Control changes with ASC 606 implementation

KPMG Executive View | April 2018

ASC 606 early adopters identify changes to financial reporting controls. KPMG highlights what those changes are.

Applicability

ASC 606, ASC 340-40, and all recently issued ASUs for these topics

- All companies

Form 10-Q control disclosures

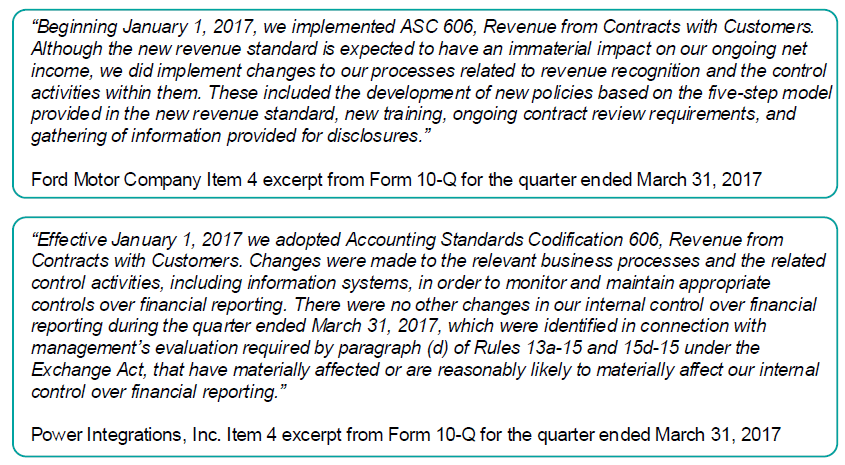

Reviews of Item 4, Controls and Procedures, of Form 10-Q, show that nearly 40 percent of companies that early adopted ASC 606 included discussion that their controls had changed as a result of implementing the new standard. Have you thought about what to disclose in your upcoming 10-Q about controls related to adoption and implementation of the new revenue standard?

Here are two examples.

These examples remind us that management has a responsibility to maintain effective controls and to disclose in the interim 10-Q filings any material changes to internal controls over financial reporting (ICFR). However, it does not appear that all early adopters limited their disclosures to material changes.

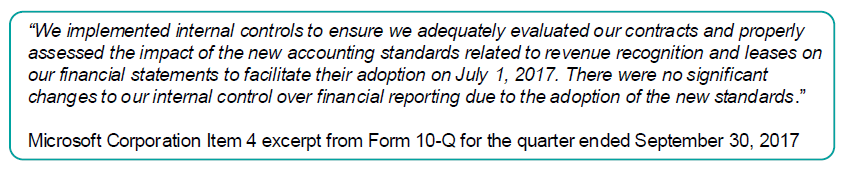

ASC 606 is so significant that some companies discussed the adoption of the standard and its effect on processes and controls even if management didn’t believe the adoption or implementation rose to the level of a material change in their controls. This approach is reflected in the following example.

Think about adoption in two parts

When considering Item 4 disclosures, it may be helpful to think about adoption of the standard in two parts: ‘one-time’ controls that were put in place to adopt and transition to the new standard; and ‘ongoing’ controls that are more permanent changes that need to be made to account for current and future transactions under ASC 606.

Even if material changes to controls were not needed for ongoing transactions, there are likely some significant changes for the one-time controls necessary to adopt and transition to the new standard.

Don’t forget entity-level controls

Further, when evaluating whether Item 4 should include language to disclose control changes, a company should also consider the effect on its entity-level controls that underpin the effective adoption of ASC 606, as well as new controls or changes to existing controls to capture the disclosures.

Controls not only need to be designed and operating to record transactions properly, but also to ensure that implementation and adoption are effective and to comply with the new disclosure requirements.

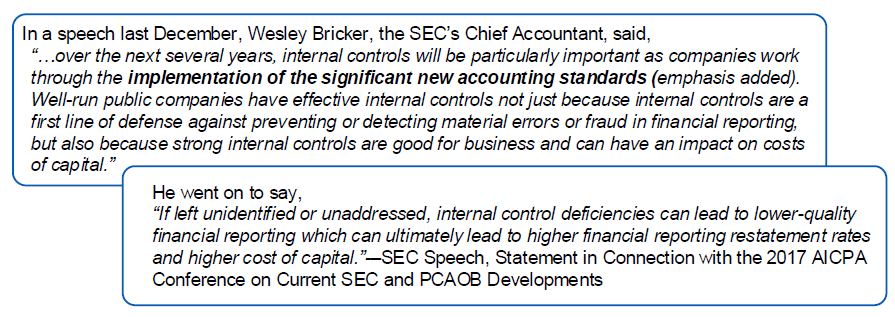

Good governance

Finally, while the risk assessment, design and implementation of ICFR is required by SEC rules and regulations, robust controls that are responsive to the new accounting standard are good, healthy governance. And disclosing information about those controls or changes to existing controls provides investors with a more comprehensive understanding of the effect on a company’s adoption of ASC 606.

Download the document:

Explore more

Handbook: Internal control over financial reporting

Our guide to designing, implementing and maintaining an effective system of internal control over financial reporting.

ASC 606 implementation – don’t forget internal controls and disclosures

KPMG’s insights on ASC 606 implementation. With adoption of the new revenue standard underway for most companies, KPMG reports on areas that may be left as low priority – with potentially risky consequences.

Handbooks

KPMG handbooks that include discussion and analysis of significant issues for professionals in financial reporting.