1 October 2024

Real estate investment market – confidence returns

- The real estate sector is now looking to the future with renewed confidence following two pessimistic years.

- Positive price and market expectations have put the Swiss Real Estate Sentiment Index back in positive territory after an all-time low.

- Market players think that the residential segment has significant price potential. Price expectations for commercial real estate segments remain negative.

- In terms of risk perception, interest rate risks have faded from the spotlight. More stringent regulation tops the real estate sector’s worry barometer.

- 77 percent believe that the current political proposals will exacerbate the shortage of affordable housing.

- More than 70 percent complain that politicians are not providing any effective means of reducing excess demand for living space.

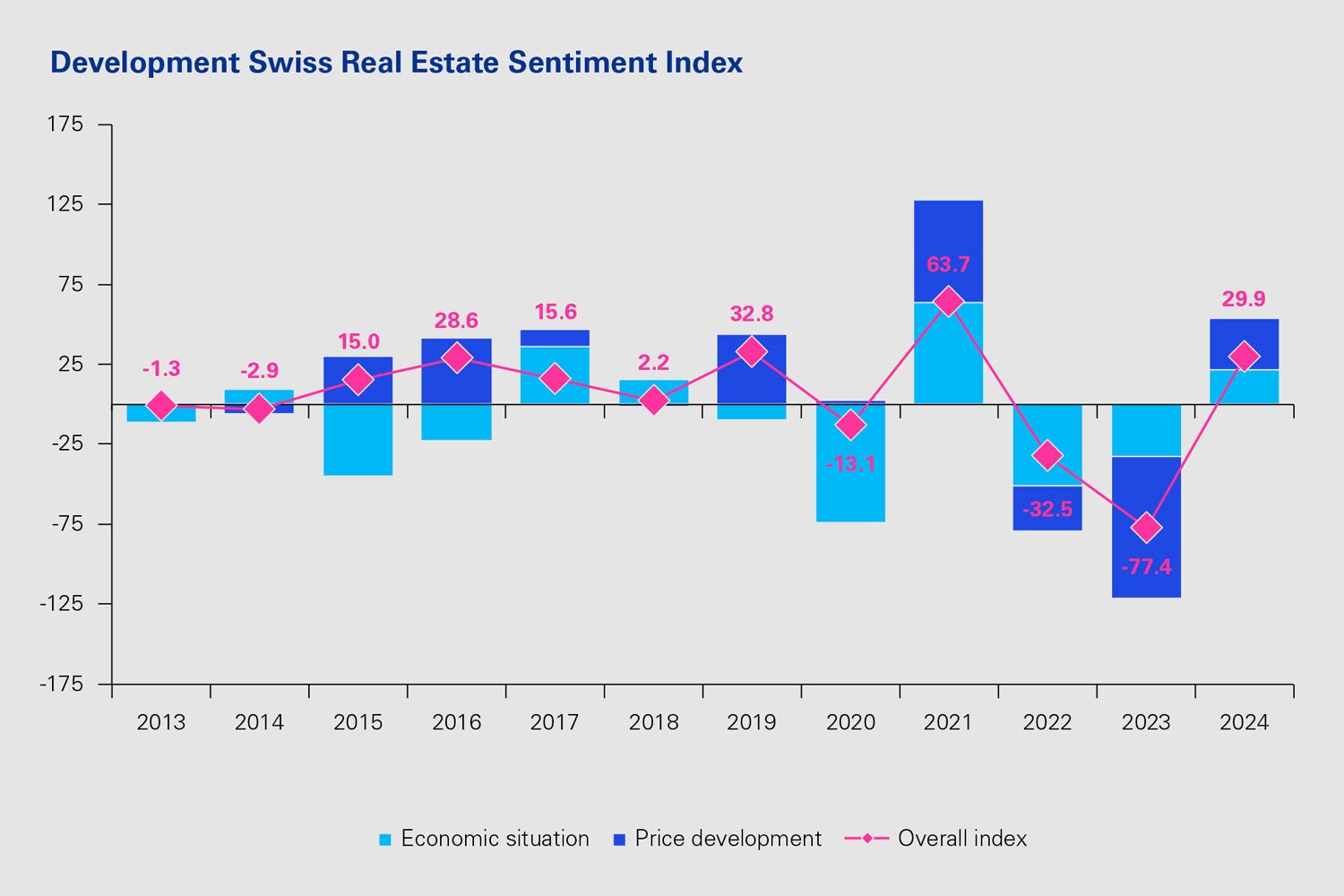

Confidence is back in the real estate sector, dispelling the negative expectations of the past two years. This is the picture painted by the results of the survey conducted for the Swiss Real Estate Sentiment Index (sresi®), which reflects the expectations in the real estate sector regarding price and market trends. The sresi® said goodbye to last year’s all-time low of -77.4 points and stands at 29.9 points in 2024.

