FRB Supervision and Regulation Report

Continued increase in supervisory findings and declining ratings at banks of all sizes; focus on governance/controls and IT/operational risk

KPMG Regulatory Insights

- Rulemaking:

- A “hold over” on rulemaking processes for capital, long-term debt, and liquidity requirements until after the new Administration takes office.

- A recognition of 2024 rulemaking slow-down due to volume of commentaries and a desire for interagency coordination (e.g., Basel III, long-term debt).

- Supervision:

- Current attention to rising delinquencies (CRE portfolios, consumer lending) and governance and controls findings (operational resilience, cybersecurity, AML/BSA).

- Recognition of a strong banking system, elevated capital levels and increased credit loss reserves.

- Expect continued short-term 2025 intensity in supervision, and particular attention to resiliency (expected and unexpected stresses), cyber and technology risks, growth (size and complexity), issue identification to remediation and emerging/forward-looking risk analysis.

__________________________________________________________________________________________________________________________________________

November 2024

The Federal Reserve Board (FRB) issues the semiannual Supervision and Regulation Report The report assesses current banking conditions and provides transparency into the FRB's supervisory priorities and actions. For institutions of all sizes, highlights include:

- Strong capital levels and stable liquidity and funding conditions.

- Continued weakness in commercial real estate (CRE) and consumer lending sectors.

- Ongoing decline in the number of institutions with satisfactory ratings.

Separately, the House Financial Services Committee holds an Oversight Hearing of the Prudential Regulators, including the FRB, Federal Deposit Insurance Corporation (FDIC), Office of the Comptroller of the Currency (OCC), and the National Credit Union Administration (NCUA). The FRB is required by the Dodd-Frank Act to testify semi-annually at hearings before the Committee and releases the Supervision and Regulation Report in conjunction with that testimony. The hearing is intended to cover supervisory and regulatory developments, rulemakings, and activities of the agencies. Highlights include:

- Findings and concerns are similar across agencies.

- The Banking Agencies will pause further work on rulemaking processes for capital, long-term debt, and liquidity requirements until after the new Administration takes office.

Supervision and Regulation Report

Highlights of the FRB’s semiannual Supervision and Regulation Report include:

Banking System Conditions. The FRB states, "The banking system remains sound and resilient overall. Most banks continue to report strong capital levels above applicable regulatory requirements. Liquidity and funding conditions remain stable compared to 2023. Asset quality generally remains sound. However, credit performance in commercial real estate (CRE) lending and some consumer lending sectors continues to show signs of weakness. Banks are adding to credit loss reserves to protect against potential credit losses."

Regulatory Developments. The report highlights regulatory developments since May 2024, including interagency (FRB, FDIC, OCC) guidance to help certain large financial institutions develop their resolution plans and an interagency final rule and separate guidance related to real estate valuation (i.e., final rule on automated valuation models and final guidance on reconsiderations of value for residential real estate valuations). The FRB also highlights an interagency statement on arrangements between banks and fintechs to deliver deposit products and services along with a related request for information on bank-fintech arrangements more broadly.

Supervisory Developments. The FRB states that supervisors are closely monitoring:

- CRE and certain consumer loan sectors (e.g., credit card, auto), which have shown signs of weakness in credit quality, giving attention to underwriting standards, loan quality, and credit loss reserves as well as counter-party credit risk management practices.

- Banks’ preparedness for managing liquidity risk, including liquidity risk-management practices and regular testing their ability to access multiple sources of contingent funding. The FRB adds that supervisors are monitoring a limited number of firms with risk profiles vulnerable to funding pressures.

- The adequacy of banks’ risk management, governance, and controls to protect their data and operations against cybersecurity threats, as well as certain services performed for the banks by their service providers.

The FRB conducted horizontal reviews of liquidity and capital planning during the first half of 2024. Capital planning and risk management examinations included assessments of firms’ capital stress testing, pre-provision net revenue secured funding transactions, and contingent capital planning. Liquidity examinations focused on firms’ recent deposit trends, funding strategies, liquidity risk-management practices, liquidity stress testing, and liquidity buffer composition

With regard to CBOs and RBOs, the FRB states that it continues to maintain a “heightened focus” on CBOs and RBOs that may be vulnerable to funding pressures (including access to contingency funding, liquidity asset buffers, and deposit outflow assumptions) and those with large CRE concentrations.

Supervisory Priorities. The report outlines FRB's current supervisory priorities for large financial institutions (with $100 billion or more in total assets), community banking organizations (CBOs - with less than $10 billion in total assets), and regional banking organization (RBOs - with between $10 and $100 billion in total assets). These priorities are outlined in the table below.

