SEC guidance released in 2010 highlighted climate-related matters that may be relevant when considering various Regulation S-K disclosure requirements; in February this year, the SEC announced that the staff would review the extent to which registrants address the topics identified in the 2010 guidance. This was followed in September by questions to certain registrants about their climate-related disclosures.

In addition, principles-based disclosures about human capital came into effect in 2020 as part of the SEC’s modernization efforts.

In June this year, the SEC’s regulatory agenda included proposals for climate risk, human capital and cybersecurity risk disclosures. To help the staff develop proposals, then-Acting SEC Chair Allison Herren Lee issued an informal request for public comment in March that closed mid-June; the consultation mainly related to climate disclosures.

SEC Chair Gary Gensler has spoken about the support expressed for the TCFD disclosures and their endorsement by leading ESG organizations. He noted that he had “asked staff to learn from and be inspired by these external standard-setters” but cautioned that the SEC should write rules and establish a disclosure regime appropriate for US markets.2

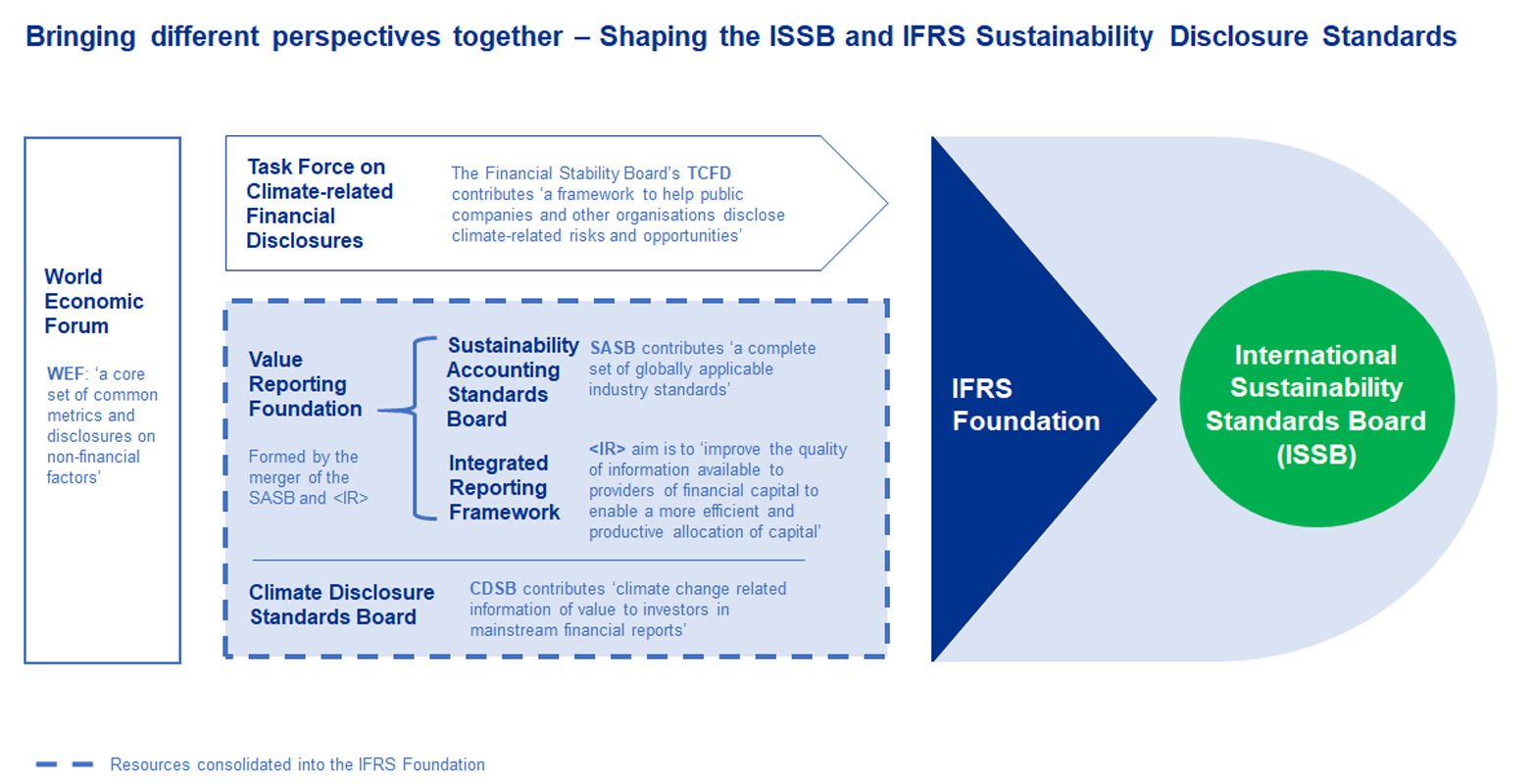

Although the SEC is clearly focused on the needs of US markets, this does not necessarily signal a lack of support for the work of the ISSB. In particular, consideration of the work of the TCFD is clearly in the thinking of both the SEC and the IFRS Foundation, which could mean that climate-related disclosures converge over time with a global baseline emerging.

2. Chair Gary Gensler, “Prepared Remarks Before the Principles for Responsible Investment ‘Climate and Global Financial Markets’ Webinar,” U.S. Securities and Exchange commission, July 28, 2021, https://www.sec.gov/news/speech/gensler-pri-2021-07-28