Footnotes

- Disruption Decoded: Private company survey results, KPMG LLP, 2024.

- Ibid.

- Ibid.

- Ibid.

- Ibid.

Discover how private company CEOs in the US are navigating disruption and positioning for growth in 2025 and beyond.

The past few years have been challenging for private companies and their CEOs. Much has changed. Disruption is everywhere. To find out how these forces are affecting private companies in the US, we surveyed more than 600 private company CEOs to see how this disruption is impacting their growth and long-term outlook. This edition of Privately Speaking explores the results of that survey.

Who did we survey?

We talked to more than 600 leaders of US-based businesses. A third were “Emerging Giants” planning to go public in the next five years. A third were “Traditional Private” companies with more than $100M in revenue but no intentions to go public. The final third was made up of “Recent IPOs”—companies that went public in the last three years and have more than $100M in annual revenue.

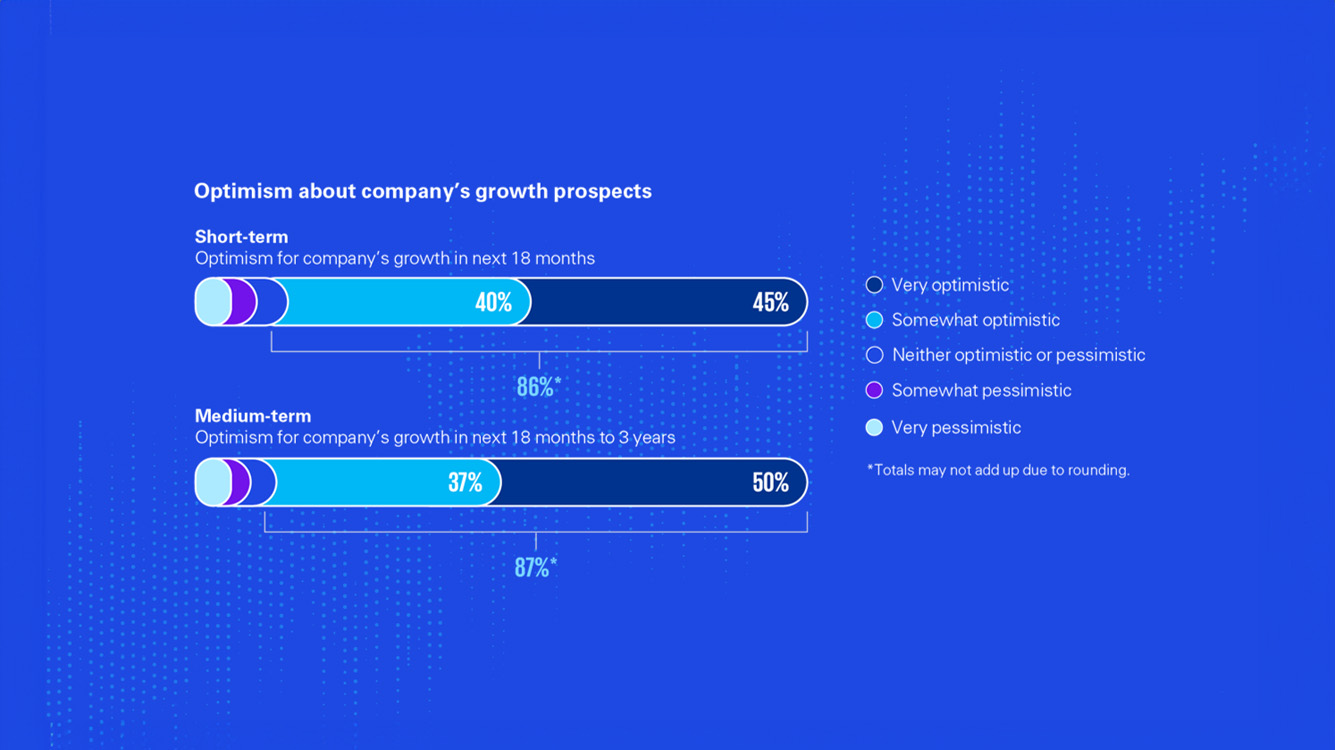

Private company leaders are optimistic about their future growth prospects, bolstered by positive economic indicators, growing consumer confidence, and favorable market conditions postpandemic, coupled with the acceleration of innovation and technology.

While all sectors are optimistic about medium-term growth, healthcare and life sciences is significantly more optimistic than other sectors, and consumer and retail is the least optimistic.

