What’s your home worth? Special housing market edition

Home values remain high after skyrocketing when the economy reopened and mortgage rates plummeted. The pivot to work from anywhere ignited housing demand, while supply remained constrained due to years of under-building.

Millennials, who suffered the worst of the setbacks due to the 2008-2009 recession, saw a chance to buy. Many fled cities to escape the risk of contagion and find larger, more affordable homes. Suburban, rural and second-tier markets boomed.

Local buyers in traditionally lower-cost markets were crowded out by an influx of newcomers with higher incomes. That compounded the upward pressure on prices. Demand for vacation homes jumped, while institutional and individual investors began to flip to rent instead of sell. All-cash sales soared.

Home prices jumped at their fastest pace on record. Prices rose nearly twice as fast in half the time of the housing bubble of the early 2000s. We have never seen anything like it. Some of that was a catch-up to the weakness experienced in the wake of the housing bust; much of it was froth. Prices remain elevated and out of reach for first-time buyers, even in markets that have endured substantial price drops.

This special edition of Economic Compass takes a closer look at the housing market. The housing recession is expected to deepen as the Federal Reserve doubles down on its efforts to derail inflation. The pace at which home values and rents fall will play a key role in how fast inflation cools.

The multifamily market will be the next shoe to drop; the tail on multifamily is much longer than that for the single-family market, given long lags to completion.

The dilemma for the Federal Reserve is the role that ultra-tight labor markets could play in reversing the drop in shelter costs. Strong labor demand could stem the fall in rents, while acute supply shortages limit the depreciation in home values. This could keep homeownership out of reach for too many, even as the market rebounds late in the year.

The ranks of the working homeless are already on the rise again. The tent city that is next to the Federal Reserve is a painful but critical daily reminder to members and researchers at the Fed’s Board of Governors in Washington, DC. It is a very sad sight.

Fundamentals

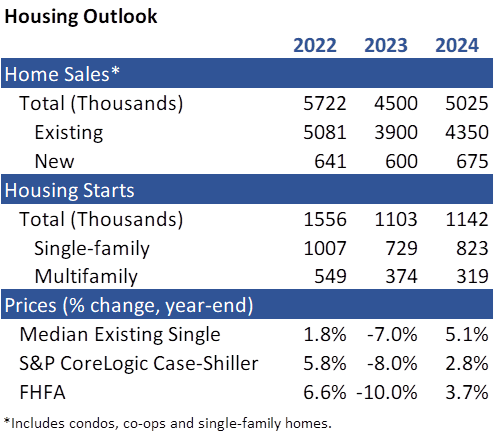

Table 1 provides an overview of the housing market outlook. The most interest-rate sensitive sector of the economy is expected to slip deeper into recession:

- Additional rate hikes by the Fed are forecast to keep mortgage rates closer to 7% than 6% much of the year. (See Chart 1.)

- Lending standards by banks are expected to continue to tighten.

- Insurance costs, especially in areas affected most by climate change, are rising.

- Real estate taxes are still catching up to the surge in home values coming out of the pandemic.

- Affordability is deteriorating.

- Inventories remain tight, especially in resales.

- Institutional investors are pulling out while individual investors remain in the market.

In response, losses in the housing market will compound. The worst of the pain will be felt midyear. Signs of life, with some new building and a uptick in sales, should occur later in the year.

Chart 1: Rates Remain Elevated in 2023

Sales

New sales contract

New home sales are forecast to fall to 600,000 in 2023, 6% below the already suppressed levels of 2022. That would bring new home sales down to 2016 levels.

Rising mortgage rates collided with escalating prices to erode affordability. Cancellations for new construction surged; some walked away from large down payments to avoid a spike in rates. What was a multiyear backlog of newly built homes has become a glut.

There was a 7.9-month supply of new homes for sale in January. Unseasonably warm weather in January and the foot traffic that accompanied it helped buoy sales and temporarily reduced supply.

Inventories are likely to rise above the eight-month threshold again this spring. That is well above the six-month supply that builders carried after we emerged from the subprime crisis.

Most builders are offering price cuts or other concessions to lure buyers in. Mortgage buybacks, which reduce monthly payments for buyers in the first years of ownership, temporarily lost their luster in the wake of the housing bust; they are back.

The median selling price of a new home fell 14% in January from the October 2022 peak. That is much more rapid than the drop in existing home values but still 29% above February 2020.

Existing hit harder

Existing home sales are forecast to drop to 3.9 million in 2023, down 23% from 2022. That matches the drop of 2007. Single-family home sales, where supply is scant and prices still extremely high, are expected to drive those losses. Condos are expected to fare better.

