Global Navigator from KPMG Economics

May 15, 2024

Welcome to "Global Navigator," KPMG Economics' monthly international newsletter. Each month we will share expert analyses on the evolving global economic landscape, providing timely insights into trade dynamics, cross-border trends and the impact of global monetary policy, along with a deep dive into the economic outlook for key regions. Designed for multinational executives, our aim is to guide you through the complexities of the global economy, helping you stay informed and helping your business seize opportunities in this dynamic international landscape.

This edition of the Global Navigator takes a closer look at the risks of a spike in oil prices and how it could reverberate through the global economy. It is one of the top risks cited by our oil economist contacts, yet it gets limited play in the financial press. One reason is the ramp-up in oil production in the US and the role it has played as a buffer for some of the most recent large threats to global oil supplies, notably since the war in Ukraine. The US has been the largest oil producer in the world since 2018, hit a new record in 2023 and continues to act as a major buffer against a spike in oil prices. That has bred a sense of complacency about future oil shocks. However, there is no way the US alone could offset a blockade in the Strait of Hormuz, which is possible given escalating tensions in the Middle East. The oil and natural gas that traverses that narrow pass is nearly equivalent to all the production in the US, which accounts for more than 20% of global oil supplies.

Situations We Are Watching -

- An escalation of geopolitical tensions, including hot wars, could trigger a surge in oil prices. Tensions in the Middle East and threats to oil transport via the Strait of Hormuz represent a much larger potential shock to global oil supplies than Russia’s invasion of Ukraine. Prices could skyrocket to $140/barrel before settling back down to their forecasted $80 to $90 per barrel range.

- The US is currently the largest oil producer and primary buffer when prices spike, but it lacks the spare capacity to ramp up fast enough to offset a disruption in the Strait of Hormuz. Shale production has propelled US oil production to record highs. However, investment in new oil assets is limited by capital discipline – the push by oil producers to return profits to shareholders – and the incentives to invest in renewables. (Many of the oil producers are also the largest investors in renewables; they see themselves as energy companies.)

- Pressure on Iran to lift a blockade would be strongest from Asian economies, which are the most dependent on oil from the Middle East. Middle Eastern oil producers that have trapped exports, together with the US, would likely add to pressure from the Asian countries to reopen the Strait of Hormuz.

Pinch points

There are four potential drivers of a spike in oil prices:

