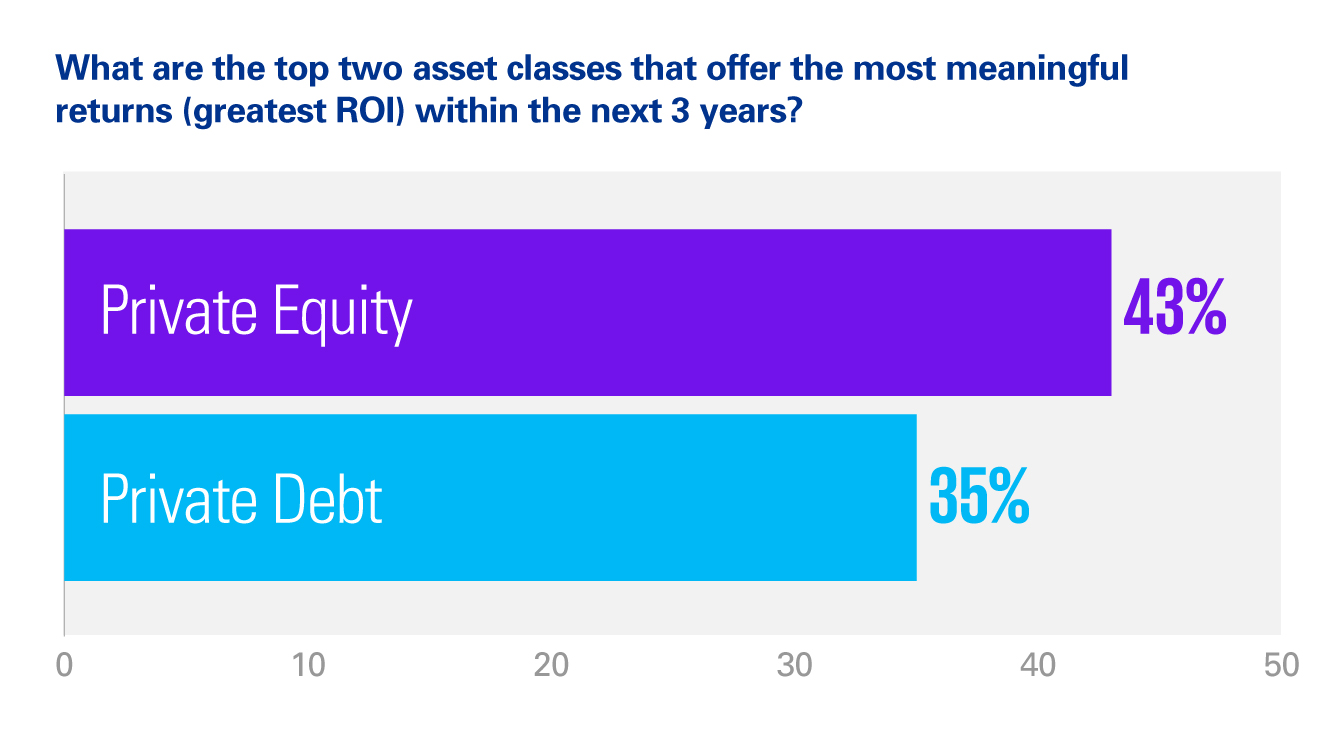

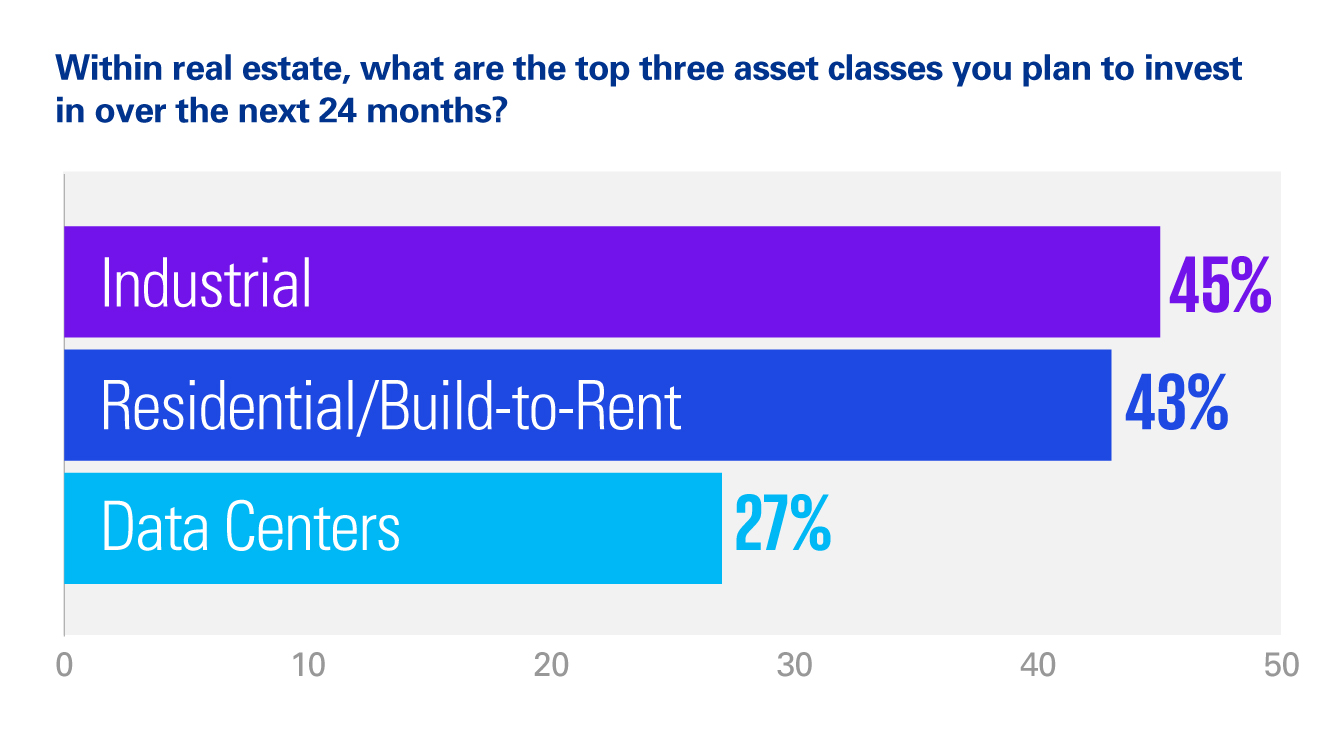

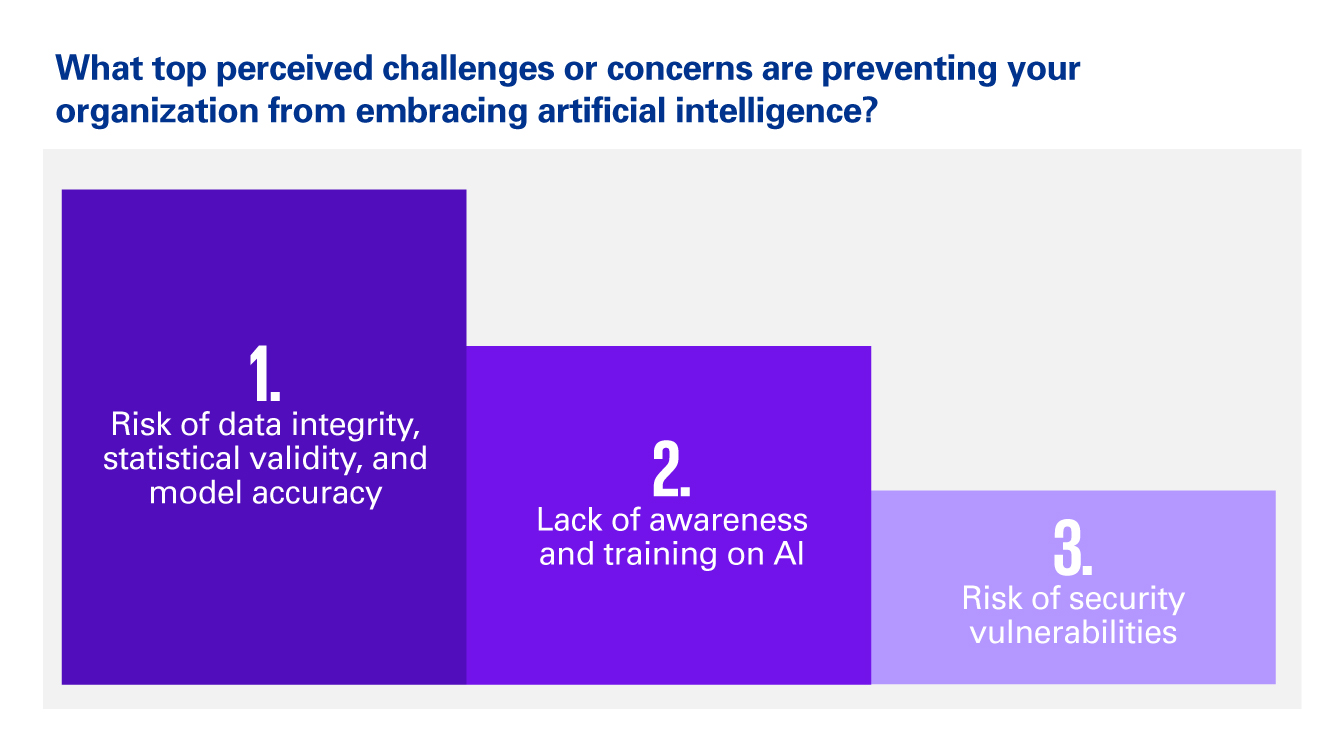

Asset managers across the US are navigating complex market conditions that are impacting their strategies for the near and long term. In July 2024, KPMG LLP (KPMG) conducted a pulse survey of asset managers to understand how factors such as the ‘higher-for-longer’ interest rate environment, an uncertain geopolitical landscape, new ways of working, and technological innovation are currently affecting them and their decision-making processes. The survey closed prior to the July 30 to 31 Federal Open Market Committee (FOMC) meetings.

Respondents from more than 120 US-based asset management firms shared how they’re navigating this environment and planning for the future. We also compared how their outlook has changed since our last survey in December 2023.