Trends in Material Weaknesses

A 2025 KPMG study of non-IPO companies reveals common themes and business process areas associated with material weaknesses.

The purpose of this study was to identify the common themes and business process areas associated with material weaknesses (MW) reported by public companies. The statistics that follow stem from a study performed by KPMG in the summer of 2024.

The study analyzes annual filings released by SEC-registered public companies for FY 2024. Data was reviewed from the third-party research database Audit Analytics, and all MWs reported were aggregated and then summarized based on the underlying themes and affected business processes related to the MW.

For purposes of this report, the 2024 year considers MWs reported in any public company filing that was released in 2024. The MWs reported in this year’s study came from companies with year-ends through June 30, 2024. The data set underlying this study does not include S-1s for IPO companies that were first time filers during the time period of the report, but includes all companies once they have filed a 10-K.

Trends in material weakness themes reported

- Of the 3,502 annual reports filed in the 2023/2024 year, 279 companies (8%) disclosed MWs in their filings.

- The percentage of companies disclosing MWs in 2024 increased as compared to the prior year.

Issues contributing to material weaknesses in 2024

Apart from the top five primary themes of material weaknesses noted below, 8% of companies have reported issues related to restatement or nonreliance of company filings.

The top five primary themes of material weaknesses noted in 2024 are consistent with the top themes reported in the several previous years.

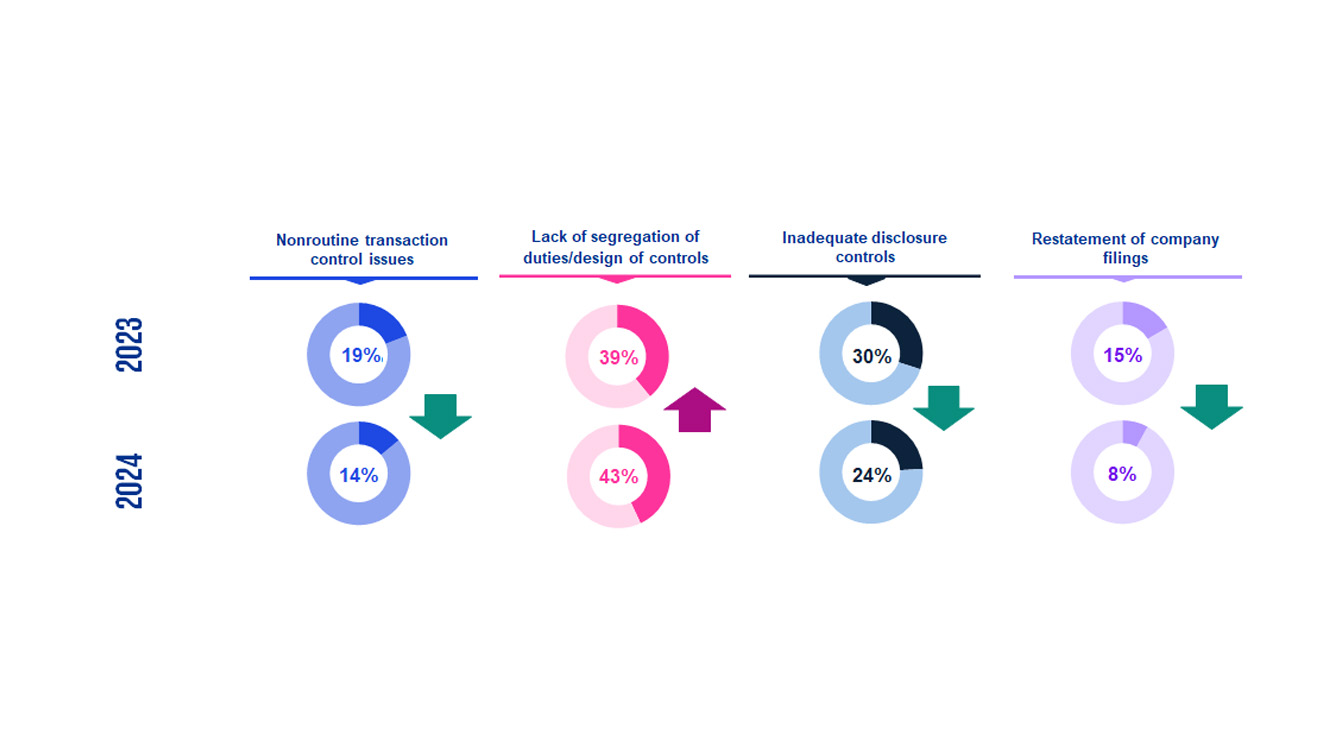

MWs related to inadequate disclosure controls decreased by 6% in FY24 which is a return to typical levels. MWs related to restatement of company filings decreased by 7% in FY24, and this is also within the typical range that’s been shown over the last several years. MWs related to lack of Segregation of Duties increased by 4% and have been trending upward. MW themes in other areas remained consistent with the prior year, only showing a 1% - 3% change in either direction.