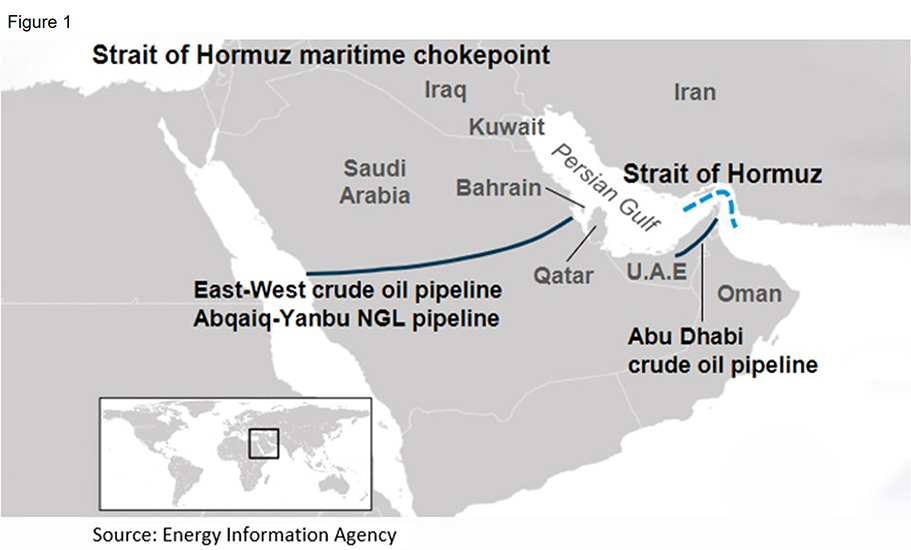

1. Disruption to oil shipments via the Strait of Hormuz. About 20% of the world’s oil and liquefied natural gas traverses the Strait of Hormuz, which is 21 miles across at its slimmest point; any disruptions to that flow would have a major impact on prices. (See Figure 1.) Our sources in the oil sector estimate that oil prices could reach as high as $130 to $150 per barrel from the mid-$80 per barrel range today if such a blockade occurred. That is by far the most extreme scenario, as it would involve a major escalation of tensions in the Middle East. It is the only scenario that the US could not offset with a rapid increase in production. The US has filled the role as safety valve in oil markets in recent years, along with the traditional swing producer, Saudia Arabia, and helped to offset major supply shocks. The US played a particularly large role in offsetting the disruptions to Europe due to Germany’s dependence upon Russian oil when the latter invaded Ukraine.

2. A further escalation of the war in Ukraine. Ukrainian attacks on Russian refineries have caused Russia to scale back crude production to avoid a glut at the refining stage but, thus far, not dramatically disrupted the balance between the supply and demand for Russian oil. An expansion of targets could further disrupt supply, but the effects are in dollars not tens of dollars per barrel, given the ability of other countries to fill the gap left by Russia.

3. OPEC+ production cuts. The Organization of Petroleum Exporting Countries plus (OPEC+), which includes twelve countries, have held to a cut in production amounting to 2-3% of global demand since September 2022. The challenge is that adherence to cuts within the bloc is weak, which has meant the cuts have done little more than create a floor under prices, rather than spur major increases. Saudi Arabia, the de facto leader of the group, and the world’s swing producer, has a relatively high breakeven price so elevated prices are welcome.

4. Hurdles to the adoption of renewable and more sustainable energy sources. Governments the world over have adopted a combination of carrots and sticks to facilitate the adoption of renewable and more environmentally friendly energy sources. A sharp increase in interest rates to combat the post-pandemic inflation as well as domestic labor and content rules to leverage subsidies, notably in the US, have slowed the ramp-up of those projects.

The challenge is even greater when factoring in the demand for energy associated with the push to adopt generative AI. The energy associated with storing and curating data, and that needed to run the large language models, is enormous. However, there is hope. The tech sector is now scrambling to secure its own energy sources – one tech behemoth is building its own nuclear plant – while startups are looking for ways to better store renewable energy. This is in addition to efforts to increase the energy efficiency of large language models to reduce the stress on energy grids.

Those shifts won’t come overnight, but when combined with a spike in energy prices, could provide a boost to the economic feasibility of renewables and accelerate their adoption. Ramping up the supply of energy will take time, but the lags could be less than we have seen in recent years.

Fallout

Inflation spikes, growth stalls

Chart 1 shows the projected shock to oil prices, should the worst-case scenario occur: a blockade in the Strait of Hormuz. Oil prices spike to $140 per barrel, nearly 60% above our current baseline scenario, which has oil prices hovering in the $80-$90 per barrel range. As of this writing, Brent crude oil is at $83 per barrel.

The model assumes a shock lasting three quarters, starting in the second quarter of 2024. A blockade in the Strait of Hormuz is the one event that could trigger such a price reaction, given excess capacity in the oil industry and the stockpile of oil inventories, largely outside of the US. Pipelines with insufficient capacity to move the oil stopped in a blockade are the only way to bypass the Strait. Alternative routes would not move substantial quantities and would add to costs and further delay shipments.

Chart 2 shows the impact that an oil price spike has on global economic growth. Relative to baseline, a three-quarter long surge in prices shaves up to 0.8% off quarterly growth rates and a quarter percent from average annual growth:

- Global inflation initially rises to 6.2% from 5.0%, the highest since mid-2023.

- Central banks are forced to scrap plans to cut rates, do a U-turn and hike by 25 basis points before holding rates flat through the spike. After oil prices normalize, central banks begin cutting in the second quarter of 2025.