Large Financial Institutions | CBOs & RBOs |

|---|---|

Capital

Liquidity

Governance & Controls

Recovery & Resolution Planning

| Credit Risk

Liquidity Risk

Other Financial Risks

Operational Risk

|

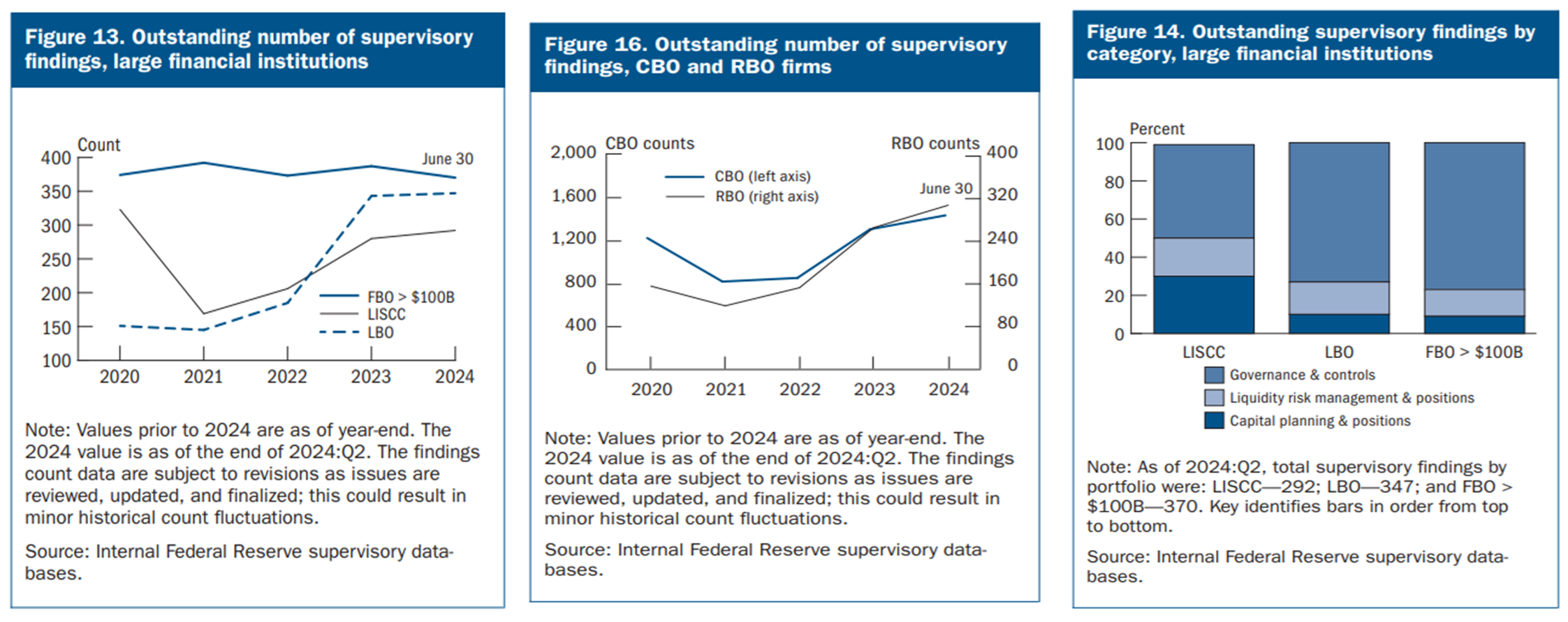

Trends in Supervisory Findings and Ratings. The report includes the following data indicating that outstanding supervisory findings for large financial institutions were stable over the first half of 2024 but continued to increase for CBOs and RBOs. For large financial institutions, the FRB states that the distribution of the findings also remained stable, with approximately two-thirds of the outstanding conclusions related to governance and control issues (including operational resilience, cybersecurity, and AML/BSA compliance). For CBOs and RBOs, the top outstanding findings continue to relate to IT/operational risk and risk management/internal controls.

The report also finds a declining number of institutions with satisfactory ratings. Weaknesses at large institutions were found in liquidity and interest rate risk management and governance and controls, with only about one-third of institutions receiving a satisfactory rating across all three components (capital planning and positions, liquidity risk management and positions, and governance and controls). Weaknesses at CBOs and RBOs were also found to relate to financial performance or risk management practices.

Congressional Oversight: Prudential Regulators

In testimony before the House Financial Services Committee, representatives of the FRB, FDIC, OCC, and NCUA provided an overview of their individual agency’s supervisory and regulatory developments, rulemakings, and activities. Their statements followed closely with the findings in the FRB’s Supervision and Regulation Report, highlighting:

- Characterization of the banking industry as sound and resilient with strong capital levels, sufficient liquidity buffers, and favorable asset metrics

- Concern for certain credit portfolios (CRE, credit card, multifamily)

- Identification of a priority on certain nonfinancial risks, including cybersecurity and AML

- Bank-fintech arrangements and activities

Other areas identified include:

- Federal regulation of certain nonbanks

- Deposit insurance coverage and related liquidity risk management

- Interagency coordination on rulemaking and guidance

Notably, the banking regulators indicate they would not attempt to advance changes to their rulemaking for capital, long-term debt or liquidity requirements ahead of the new Administration taking office.

Dive into our thinking:

FRB Supervision and Regulation Report; House Oversight Hearing

Continued increase in supervisory findings and declining ratings at banks of all sizes; focus on governance/controls and IT/operational risk

Download PDFExplore more

Get the latest from KPMG Regulatory Insights

KPMG Regulatory Insights is the thought leader hub for timely insight on risk and regulatory developments.

Meet our team