Mortgage rates rose back above 7% in early March and should remain elevated through spring and summer. Long-term rates tend to follow the 10-year Treasury bond yield, which is expected to rally once rate cuts appear imminent. The Fed does not plan to cut rates until 2024; Treasury bonds will front-run those cuts. That sets the stage for a late-in-the-year drop in mortgage rates and a rebound in sales.

Applications for purchase were down over 40% from a year ago in February. Adjustable-rate mortgages (ARMs) are holding up better than fixed-rate mortgages. Buyers are betting on rate cuts by the Fed as their mortgages reset in 2024. They are using ARMs to get into the door of the few homes that are listed.

Millennials still make up more than half of purchase applications, despite the spike in rates and erosion in affordability. That share is off a much smaller base than earlier in the recovery.

Almost three-quarters of first-time buyers and more than 40% of trade-up buyers are millennials. The excess savings generated by the pandemic no doubt contributed to those inroads by the largest cohort of home buyers.

The share of those who either locked into ultralow rates or paid off their mortgages has surged. Those homeowners have a natural hedge against escalating shelter costs. Some have opted to rent them out to cash in on the demand for single-family rentals, further constraining the stock of homes.

A San Francisco colleague recently quipped that someone would have to pry his 3% fixed-rate mortgage out of his dying hands. He never expects to sell, given the high cost of trading up.

Home buying attitudes are deteriorating. Only 17% of home buyers said that it was a good time to buy in January, more than 10% below a year earlier. That was before the spike in rates in February.

That has not stopped bidding wars for scarce entry-level properties. There was an abysmal 2.9-month supply of existing homes for sale in January, less than half of the six months necessary for a more balanced market. That is placing a floor under prices and crowding out first-time buyers out of the market.

Affordability dropped to the lowest level since the 1980s. (See Chart 2.) The ranks of renters, unable to build the wealth associated with ownership, are expected to remain high.

