IPO Insights Q2 2024

Perspectives on the quarter’s market trends

Taking a company public can boost its profile and provide much−needed capital resources. But ensuring readiness for the capital markets requires a keen understanding of the current initial public offering (IPO) market—significant exits; sectors on the rise; trends in deal prices, sizes, returns; and more.

IPO Insights delivers the latest information and analysis on quarterly IPO activity and performance. Prepared by professionals from the KPMG Capital Markets Readiness and KPMG Private Enterprise practices, this quarterly report is designed to help private market business leaders prepare their companies to tap into the capital markets.

Is the window open yet?

The headline numbers suggest US IPO markets are on a tear compared to 2023 (admittedly a low bar). Volume was up 19.4 percent quarter-over-quarter with 43 market debuts. Gross proceeds rose 26.5 percent to $8.9 billion. This marks the third consecutive quarter of double-digit growth in both measures. Given that common wisdom anticipates at least one rate cut by the Fed this year, and data suggests volatility is down and confidence is up, there are some very positive signs that IPO markets are truly open.

But don’t expect the markets to quickly snap back to their pre-inflation dynamics. In this environment, the data suggests investors are rewarding larger companies (the three biggest listings in the quarter all saw returns rise over the quarter) in more stable industry segments (industrial manufacturers raised $2.25 billion with 17 offers) with demonstrated profitability (Viking Holdings, purveyor of cruise vacations, raised $1.5 billion and rose nearly 30 percent on the quarter).

Barring any unexpected geopolitical or macroeconomic strife, IPO markets should remain strong into Q3 2024. With the US presidential election coming up in November, we expect to see another uptick in IPO volume as companies look to get out ahead of that event.

Highlights of Q2 2024

- 43 US IPOs raised $8.9 billion in the quarter, with volume up 19.4 percent and total proceeds up 26.5 percent over the previous quarter.

- Viking Holdings led the IPO pack, raising $1.5 billion on debut and then rising 29.8 percent to end the quarter.

- Improved manufacturing conditions and business confidence helped industrial manufacturers notch up a 5x increase in proceeds compared to Q2 2023.

No. of IPOs and gross proceeds (US$B)

The below data includes 3 direct listings each closed in 2Q22, 3Q23 and 4Q23 respectively

While we haven’t had the Big Bang listings that investors would have liked to see, there has been a number of large listings that have achieved good valuations and strong returns. Alongside positive economic data and the potential for lower rates, we are seeing notable optimism among private market companies looking to go public in the next few quarters.

Conor Moore

Global Head, KPMG Private Enterprise

Industrials keep the engine revving

Industrial manufacturers received a warm welcome in the US IPO markets overall. In the most recent quarter, the sector brought 17 new listings to market, raising a combined $2.25 billion. With the exception of the energy sector—where a single IPO was responsible for the sector’s 21.8 percent return—industrial manufacturers led the pack with a 17.4 percent gain on the quarter.

Somewhat telling, many of the more traditional IPO sectors failed to capture investor confidence. Just two big tech stocks came to market and both ended the quarter down. Healthcare performed somewhat better, led by Waystar Holding’s $967 million raise, which ended the quarter flat. Overall, the sector raised $2.3 billion across eight listings but fell 4.3 percent over the quarter.

With some doubts lingering about the strength and confidence of the US economy, consumer and retail stocks received a frosty reception from the markets. Just four listings debuted in the quarter, the largest raising just $40 million. By the end of the quarter, the sector’s IPOs had recorded a 69.9 percent decline in value.

Investors are looking for companies with strong balance sheets, a clear path to profitability and resilience to market forces. Companies preparing for an IPO will want to make sure they clearly articulate their story to the market in a way that decouples them from some of these more unpredictable external forces.

Shari Mager

Partner and U.S. National Leader, Capital Markets Readiness, KPMG LLP

PE and VC still holding

Private equity (PE) and venture capital (VC) both made tepid reentries into the IPO markets during the quarter, as concerns about market conditions and lower valuations pushed out holding periods.

PE exit volumes remain depressed (down nearly 30 percent year-over-year) and although exit values rose more than 70 percent year-over-year, that speaks more to the poor results of Q2 2023 than any real rise in valuations overall. In fact, PE exit values fell more than 23 percent quarter-over-quarter, reversing a three-quarter rising trend.

VC exit volumes and values were also down quarter-over-quarter, with both falling by around 7 percent. Despite the high-profile debuts of Rubrik and Ibotta in April, VC activity was fairly muted over the quarter. Some pundits suggest it will remain that way until the Fed starts cutting rates and valuations start to rise.

PE exit value by type (US$B) (Percentage share)

Percentage share of each type of PE exit in the total dollar value of exits

US VC exit value by type (US$B) (Percentage share)

Percentage share of each type of VC exit in the total dollar value of exits

Future trends

The ups and downs of election markets

It is true that IPO volume and values tend to drop significantly during an election month. However, the data also suggests that markets tend to be particularly robust before and after US presidential elections. Indeed, we have seen a noticeable trend of increasing IPO volumes and values leading up to the election in the last two election cycles. The markets then go into rapid decline for November, after which they tend to quickly bounce back, delivering a strong recovery in December and January.

