CEOs today are navigating a U.S. economy that has entered the age of compound volatility: the combination of disruptive risks to growth and structural changes — from sticky inflation to the energy transition to a shifting labor market — that raise the cost of doing business with little margin for error on strategy development and execution.

This year’s KPMG CEO Outlook analyzed insights from more than 1,300 CEOs at large companies globally, including 400 in the United States, to evaluate how they are navigating the challenge of compound volatility.

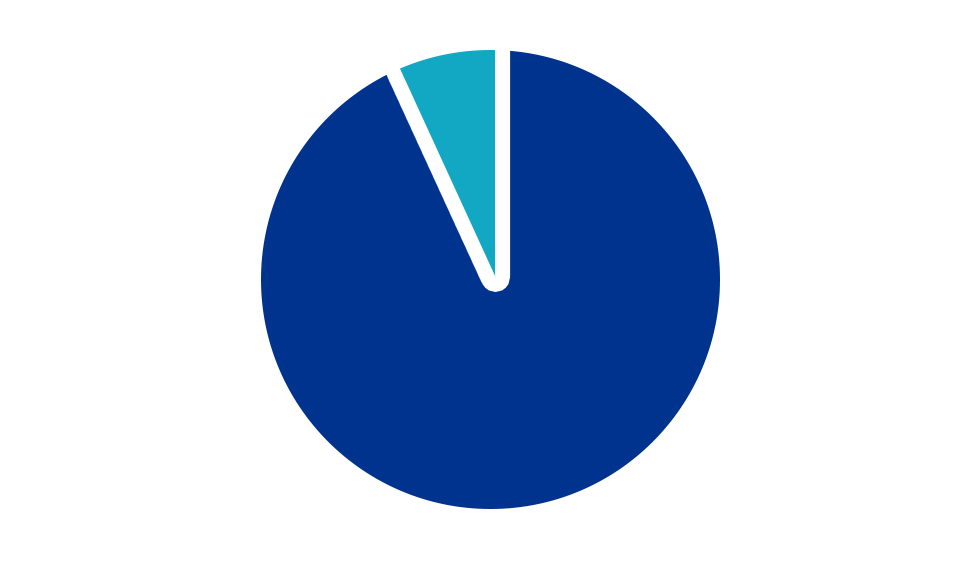

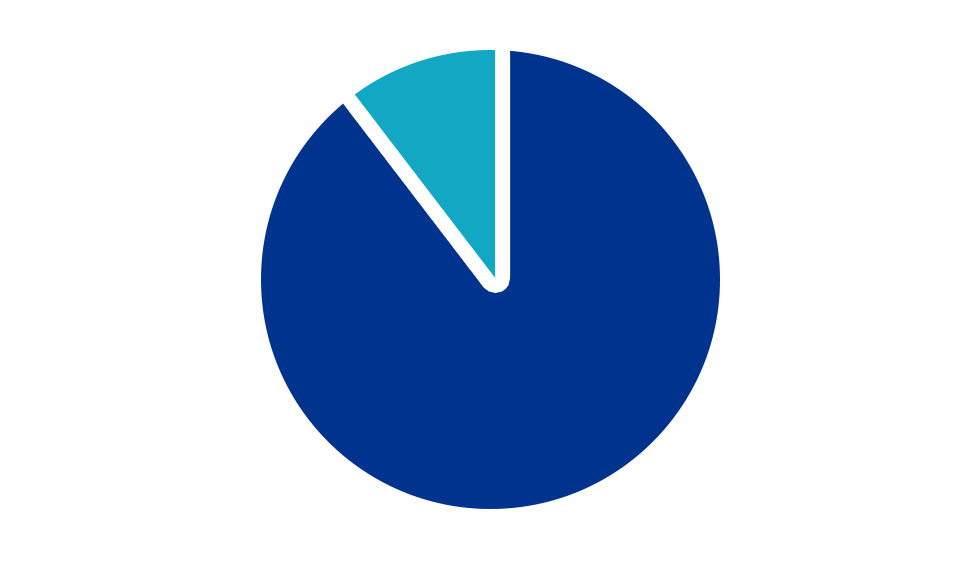

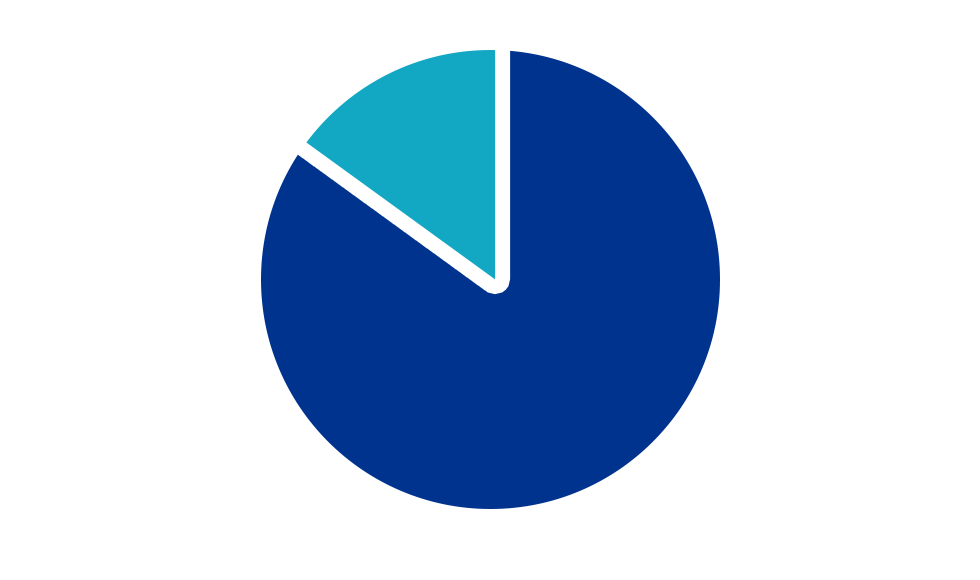

Business leaders report they remain confident in the long-term growth prospects of the U.S. and global economies, but confidence is more subdued when it comes to the growth prospects of their companies.

CEOs are investing in long-term growth strategies, while remaining agile to take advantage of new opportunities and respond to unforeseen challenges in this environment. They are committed to investments in generative AI and sustainability to grow their businesses, and they are prepared to seize transformational M&A opportunities.

They broadly recognize generative AI is a promising pathway to growth that is rapidly accelerating the rate of innovation in our economy. It is a top investment priority for their organizations, and they are mindful to engage their workforce on ethical and effective use of AI.

CEOs are maturing their sustainability strategies to advance specific decarbonization, M&A, and sustainable finance efforts, expecting financial returns in the next three to five years. Moreover, failure to engage on sustainability risks losing top talent and their competitive edge.

Both generative AI and sustainability investments can enhance resilience and improve agility, helping CEOs lead in our more complex and fragmented global economy.

Talent and culture are more important than ever in this fast-changing business environment in which multiple organizational redesigns are the norm and workforce expectations are shifting when it comes to flexibility and purpose. CEOs must foster an ethical culture that embraces change, innovation and smart risk-taking to drive growth; invest in continuously upskilling their people; and protect them from burnout. CEOs want more workers to come into the office and will reward those who do – but need to communicate expectations clearly to build trust.

With the pace of change unrelenting, CEOs are taking bold, decisive action and embracing equity, purpose and sustainability to ensure their organizations achieve their long-term growth ambitions.

Paul Knopp

KPMG U.S. Chair and CEO