- MWs reported were often the result of more than one overlapping issue/challenge.

- Percentages are calculated by dividing the number of companies with MWs in a category by total number of reports in the stated year. Individual companies may be reported in multiple years.

The following issues contributing to MWs showed notable trends over the last five years from 2020 - 2024, as depicted below:

- MWs reported were often the result of more than one overlapping issue/challenge.

- Percentages are calculated by dividing the number of companies with MWs in a category by total number of reports between 2020–2024 (1,134). Individual companies may be reported in multiple years.

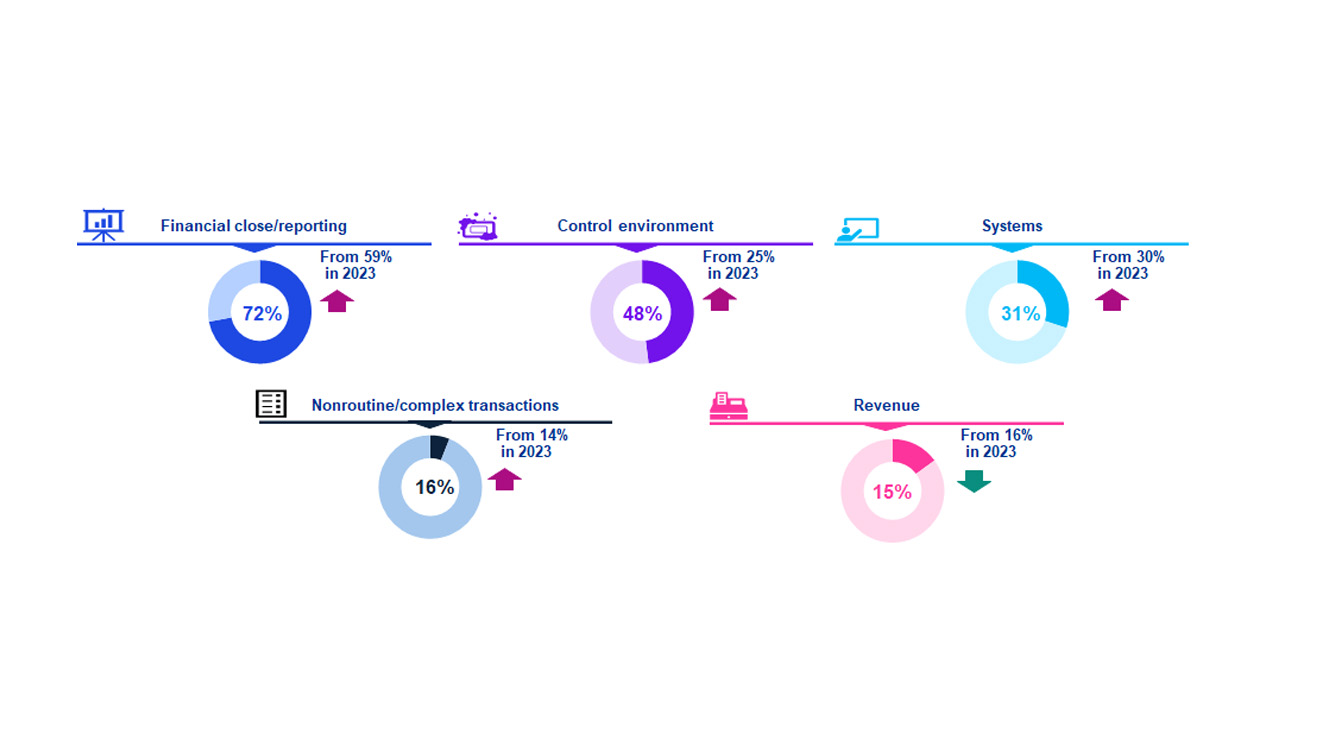

Process areas with highest concentration of MWs in 2024

The graphs below represent the percentage of MWs by process area reported in 2024, with percentage changes from prior year indicated next to the relevant process area. The level of MWs related to Systems and Revenue remained nearly consistent with the prior year, while Financial Close, Control Environment, and Non-Routine complex transactions related MWs increased in the current year.