Source: Disruption Decoded: Private company survey results, KPMG LLP, 2024

Notwithstanding the ongoing concerns about the state of the US and global economy, private company CEOs seem bullish about their growth prospects. Private companies often view disruption as opportunity. And they are confident they have the agility and focus they require to turn those opportunities into growth.

Sal Melilli

Partner, Audit Sector Leader, KPMG Private Enterprise

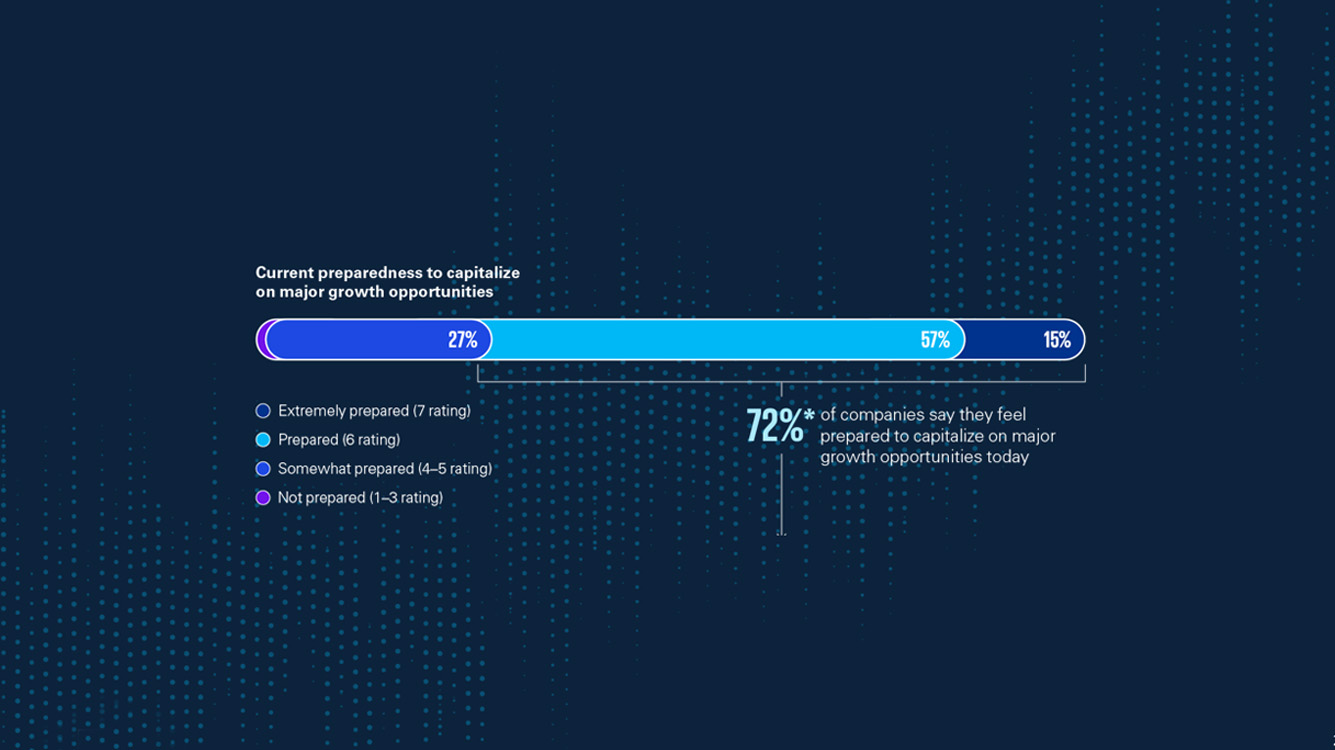

CEOs at private companies certainly think they are well prepared to make the most of new opportunities. Indeed, nearly three-quarters of our respondents say they feel prepared to capitalize on major growth opportunities today. Interestingly, those categorized as Traditional Private companies indicated the highest level of preparedness (79 percent) versus Emerging Giants and Recent IPOs (68 percent and 68 percent, respectively).1

Across industries, healthcare and life sciences companies believe they are the most prepared, while financial services and consumer and retail companies believe they are the least prepared.

Source: Disruption Decoded: Private company survey results, KPMG LLP, 2024.

