05 February 2024

Fewer mergers and acquisitions on the Swiss M&A market

- 484 mergers and acquisitions with Swiss involvement and a deal volume of around USD 72 billion in 2023 (previous year: 647 transactions amounting to USD 139 billion)

- Most active sectors: Industrial Markets, Telecommunications, Media and Technology as well as Pharmaceuticals and Life Sciences

- Largest transaction: Glencore’s sale of Viterra to Bunge for around USD 17 billion; CS acquisition by UBS in fourth place

- Fewer transactions with private equity firm involvement

- Technology aspects are increasingly becoming a key success factor in mergers and separations

At 484 mergers and acquisitions, 25 percent fewer transactions were conducted compared to 2022. That means M&A activity is shifting back toward the long-term average. “The decline in the number of deals compared to the prior two record-breaking years is mainly linked to the increase in interest rates and higher economic uncertainty,” explains Timo Knak, Head of Deal Advisory at KPMG Switzerland. Another thing that stands out is the sharp decline in deal volume, which dropped by almost fifty percent from USD 138.5 billion in 2022 to USD 72.2 billion in 2023. KPMG Deal Advisory anticipates a slightly upward trend for the current year.

Highest level of activity in the industrial goods sector

Accounting for 98 transactions and a deal volume of around USD 6 billion, 20 percent of all transactions in 2023 were attributable to the industrial goods sector. That makes this the first time since the start of the coronavirus crisis that Industrial Markets has relegated the Telecommunications, Media and Technology (TMT) sector to second place in terms of the most active sectors on the M&A market. With 76 transactions and a deal volume of just a little over USD 1.1 million in 2023, the TMT sector reported considerably less activity than in the previous year, which had featured 124 transactions and a volume of nearly USD 15 billion. As in the previous year, the Pharmaceuticals and Life Sciences sector came in third with 72 deals and a volume of nearly USD 25 billion.

The smaller percentage of mergers and acquisitions with private equity involvement is noteworthy: while the past few years had seen equity firms involved in around a third of the transactions, this figure dropped to less than a quarter in 2023. The transaction volume of this investor group also fell to a 10-year low at USD 4.8 billion (previous year: USD 35 billion). “Due to the difficult economic environment, many private equity investors focused on optimizing their existing portfolios last year. In addition, the price expectations of sellers and buyers often did not match, which is the basic prerequisite for an active M&A market,” says Timo Knak.

