After the fall: A structural change watch list

Inflation and higher rates are plaguing developed and developing countries alike.

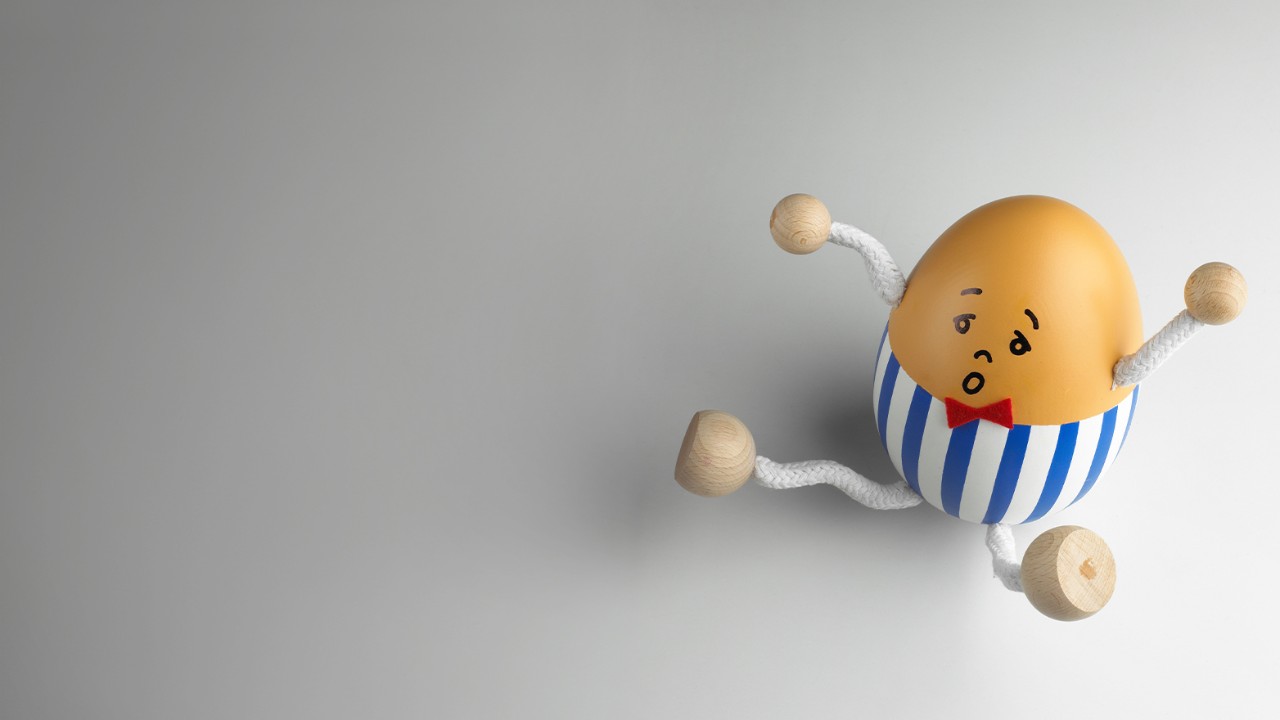

Humpty Dumpty sat on a wall.

Humpty Dumpty had a great fall.

All the king’s horses and all the king’s men

Couldn’t put Humpty together again.

Humpty Dumpty’s fall seems a perfect metaphor for the post-pandemic economy. Everything from escalating geopolitical tensions to a rise in populism has fragmented the global economy. What is left is a world that is more susceptible to supply shocks and prone to bouts of inflation than the world we left.

But Humpty’s story didn’t end there. Children’s author and illustrator Dan Santat wrote a sequel called After the Fall. Humpty survived the fall but there were wounds “…that couldn’t be healed with bandages and glue.”

Humpty developed a debilitating fear of heights, which changed how he lived his life. It kept him from climbing the wall and getting close to the birds, something the forlorn egg loved most. That seems a more apt metaphor for the structural changes we face. Fear has become a motivator; countries are hunkering down, upping their spending on defense and becoming more polarized within their borders.

Economists observe two forms of change:

- Cyclical changes play out rapidly, like the initial surge in home sales that we saw when mortgage rates plummeted as the economy initially reopened.

- Structural changes take years to form and to play out; they are why no two business cycles are the same. Decades of restrictive zoning laws and consolidation among builders following the subprime crisis are examples. They exacerbated housing shortages. Bidding wars broke out even as rates jumped and demand cooled.

Structural changes can reset our sense of gravity. They have left central banks worried that inflation once deemed transitory may become entrenched.

This edition of Economic Compass provides a structural change watch list, as a second installment to what I learned in off-the-record meetings with economists from around the world last month. The fear that we are experiencing is not unique to the U.S. It is surprisingly common across economies and has the potential to fundamentally alter the trajectory of the global economy. The world that is emerging is likely to be more susceptible to supply shocks and rate hikes. Add recent advances in artificial intelligence (AI), and existing business models will be challenged.

