Footnotes

- MIT Sloan School of Management: Tapping the power of unstructured data, August 1, 2022.

Our team of data scientists and technology professionals can help you harvest new data and different types of data and interpret more signals and uncover more complex patterns.

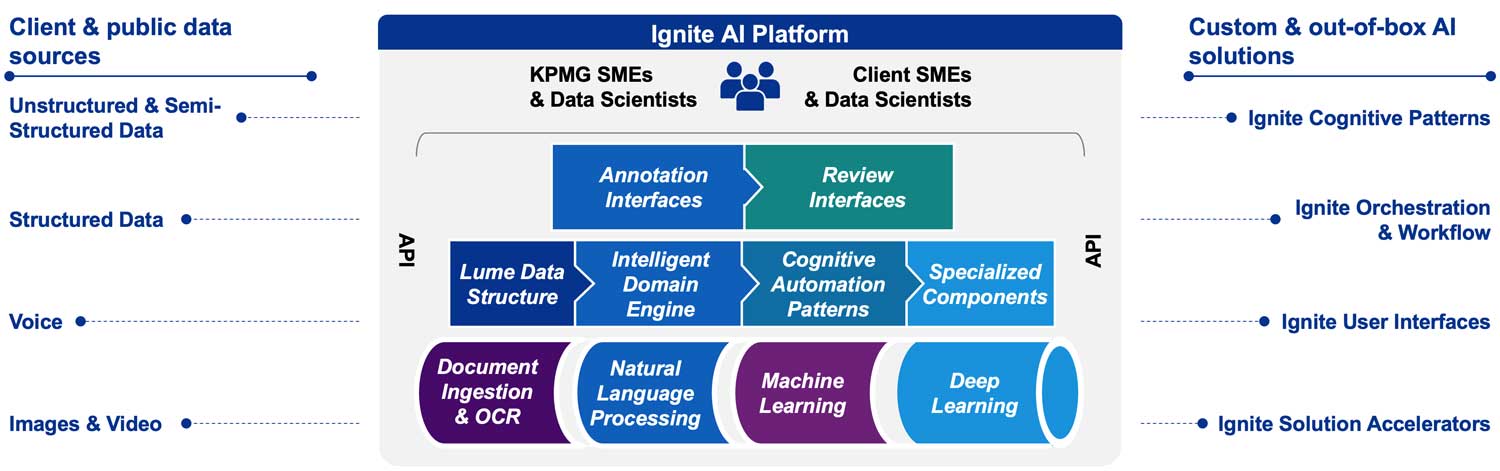

Ignite combines dozens of powerful features and industry leading AI tools into a single, flexible and easy-to-use AI development platform. You can build, train, configure and deploy your own custom AI-enabled solutions far faster than ever before.

Ignite includes a robust portfolio of prebuilt, industry-tested AI-enabled solutions designed to tackle some of the most common and complex business challenges. You can quickly and easily replace many error-prone manual processes and unlock valuable insights trapped in your data.

Ignite is backed by our team of highly skilled data scientists, technology professionals and business advisers with deep industry- and domain-specific experience. They can help you attack even the most complex data challenges and help maximize the value of your AI-enabled solutions.

Eighty to 90 percent of organizational data is trapped in unstructured documents, images, audio and video1. Extracting insights from that unstructured data is one of the most significant challenges businesses face today — but not with KPMG Ignite. KPMG Ignite brings together natural language processing, machine learning (ML), deep learning, document ingestion and optical character recognition (OCR) capabilities into a single suite of tools designed to turn unstructured data, voice and images into meaningful, codified structures.

Read documents, extract facts and perform analysis

Credit card agreements, appraisals, closing documents, loan estimates, K1s and more.

Identify patterns in the data and learn new behaviors

Automated teller machine (ATM) images, more...

Perform human tasks using integrated human feedback

Mortgage call transcripts, customer service calls, more...

Apply machine learning models on structured data

Accelerate your AI strategy by three to five years

The KPMG Ignite platform empowers you to rapidly solve common and complex business challenges, with user-friendly interfaces to build, train, configure and deploy advanced AI-enabled solutions.

Ignite enables you to systemically consume documents and other sources for identification of information according to your framework of choice.

Ignite includes a digitized process designed by subject matter experts (SMEs) for SMEs to decrease the amount of human intervention that’s required for workflow review, approval and remediation.

You can dynamically extract key performance indicators (KPIs) for meaningful analysis and reporting fit to complement your environmental, social and governance (ESG) program.

Our Ignite platform includes more than 30 building blocks of AI services and components that can be reused to accelerate AI enabled solutions development.

Our Ignite platform offers multiple interfaces optimized for different subject matter and domain experts, business users and data scientists, making it easier and more intuitive for each to use.

Ignite can easily integrate with your existing applications and third-party platforms including other OCR and AI solutions.

Our continued investment in the platform, our extensive domain knowledge and experience across multiple industries, and our collaboration with clients will help ensure that Ignite continues to remain a leading AI platform.

LIBOR analytics

AI-enabled interpretation and amendment of London Inter-Bank Offered Rate (LIBOR) based agreements

Commercial lending

AI-enabled identification, extraction, and assessment of commercial loans processing documentation

Securities analyzer

AI-enabled review and assessment of complex securities prospectus language and documentation

Commercial leakage

AI-enabled automation and analysis of contract leakage

Regulatory mapping

AI-enabled regulatory mapping that automates and enhances parsing, and mapping of regulations

Procurement contract analytics

AI-enabled review, analysis, and refinement of supplier and/or customer contracts

With KPMG Ignite, we partner technology with skill. We lead with experience in delivery.

More than two dozen financial institutions have capitalized on the power of AI through KPMG Ignite. Here are just a few examples:

LIBOR transition services

We’ve analyzed over 100,000 loan contracts for key London inter-bank offered rate (LIBOR) transition terms, with approximately 95 percent AI accuracy. Over 30 million pages were processed, eliminating between 250 and 300 full time equivalent (FTE) years of review work across multiple banks.

Regulatory policy automation

We used MDP to help build and deploy a marketing and sales intelligence solution for a leading US investment management company. Armed with trustworthy, timely data, the marketing team is able to finely target campaigns based on business goals, reducing sales call-to-action time from weeks to one day.

Loan origination automation

We’ve helped several large US banks automate their loan setup processes, eliminating data entry for the majority of loans originated by the banks.

Our professionals immerse themselves in your organization, applying industry knowledge, powerful solutions and innovative technology to deliver sustainable results. Whether it’s helping you lead an ESG integration, risk mitigation or digital transformation, KPMG creates tailored data-driven solutions that help you deliver value, drive innovation and build stakeholder trust.