Economy poised to slow

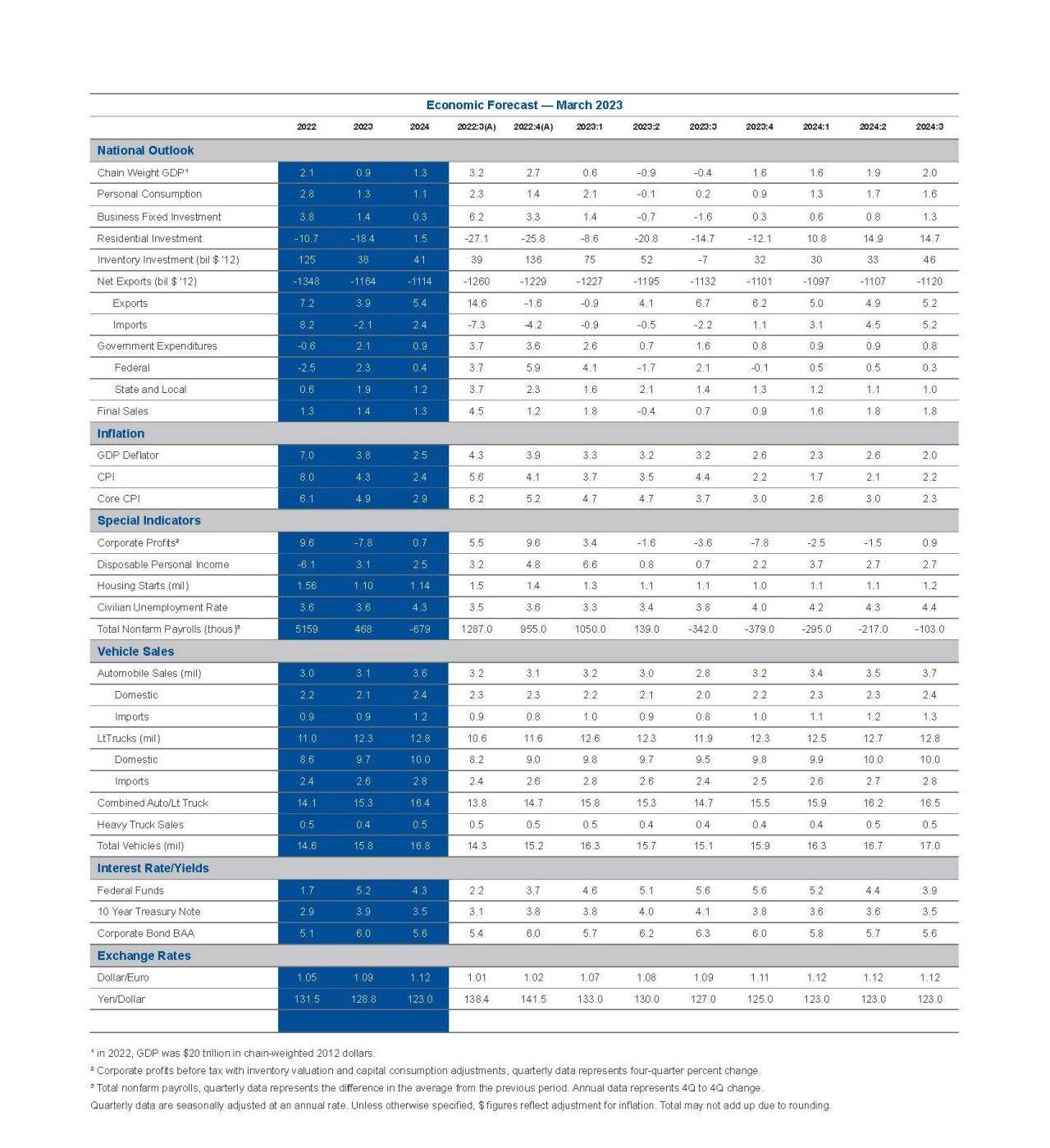

Real GDP growth came in at a 2.1% pace in 2022. Growth in the fourth quarter came in at a revised 2.7% pace, 0.2% lower than initial estimates. Inflation took a larger bite out of consumer spending than previously reported. Housing contracted. Business investment rose and inventories ballooned. The trade deficit narrowed but for the wrong reason: exports contracted less than imports. Government spending held up as infrastructure projects ramped up.

Prospects for the first quarter are much weaker. A sharp drop in inventories is expected to offset a boost in consumer spending. The record 8.7% cost-of-living adjustment to Social Security payments was spent in January. Business investment is forecast to increase at less than half the pace of the fourth quarter. Exports and imports are poised to fall further, leaving the trade deficit unchanged. Government spending should moderate after the initial ramp up of infrastructure projects. Real GDP is expected to rise 0.6% in the first quarter before slipping into a modest contraction this year.

The Fed continues to tighten. The Fed expects to continue to raise rates in the first half of the year. Financial markets are finally capitulating and have tightened credit conditions. The extent the Fed raises rates will depend heavily on whether financial markets continue to work with it, instead of against it. The forecast now has the fed funds rate ending the year at 5.75%, 0.5% higher than last month.

Chart 2: Affordability Eroded

Starts

Single-family continues its descent

Single-family home construction is forecast to fall to 729,000 units in 2023, nearly 30% below the already suppressed level of 2022. That marks the worst two-year decline since 2008-2009.

We are not seeing a repeat of the subprime crisis, given the cushion on equity and better credit standards. The problem is lack of supply at the lower end and the inability to clear the market at current prices.

Materials prices have come off their highs, which should reduce the cost of construction and repairs needed to upgrade what has become an older stock of homes. In the wake of the housing bust, many homes fell into disrepair due to homeowners being unwilling to make repairs when their homes were worth less than their mortgages.

The hurdles to reviving construction are labor and zoning. A dearth of construction activity, consolidation of builders, and curbs on immigration caused chronic worker shortages. Many skilled carpenters aged out and retired, while immigration collapsed. The construction industry is much more reliant on immigrant workers than the overall economy.

Meanwhile, NIMBY (not in my backyard) zoning laws have been boosting lot sizes and limiting density for decades. That forced builders to build bigger, less affordable homes and not build as many starter homes.

The millennial generation is the largest cohort with more of them waiting on the sidelines to form new households. Younger millennials are still aging into their prime home buying years. More households being formed will mean more demand for housing construction activity.

Multifamily shoe drops

Multifamily construction is forecast to fall to 374,000 units in 2023, 32% below the still elevated pace of 2022. The multifamily market hit its highest level of construction activity since 1986 in 2022. The luxury or “class A” market is particularly overbuilt.

Rents have begun to roll over with a drop in demand among younger workers. New college graduates are opting to work from their parents’ homes, or double up with one or more roommates to make ends meet. Foreign undergrads, who drove demand in major urban areas, are returning but not as we once saw.

Generation Z is a smaller generation than millennials. The shrinking ranks of young adults and children are showing up in reduced school enrollments. Colleges have noticed as have landlords. Vacancies are rising.

