Retail therapy…The outlook for the U.S. consumer

A soft landing is possible and even probable…but our journey is not yet done.

November 8, 2023

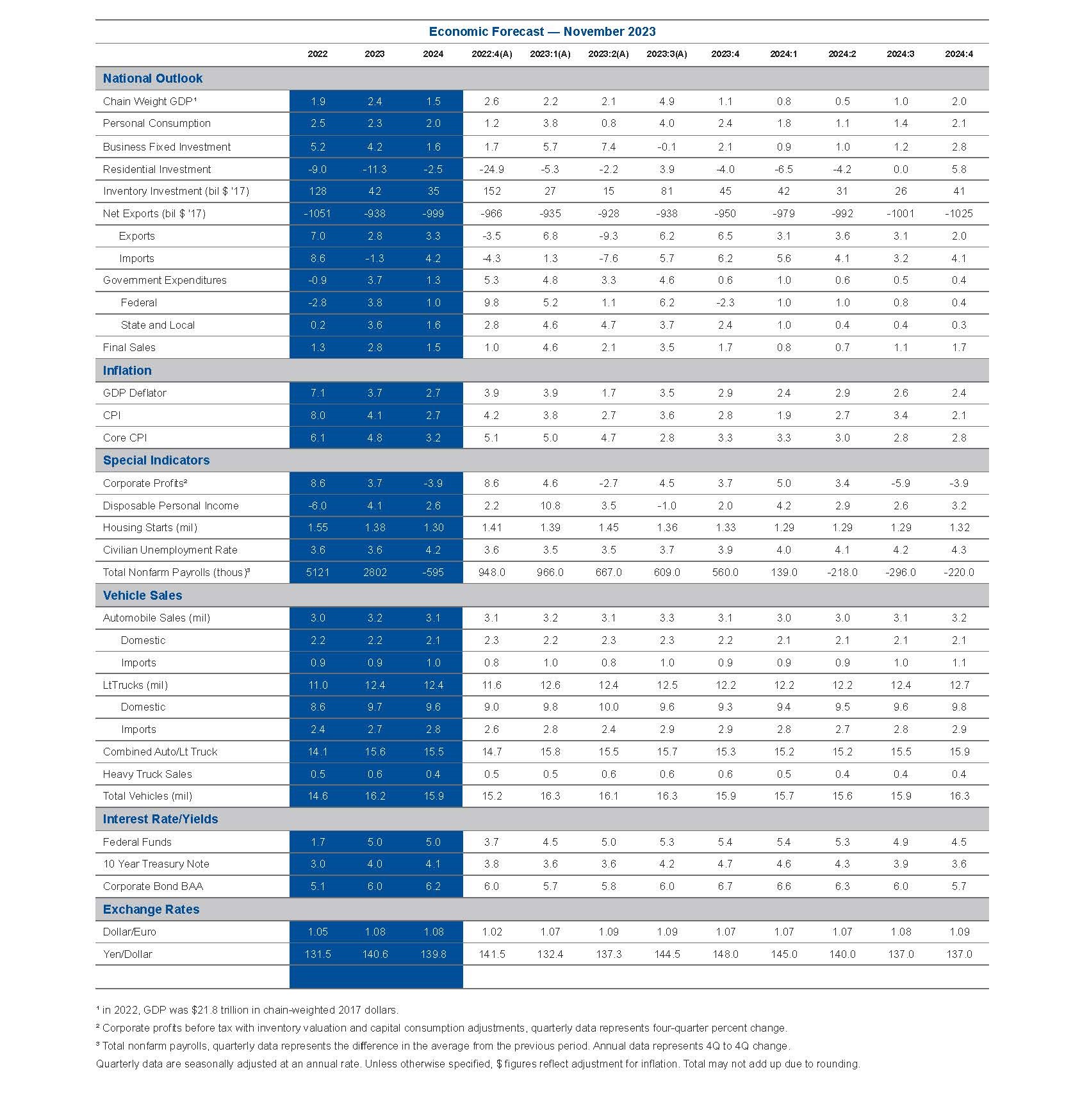

The economy surged at a 4.9% annualized pace over the summer, its fastest since 2021. Gains in consumer spending alone accounted for more than half of that increase. Spending on everything from vehicles, which require financing, to clothing and concert tickets accelerated. Taylor Swift and Beyoncé single-handedly lifted the economic fortunes of the cities they toured.

More stunning is that those spending gains occurred in the wake of the Federal Reserve’s most aggressive credit tightening cycle since the 1980s. The U.S. was an outlier among its peers. Growth in Europe slowed with many economies slipping into or flirting with recession.

Our elected officials decided that COVID would not be the iceberg that took down the ship. Fiscal and monetary stimulus gave households lifeboats with supplies to traverse COVID-tainted waters. We can debate whether that stimulus overshot, given the flare in inflation. What is not debatable is that it worked.

Households paid down debt, locked into low mortgage rates and banked the savings. The once beleaguered U.S. consumer emerged an Atlas, holding up the global economy.

