France: Update on introduction of mandatory e-invoicing

Implementation timetable confirmed but scope of public portal limited

The French Ministry for the Budget confirmed in a press release dated October 15, 2024, the timetable for introduction of mandatory business-to-business (B2B) electronic invoicing (e-invoicing):

- September 1, 2026: Obligation for all companies to receive dematerialized invoices, and obligation for large and mid-size enterprises (ETIs) to issue dematerialized invoices

- September 1, 2027: Obligation for small and medium-sized enterprises (SMEs) and microenterprises to issue dematerialized invoices

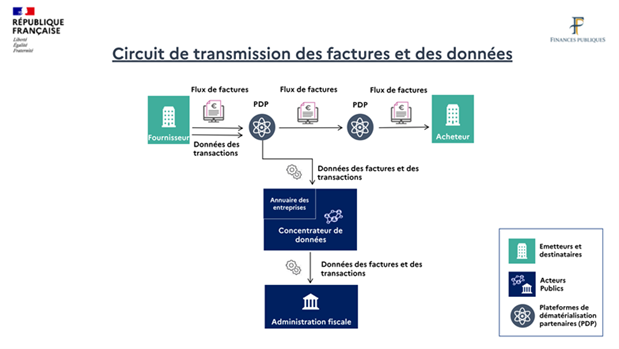

However, the project will be pursued “with priority given to the construction of a directory of recipients, essential for exchanges between platforms, and a data concentrator enabling data to be transmitted to the tax authorities.”

In other words, the public portal will only be responsible for:

- Maintaining the companies directory

- Transmitting data to the tax authorities, enabling them to pre-fill tax returns (e-reporting)

Under the previous scheme, the public portal was intended to enable invoices to be sent and received free of charge. Under the new scheme, only partner dematerialization platforms (PDPs) will enable invoices to be exchanged between operators, so that by September 1, 2026, all companies, whatever their size, will need to have chosen such a platform to be able to receive electronic invoices.

The new architecture is represented by the following diagram on the tax administration website:

For more information, contact a KPMG professional at KPMG Avocats:

Laurent Chetcuti | laurentchetcuti@kpmgavocats.fr

Armelle Courtois-Finaz | acourtois-finaz@kpmgavocats.fr