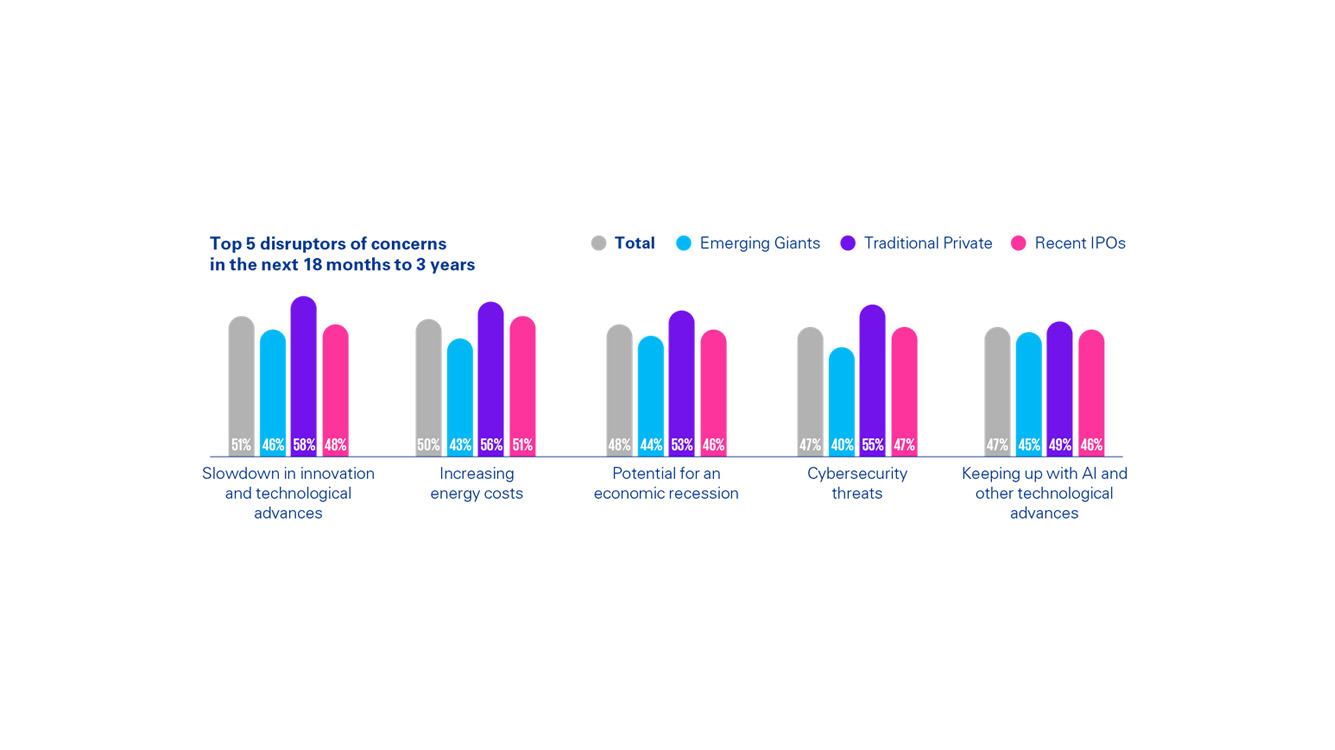

Private company CEOs may be bullish, but they also recognize there are many potential threats to growth. In the near term (next 18 months), they are very concerned about a slowdown in innovation and technological advances, increasing cybersecurity threats, ongoing inflation, and an inability to acquire and retain talent.

Looking further out (18 months to 3 years), cybersecurity and a slowdown in innovation and technology persist as top concerns, but recession and increasing energy costs also top the list of conditions that can stymie growth.

Source: Disruption Decoded: Private company survey results, KPMG LLP, 2024

The current macroeconomic and sociopolitical environment remains unsettled globally. And externalities such as weather events, cyberattacks, and trade wars are growing concerns. In this environment, private companies need robust risk management strategies to mitigate potential disruptions and ensure sustainable growth.

Francois Chadwick

Partner, Tax, KPMG Private Enterprise

More than three-quarters of private company leaders say they expect an increase in their M&A deal activity over the next 18 months, despite current higher interest rates. In part, that may be because some private equity houses are sitting on significant amounts of “dry powder” that they are keen to deploy. Many portfolio company CEOs likely expect to see a bolt-on acquisition in the near future.

At the same time, our survey shows that the group of companies categorized as Recent IPOs are much more likely to forecast an increase in their deal activity—potentially seeing it as a way to fast-track further growth and expansion of their businesses and/or to acquire disruptive AI technology.

