24 September 2025

Swiss Real Estate Sentiment Index 2025

Real estate index at all-time high

- Despite its negative sentiment regarding the economy, the real estate sector is optimistic: The Swiss Real Estate Sentiment Index is at its highest level since its inception in 2012.

- This is driven by positive price expectations, for the first time also extending to peripheral locations.

- The availability of suitable investment opportunities in the residential segment is considered more constrained compared to last year.

- According to industry assessments, bureaucracy and regulations pose major obstacles for the creation of affordable housing.

- The survey identifies tighter regulation as the sector’s most significant risk.

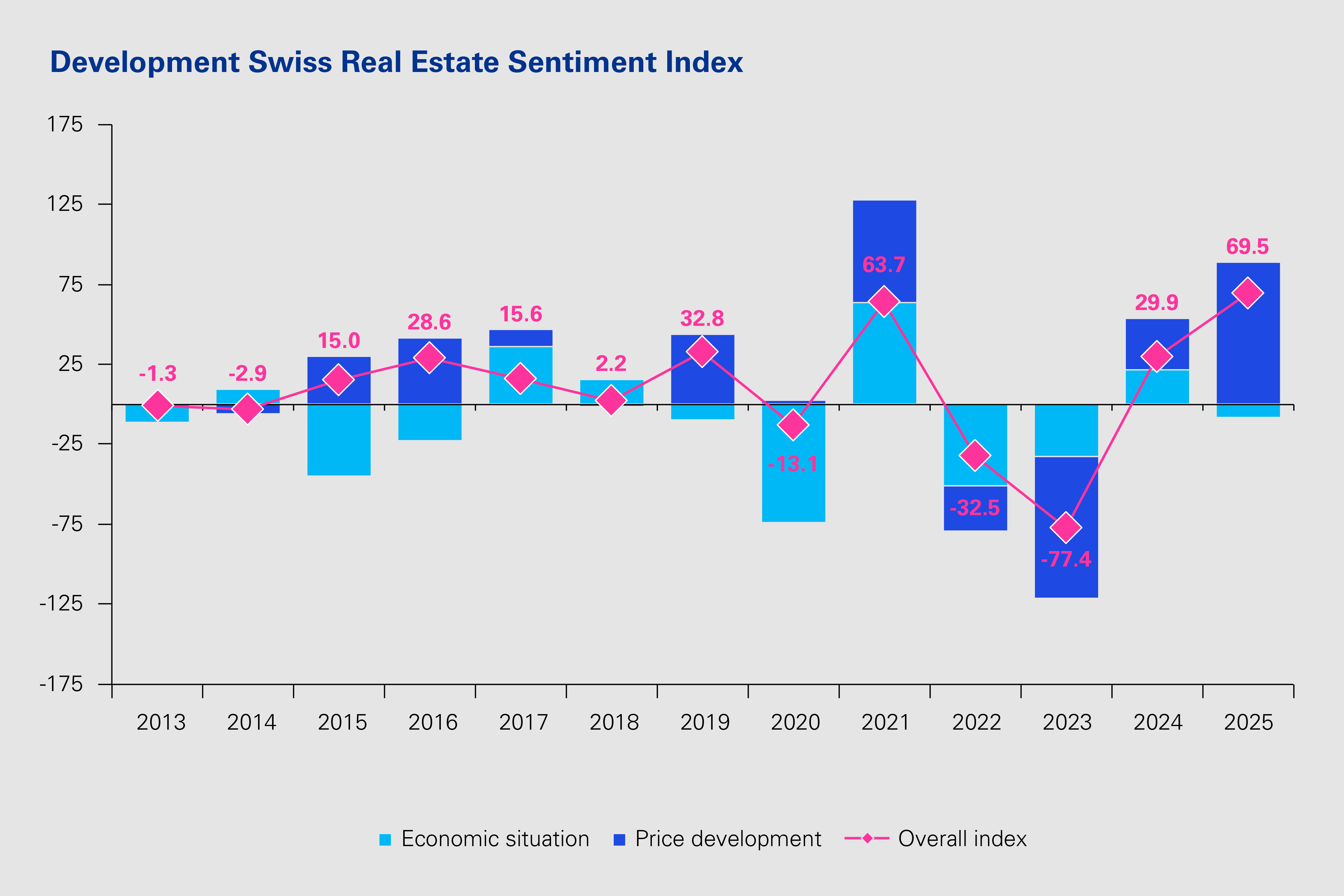

Despite its subdued assessment of the economic situation, the Swiss real estate sector is optimistic about the future. This is the picture painted by the results of the survey conducted for the Swiss Real Estate Sentiment Index (sresi®), which reflects the sector’s expectations regarding price trends and economic development for the next twelve months. In just two years, the index has climbed from its historic low of -77.4 points in 2023 to its current all-time high of +69.5 points.