Positive economic development expected

At 21.5 points, expectations regarding economic development for the next twelve months are in slightly positive territory after being clearly negative in the previous two years. “The optimistic economic outlook is linked not only to the relaxation on the interest-rate front but also to the progress that central banks have made in their efforts to fight inflation,” explains Beat Seger, Real Estate Expert at KPMG.

Price expectations only positive for residential segment

Expectations regarding price trends have also brightened in comparison with the previous year. After last year’s clearly negative assessment of the price trend (-88.6 pts) across all real estate segments, respondents now expect to see slightly increasing prices again over the next twelve months. This sentiment is reflected in the price index, which stands at 32.0 points.

The real estate sector only expects higher prices in the residential segment, however. Price expectations are still negative for the commercial real estate segments such as office, commercial and retail spaces as well as special-purpose properties.

Rising prices expected, particularly in Zurich, Lucerne/Zug and Geneva

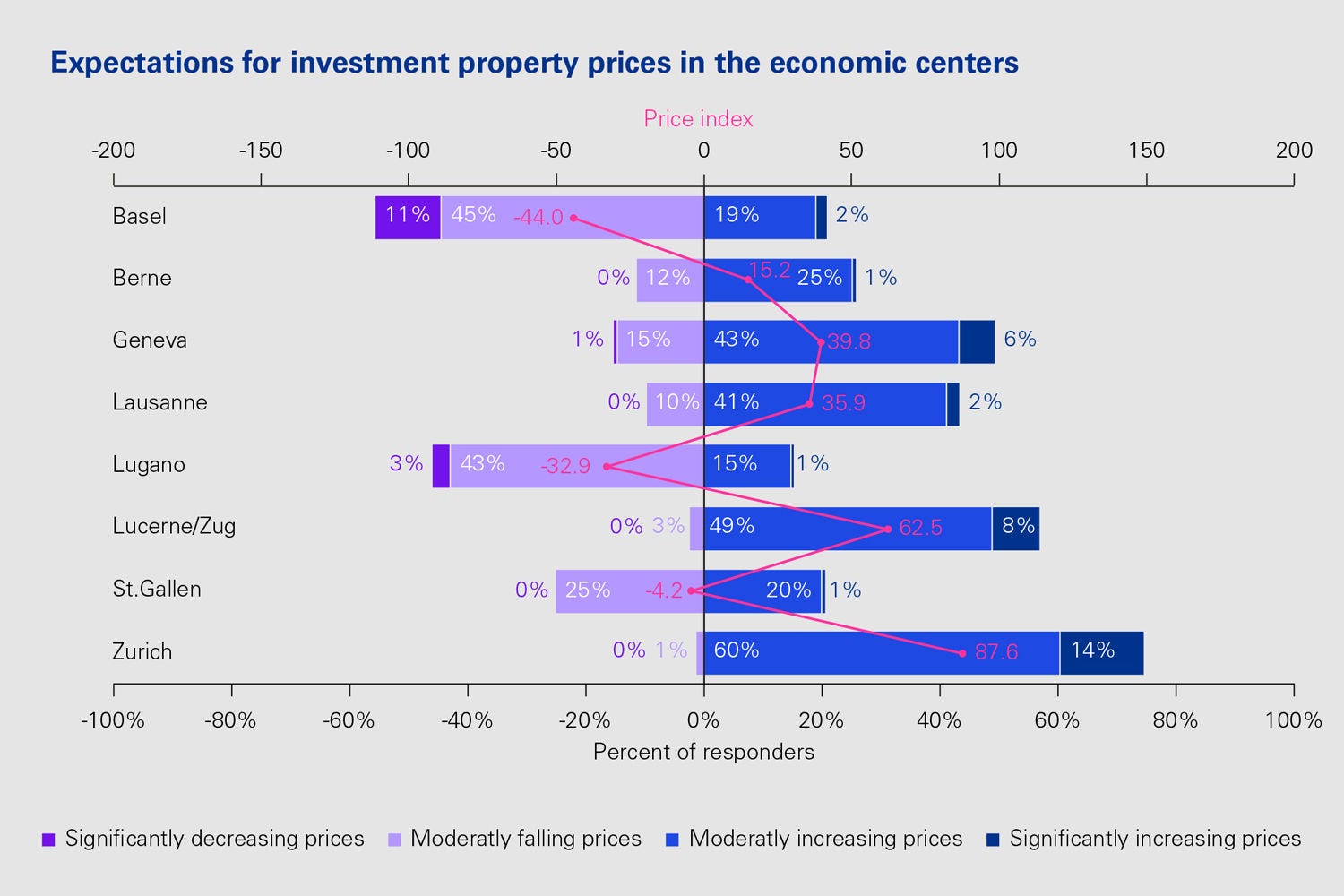

Price expectations for secondary centers and central locations are back in positive territory. At a price expectation index of 72.8 points, respondents are anticipating noticeable price increases for central locations. While market players still expect the price trend at peripheral locations to be negative (-42.2 pts), they think it will be less pronounced than in the previous year (-132.5 pts).

The consolidated opinion on price trends has also brightened again for economic centers. The real estate sector expects most price trends to be positive, especially in Zurich (87.6 pts), Lucerne/Zug (62.5 pts) and Geneva (39.8 pts). Price expectations are most clearly negative for the economic centers of Lugano (-32.9 pts) and Basel (-44.0 pts).

Supply largely intact

At -73.3 points, respondents rated adequate investment opportunities in the residential segment as having become scarcer again (2023: -60.9 pts). A multi-year comparison, however, reveals that the situation has eased slightly. The availability of special-purpose properties is also considered low, yet at -22.3 points it remained on a par with last year’s moderate level (-21.6 pts). The availability indices for office, commercial and retail spaces remain in slightly positive territory, which indicates a sufficient supply of investment opportunities.

