October 2024

With the FCA having finalised its rules and guidance, the UK's Overseas Funds Regime (OFR) went live at the end of September 2024, following several years of development.

This article summarises how the OFR will operate and sets out practical next steps for EEA fund managers that are launching new funds or are seeking to transition existing funds into the new regime.

The OFR journey to date

At the end of the Brexit transition period, EEA funds lost their ability to passport into the UK. However, passporting funds were able to take advantage of the Temporary Marketing Permissions Regime (TMPR) that was established by the UK to provide continuity while permanent market access arrangements for funds were considered.

Although there is an existing way that overseas funds could have been recognised to market to UK retail investors (the FSMA s272 gateway), it is a relatively complex and onerous process, both for the FCA and fund managers. The scale of the challenge was also a factor, with over 8,000 EEA UCITS in the TMPR. As a result, the OFR was introduced to allow for streamlined access to market to UK retail investors, if the UK government finds the jurisdiction of the fund to be equivalent from an investor protection perspective (see FSMA s271B).

Following the government's positive equivalence determination for EEA UCITS (including Exchange-Traded Funds, but excluding Money Market Funds), the laying of required legislation, and the FCA finalising its rules, the OFR will be up and running shortly.

The FCA's policy statement

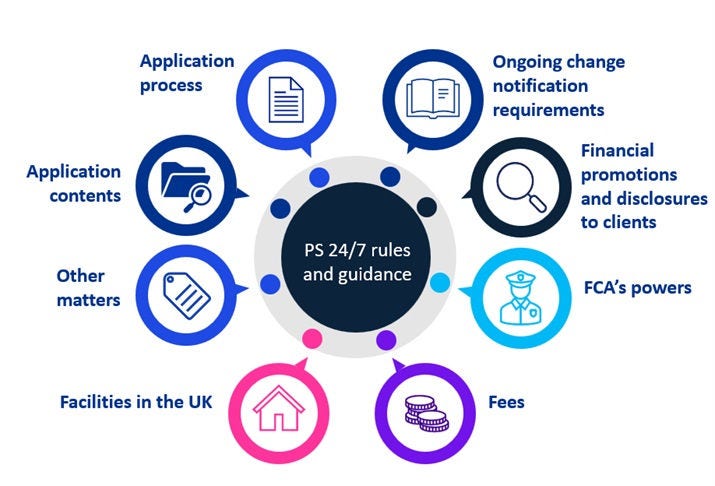

Following its consultation (CP 23/26), the FCA's final rules and guidance in policy statement PS 24/7 took effect from 31 July 2024 and set out how the FCA will operationalise the OFR and bring it to life from September.

The final rules include requirements covering various topics, from the information and content to be included in applications for recognition, to the FCA's powers and fees that it will charge:

Compared to the consultation, only minor changes were made in the policy statement.

Where the draft rules have been amended, the changes have generally been positive. For example, the FCA will now permit UK-authorised and OFR funds to have identical names, as long as the UK distribution channel makes the domicile of the fund sufficiently clear. And the FCA has removed the requirement to notify it 30 days in advance of certain changes taking effect in the UK — instead fund managers may in most cases notify the FCA `as soon as reasonably practical' after a change is approved by an EU regulator, or after wider changes or events have occurred.

What happens when?

The OFR will be rolled out in several stages:

- 30 September 2024: The OFR opens for new EEA funds that are not in the TMPR.

- 1 October 2024 — 31 December 2024: Stand-alone schemes in the TMPR can apply for recognition.

- 1 November 2024 — 30 September 2026: For umbrella funds in the TMPR, the FCA will assign landing slots to EEA fund managers in alphabetical order of the fund management company. Fund managers will be able to submit their applications at any time during their assigned three-month landing slot.

After applying for recognition and paying the application fee, the FCA has two months to make a decision.

Preparatory steps for fund managers

There are a range of tasks and activities that fund managers should be putting in motion now. These include straightforward matters, such as checking whether the FCA holds accurate contact details for the firm and if the fund population data held with the FCA is correct, to the more complex process of identifying and gathering the required information for applications in an efficient manner.

Key next steps for fund managers include:

- Gap analysis: A gap analysis should be performed against all the obligations in the final rules and guidance to map these against existing processes to identify where enhancements are needed, or new processes are required. For example, likely gaps will relate to fund prospectuses and the need to include further information about the status of the fund under the UK FOS and FSCS, and on how a UK investor can make a complaint.

- Operating model: The gap analysis should help inform the design of a target operating model or framework that underpins all aspects of the OFR application process and enables the delivery of applications at scale in an accurate and efficient manner.

This should include the identification of relevant owners and stakeholders, any technology that will be used to support or automate aspects of the information gathering process, and governance arrangements that will oversee application approval and sign-off.

The operating model should also be future-proofed to facilitate ongoing compliance and post-application processes, such as the identification and delivery of notifications to the FCA, as well as to cater for the recognition of newly launched funds in future once any initial project is stood down.

- Review of EEA and UK product ranges: There may be some product-related efficiencies to be realised, now that there is certainty that EEA UCITS may be marketed to UK retail customers if they are recognised by the FCA. There is therefore a strategic opportunity for fund managers to review their respective ranges in the medium term.

The remaining pieces of the OFR puzzle

Although the OFR will commence shortly for EEA UCITS, some further developments can be expected:

- Extension of the Sustainability Disclosure Requirements (SDR): Currently, overseas funds are out of scope of the FCA's SDR and are required to display a notice as such (you can read more on the SDR here). However, the UK government will consult soon on extending the SDR to OFR funds.

Depending on the outcome of the government's consultation, and subject to associated FCA rules and guidance, any legislative requirements related to SDR for OFR funds are likely to come into force in the second half of 2025. This has the potential to be a challenging area, where some EEA funds may need to comply with both the EU SFDR and the UK SDR. - Money Market Funds (MMFs): Although EEA UCITS have been deemed to be equivalent under the OFR, the equivalence decision specifically excluded MMFs. This is because the UK is currently concluding a consultation on reforming and the UK MMF regime. The outcome will be particularly important, given the significant number and scale of sterling-denominated MMFs domiciled in the EEA in comparison to the UK.

- Reforms to UK PRIIPs Packaged retail and insurance-based investment products Regulation: The UK has progressed plans to repeal the PRIIPs disclosure framework and to replace it with a modernised and streamlined disclosure framework based on the concept of Consumer Composite Investments (CCIs). Following an FCA consultation later this year, it is expected that OFR funds will be required to follow FCA rules under the new disclosure framework from 1 January 2027 at the latest.

- Equivalence decisions for other jurisdictions: Although the UK and EU have similar rules governing UCITS (putting aside notable exceptions, such as the UK assessment of value requirements), it still required years of work and analysis to reach an equivalence decision for the EEA. While other jurisdictions may also be hoping to be granted equivalence, it appears unlikely that there will be any additional equivalence determinations, in the short term at least.

- Ongoing data reporting to the FCA: In future, the FCA plans to collect information from OFR funds to carry out its functions. However, it will undertake a review of data reporting for wider funds (including UK funds) first.