The pipeline on multifamily (five units or more) hit the highest level on record in late 2022. The data goes back to 1970 and includes the gluts of 1973 and the early 1990s. The outlier is two-to-four-unit projects; only 16,000 of those homes were built in 2022, about a tenth of the peak of 1972.

Many buildings started will likely go unfinished. We have seen this before. During the real estate bust of the early 1990s, the cranes came down almost overnight along the Chicago skyline as bank lending dried up. Many believed real estate investment trusts (REITs) would prevent overbuilding; the losses of 2008-2009 proved they did not.

The youngest and oldest home buyers tend to lean toward condominiums and cooperatives, which are often priced lower than single-family detached homes. Fewer condos are being built each year as a share of total construction, while existing inventories remain low. Watch for a rise in the conversion of apartments currently under construction into condos.

Long lags for multifamily construction mean it will take more time to correct and longer to recover than the single-family market. The slowdown in the multifamily market could reach well into 2025.

Prices

Home prices fall

Home prices are expected to fall between 7% and 10%, depending on the measure. The S&P CoreLogic Case-Shiller Home Price Index is expected to drop another 8% in 2023, or 10.5% from the peak by year-end. That will bring prices to the still elevated levels of late 2021 when the market was red hot. (See Chart 3.)

Building and buying activity tend to be derailed faster and harder than prices. That was true during the height of the housing bubble in the early 2000s. Single-family sales peaked in the summer of 2005, nearly two years ahead of home prices; single-family starts peaked in early 2006, more than a year ahead of prices.

Property taxes adjust to rising values with a lag. Even homeowners who have stayed put will feel the pinch of higher taxes eventually. High tax bills could add to the hurdles on affordability in some states.

Rents have fallen more rapidly than home prices, despite the rise in demand for rentals. The Fed is counting on those declines to cool inflation.

The sticking point is the tight labor market. Recent research by the Kansas City Federal Reserve Bank suggests that wage gains could place a floor under how much rents fall in the hottest markets. Hence, the Fed’s focus on the labor market.

Regional disparities intensify

The West is experiencing the largest price declines. Home prices in San Francisco and San Diego have fallen sharply but remain out of reach for most buyers. In Arizona and Nevada, where institutional investors pulled out, prices collapsed. Boulder, Salt Lake City and Seattle are seeing double-digit declines from tech layoffs and the reversal of COVID-era migration.

The Midwest is forecast to see flat to modest price growth in 2023, as most markets never soared. Omaha, Milwaukee, Cleveland and Indianapolis are some of the cities that remain attractive to buyers, as they are significantly more affordable. Chicago, which is more expensive than its neighbors, is in that mix.

The Northeast will experience some cooling of prices due to net migration away from the region. A lack of land and restrictive zoning regulations will keep a floor under prices by restraining new builds. Home prices in New York, Washington, D.C. and Boston have softened but continue to post positive year-on-year gains.

The South remains in high demand. Atlanta, Charlotte and Tampa are still posting double-digit home price gains. All cash sales now dominate areas hit hardest by Hurricane Ian, including Naples and Fort Myers. Miami is an island unto itself; prices are still sizzling.

Recent research suggests that home buyers tend to discount the risk of devastation due to climate change; insurers do not. Insurance costs have skyrocketed, if you can get it in areas the most at risk for extreme weather events. Miami homeowners could lose almost $8 billion to damages caused by severe weather over the next several decades.

Chart 3: Home Prices to Remain Above 2020 Levels

Implications for the Fed

Chart 4 shows core (excluding food and energy) PCE inflation. That is the baseline for the Fed’s 2% inflation target; it makes up nearly 90% of overall inflation in the economy. Three trends are notable:

- Core inflation remained stubborn and accelerated in January on the heels of faster inflation in the service sector. It was 4.7% on a year-over-year basis, more than double the Fed’s target.

- The boost to inflation provided by shelter costs remains substantial.

- Core services inflation, which is more dependent on labor costs, rebounded.

In response, the fed funds rate is expected to hit the 5.5%-5.75% range by July. That is half a percent higher than we forecast a month ago.

Bottom Line

The recession in housing is expected to worsen in 2023, with the brunt of the pain felt in activity rather than in prices. Home values will fall but not like they did in the wake of the subprime crisis.

That is good news for homeowners but bad news for buyers. Fewer households will be able to achieve the American Dream of homeownership; a larger swath of want-to-be home buyers will become renters.

Chart 4: Inflation Fueled by Services

Dive into our thinking:

What’s your home worth? Special housing market edition

A downturn in housing has been aided by the fastest rate hikes we’ve seen in a generation.

Download PDFExplore more insights

Meet our team