19-02-2024

The L-QIF for real estate investments does not receive any special tax treatment, but is nevertheless attractive.

Tax aspects of the L-QIF for real estate investments

Tax aspects of the L-QIF for real estate investments

From 1 March 2024, qualified investors will have access to a new investment vehicle for investing (among other things) in real estate. The L-QIF (Limited Qualified Investor Fund) does not require authorization from the Swiss Financial Market Supervisory Authority (FINMA). This makes it faster and less expensive to set up. Investor protection is ensured, among other things, by the fact that an L-QIF may only be managed by certain institutions supervised by FINMA. The amendments to the Collective Investment Schemes Act (CISA) and the Collective Investment Schemes Ordinance (CISO) must be taken into account.

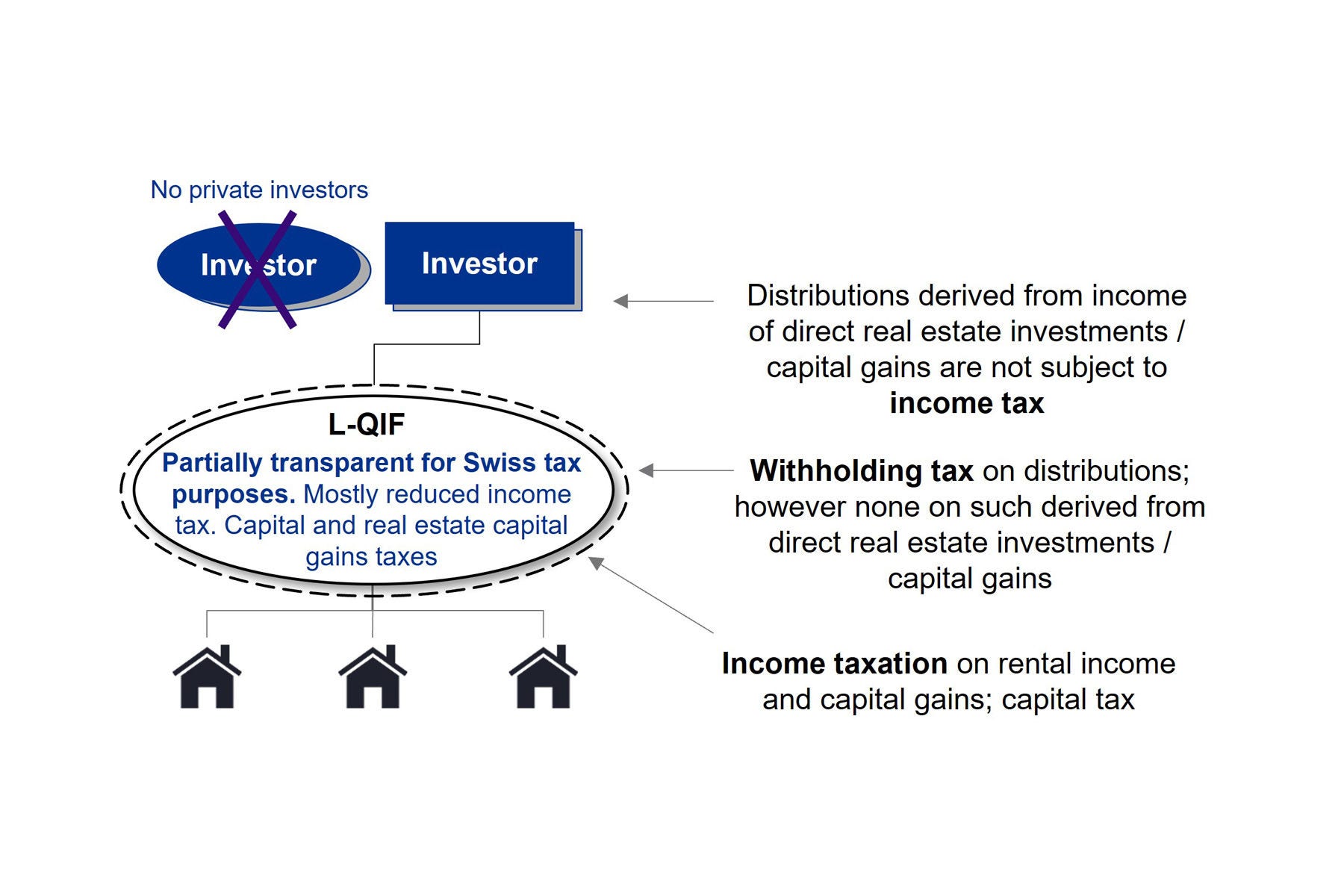

The L-QIF receives no special tax treatment and is taxed in the same way as conventional collective investment schemes. Worth mentioning in this context is the fund with direct real estate holdings, which is subject to a lower profit tax in most Swiss cantons compared to a real estate company subject to ordinary taxation. However, private investors, who may also qualify as qualified investors, are not eligible to invest in such an L-QIF with direct real estate ownership. Still, L-QIFs may be of interest to them for indirect ownership of real estate and other assets. In contrast, there are no such restrictions for other qualified investors (e. g. banks, insurance companies and pension funds).

The tax treatment of an L-QIF with direct real estate ownership can be illustrated as follows:

Current income is recognized at the following effective profit tax rates compared to a real estate company subject to ordinary taxation:

Effective corporate income tax rate (Federal/cantonal/communal), cantonal capitals, status 2023, information without guarantee

| Canton | AG | AR | AI | BL | BS | BE | FR | GE | GL | GR |

| Real estate company | 16.3 | 13.0 | 12.7 | 15.9 | 13.0 | 21.0 | 13.9 | 14.0 | 12.3 | 14.8 |

| L-QIF with direct real estate ownership | 12.5 | 9.7 | 9.3 | 12.2 | 9.7 | 18.3 | 10.6 | 14.0 | 8.9 | 11.6 |

| Canton | JU | LU | NE | NW | OW | SG | SH | SO | SZ | TG |

| Real estate company | 16.0 | 12.1 | 14.9 | 12.0 | 12.7 | 14.3 | 13.8 | 15.3 | 13.9 | 13.2 |

| L-QIF with direct real estate ownership | 12.9 | 8.7 | 10.9 | 6.4 | 9.4 | 17.1 | 7.5 | 12.1 | 10.6 | 9.9 |

| Canton | TI | UR | VD | VS | ZG | ZH |

| Real estate company | 19.2 | 12.6 | 14.0 | 17.1 | 11.8 | 19.7 |

| L-QIF with direct real estate ownership | 10.6 | 9.2 | 13.3 | 10.3 | 8.4 | 11.8 |