Inflation has cooled but the Fed refuses to declare an end to higher rates. “The historical record cautions strongly against prematurely loosening policy. We will stay the course until the job is done,” said Chairman Jay Powell.

This edition of Economic Compass takes a closer look at household balance sheets and what it will take to slow consumer spending. Powell expects a period of “below-trend growth.” That is fedspeak for a rise in unemployment. Can we have a rise in unemployment without slipping into a recession? We already have. Unemployment moved from 3.4% in April to 3.9% in October, despite a surge in growth. How? Productivity growth picked up, which enabled firms to do more with fewer hires.

Special attention will be placed on the Fed’s game plan. It is waiting to see how earlier rate hikes and the rout in the Treasury bond market play out.

The economy slows abruptly

Real GDP growth soared to 4.9% in the third quarter, the fastest pace since the economy fully reopened in 2021. Robust gains in consumer spending, the first increase in the housing market in nine quarters, a rebuilding of inventories and strong government spending fueled those gains. Business investment and the trade deficit essentially moved sideways during the quarter.

Real GDP growth is forecast to slow to 1.1% in the fourth quarter. Consumer spending is expected to moderate but remain buoyant. Housing activity is forecast to contract in response to the chill of 8% mortgage rates. New orders for computers suggest that business investment will remain slightly positive. Inventories are expected to be bogged down by losses in vehicle production due to the UAW strike.

The back and forth over a budget deal is expected to hold government spending in check. The trade deficit is expected to widen, largely in response to weaker growth abroad.

Real GDP is expected to slip below 1% in the first half of 2024. That is when the brunt of earlier rate hikes and credit tightening are expected to hit hardest. The economy is expected to rebound in the second half as the Federal Reserve begins to normalize policy and rates start to come down. Pent-up demand for homes and vehicles remains substantial, while firms have delayed infrastructure projects.

The Fed stays on the sidelines. Chairman Jay Powell signaled that the Fed is willing to wait out the effects of earlier rate hikes and the bond market before weighing another hike. We think we have reached the peak in rates for the cycle but do not expect the first cut until June 2024. The fed funds rate is not expected to fall to pre-pandemic lows in 2024 or 2025; the neutral fed funds rate has moved up.

A slow squeeze

Chart 1 compares the recent performance of consumer spending against our forecast through 2024. Consumer spending is poised well at the start of the fourth quarter, given the persistence of strong gains through September. Consumers do not need to do much from here to get another solid quarter of gains.

Prospects for the start of the year are worse. Spending related to housing and big-ticket items, which need to be financed, is the most vulnerable. Spending on services is expected to weather the transition better. Taylor Swift concerts a year from now are sold out; good tickets are selling for over $3000 apiece.

Tailwinds

Consumers entered the summer with a host of tailwinds, many of which persist today:

- Inflation cooled more rapidly than compensation, which restored some of the purchasing power lost to inflation. (See Chart 2.)

- Households still had $1.3 trillion of the $2.3 trillion in excess savings amassed during the pandemic, nearly double previous estimates. Baby boomers are spending much more after they retire than earlier cohorts, supported by the interest they are earning on those deposits.

- Debt service burdens remain low, which is enabling consumers to take on more debt. (See Chart 3.)

- Household net worth jumped at the fastest pace and to the highest level on record between 2019 and 2022. Gains spanned income strata, age and educational attainment.

Households were in such good shape that student loan borrowers started to repay their debts in August, two months ahead of the end to COVID-era forbearance. Those who could, got ahead of the interest that was about to accrue on that debt.

Even the housing market, which had been frozen in the grip of what has become known as a mortgage winter, showed signs of thawing. Homeowners who are locked into low rates can’t afford to trade up, while more than 40% of homeowners have paid off their mortgages. Builders built smaller, more affordable homes and offered deep discounts to keep first-time buyers in the market.

Few opted into adjustable rate mortgages. That is a legacy of the subprime crisis. Many are unaware of how adjustable rate mortgages work after such a long period of low fixed rate mortgages, while others fear the uncertainty of adjustable rate mortgages - rates can go up and down.

Job openings remained elevated at the end of September but the response rate to the surveys has deteriorated. Data by the job posting sites suggest that job openings and advertisements for wages have cooled more rapidly than in the “official” government data but remain well above pre-pandemic levels.

High-propensity business formation – businesses with the intent to hire – picked up in September and is nearly 60% above pre-pandemic levels. The return of dynamism in the U.S. economy has been a welcome shift and added buoyancy to the labor market. However, the failure rate on new businesses is high, especially in an environment where credit is tighter.

Chart 1: Slows but does not collapse

Consumer spending, % change annualized rate

Chart 2: Compensation moves above inflation

Year/year % change

Chart 3: Debt service burdens hover near pre-pandemic lows

Household debt service ratio, SA

Headwinds

All boats did not rise with the tides. The gap in net worth between the highest and lowest earning households widened, despite gains in net worth. The ranks of those in poverty rose above 2019 levels in 2022, while low-income households dipped into their savings. Inflation hits those who can afford it least the hardest.

Higher interest rates mean that new debt is compounding much faster than in the past. Credit defaults have risen, especially among subprime borrowers. Credit card and vehicle loans have been the hardest hit. The length of used vehicle loans has been extended to reduce monthly payments. (See Chart 4.)

