Venture Pulse Q2 2023

The Venture Pulse report provides insights around trends, opportunities, and challenges in the US venture capital market.

VC investment in the US dropped slightly in Q2’23, despite a $6.8 billion raise by payments processing company Stripe. The deal was the largest VC raise in the US by far during the quarter, followed by two large raises in the Artificial Intelligence area—a $1.3 billion raise by Microsoft-backed Inflection, and a $450 million raise by AI company Anthropic. Additional large deals included a $421 million raise by specialized cloud computing provider CoreWeave and a $401 million raise by cell and gene therapeutics company ElevateBio.

Deal speed continues to slow, despite availability of cash

Uncertainty continued to permeate the VC market in the US during Q2’23, amidst ongoing geopolitical challenges and concerns about inflation and interest rates. Despite the relatively stable level of VC investment in the country, the total number of VC deals in the US continued to decline—falling to a level not seen since 2015. Dealmaking was very sluggish during Q2’23, with most funding rounds at all deal stages taking longer to complete. AI-focused deals proved one of the few exceptions, driven by skyrocketing interest in the space in the wake of ChatGPT’slaunch late in 2022.

While traditional VC firms in the US still have cash they need to deploy, their caution has increased significantly amid concerns about high valuations and the ability of startups to meet their projections. Prudent startups have also focused on cutting their burn rates in order to preserve cash and avoid the need to raise funds given current market conditions. These factors, combined with dealmakers taking more time to agree to pricing, have contributed to the slowdown in completed deals.

Business productivity attracts interest from VC investors in US as companies look to do more with less

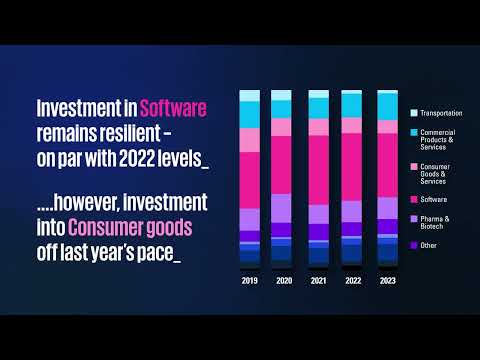

Similar to trends seen globally, AI attracted significant investment in the US during Q2’23, including a $450 million raise by Anthropic and a $300 million raise by OpenAI. The US also saw VC investors prioritizing software and business productivity solutions during the quarter as companies across sectors continued to focus on right-sizing their businesses and optimizing their productivity using technology. During Q2’23, network-as-a-service provider PacketFabric raised $372 million, while no-code business intelligence solutions provider Sigma Computing raised $340 million. Companies focused on heath and biotech, drone technologies, and alternative energy also continued to attract attention from VC investors in the US during Q2’23.

With IPO window firmly shut, waiting companies focus on improving profitability

The IPO environment in the US remained in drought conditions in Q2’23, with little expectation of a rebound prior to 2024. Given the ongoing closure, a number of companies that had previously planned for IPOs have turned their attention to improving their financial metrics in order to present themselves in a more firmly positive light once the IPO window does open. Both VC investors and startups believe the market will have a limited tolerance for companies that are not profitable or within line of sight of becoming so. As such, companies are focusing on their sales and profit margins, removing excess headcount, and deploying technology in order to improve their operational efficiencies.

For some companies waiting for the IPO door to open, the prognoses is more dire—with concerns that they will run out of cash before they can IPO. These companies are beginning to look for way to shore up their funding in order to bridge the gap to a possible IPO.

Trends to watch for in Q3’23

VC investment in the US is expected to remain soft heading into Q3’23. Given the uncertainty in the market and the possibility of further interest rate hikes at least during the rest of 2023, VC investment in the US could fall further over the next quarter absent a Stripe-like transaction.

IPO activity is expected to remain shut-down in Q3’23, although the number of companies preparing or ready for an IPO suggests that should the window open late in the year, there could be a resurgence in IPO activity heading into Q1’24 should the companies first out the door find success.

AI will likely remain a very strong area of investment in Q3’23, with corporates taking a strong role in making VC investments in the space. The alternative energy, EV, and EV battery spaces are also expected to remain high on the radar of VC investors in the US.

I believe we are looking ahead at one of the most interesting 12–18 month periods of venture investing. We arguably have never seen this level of economic and geopolitical uncertainty matched against such an exciting world changing phenomenon ─ AI. The competition between these two competing forces will be fascinating to watch.

Conor Moore

National Leader, KPMG Private Enterprise

Key insights from Venture Pulse Q2 2023

In the U.S. in Q2’23

1

2

3

4

5

Dive into our thinking:

Q2’23 Venture Pulse Report – Global trends

A global overview of key findings uncovered from the Q2’23 Venture Pulse Report.

About the Pulse Series

Explore more

KPMG Private Enterprise Tech Innovator in the U.S. 2023

Tech innovators of today. Titans of tomorrow.

Meet our team

Subscribe to Private Enterprise insights

Subscribe to receive pertinent information that will help you drive value for your private company.