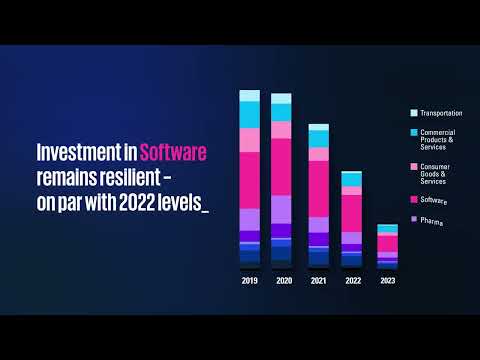

Ongoing concerns about valuations keeping M&A activity at bay

M&A activity in the US remained very dry in Q3’23, primarily driven by ongoing concerns about valuations given the growing number of downrounds, the cost of debt being meaningly higher and the lack of significant exits. Once valuations have stabilized and been proven in the public markets, M&A activity will likely pick up. Corporate M&A activity will likely pick up first as companies look at whether writing a check for an existing company would be better than building innovative solutions in house.

First time VC funds facing greater challenges as LPs put pressure on VC firms

With interest rates up and more options at their fingertips, LPs are starting to get more selective with their investments. They are also putting significantly more pressure on the VC firms they invest with to show results. This has led to VC firms conducting fewer deals and substantially more due diligence. It has also led LPs to become more cautious about investing in new funds—particularly first time funds—without having a proven track record. During Q3’23, a number of first time funds struggled to raise funds—a distinct change compared to a year or two ago, when proven investors rarely found it difficult to fundraise, even for first time funds.

Trends to watch for in Q4’23

Heading into Q4’23, many eyes in the US will be on the IPO market to see whether other tech startups follow in the footsteps of Arm, Instacart, and Klaviyo. If the IPO market opens up more broadly, M&A activity could also experience a rebound as investors receive more certainty as to whether valuations have stabilized at a healthier level. While fundraising activity is expected to remain slow across the US in Q4’23 and into Q1’24, as exits start to materialize in greater numbers and liquidity gets back to the investor base, fundraising will likely begin picking up again.

Within the US, AI is expected to continue to attract significant attention from VC investors, particularly AI focused on specific sectors like health and biotech and legal and other professional services. ESG, meanwhile, could see some pullback over the next few quarters as an overarching focus of companies, although environment-focused solutions, such as alternative energy and cleantech, are expected to remain attractive.