The IFRS Sustainability Disclosure Standards, introduced by the International Sustainability Standards Board (ISSB) in 2023, provide a global reporting standard for companies to publish sustainability-related financial disclosures and strengthen transparency in the capital markets.

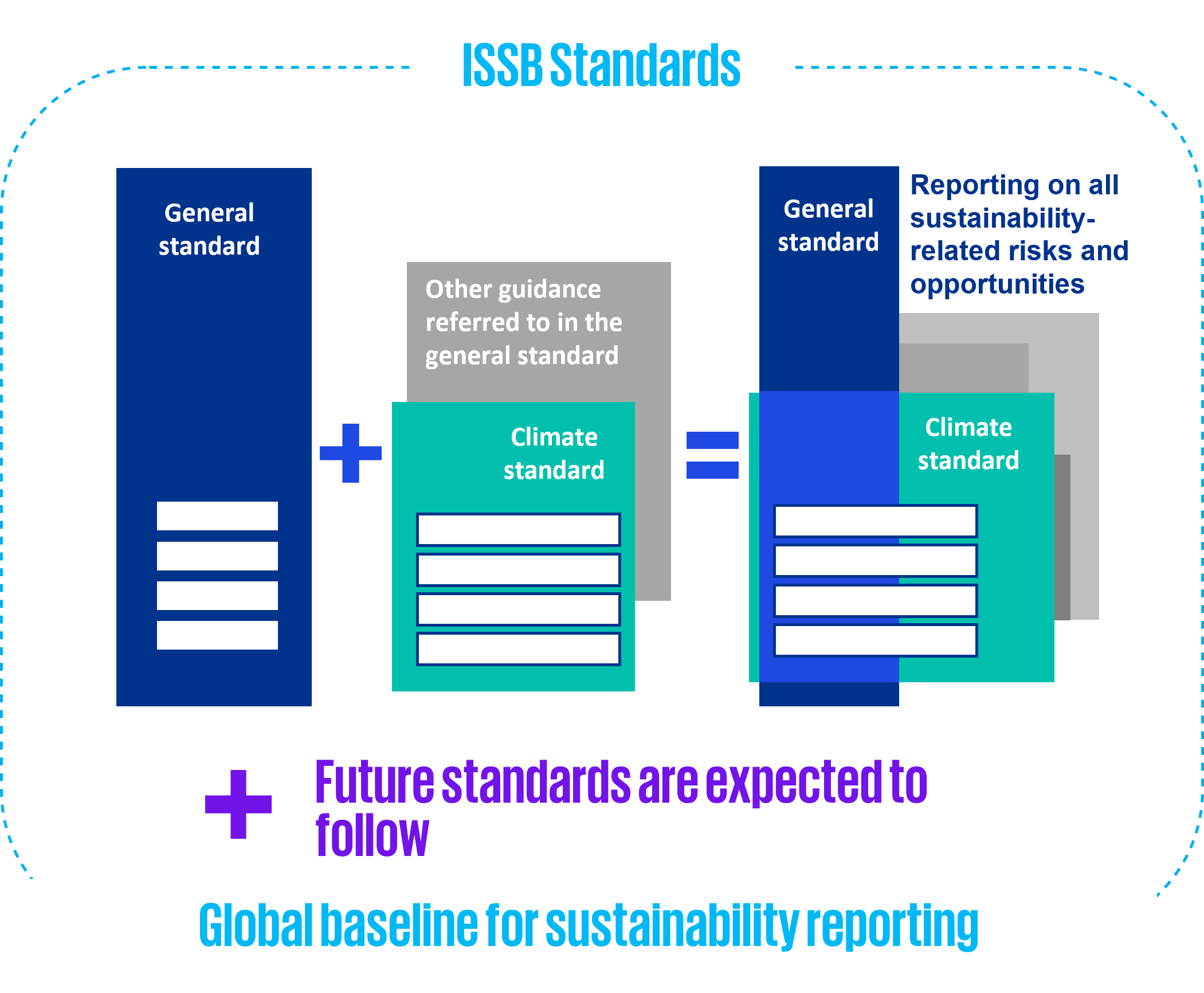

IFRS S1 sets out the general requirements for disclosing all material sustainability risks and opportunities, while IFRS S2 focuses specifically on climate-related disclosures such as climate related risks, scenario analysis, climate-risk metrics and ESG performance targets.

Both standards follow the four Task Force on Climate-Related Financial Disclosures (TCFD) pillars – governance, strategy, risk management, and metrics & targets – ensuring consistent and comparable information across jurisdictions. Together, they aim to improve sustainability data quality, support investor decision-making, and align with other TCFD-based disclosures and reporting initiatives.