In cantons with a dualistic system (not underlined in the table), these tax rate differences are also fully effective for capital gains. In monistic cantons (underlined in the table), however, the holding period dependent and usually higher real estate capital gains tax rates are applied equally to both investment vehicles, meaning that the tax rate difference only affects the direct federal tax and the recaptured depreciation at the cantonal level. Ongoing taxation and the taxation of capital gains are generally lower for an L-QIF with direct real estate ownership than for a real estate company.

Admittedly, these are not really new tax findings. However, given the simplified and cost-effective establishment of this new fund category and the ability to establish a project-based vehicle for a relatively short period of time, the L-QIF is likely to develop into a suitable fund category for real estate investments. The regulatory aspects must be examined carefully in each individual case. Among other things, this also applies to the regulations on transactions with related parties.

L-QIFs with indirect real estate ownership are also likely to develop in the market as a suitable form for joint ventures. This variant is also available to private investors as qualified investors. The consolidation of individual property companies and the participation of additional investors in a larger property vehicle are likely to be the driving ideas behind this.

When setting up an L-QIF structure, the tax consequences of the property transfer must be examined in detail. Even in the absence of an economic change of ownership, there is still a risk of transfer taxes being levied in certain cantons (see e. g. BGE 9C_312/2023 of 7 December 2023).

L-QIFs are not only suitable for direct or indirect property ownership but can also develop into an attractive form of investment for other assets, including for private investors (e. g. movable assets of pension funds and other professional investors, family assets and succession planning). Family ties among investors are not necessarily detrimental in this respect and FINMA's authorization practice will ultimately determine whether L-QIFs will be successful in this market segment.

Conclusion

The L-QIF will be used for both direct and indirect real estate investments. From a tax perspective, it is treated in the same way as conventional collective investment schemes. Thanks to the simplified and cost-efficient establishment of an L-QIF, the tax advantages of investments with direct real estate ownership will become increasingly apparent, but funds with indirect real estate ownership should also see a revival.