An early stage, but rapidly growing business, poised for significant growth? You’re what we call an emerging giant.

Privately-owned, forward-thinking and ambitious, you have plenty of potential and lots of innovative ideas. And you’re now looking for ways to manage and accelerate your growth.

You may be cautious about squeezing into services that are too limited for your ambitions. Likewise, you want to avoid sizing up to a corporate category that is much too big, too complex and too soon. And you certainly don’t want a service that overwhelms your budget.

You want services that are as unique as you are, for the enterprise you already are and the giant you aspire to become.

Welcome to KPMG’s Emerging Giants Centre of Excellence, purposefully designed for start-up and scale-up businesses, across all sectors, no matter where in the UK you are based.

Who are we?

For businesses that need a different type of support at critical points in their lifecycles, we’ve wrapped our specialist services into our Emerging Giants Centre of Excellence.

You’ll find KPMG people, with a genuine enthusiasm for nurturing exciting and innovative growth businesses, who take the time to understand your plans and identify the bespoke services to help get you there.

Along the way, we steer you through early-stage funding and investment, guide you through your governance responsibilities, and help you to tackle the inevitable challenges that come with growth.

As your trusted advisor, we can introduce you to industry specialists from across our global firm, who can help you measure where you’re at and where you’re heading. We can walk you through tried and tested means of getting to your destination, while exploring alternative routes for businesses that are anything but ordinary.

When the time is right, the adviser that has supported your businesses growth will be at your side as you plan for an exit.

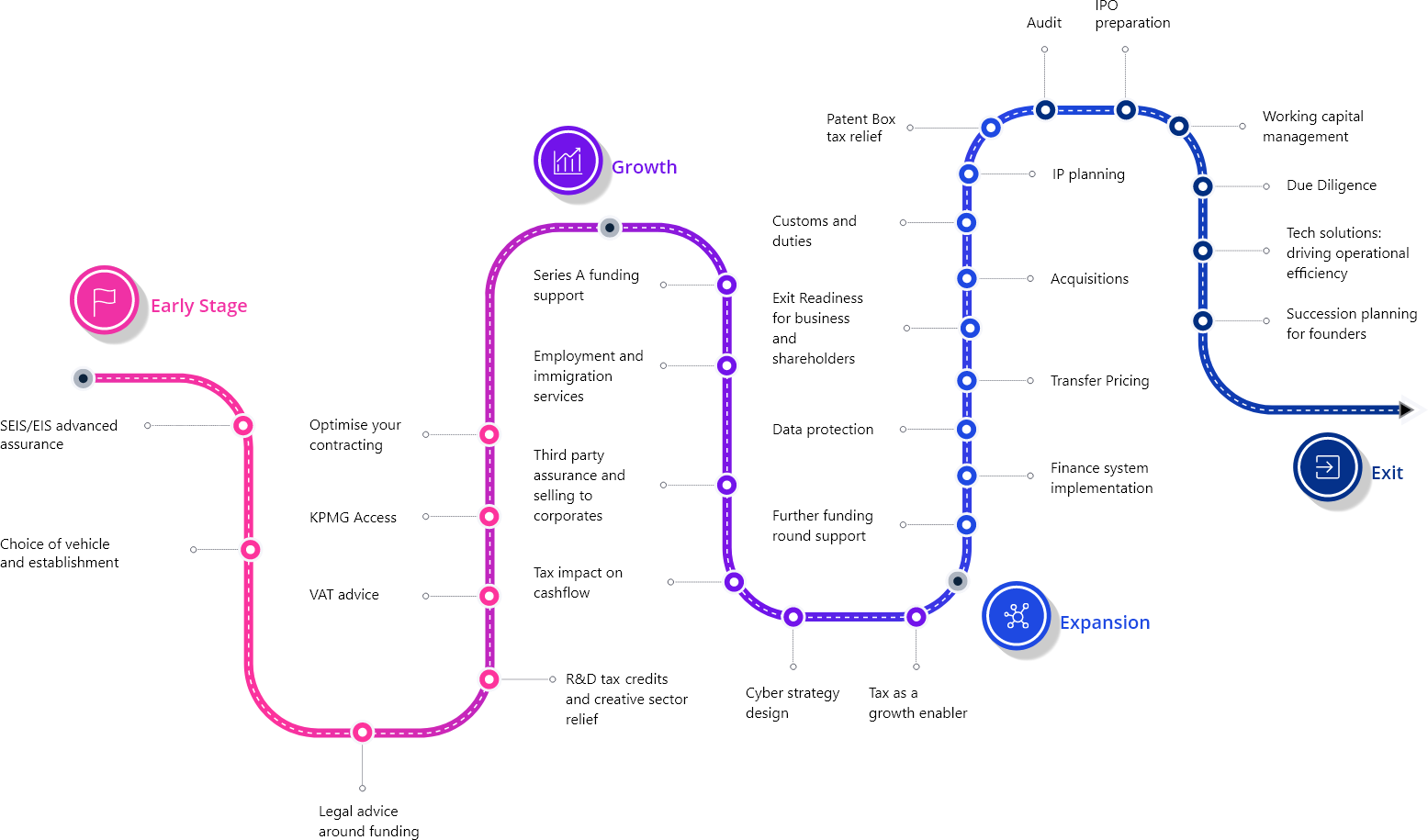

Here are just some of the ways in which provide extra support to ambitious businesses like yours. Click on the icons to find out more.

Emerging Giants lifecycle

As your business grows, you might need additional support along the way. Here’s how we can help you to navigate the ups and downs in your lifecycle.

Support as you grow

Working with Emerging Giants, we have identified four core areas where our clients really value external knowledge and support.

Attracting, motivating and retaining high-performing people can be a challenge. As an emerging giant, we can support your employment strategy with:

- Payroll, compensation policies and solutions tailored for your globally mobile employees. Our People Services team can provide valuable advice on attracting and retaining top talent with relevant and enticing rewards and benefits.

- Connect on Board, our platform to identify the non-executive directors who are the right fit for your board.

As a fast-growing business, your aspirations are likely to extend beyond your core market. We can help you to:

- Scale up and branch out. Our global network of KPMG firms means we’ve got specialists in locations around the world, on the ground and ready to help as you expand into new markets or territories.

- Manage the complexities of international tax. Whether you are expanding your international footprint, investing cross-border or need help with identifying and managing tax risk in your current business, you can leave your international tax to us.

- Comply with your obligations under company law. Our company secretarial services help to keep you and your business compliant, reducing the risk of enforcement action, so that you can get on with your day-to-day activities and grow.

- Ensure that your business stays relevant and competitive with international business structuring.

As your businesses scales, we’ll help you to keep on top of your regulatory, compliance and governance obligations. We can support you with:

- All aspects of your tax affairs via our family office and private client services.

- Liaison with HMRC to resolve your corporate tax enquiries promptly and efficiently.

- Legal solutions to your regulatory, compliance and governance challenges, as well as your ESG responsibilities.

- Tax compliance in the digital age.

Testimonials

- Adam Dickinson

- Tim Davies

- Elizabeth Huthman

Our private enterprise insights

Something went wrong

Oops!! Something went wrong, please try again

Our people

Euan West

Head of UK Regions and UK & EMA Head of KPMG Private Enterprise, Head of Markets & Growth

KPMG in the UK

Get in touch

Discover why organisations across the UK trust KPMG to make the difference and how we can help you to do the same.