- The US dollar appreciates as investors seek the relative safety of the US Treasury market; the spillover effects of weaker currencies abroad lower the costs of imports.

- Financial market volatility intensifies with equity market swings around the world.

- Consumer spending decelerates as rising prices erode purchasing power and deal a blow to consumer confidence. Gas prices are one of the largest determinants of consumer attitudes across the largest oil consuming countries.

- Business investment slows, as escalating costs and interest rates crimp profit margins, while heightened uncertainty prompts firms to shelve big investment plans. The push to transition to renewables and improved capital discipline by oil firms tempers investments in oil assets.

- Fiscal budgets are strained as decreased tax revenues limit the ability of governments to offset the higher oil prices with interventions.

To counter the spike in prices, non-Middle Eastern oil producers would expand production. US shale producers would likely boost production slightly but capital discipline (shifting the focus from additional investment to adding financial value) and a fear of investing too much, with the pivot to renewables are expected to cap gains. The largest pushback will come from large Asian economies that depend the most on oil from the Middle East. The US military also could deter attacks on vessels and enforce sanctions.

Chart 1: Blockade in Strait of Hormuz causes oil spike

Price per barrel

Chart 2: Blockade blunts global growth for 9 months

GDP, Q/Q annualized rate, Percent

Winner & losers

Non-Middle Eastern oil producing countries tend to benefit, while Middle Eastern oil producers and oil consuming countries tend to suffer. Table 1 shows the top 10 winners and losers of an oil shock in terms of the boost or blow to real GDP growth.

Table 1

Winners

Non-Middle Eastern oil producers. Guyana has experienced an oil production boom that emerged from some of the largest oil discoveries of the last decade. The country’s reserves place it in the top 20 globally and would cause a massive jump in real output for as long as the spike persists. These newfound reserves were key drivers in the border dispute with Venezuela.

Argentina should benefit from the spike if the spoils are not mismanaged. With a low breakeven cost and large investments in shale coming from multinationals, Argentina aims to attribute around 20% of total GDP to oil by the end of the decade. Colombia nearly cracked the top 10 winners. It exports roughly half of its oil, so while it faces worse consumer dynamics than Argentina, it should be able to squeeze out a decent return.

Venezuela boasts the world’s largest oil reserves but is notoriously inefficient. Inadequate infrastructure, mismanagement and policy issues would cause it to struggle to take full advantage of the situation—even if the US removed recently reimposed sanctions.

Algeria, Nigeria and Angola are forecast to experience real output increases and unemployment rate declines. Each derives a substantial portion of GDP from oil industries. Norway, unaffected by inefficiency or sanctions, can take advantage of the spike and further pad its sovereign wealth fund.

Generally, jobs are added, manufacturing swells and government coffers are filled via increased tax revenues. Currency appreciation makes exports more expensive while the rest of the world is pulling back. Consumption and investment move higher as stronger domestic currencies and the incremental increases in exported oil allow for expanded spending.

Losers

Middle Eastern countries that use the Strait of Hormuz to transit oil. While the higher oil prices are welcome, the inability to move oil is comparatively more problematic. The hit to GDP is as much as 15% for some of these countries. Only Saudi Arabia and the UAE have pipelines that allow for bypassing the Strait; their capacity barely puts a dent in normal seaborne flow.

Oil breakeven prices vary in the Gulf. Even in our liberal estimates of fully utilizing the Saudi and UAE pipelines to sidestep the Strait, the revenue shortfall leaves governments underfunded. How much worse for countries without similar pipelines?

This dynamic is what creates space for non-Middle Eastern oil producers to win big. It is why an Iranian blockade would be met with intense pressure to cease and desist from Middle Eastern oil producers.

Emerging markets (EMs) bear the brunt of inflation and subsequent fiscal challenges. Last month’s Global Navigator discussed the challenges facing EM central banks and governments which are more vulnerable to price shocks because they are less equipped to handle increases in debt servicing costs when bond yields increase. The cost of their imports rises as local currencies depreciate. Larger EMs have large foreign exchange reserves to counter the depreciation of their currencies.

