity levels above applicable regulatory requirements. Deposits have increased overall since the last report. Some banks still face challenges navigating changes in depositor behavior, higher funding costs, and reduced market values for investment securities. Asset quality generally remains sound. However, CRE and consumer loan delinquencies have been increasing. Earnings have declined as banks have increased loan loss provisions and incurred higher funding costs."

Regulatory Developments. The report highlights regulatory developments since November 2023, including an interagency (FRB, FDIC, OCC) request for comment on reducing regulatory burden and guidance on third-party risk management (TPRM) for community banks.

Supervisory Developments. The FRB states that it "conducted examinations and closely monitored liquidity positions and risk management at large financial institutions, including reviewing recent deposit trends, deposit and liability management strategies, liquidity risk-management practices, access to secured funding, liquidity stress test projections related to deposits, and liquidity buffer composition." Supervisors also completed examinations to assess the following:

- Interest rate risk management practices.

- Credit risk management practices, particularly CRE and credit card loan quality, internal risk reporting, loss forecasting, and adequacy of reserves for credit loss.

- Cybersecurity risk management.

Similarly, the FRB states that it "intensified" monitoring of CBOs and RBOs that appeared most vulnerable to funding pressures (including access to contingency funding, liquidity asset buffers, and deposit outflow assumptions) and those with large CRE concentrations.

2024 Supervisory Priorities. The report outlines FRB's supervisory priorities for the remainder of 2024 for large financial institutions (with $100 billion or more in total assets), community banking organizations (CBOs) (with less than $10 billion in total assets), and regional banking organization (RBOs) (with between $10 and $100 billion in total assets). These priorities are outlined in the table below.

Large Financial Institutions | CBOs & RBOs | KPMG Regulatory Insights |

|---|---|---|

Capital

Liquidity

Governance & Controls

Recovery & Resolution Planning

| Credit Risk

Liquidity Risk

Other Financial Risks

Operational Risk

| Relevant sections of the Ten Key Regulatory Challenges of 2024: Relevant Regulatory Alerts: |

Trends in Supervisory Findings and Ratings

The report includes the following data indicating that supervisory findings for large financial institutions, CBOs, and RBOs continue to increase. For large financial institutions, the FRB states that approximately two-thirds of the outstanding conclusions relate to governance and control issues (including operational resilience, cybersecurity, and AML/BSA compliance), followed by an increasing number of findings related to liquidity and interest rate risk management practices. For CBOs and RBOs, the top outstanding findings relate to IT/operational risk and risk management/internal controls.

The report also finds a declining number of institutions of all sizes with satisfactory ratings. Weaknesses at large institutions were found in liquidity and interest rate risk management and governance and controls, with only about one-third of institutions receiving a satisfactory rating across all three components (capital planning and positions, liquidity risk management and positions, and governance and controls). Weaknesses at CBOs and RBOs were also found to relate to liquidity and interest rate risk management.

2. Financial Stability Report

The FRB's Financial Stability Report distinguishes between shocks to and vulnerabilities of the financial system, and primarily focuses on vulnerabilities across four categories and several near-term risks to the financial system, each of which is highlighted below.

Overview of financial system vulnerabilities. The report provides an overview of financial system vulnerabilities in four areas:

- Asset Valuations: The report states that asset valuations have increased to elevated levels relative to fundamentals, corporate credit spreads have narrowed, residential real estate valuations remain near their peak, and CRE market conditions (e.g., vacancy rates, rent rates) continue to deteriorate, particularly for the office sector, since the October 2023 report.

- Borrowing by Businesses and Households: The FRB notes businesses and households continue to improve their financial condition (e.g., reducing outstanding debts, leverage), but vulnerabilities remain moderate as measured by indicators for businesses and households (e.g., overall leverage, interest coverage ratios (ICRs), household debt, mortgage credit risk, and general consumer credit risk).

- Leverage within the Financial Sector: The FRB states that the overall banking system remains sound, with bank profitability remaining robust. Despite rising delinquency rates in some consumer and CRE loan segments, credit quality also remained sound. However, vulnerabilities associated with financial leverage remained notable, reflecting fair value losses on fixed-rate assets for some banks and elevated leverage at some nonbanks.

- Funding Risks: Overall, the report states that there remains a high level of liquidity in the banking industry. However, structural vulnerabilities (e.g., rapid outflows/runs) persist at money market funds, other cash management vehicles, and stablecoins, and liquidity risks persist in bond mutual fund asset holdings and with central counterparties amid interest rate volatility.

Near-Term Risks to the Financial System. The FRB highlights possible interactions between the existing vulnerabilities and the following near-term risks to the financial system:

- "Higher-for-longer" interest rates in the U.S. and other advanced economies could strain the global financial system.

- Worsening global geopolitical tensions could lead to broad adverse spillovers and policy uncertainty.

- Weaknesses in economic activity could compound existing strains in real estate markets, both domestically and globally (particularly CRE), and amplify risks to the global financial system.

Dive into our thinking:

FRB Reports: Supervision and Regulation; Financial Stability

Increasing supervisory findings and declining ratings at banks of all sizes; focus on governance/controls and IT/operational risk

Download PDFExplore more

Get the latest from KPMG Regulatory Insights

KPMG Regulatory Insights is the thought leader hub for timely insight on risk and regulatory developments.

Meet our team