Price expectations positive for peripheral locations for the first time

The sharp rise in the sresi® is attributable to the sector’s confidence that prices will increase over the next twelve months. The sub-index “Price development” came in at +89.0 points this year (previous year: +32.0), higher than ever before. Two years ago, it was still in negative territory.

According to Beat Seger, Real Estate Expert at KPMG Switzerland, “Positive price expectations on the real estate investment market are the result of renewed investment pressure and the expected positive trend in rental prices.”

For the first time in the survey’s history, price expectations are positive across all location classes. This is particularly evident at central locations. There, the price index is highest at +117.6 points, followed by secondary centers and metropolitan areas at +90.0 points and peripheral locations at +16.3 points. These figures were 40 to 60 index points lower in the previous year.

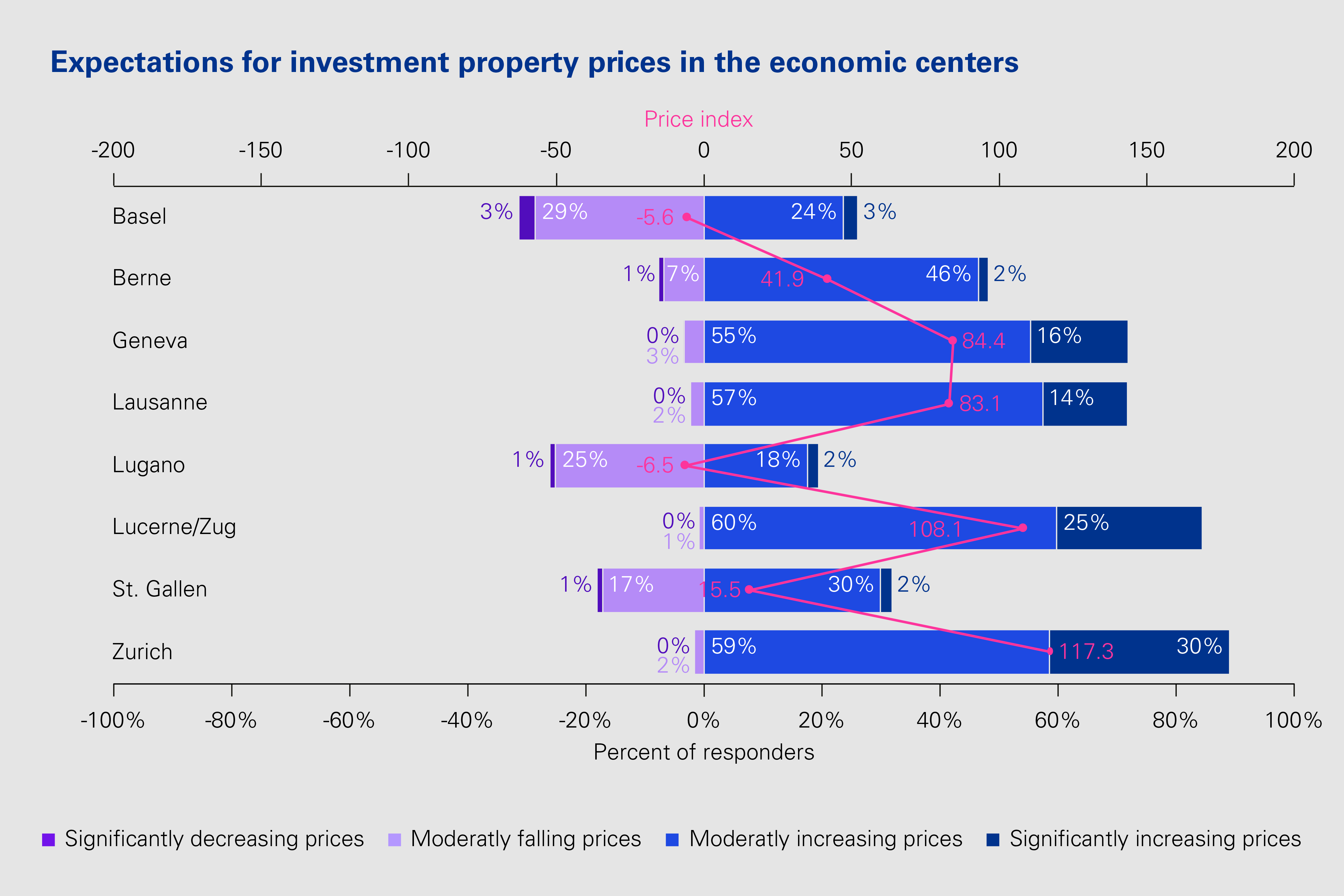

Price increases expected, particularly in Zurich, Lucerne/Zug and Geneva

The real estate sector expects a positive price trend, especially in the economic area of Zurich, Central Switzerland and the Lake Geneva region. The biggest price increase is expected in Zurich (+117.3 points), followed by Lucerne/Zug (+108.1 points), Geneva (+84.4 points) and Lausanne (+83.1 points). Price expectations for Basel (-5.6 points) and Lugano (-6.5 points) are in slightly negative territory, but are considerably more positive than in the past three years.

Subdued expectations regarding economic development

By contrast, the real estate sector views the economic outlook more negatively than in the previous year: Whereas the “Economic situation” sub-index was still in positive territory at +21.5 points in 2024, it is currently at -8.4 points; this signals an expectation that the economic environment will slow down compared to the previous year.