EM labor market effects are offset between oil and non-oil producing countries. Latin America is hit particularly hard by inflation. As a major importer of Middle Eastern oil, Asian manufacturing suffers from higher prices and decreased consumer demand.

The euro area, still feeling the effects of higher energy prices from the Russia-Ukraine War, experiences some of the worst inflation of any region. Industrial production and export growth plummet. Manufacturing job losses approach 100,000. That should strengthen the resolve of the euro area to bolster its green transition, including EV production.

The US is unique in that it is both the world’s largest oil producer and consumer. Even with American production, the US still imports millions of barrels of oil and is not shielded from the price shock. US oil producers are not expected to increase oil-related investment and will ride the revenue wave to enhanced shareholder returns.

The blow to American consumer spending is greater than the boost to production, which puts it on the losing side of the ledger. Nearly 1.5 million jobs are forecast to be lost. The strength of the dollar helps ease the blow as will the centrality of the Federal Reserve to financial markets. More debt would be added to make up the government revenue shortfall. That would exasperate Treasury debt servicing as the Fed is forced to hike rates to counter the oil shock-induced inflation.

About 20% of the world’s oil and liquefied natural gas traverses the Strait of Hormuz, which is 21 miles across at its slimmest point; any disruptions to that flow would have a major impact on prices.

Benjamin Shoesmith, KPMG Senior Economist

Bottom Line:

The risk of a spike in oil prices due to a blockage of the Strait of Hormuz is rising. Such an event would boost inflation, force many central banks to hike instead of cutting rates and deal a blow to global growth. Financial markets are poor at pricing in the risk of fat-tail events, such as a spike in oil prices. The ability of the US to act as a buffer for global oil supplies has spawned complacency. Any spike we see is expected to be short-lived, given the broad-based backlash such a move would trigger. The only major beneficiaries of a spike in prices are large oil producers outside of the Middle East, including Russia and several countries in Africa and Latin America.

Global forecast update

Global growth is forecast to decelerate slightly from 2.7% year-over-year in 2023 to 2.6% in 2024. Consumption is expected to drive gains, as inflation continues to cool and central banks begin the process of cutting rates. Investment is expected to pick up more slowly, after central banks start cutting rates in earnest. Most central banks are expected to begin rate cuts in the second half of 2024. The Federal Reserve is an outlier and not expected to cut until late in the year. Fiscal stimulus is expected to be limited, given already high debt loads, which are now compounding at much higher rates than we have seen since prior to the onset of the global financial crisis in 2008-09.

Leaders and laggards: Shifts in supply chains are driving growth in the developing world. The Association of Southeast Asian Nations (an economic and political union of ten countries referred to as ASEAN) has been the largest beneficiary. Latin America is next on the list. With Mexico seeing the largest gains due to the USMCA trade agreement and its access to the US market. The US should lead gains in the developed world, despite an expected slowdown in 2024. Japan is battling a rapidly depreciating currency, while the Euro Area is expected to remain sluggish. The biggest laggards are those countries still rampant inflation, such as Argentina and Zimbabwe.

Global risks: The Federal Reserve is now holding off on rate cuts, which has triggered large currency moves across the developed and developing world. That could delay the pace of rate cuts elsewhere, notably in smaller emerging markets. A spike in oil prices would push many central banks to start hiking again.

Global Outlook Forecast - May 2024

Subscribe to insights from KPMG Economics

KPMG Economics distributes a wide selection of insight and analysis to help businesses make informed decisions.

Explore more

Global Navigator from KPMG Economics

Breaking away from the Fed? Foreign central banks poised to cut.

KPMG Economics

A source for unbiased economic intelligence to help improve strategic decision-making.

Falling exports helped push up trade deficit

Holding inventories remains expensive.

Meet our team