Remember how moving to the cloud was going to save your company money? Instead of endlessly acquiring more servers for future needs, you’d provision only as much data storage and computing capacity as you needed — no more, no less — in the cloud. You’d also gain the flexibility to adjust your usage up or down, on demand, as circumstance dictated. With that, you’d bid a cheerful goodbye to excess capital investments and much of the labor required to maintain on-premises IT systems.

Today those cost savings are an increasingly distant dream. While the cloud has delivered on many of its promises — boosting agility by allowing companies to quickly spin up new environments and resources, taking advantage of cloud-native services and scale applications globally — it has fallen short of its loftiest financial promises. In the 2022 KPMG U.S. Technology Survey, 66 percent of business executives say their organization’s cloud programs have not lowered the total cost of ownership of IT systems.

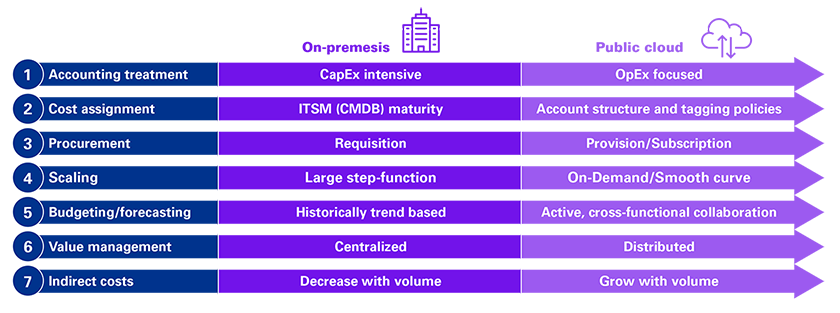

The culprit isn’t the technology itself but rather a near universal failure to adapt to the nuances of managing a modern resource that works very little like the legacy environment it replaced. With the cloud, consumption is decentralized and IT departments no longer have tight control over on-site data centers and their costs. Shadow IT is more common, with business users able to provision technology platforms and IT infrastructure with a figurative click of the mouse. Wasteful cloud spending is further driven by complex billing structures, compounded in many cases by the use of multiple cloud service providers.

In short, the rush to the cloud has led to excess spending and insufficient oversight, leaving many organizations struggling to balance the value of cloud agility and innovation against the need for guardrails to control costs.

In working and speaking with clients, KPMG has identified several common challenges to efficient cloud resource management. Too often, IT financial management processes fall short when trying to account for the variable nature of cloud spend. KPIs are not focused on the right outcomes, and reporting isn’t done in a language understood by all parties. Finance teams often lack the technical acumen to make recommendations for cost savings, while engineering and development teams lack incentives to think financially. Without the appropriate tools and governance in place, effectively planning, monitoring, analyzing and reporting on cloud spend and performance becomes difficult — as does further decision-making about how the cloud should be used and managed. The sometimes adversarial relationship between IT and finance, especially when the latter is tightening the corporate purse strings, doesn’t help because it discourages cooperative planning.

All these developments have left some organizations feeling a bit like the family that cut cable to save money, only to sign up for so many streaming services that the envisioned savings evaporated.

66% say cloud programs have not lowered total cost of ownership of IT systems.