The outlier in the mix is work from home (WFH), which is much more of a U.S. than global phenomenon. It is reshaping how and where we work, how productive we are and where activity occurs. Some of the hottest cities pre-pandemic have been hollowed out.

A top 10 list

Structural changes

#1. Inflation is inertial. Our Latin American colleagues, who have the most recent experience with inflation, were quick to remind us of the inertial characteristics of inflation. If allowed to persist, bouts of disinflation and inflation tend to become self-perpetuating. Hence, the forty-year deceleration in inflation prior to the pandemic. Now we are on the other side of that coin.

The inflation coming out of the pandemic persisted long enough to shift behaviors. Workers want to be compensated for inflation, while firms want to retain profit margins.

The result could be what some at the ECB have termed a “profit-wage” spiral. Wage indexation, which entrenched the inflation of the 1960s and 1970s, is showing up in parts of Europe. Core measures of inflation remain elevated at home and abroad.

In response, central banks have resumed or continued rate hikes. The Bank of England, the Reserve Bank of Australia, the European Central Bank (ECB) and several Nordic banks all raised rates in June.

The Central Bank of Canada, which was one of the first to raise and pause on rate decisions, resumed hikes in June. A bottoming in home values threatened a resumption of shelter-based inflation. The same is true in the U.S.

The Fed skipped June then all but pledged to raise rates in July. The Summary of Economic Projections in June revealed that most within the Fed’s leadership expect at least two more rate hikes this year; no one expects a cut.

The challenge has been financial markets, which have consistently front-run central banks on the timing and size of rate cuts. That has, ironically, prolonged the current tightening cycle and could delay rate cuts.

The question is whether a global recession can be averted. The jury is still out, with rolling recessions across industries and regions. Europe is more at risk for a hard landing than the U.S., as it slipped into a technical recession this winter.

#2. Sovereign debt burdens are mounting. Developed as well as developing economies took on massive amounts of debt to counter the effects of the pandemic and war in Ukraine. That added to the debt left over from the global financial crisis. Inflation accelerated and triggered a chain reaction of rising rates and escalating debt service burdens. Concerns about solvency emerged.

Developing economies are in worse shape than developed economies but both are precarious. The surge in rates and plummet in the value of the pound sterling when the U.K. government attempted to pass an unfunded tax cut last September are evidence of that.

Countries from Latin America to Africa and the Middle East are suffering the ravages of hyperinflation. The Central Bank of the Republic of Türkiye nearly doubled rates from 8.5% to 15% in June. The effort was designed to combat an “official” inflation rate of 38.2%; traders were unimpressed. The exchange value of the lira hit a new low against the dollar after the move.

Argentina is in yet another mess, with the International Monetary Fund (IMF) still attempting to deal with the last debt crisis. Brazil has weathered the storm better but is pursuing policies that could challenge the country’s solvency three to five years down the road.

The IMF estimates that more than 60 countries are in distress or getting close to being in default. China’s lending for its Belt and Road initiatives has thrown sand in the gears of resolving the crisis. China’s lenders have forced debt payment extensions instead of accepting haircuts, which has slowed the resolution process for countries in default.

#3. Economic security takes on a new meaning. The pandemic, the war in Ukraine and a surge in extreme weather events revealed the fragility of global supply chains. That intensified the backlash to globalization (specifically trade with China) and desire for countries to become more self-reliant.

The arms race spans developing and developed economies. Those shifts, coupled with the push to subsidize “strategically important industries,” are adding to sovereign debt and exacerbating inflation. Semiconductor and EV plants are included.

“Friend-shoring” and regionalizing of supply chains are more popular than onshoring. Capital flows to China have stalled but picked up elsewhere. Mexico will be one of the largest beneficiaries.

The next shoes to drop will be investment and export controls, potentially including cloud computing. The goal is to preserve cybersecurity and limit AI development in China. In retaliation, China has adopted export restrictions. They have banned rare earths essential for production of chips, solar panels and military equipment.

Pulling out of China is not like pulling out of Russia, despite some recent diplomatic thawing between the U.S. and China. Hence, the push by major firms and their CEOs to improve relations. The supply chain is much more complex, while access to China’s market is more important. There are few substitutes.

#4. China is losing momentum. The country maintained a model of forced savings, exports and government investment for more than a decade after it was useful. That prompted nonproductive investments, notably in real estate, which fueled an unsustainable accumulation of debt.

The reopening of the country’s economy with the abrupt end to its zero COVID policy proved underwhelming. China used reopening as an excuse to pull back on fiscal stimulus, which set the country further back. Reforms needed to juice domestic demand have been scant, while exports and manufacturing activity are slowing.