Interestingly, even during the past election periods, the S&P 500 index showed stability with minimal variations. But the Volatility Index (VIX) tends to significantly increase in the month before an election, possibly pointing to uncertainties about the outcome.

While a temporary halt in the emerging IPO recovery is expected in the weeks surrounding the November 5 vote, it is unlikely to significantly affect the pace of listings, which have shown improvements compared to the previous year. However, this pause is likely to prompt some IPO candidates to reconsider and adjust their timelines.

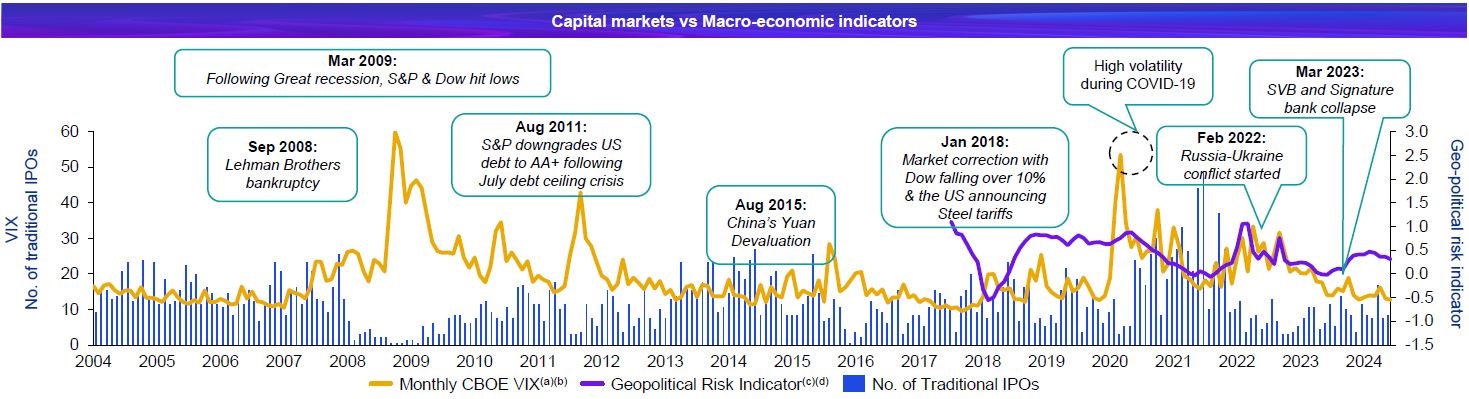

Monitoring geopolitical risk

There is a clear correlation between volatility and IPO volumes. When volatility is high, as measured by the CBOE Volatility Index (VIX), IPO volumes tend to be low. When the VIX spiked in April 2024 due to geopolitical tensions between Israel and Iran, coupled with broad uncertainties surrounding interest rates, investors’ appetite for new listings cooled.

However, through May and June, the VIX fell—reaching its lowest recorded levels (13.1 and 12.8 respectively) in 2024—facilitated by slight improvements in inflation data, employment numbers, and emerging market resilience. Those looking for signs of an IPO market resurgence may want to keep a close eye on the VIX.

Source: KPMG US Equity Capital Markets Update Q2 2024 Report, KPMG LLP, July 2024

The pipeline remains full

With 232 companies in the IPO pipeline as of the end of Q2 2024, a number of strong companies are now poised to go public. Cancellations have fallen from 20 last quarter to 15 this quarter as firms grew more optimistic about the revival of the IPO markets in the second half of the year.

We know of many companies who are ready to go once they start to see investor interest align with their offerings. Should the markets continue on their current trajectory, we expect to see a significant number announce listings in the third quarter.

Outlook

The US IPO market is anticipated to gain momentum in the remaining quarters of 2024, driven by expectations of improving inflation, anticipated Fed rate cuts, and improved market enthusiasm. We expect to see a surge in smaller deals, particularly for more mature companies with strong balance sheets.

With the market now anticipating lower interest rates in the second half, we are optimistic that we will see a rise in deal volumes and value through the summer and into late October. However, any substantive increase in IPO activity is expected to hold off until 2025.

How KPMG can help

Understanding the key trends and investor expectations is critical to preparing for an IPO. Investment narratives matter. They cut through the deluge of data and analysis, and help companies sift real windows of opportunity from market noise. And the most compelling deal stories come from insights about a company’s unique mix of valuation drivers. Sector. Markets. Customers. Portfolio mix. Capital structure.

At KPMG, our professionals offer a range of services specifically designed to help privately owned companies—venture-backed or otherwise—navigate each stage of the IPO journey. We help entrepreneurial ventures simplify the complex challenges of going public, while helping ensure they meet their diverse regulatory, compliance, and reporting requirements.

Working with KPMG, you gain access to trusted advisers who share your entrepreneurial mindset. And we can help you understand and improve the factors that drive maximum deal value for your offering.

Meet our team