Knowing when and where to invest is not easy. Indeed, most oil and gas companies today need help to develop their transition plans and articulate their positions to their stakeholders. Leaders can start by considering the following factors:

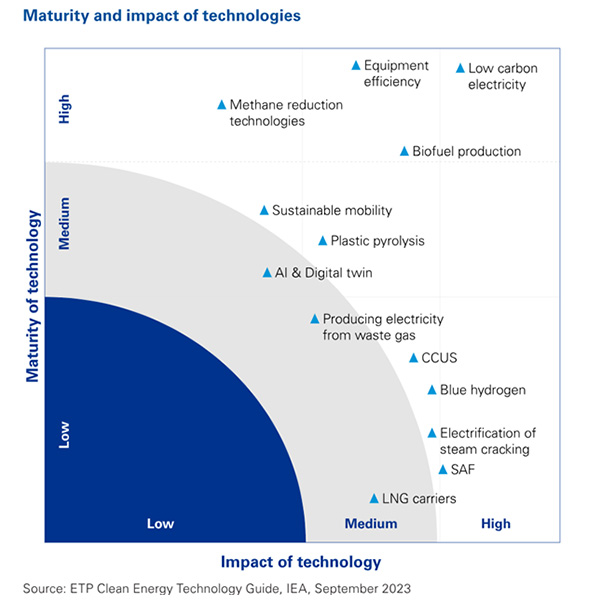

What: Knowing what new models or technologies to invest in can be challenging. We are seeing significant investment flow into various options such as CCUS, renewables, hydrogen, electric vehicle charging, biogases, and biofuels. We are also seeing some oil and gas companies look at new opportunities that leverage their embedded capabilities or play into future growth areas, such as the mining and processing of battery minerals. Every company’s list of opportunities will be prioritized slightly differently depending on their ambition, objectives and strengths.

When: The timing of investments is also a big challenge. Oil and gas companies are developing new energy capital assets using a phased approach instead of committing to the large capital project up front. Large projects can be broken into smaller phases to limit their exposure to market volatility at any given time. Oil and gas companies will only expand given the market economics makes sense. Ideally, you want to scale up as demand rises. However, demand for alternative sources has yet to materialize in some markets. That means that oil and gas companies should start building partnerships and ecosystems of customers, providers and generators that can work together to raise demand and supply in tandem. The good news is that there are incentives and funding mechanisms available that could help reduce the demand risk and make funding more viable.

Where: The financial incentives and business confidence created by the US Inflation Reduction Act (IRA) have helped the US emerge as a key competitor for alternative energy investment. Yet other markets are also developing attractive incentives for investors in key energy sectors. The trick is in knowing where to invest to maximize value globally. There could be a unique role to play in helping shape and address the energy agenda in developing and emerging markets where oil and gas companies have existing relationships. Local supply chain capabilities and available skills will also influence where oil and gas companies choose to invest.

How: There are many avenues of entry and expansion depending on the sector or technology. Options include investing in technologies, funding start-ups, or snapping up key value chain players. We believe that every avenue will require oil and gas companies to develop ecosystems and partnerships to execute their transition plans – whether to drive demand, create secure supply chains, embrace innovation or create new business models. Again, the available incentives could affect how those partnerships are formed and structured.