Latest: EU agrees on Omnibus amendments and EFRAG releases Draft Simplified European Sustainability Reporting Standards (ESRS)

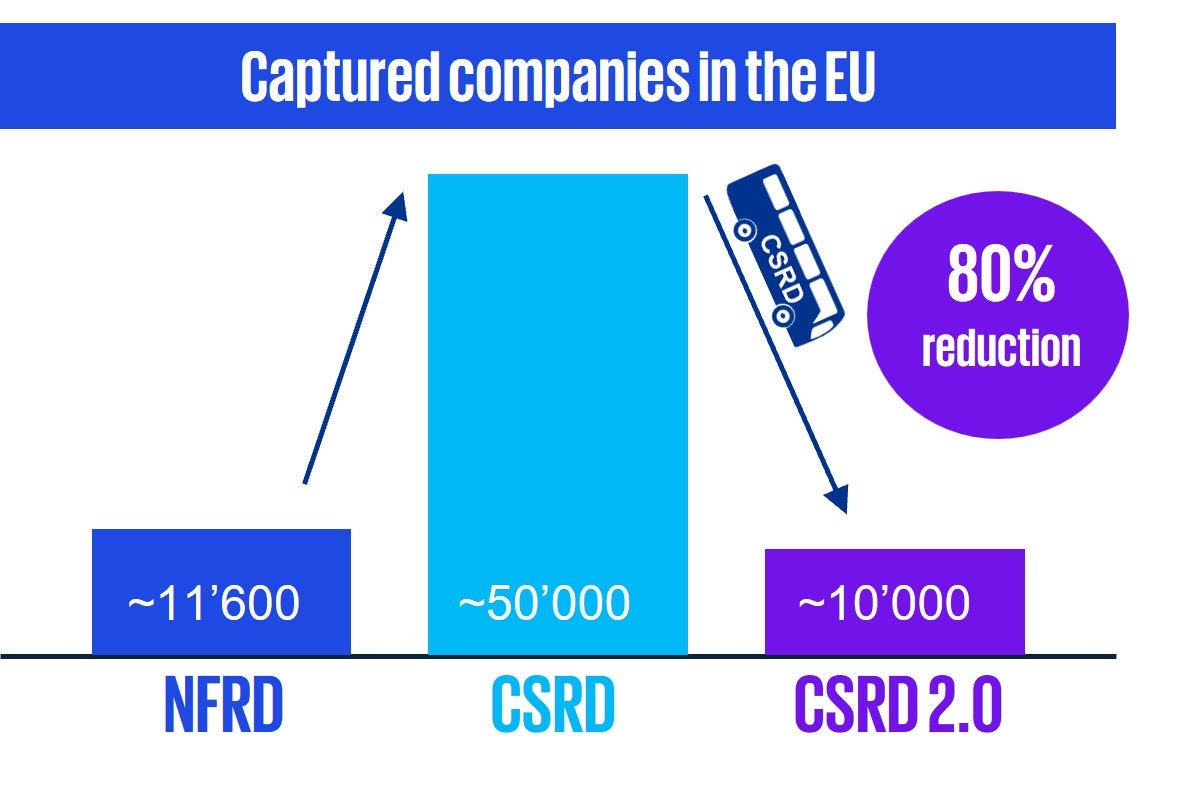

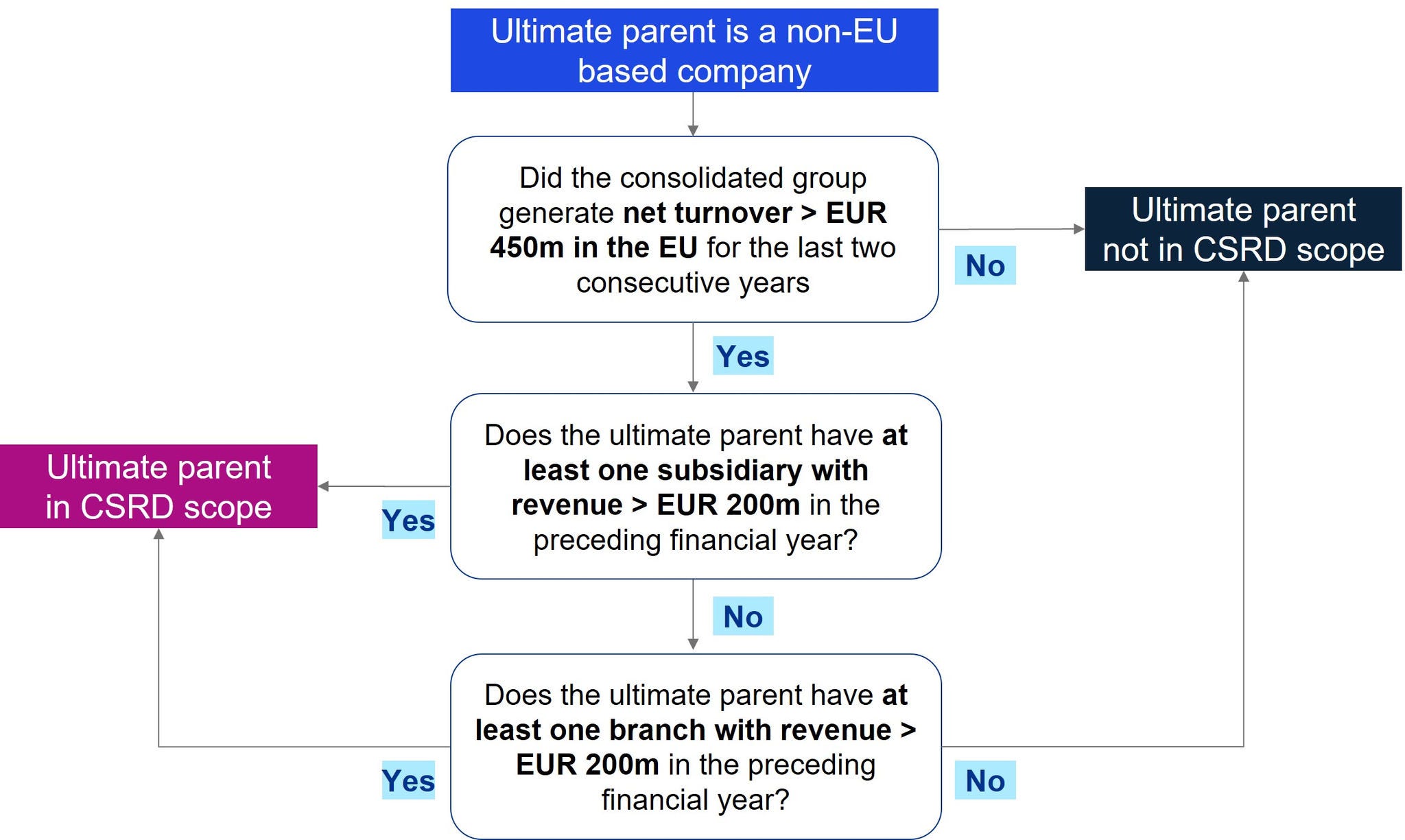

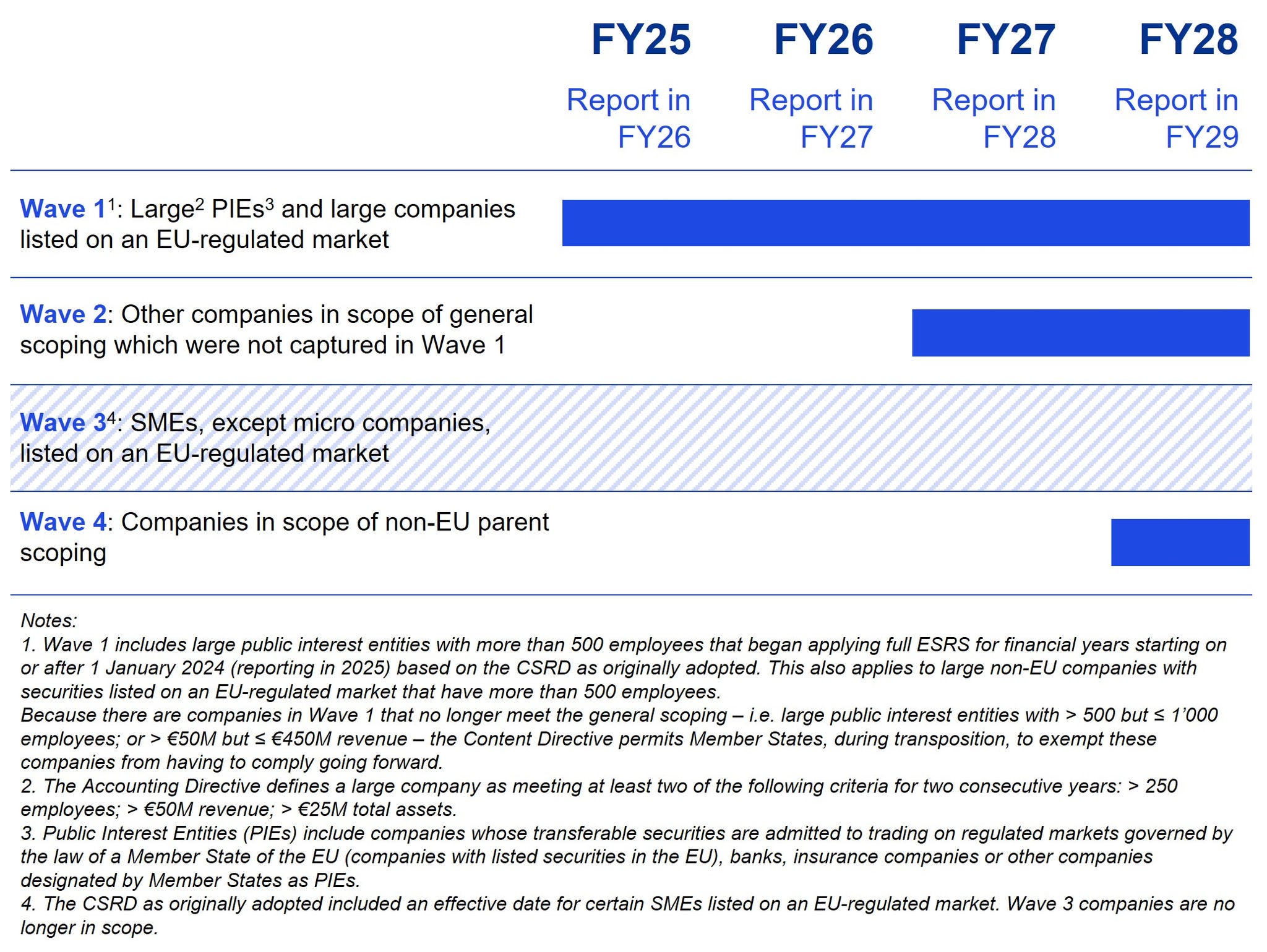

The EU has reached an agreement on major amendments to the CSRD. Most notably, the agreement raises the scoping thresholds, significantly reducing the number of companies in scope. Once the changed rules are published in the Official Journal of the EU, Member States will have 12 months to transpose them into national law, likely by March 2027.

EFRAG, the EU’s corporate reporting advisory board, has also released the Draft Simplified ESRS (Draft ESRS 2.0) and submitted them to the European Commission (EC). The EC will now proceed with its own due process, including public consultations, to determine whether further changes are required. Adoption of the ESRS Delegated Act is anticipated in the second quarter of 2026.

Our guide explains the changes EFRAG has proposed and what they mean in practice. While the Draft ESRS 2.0 reduces the number of mandatory (“shall”) datapoints by about 60% across all standards, this does not lead to a similar decrease in effort. Companies should expect only about a 20% reduction in overall reporting effort, since core processes, data quality requirements and assurance obligations remain substantial. The updated requirements are expected to take effect starting January 2027 for reporting on financial year 2026.