- MWs reported often impacted multiple process areas.

- Percentages are calculated by dividing the number of companies with MWs in a category by total number of companies that reported MWs (279) in 2024.

Trends in MWs over multiple years

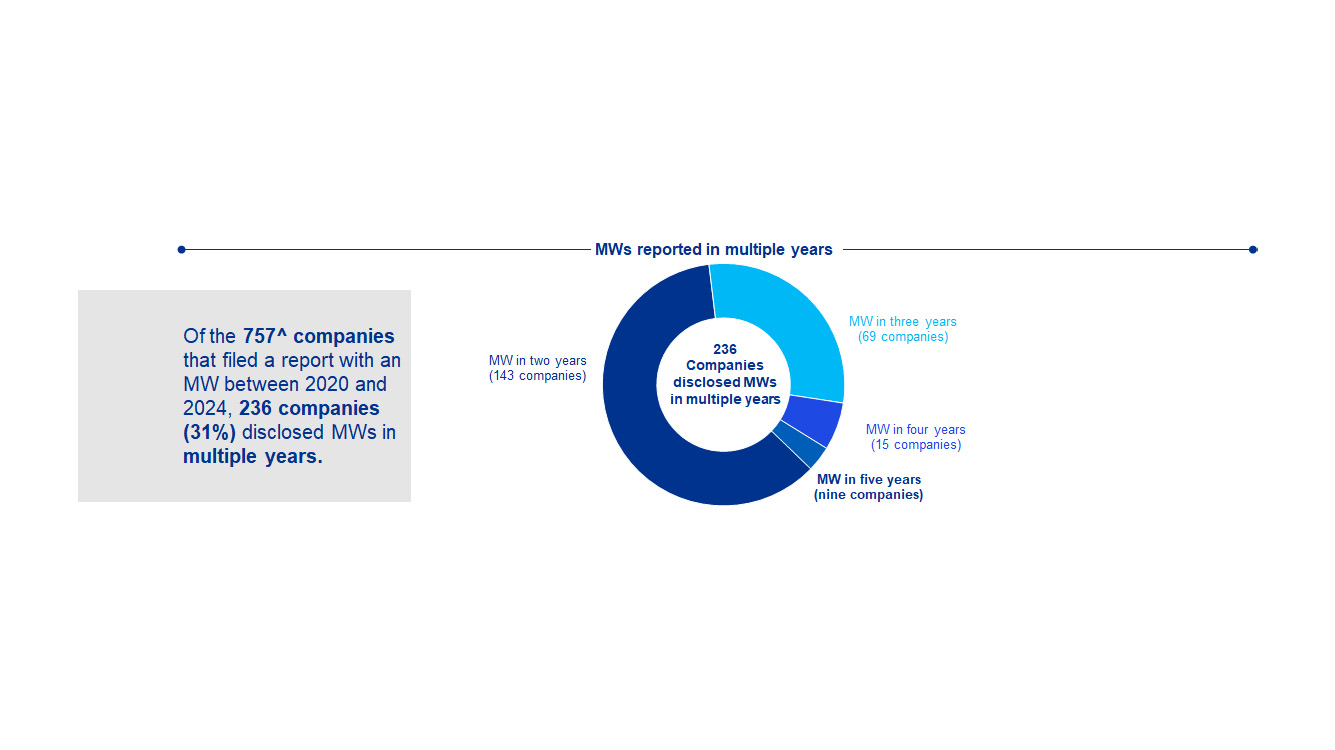

Between 2020–2024*, there were 236 companies that reported MWs in multiple years, which represents 31% of the total companies filing a report with a MW during the time period.

* This analysis is based on the data sets included in our current and previous studies, dating back to KPMG’s 2020 Material Weakness study.

^ The 757 companies reported in the table above represent the unique count of companies filing a report with an MW between 2020–2024 (i.e., excluding duplicative company counts in which there was a multiple MW reported or multiple filings in one year).

Dive into our thinking:

Trends in material weakness - non-IPO companies

Download PDFExplore more

2024 IPO material weakness study

A KPMG study of traditional IPOs reveals common themes and business process areas associated with material weaknesses

The Future of SOX insights

The latest SOX trends and insights organizations need to know about

Tech adoption, strategy shifts, and regulatory navigation

Trends in ICFR Programs

Compliance & accuracy of data and cloud computing control risks

Trends in ICOFR Programs

Meet the team