Student loans have historically been a primary driver of credit defaults. Efforts to ease the servicing of that debt for low-income households are expected to alleviate the burden of repayment. Delinquencies on student loans will not be penalized until October 2024, which will further delay the consequences of those defaults.

Bank credit conditions remained in recession territory this summer. That is making it harder for households and firms to finance big purchases. Credit for multifamily developers has been particularly tight. That is before we see the full effects of losses in the office market, which will further crimp access to bank credit. (See Chart 5.)

The Fed added special questions to the October Senior Loan Officer Opinion Survey. They revealed that credit conditions for individuals with FICO scores lower than 680, which covers nearly half of all borrowers, and commercial and industrial loans are about to get much tighter. Larger banks are offering easier credit conditions than lower tiers.

Treasury bond yields, which set interest rates for a much larger share of credit, have risen significantly. Everything from mortgage rates to corporate and municipal bond yields have soared. That has dumped a bucket of cold ice on the housing market. Mortgage rates hit 23-year highs and mortgage applications plummeted to multi-decade lows in October.

Home builder sentiment fell for the third consecutive month in October to the lowest level since October 2022. That was the last time that the Treasury bond market tanked. Mortgage rates crossed the 7% threshold, a tipping point for buyers. Housing affordability has slipped to the lowest levels since the mid-1980s. (See Chart 6.)

Why do we care? Because we tend to fill and remodel the homes we buy. Big-ticket home furnishings, appliances and spending at building material and garden stores are expected to be hardest hit.

All-cash sales of vehicles have picked up, but the pool of people who can afford that is limited. Rising prices, soaring financing rates and the shortages from the UAW strike will take a toll on sales through the first half of 2024.

Social Security payments are slated to rise 3.2% in January, less than half the 8.7% of a year earlier. That will diminish the boost to spending we saw from retiring baby boomers in early 2023.

The surge in corporate debt in 2021 and early 2022 is set to be repriced in 2024. That will squeeze cash flow and could trigger a more consequential slowdown in employment. (See Chart 7.)

Employment gains slowed in 2023, while unemployment moved higher. Most of the increase in the unemployed was due to more people looking for work, not a surge in layoffs. A rise in the ranks of those out on strike exacerbated that increase in October; strikers are not counted as unemployed but those laid off due to work stoppages are.

This is at the same time that hiring has become more concentrated in less interest rate sensitive sectors. Nearly 90% of the rise in employment in the third quarter occurred in only three sectors: leisure and hospitality, healthcare and private education, and government. State and local governments are still dealing with staffing shortages.

Those shifts have made employment more vulnerable to external shocks. The actors’ and UAW strikes are a case in point. More than 45,000 workers were on strike in October. Even more were laid off or forced to take part-time work to make up for wages lost to strikes.

The unemployment rate is expected to hit 4.3% by year-end 2024. That is too slow of an increase to be considered a recession but will level the playing field between workers and employers.

Chart 4: Credit delinquencies edge higher

Transition into deliquency (30+), percent of balance

Chart 5: Banks Tightening Standards

Percent reporting

Chart 6: Housing affordability tanks

Index, fixed-rate mortgages, 100+ = more affordable

Chart 7: Nonfinancial corporate debt outstanding

EOP, SA, $ billions

Fed in wait-and-see mode

Chart 8 shows the trajectory for the core (excluding food and energy) personal consumption expenditures (PCE) index, the Fed’s favored measure of inflation. Recent data suggest underlying inflation may be getting stickier. The persistence of inflation, particularly in the service sector, is worrisome. Medical insurance costs are scheduled to rise rapidly as plans are renewed, while deductibles are rising.

The Fed wants to see core PCE drop below 3% for an extended period before it starts normalizing policy. That puts the first rate cut in June. That is a bit sooner than we expected last month, but is contingent on higher Treasury bond yields. The descent in rates is expected to be slower than the ascent.

Chart 8: Descent on inflation slows

PCE core, 4q/4q % change

Bottom Line

We have weathered the storm of inflation and rising rates better than our counterparts abroad. Why? Because the once beleaguered U.S. consumer cleaned up its act and stepped into the role of Atlas. The story of Atlas is one of endurance, not strength alone. The two are related but not the same.

Endurance is more about overcoming the obstacles ahead than reflecting on the distance we have come. A soft landing is possible and even probable but not guaranteed; our journey is not yet done. One foot in front of the other, eyes on the horizon, focus on crossing the finish line.

Dive into our thinking:

Retail therapy...The outlook for the U.S. consumer

Download PDFExplore more

KPMG Economics

A source for unbiased economic intelligence to help improve strategic decision-making.

After the fall: A structural change watch list

Inflation and higher rates are plaguing developed and developing countries alike.

Resilience, revisions & risks… Weathering political dysfunction & war

The bond market does the heavy lifting for the Federal Reserve.

Meet our team

Subscribe to insights from KPMG Economics

KPMG Economics distributes a wide selection of insight and analysis to help businesses make informed decisions.