CS acquisition one of the most prominent Swiss M&A transactions

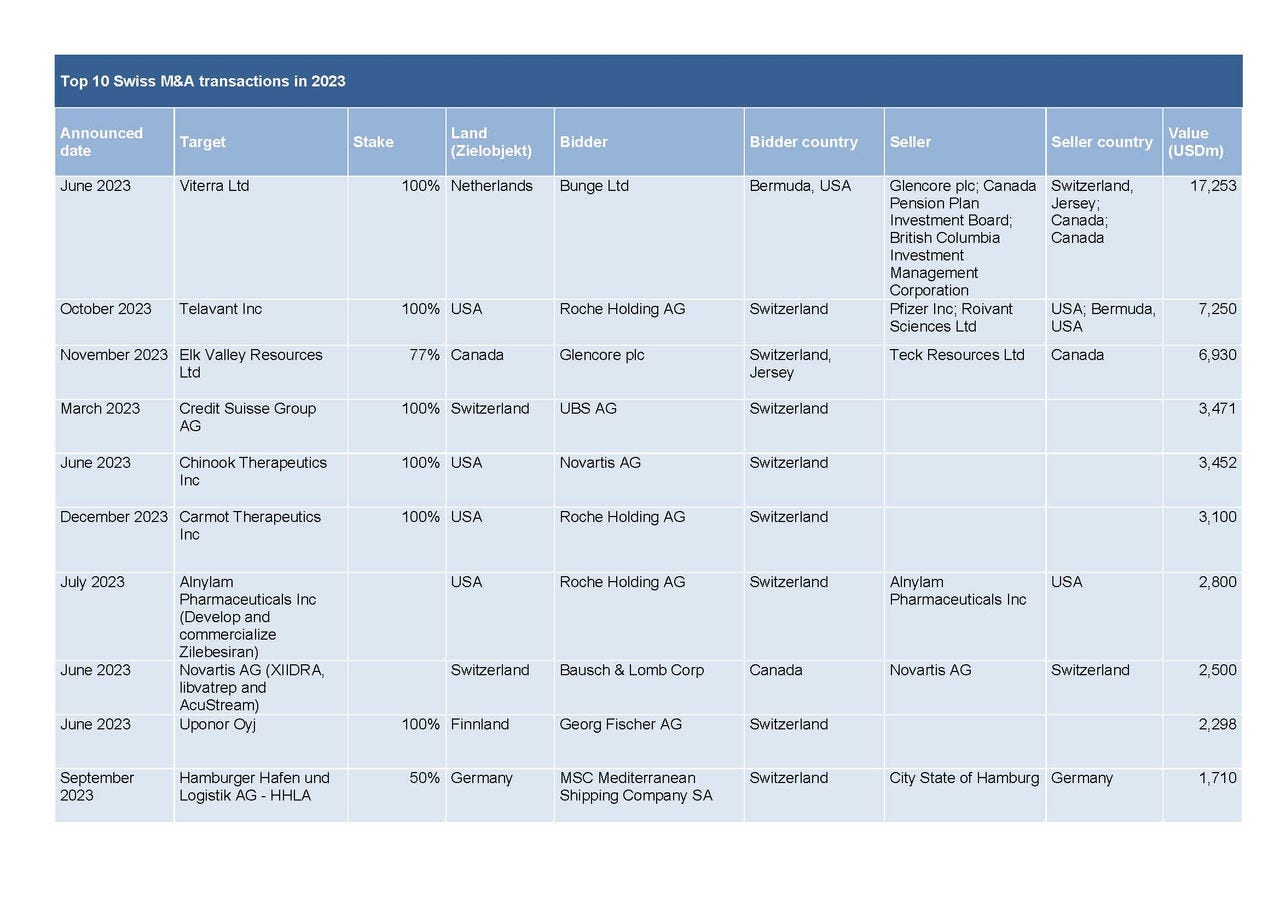

The ten most important mergers and acquisitions in 2023 accounted for around 70 percent or USD 51 billion of the total transaction volume. While UBS’s acquisition of Credit Suisse generated the most publicity, it ended up being fairly moderate given the deal’s volume of around USD 3.5 billion. The largest transaction was Glencore’s sale of Viterra to Bunge (both of which are agribusinesses) for USD 17.3 billion, followed by Roche’s acquisition of Telavant, a biotech company, for just under USD 7.3 billion. Glencore – this time on the buyer’s side – came in third with its acquisition of the steelmaking coal division of Elk Valley Resources from Teck Resources for around USD 6.9 billion. This transaction came on the heels of a failed attempt by Glencore to acquire a 100 percent stake in Teck Resources at the start of the year, when it made an offer of just under USD 31.9 billion for the Canadian mining company.

Table: Ten largest transactions with Swiss involvement in 2023

Table: Ten largest transactions with Swiss involvement in 2023

Swiss companies busy making purchases abroad

Contrary to the popular opinion that Swiss companies are being increasingly bought up by foreign companies, the data paint a different picture: Swiss companies acquired foreign companies or parts of companies in 216 cases (45 percent of all transactions), whereas foreign companies acquired Swiss companies or stakes in Swiss companies in 118 cases (24 percent of the transactions). At 86 deals, domestic transactions (Swiss/Swiss) accounted for almost one fifth of all transactions. Some 13 percent of all transactions were attributable to foreign deals with Swiss vendors (64 deals).

Outlook: Focus in mergers and acquisitions is increasingly on IT

Timo Knak expects another slight increase in both the level of M&A activity and the transaction volume in the current year. “M&A is still a strategically important topic,” says Knak. However, in the eyes of this expert, the complexity of mergers and acquisitions will continue to increase – not only due to higher sustainability requirements, but also with respect to technological developments. “Companies’ IT landscapes will become increasingly complex, partly because of the rise of artificial intelligence. This development will also impact the transaction business,” says Knak. “On the one hand, the importance of IT due diligence prior to a transaction is increasing in order to identify risks such as system vulnerabilities and data protection breaches at an early stage. On the other hand, for both takeovers and spin-offs, the parties involved have to make sure the integration or separation process doesn’t disrupt any business-critical processes. That makes the effective management of these technological aspects vital in order to prevent unpleasant surprises.”