Artificial intelligence (AI) is reshaping the finance sector — from automating financial reporting to enhancing audit quality and enabling predictive analytics. But how far can AI go in transforming the role of the auditor and improving decision-making in financial institutions?

According to the KPMG Global AI in Finance Report (Nov. 2024), 73% of companies in Switzerland are piloting or already using AI in financial reporting. This number is expected to reach nearly 100% within the next three years.

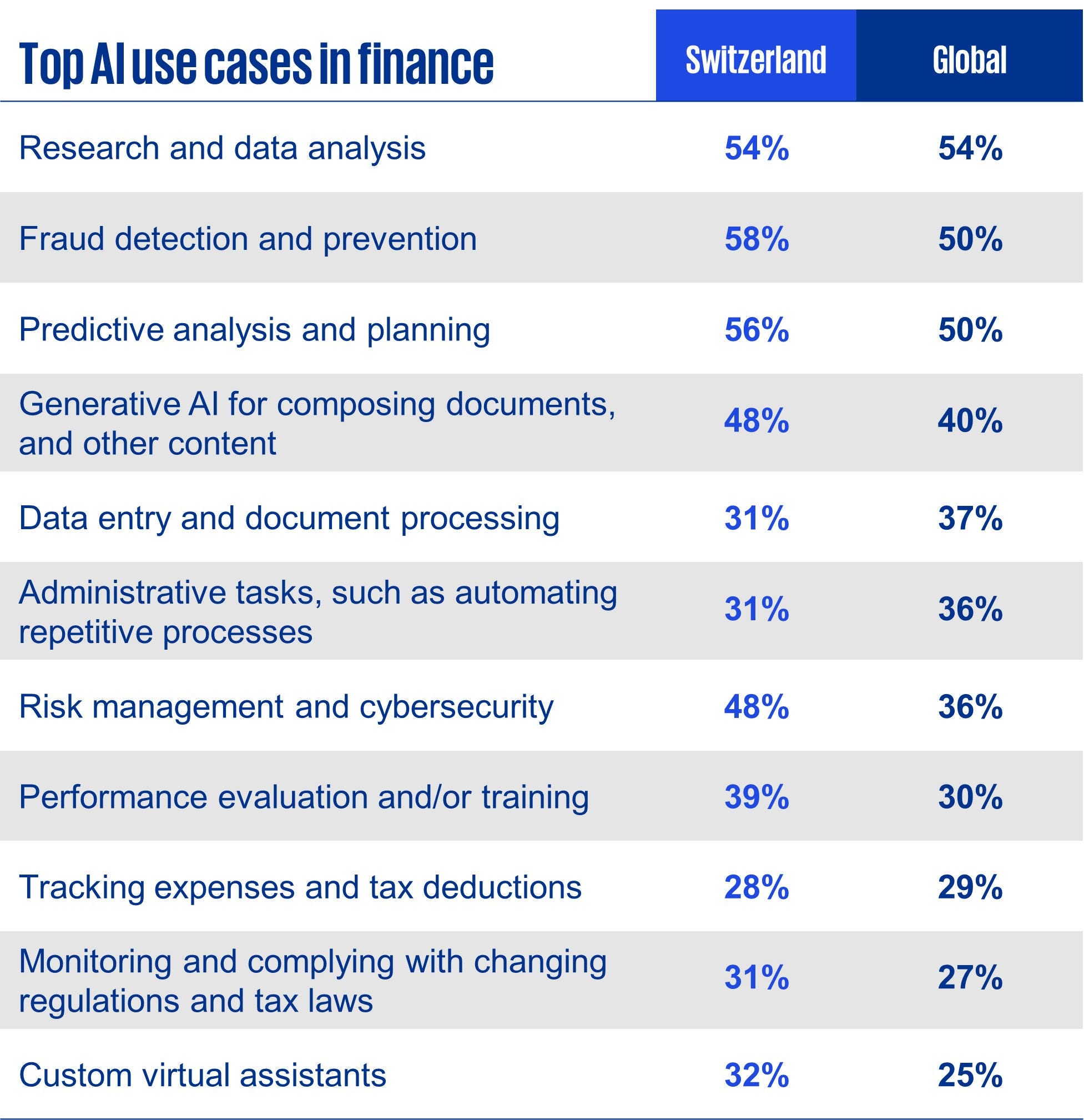

The growing use of AI in finance brings substantial benefits:

- It automates repetitive, manual tasks, improving speed and accuracy.

- It enables real-time analysis, including fraud detection and anomaly recognition.

- It supports predictive analytics, allowing companies to forecast financial outcomes and anticipate risk.

At the same time, AI introduces new challenges such as algorithmic transparency, data quality issues, and ethical concerns. Responsible use and oversight of AI systems are essential to maintain trust among regulators, investors and stakeholders.