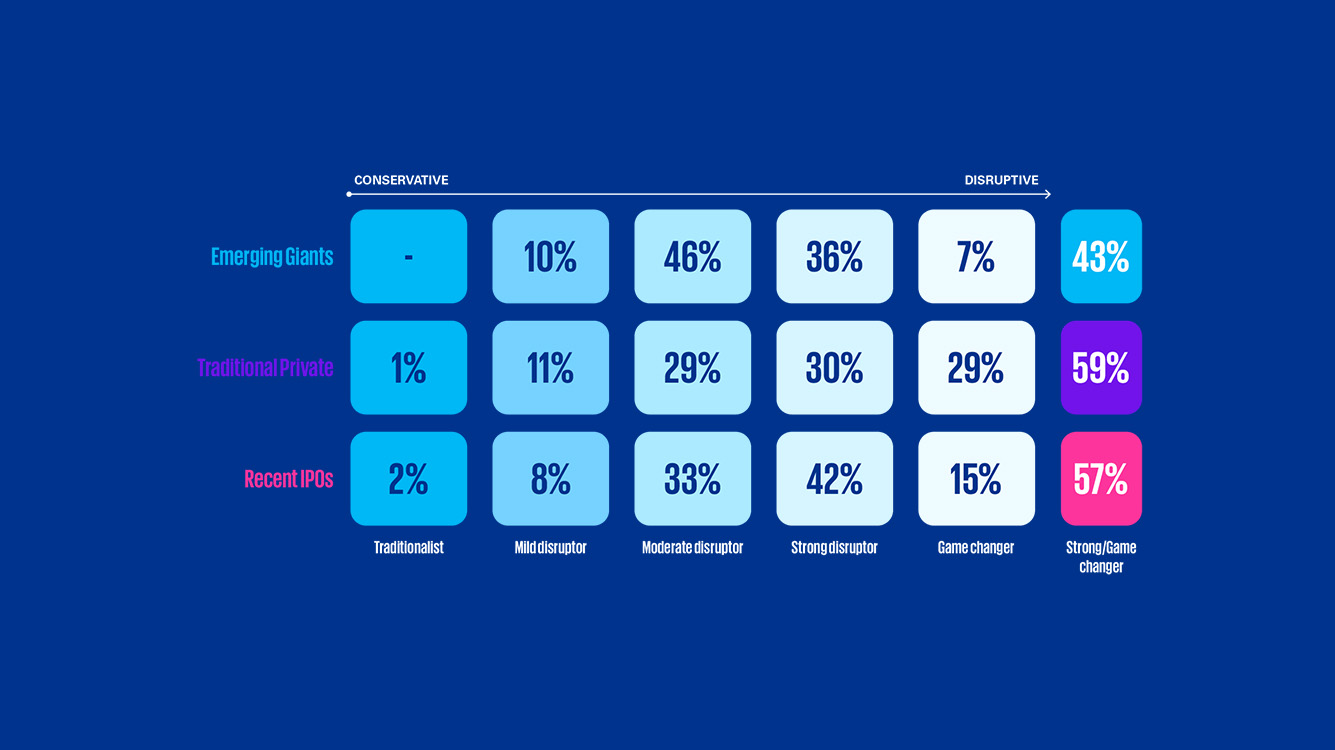

More than half (53 percent) of the private company leaders in our survey say they are either “strong disruptors” or “game changers” in their industry.2 However, that means different things depending on the type of private company you lead.

Source: Disruption Decoded: Private company survey results, KPMG LLP, 2024.

Want to learn more? Get the full survey results in Disruption Decoded: Private company survey results, a new report from KPMG Private Enterprise.

Private company CEOs and leaders think they can find opportunity in the disruption of today’s market environment, and they are preparing themselves—strategically and tactically—to be ready when the opportunities present themselves. It’s an exciting time to be a private company leader.

Shari Mager

Partner, US National Leader, Capital Markets Readiness, KPMG LLP

Whether you’re a high-growth venture capital or private equity-backed company, family business, or family office, KPMG Private Enterprise is focused on your success—now and in the future.

Disruption Decoded: Private company survey results

Perspectives on growth, AI, and reporting from private and newly-public companies.

Privately Speaking Series

Practical insights for private market leaders from private company advisors.

Subscribe to receive pertinent information that will help you drive value for your private company.