Regulation is the biggest worry

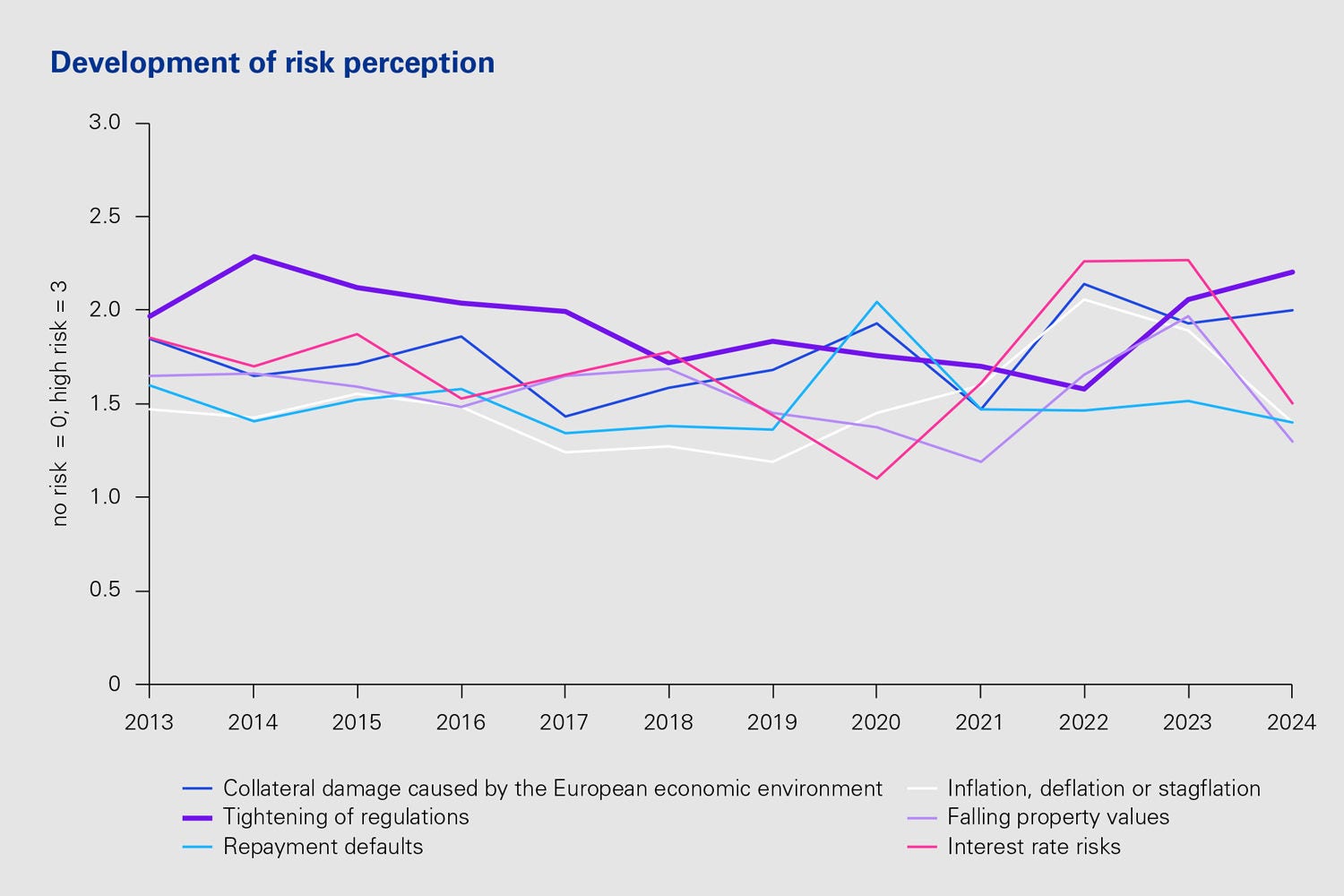

Expressed on a scale of one to three, more stringent regulation tops the real estate sector’s worry barometer at 2.2 points, followed by the potentially negative impact of the European economic environment (2.0 pts). Interest rate risks have largely faded from the spotlight compared to the two previous years.

The risk of more stringent regulation was only perceived as being slightly higher (2.3 pts) in the 2014 survey, which could be linked to the interest rate situation at the time as well as the decision made in the previous year to activate the countercyclical capital buffer. The current assessment is likely a consequence of measures already adopted to cap earnings, upcoming political initiatives, spatial planning challenges and the implementation of sustainability requirements.

Policies ineffective in addressing housing shortage and sustainability

The vast majority of those surveyed believe that the current political proposals will exacerbate the shortage of affordable housing. 77 percent of respondents either “rather agree” or agree with this statement, whereas only 8 percent disagree.

At the same time, more than 70 percent complain that politicians are not providing any effective means of reducing excess demand for living space. Only 4 percent are confident that politicians are actively working to tackle the challenges of creating new housing.

According to at least 63 percent of those surveyed, the regulation of affordable housing could present an obstacle on the path to achieving sustainability goals for residential real estate. Just 11 percent of respondents believe that regulatory intervention has no impact.

Nevertheless, 28 percent of those surveyed believe that the net zero target by 2050 is attainable through the defined reduction pathways. This corresponds to a year-over-year improvement of 10 percentage points. However, 72 percent still think that this sustainability goal can only be achieved in part, or not at all, by the agreed deadline.

Further information and the detailed study can be found at www.kpmg.ch/sresi

Methodology

The KPMG Swiss Real Estate Sentiment Index (sresi®) serves as an early indicator of anticipated trends in the Swiss real estate investment market. The main index consists of the assessment of economic and price trends in the real estate investment market. In the aggregated index, the assessments of economic conditions are weighted at 20% and the assessments of the price trends at 80%. The sub-indices reflect the expectations of survey participants, with reference to individual market and real estate use segments. Data collection first took place in 2012 and is undertaken annually to generate the indices, allowing market assessments to be compared over time. Around 400 real estate investors and appraisers in the Swiss real estate investment market took part in this year's survey. The survey participants represent an investment and valuation volume of around CHF 350 billion. The survey took place between 14th June 2024 and 26th August 2024.