“Despite the favorable conditions for real estate investments in Switzerland, geopolitical challenges and supply chain disruptions are weighing on the economic outlook,” says Beat Seger. “This will also have an impact on investment spending in the real estate sector.” For example, only 9% of respondents indicated that they do not factor the geopolitical and economic situation into their investment decisions.

Residential segment: shortage of suitable investment opportunities

According to the survey, if the respondents had to invest CHF 100 million in capital in real estate over the next twelve months, they would invest around two thirds of it in the residential segment. This figure would amount to at least 75% among pension funds and insurers. This strong preference, coupled with construction activity that is too low compared to demand, means that survey participants in the residential segment are experiencing a severe shortage of suitable investment opportunities.

At -107.9 points, the sresi® supply index for this segment is therefore well into negative territory (previous year: -73.3 points). The availability of special-purpose properties is also assessed as (rather) meager (-38.1 points), while the supply of office, commercial and retail spaces is perceived as being sufficient.

Affordable housing: bureaucracy and regulations in the way

According to those surveyed, regulations and bureaucracy are the biggest factors negatively impacting the availability of affordable housing. Roughly two thirds of survey participants feel that regulations have a very negative impact, whereas 20% view the impact as slightly negative. 61% perceive bureaucracy as being a very negative factor, while a third of respondents consider it slightly negative. Political developments (47% very negative, 35% slightly negative) and high construction costs (38% very negative, 51% slightly negative) are also perceived as being key factors behind the availability of affordable housing.