China’s leadership has repeatedly abandoned its growth targets in recent years; it rolled back targets for 2023 after a less than stellar reopening. Youth unemployment topped 20% in April, twice the pre-pandemic average.

Medium term, China looks more like Japan in the 1990s. China’s working-age labor force peaked in 2018; its overall population is now shrinking. Those demographics and a lack of productivity growth suggest that potential growth could slip to 2.5% in the years to come. That is a huge slowdown from the double-digit gains that fueled the global economy for much of the 2000s and early 2010s.

#5. Aging demographics are compounding labor shortages. The pandemic accelerated the aging of the baby boom into retirement. Older people were hit harder by the initial wave of infections and fatalities due to COVID. Fear of contagion, the higher risks of working frontline jobs, long COVID and the crisis in both child and elder care accelerated retirements and permanently sidelined more of those over 55.

A pick-up in immigration following border lockdowns has alleviated some of the imbalance between demand and supply but is still lagging. Most countries remain averse to immigration, despite widespread labor shortages.

Add a drop in life expectancy – the U.S. now lags Türkiye - and it is little wonder labor demand far outstripped supply when the economy reopened. Absent the recent catch-up in mostly legal immigration, growth in the labor force would have been much weaker.

We are not alone. The eurozone, which slipped into a technical recession, is still dealing with labor shortages. Unemployment in the U.K. remains near record lows. Hence, the concern by central banks that wages may not cool enough to derail inflation.

#6. Work from home (WFH) is not going away. Recent research published by Stanford University shows that WFH surged by five-fold between 2019 and 2023; nearly 40% of all workers are now working at least one day a week from home. That includes high and low skilled workers.

Workers who work fully remote are 10% less productive than fully in-person workers. Hurdles on communication, mentoring, networking and self-motivation appear to be factors. (I can see a lot of heads nodding.) The reduction in costs associated with fully remote work partially offsets the loss of productivity.

Hybrid models show no loss in productivity. (Some are likely surprised by that.) The peak days for workers in the office are, unsurprisingly, Tuesday through Thursday.

Women with small children and underrepresented minorities are less likely to return to offices. The crisis in childcare and micro-aggressions are likely culprits. That suggests firms have more work to do to retain the benefits in decision making derived from more diverse teams. Recruitment and retention improve with hybrid models.

Improvements in technology are expected to boost the productivity associated with WFH, even fully remote options. One recent study of call centers revealed a 15% boost in productivity as measured by issues resolved when workers were able to leverage new AI models. All that increase accrued to the lowest performing workers.

The push to bring workers back into the office hit a wall in 2023. Mass transit and Kastle data on key card swipes plateaued 40% below pre-pandemic norms in the first half.

#7. WFH is reshaping urban centers. What were once some of the hottest urban markets have fallen off a cliff. Office occupancy is down, while vacancy rates are rising. Office vacancies are close to 19% across the largest urban centers and rising. That matches the peak hit in the early 1990s due to the savings and loan crisis.

The 1990-91 recession was mild and short-lived but tough to escape because of the overhang of commercial real estate. Lenders struggled with loan losses, while cities struggled with unused space. The silver lining is how rapidly the excess space was absorbed. Older, less user-friendly buildings were demolished.

Even pandemic winners are struggling. Offices in Houston and Dallas are only about 60% occupied, while the backlog of office space in the pipeline is at a record.

The bulk of the impact is still ahead of us, given the multiyear nature of office leases. A lot of office leases are scheduled to reset over the next two years. Office valuations will drop and loan losses on leases will rise.

However, we are unlikely to see the demise of cities that many predict. Industry clusters, also known as agglomeration, still matter. Tech hubs have moved, not disappeared.

Separately, violent crime has fallen dramatically over the last year. The murder rate has fallen at a double-digit pace from a year ago in most cities, including New York. That is a stunning and welcome improvement.

#8. Generative AI (GenAI) is full of promise and peril. GenAI technologies have prompted a frenzy of speculation about how they could disrupt existing business models, boost productivity, displace workers, and in the extreme, destroy humanity. (Cue Hal in 2001: A Space Odyssey.)

The problem is the lag between innovation and commercialization, which can be substantial. Investors bet on the sector before they know the winners. The result is a financial bubble.

Bubbles precipitated the expansion of rail, utilities and the internet. The hype around GenAI is similar, with few looking at the hurdles to commercialization.

- Taiwan has a chokehold on semiconductor production — it takes time to build a chip plant;

- Ukraine is critical to the supply of semiconductor-grade neon; and,

- Russia is a major supplier of palladium and semiconductor-grade nickel.

Regulation is lagging on issues of data privacy and use standards for GenAI, especially in the U.S. The threat from deepfake videos and content is particularly problematic, given the influence they can wield over voters. Candidates for the 2024 presidential elections in the U.S. are already experimenting with the technology.

