A July Heatwave

Pushed inside by the heat, people spent more on goods than services.

August 31, 2023

Personal consumption expenditures surged 0.6% after adjusting for inflation in July, well ahead of the 0.2% inflation-adjusted drop in personal disposable incomes. A drop in the personal saving rate to 3.5% filled the gap between real spending and disposable incomes. That is the lowest saving rate since November 2022; much of the excess savings amassed during the pandemic has now been depleted.

The gains suggest that real GDP growth is tracking at a 3.7% pace in the third quarter, a sharp acceleration from the downwardly revised 2.1% pace of the second quarter. That acceleration in growth we have seen thus far this summer was flagged as a concern by Federal Reserve Chairman Jay Powell in his speech at the Jackson Hole Symposium last week. He said, "Additional evidence of persistently above-trend growth could put further progress on inflation at risk and could warrant further tightening of monetary policy."

Blistering heatwaves and online promotions pushed people online and inside in July. Spending on goods far outpaced the strength in services, although all categories of spending accelerated during the month. Travel abroad picked up more than domestic travel. That didn't stop the national park services from reporting record crowds this summer.

The personal consumption expenditures (PCE) index, which is the Fed's favored measure of inflation, rose 0.2% in July, well in-line with expectations. A sharp drop in big-ticket durable goods prices was more than offset by an acceleration in service sector inflation. Large items, such as vehicles, are more susceptible to rate hikes and are finally cooling in price in response to a surge in financing costs. The PCE index rose 3.3% from a year ago in July, up slightly from the 3% year-over-year pace of June. A peak in inflation in June 2022 helped to suppress the year-over-year gain in the index for June.

Core PCE (excluding food and energy) inflation, which is the best predictor of future inflation, also rose 0.2% in July. That translates to a 4.2% year-over-year increase in July, up 0.1% from the pace of June.

The core services PCE index, which strips out shelter and household energy costs and more closely tracks underlying inflation trends, jumped 0.5% in July - that is its fastest monthly pace since January. Core services jumped 4.7% from a year ago, the fastest pace since February. The three- and six-month moving averages came in 3.9%. A surge in portfolio management fees contributed to the jump in core services but even excluding those gains, the super core was still up 0.3%, which is still too hot for the Federal Reserve. Powell flatly rejected any change in the Fed's 2% target on inflation in his speech last week; they want to ensure that the inflation gets back to that target and believe that will take some time - potentially into early 2025.

The probability of a November rate hike is now close to a coin flip.

Bottom Line:

Powell took a rate hike in September essentially off the table at his speech at Jackson Hole; the Fed wants time to see whether the acceleration we are seeing in growth warrants another rate hike or not. However, today's core inflation data was not encouraging and keeps November in play. The probability of a November rate hike is now close to a coin flip as the Fed struggles to deal with what appears to be sticky service sector inflation, which is less sensitive to rate hikes than goods prices.

Explore more

Consumers drain savings to spend

The outlier is spending on food; it has been trending down in real terms since August 2021.

KPMG Economics

A source for unbiased economic intelligence to help improve strategic decision-making.

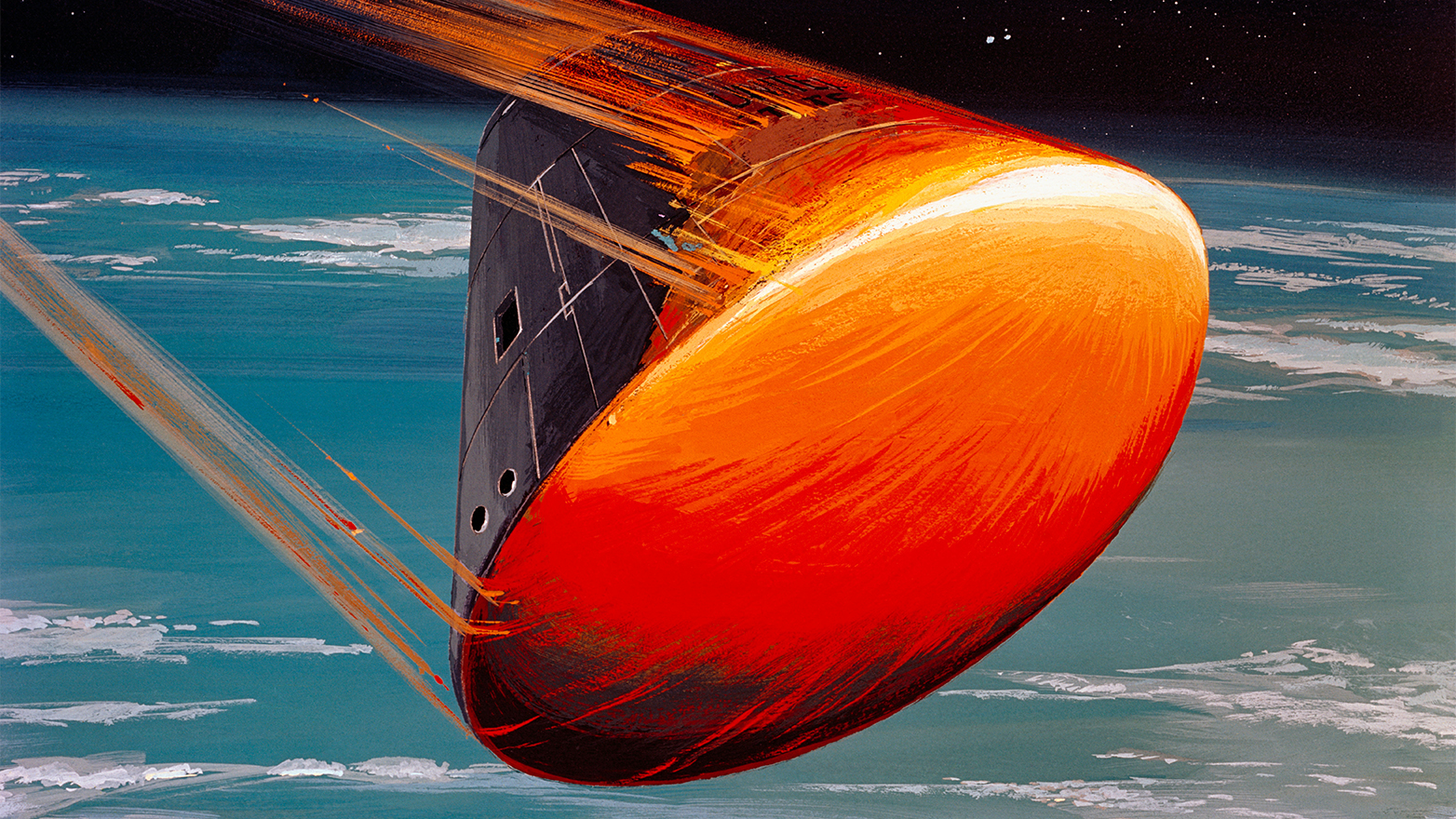

Frictions upon reentry: Three landing scenarios

Meet our team

Subscribe to insights from KPMG Economics

KPMG Economics distributes a wide selection of insight and analysis to help businesses make informed decisions.