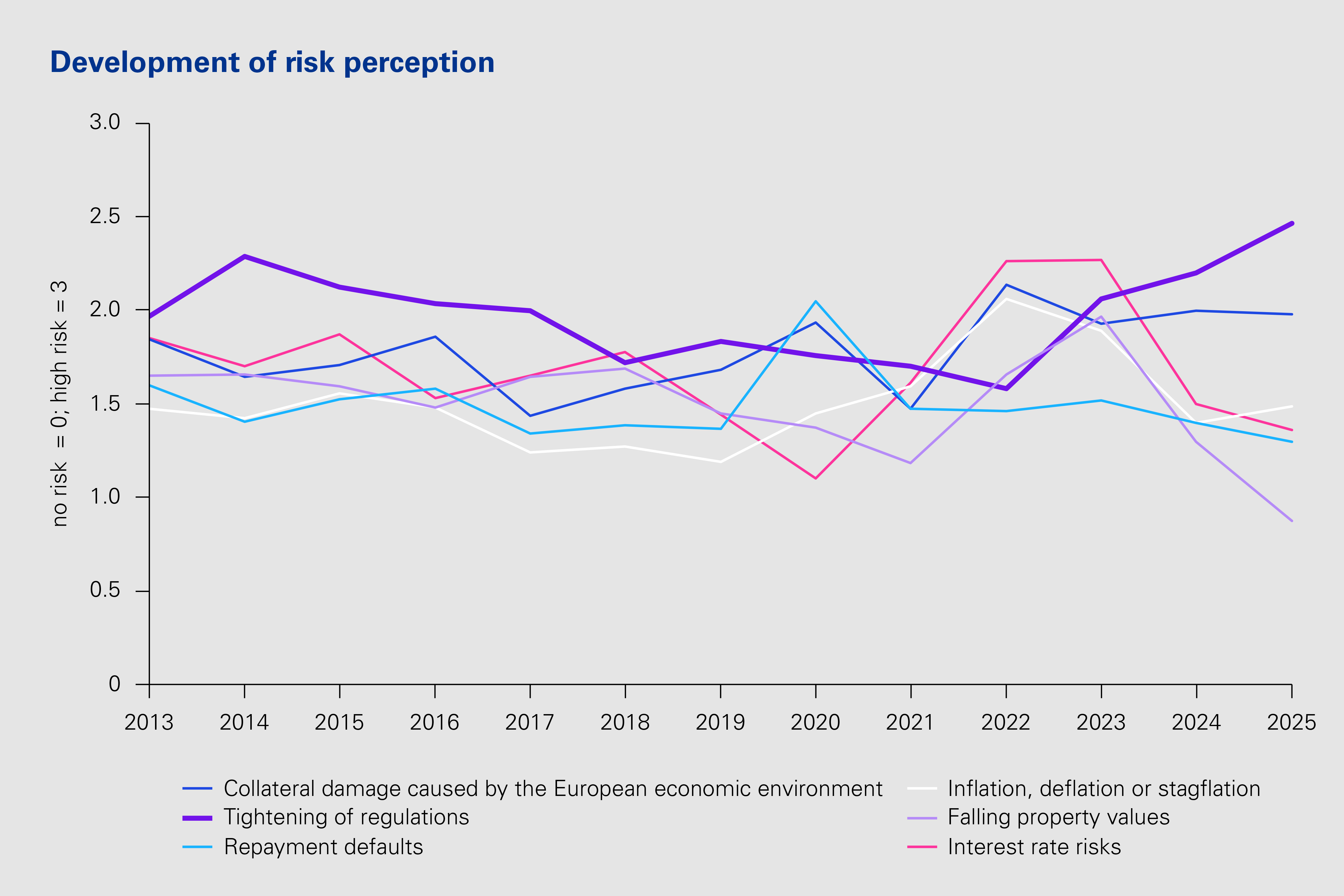

Regulation as the most significant risk

Scoring 2.5 points on a three-point scale, the highest score ever recorded, tighter regulations pose the biggest threat to the Swiss real estate investment market according to the real estate sector. While the risk of contagion from the economic environment in Europe followed as the second-biggest threat at 2.0 points, this score does not stand out from the survey results of recent years despite geopolitical and economic challenges. Other risks, such as payment defaults or interest rate and monetary policy developments, are rated much lower than tighter regulation, with scores of 1.5 or fewer points.

Focus on return-relevant sustainability factors

While three quarters of the players surveyed conduct at least a partial risk assessment of their portfolios for climate risks and natural hazards, just 14% indicate that they are in a position to quantify these risks in their portfolios. Unsurprisingly, insurers are the investor group that takes the most specific approach to risk analysis.

Numerous sustainability factors play a role when evaluating investments and calculating purchase prices. “The most important sustainability criteria are the ones that directly impact user demand and the return on investment,” says Seger. According to the survey, those are primarily location and accessibility, renewable energy sources and space efficiency and functionality. Major cost drivers such as building and soil pollutants are named as key criteria as well. Social factors and biodiversity, on the other hand, play a minor role.

For more information as well as the detailed study with interactive dashboards, please go to: www.kpmg.ch/sresi

Methodology

The KPMG Swiss Real Estate Sentiment Index (sresi®) serves as an advance indicator for anticipated developments in the Swiss real estate investment market. The main index is compiled based on assessments of economic developments and price trends in the real estate investment market. The aggregated index reflects respondents’ assessments of the general economic situation (weighted at 20 percent) and the real estate price trend (weighted at 80 percent). The sub-indices express the opinions of market players with respect to individual market and use categories.

This data was first collected in 2012, and the survey is repeated every year to generate an index that enables a comparison of market assessments over time. Some 400 real estate investors and appraisers from the Swiss real estate investment market participated in this year’s survey. The respondents represent an investment and appraised volume of roughly CHF 355 billion. The survey was conducted between 10 June and 25 August 2025.

About KPMG Switzerland

KPMG Switzerland is a leading service provider in the areas of Audit, Tax & Legal, and Advisory & Consulting, with a total workforce exceeding 3,100 employees. We operate in 10 locations throughout Switzerland and one in Liechtenstein. Our clients benefit from our tailored solutions and our strategic alliances with technology partners that support our audit and non-audit services alike. In the 2024 financial year, KPMG Switzerland generated net sales of CHF 548.8 million. On an international level, we operate in 142 countries and territories and have more than 275,000 people working in member firms around the world.