This is in addition to the increased cyber security threats posed by GenAI. That means more funds must be allocated to defend against attacks at the same time firms are ramping up GenAI capabilities.

Property rights and trust in our institutions are critical to the functioning of democracy and market economies. GenAI can be used to further undermine trust in our institutions and rule of law. The result could further polarize the electorate. (See below.)

Unlike other technological innovations, the winners are more likely to be firm as opposed to sector specific. That further complicates the process of picking early winners and compounds the risk of asset bubbles.

#9. Political polarization intensifies. Opinion polls just about everywhere reveal deep political divisions. Voters on the extremes of the political spectrum have loyal voting blocks, which dominated election outcomes. Fewer feel that elected officials represent their interests. The situation by many measures is the worst since the 1930s.

Why do we care? Because polarization foments civil unrest and undermines the efficiency with which the economy can operate. Ideology instead of economic realities determine policy decisions. That distorts economic outcomes.

I used to be surprised by the extent of discussion economists from developing economies spent on corruption. The hurdles to development were palpable.

It is humbling that the first questions I get about the U.S. are now about those very same issues. Dysfunctional politics instead of economic fundamentals are determining economic outcomes.

The situation was decades in the making. We pursued globalization without taking into account or compensating the casualties of free trade. Vicious cycles of joblessness and falling wages erupted. Former industrial meccas rusted as plants were idled.

The problem is what some voters see as the solution. Instead of investing in the education and earning potential of those left behind, an influential swath of the electorate has chosen to suppress the ability of domestic and foreign competitors to work. That lowers the productive potential of individuals and the economy as a whole. We are quite literally discarding workers in a world where workers are scarce.

Misinformation campaigns are fanning the flames of discontent. The divisions are so deep that urban economist Richard Florida predicts that more political sorting will occur by state and city. That raises yet another issue that firms must weigh when deciding where to locate and expand their businesses.

Last but by no means least, policy is becoming less predictable. That uncertainty acts as a tax on the economy, causing individuals and firms to hesitate instead of moving forward with large economic decisions.

#10. Disruptions due to climate change escalate. We are living with the consequences of climate change in real time. Temperatures the world over are hitting record highs. Those shifts have ignited fires, exacerbated droughts and floods, increased fatalities due to heat exhaustion and stressed energy grids.

The war in Ukraine and the disruption to Russian oil and natural gas have intensified the push to adopt more renewable energies, notably in Europe. Getting from here to there is not easy. In the interim, war has increased the use of coal plants and is adding to carbon emissions.

These shifts are further disrupting supply chains; it is hard to work, let alone produce amidst rolling blackouts. Food supplies have been disrupted from Australia to Argentina. A drought is limiting the size and weight of ships that can traverse the Panama Canal, a key thoroughfare for trade.

The costs associated with ramping up a greener infrastructure are considerable. EV production is accelerating, while the infrastructure needed to charge EVs is lagging. That is before we deal with the challenge of mining the minerals and rare earths needed to produce EVs.

In the interim, the ferocity and frequency of extreme weather events is expected to increase. Some parts of the world will be unlivable.

Fatalities due to heat exhaustion have already surged. The heat wave that hit Texas and much of the South hard in June and early July was particularly costly. The period from July 3-6 was the hottest on record globally.

Migration from what were some of the hottest pandemic economies – literally and figuratively – could reverse. That could amplify the sorting by states and cities that is likely to occur via political polarization.

Bottom Line:

Humpty Dumpty’s fall provides a useful metaphor for the fear driving the fragmentation, harder borders and scramble to deal with climate change on a global scale. The effects are far reaching, long-lived and likely to reshape how the global economy will perform for some time to come.

If we fail to face those fears, those shocks will compound. Most countries are likely to become more susceptible to supply shocks, bouts of inflation and rate hikes going forward. This is where the metaphor in the sequel kicks in.

Once Humpty Dumpty faced his fear of heights and climbed the wall again, he discovered his true self. He hatched into the bird he was meant to be, spread his wings and soared to new heights. By facing our collective fears, we could morph into a less fractured world, better able to deal with the commonality of the challenges we face.

NATO’s reaction to Russia’s invasion of Ukraine proved Putin wrong; the world is still unified in some very important ways when it comes to the threats we face. Cooperation is possible, even when most think it is improbable.

It is on that hope that I will conclude, or to quote John Lennon, “You may say I’m a dreamer but I’m not the only one. I hope someday you’ll join us, and the world will live as one.”

Dive into our thinking:

After the fall: A structural change watch list

Inflation and higher rates are plaguing developed and developing countries alike.

Download PDFExplore more

Meet our team

Subscribe to insights from KPMG Economics

KPMG Economics distributes a wide selection of insight and analysis to help businesses make informed decisions.