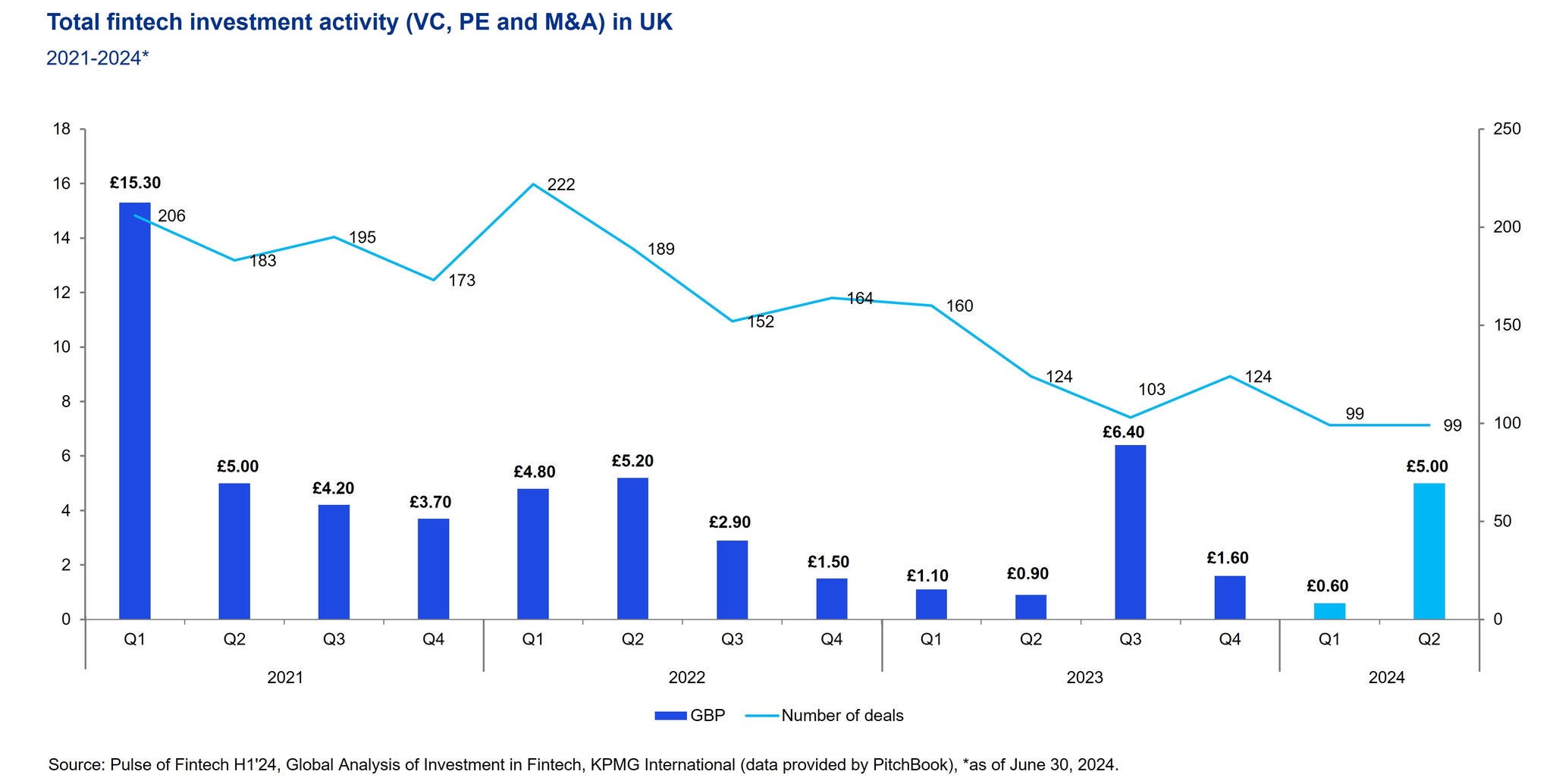

- Total UK fintech investment decreased to £5.7bn in H1’24, from £8bn in H2’23. However, this is an increase from £1.9bn in H1’23.

- 198 UK M&A, Private Equity and Venture Capital fintech deals were completed in H1’24, down from 284 in H1’23, and down from 227 in H2’23. The largest fintech deal in the UK and Europe in H1’24 was the £3.1bn buyout of financial software company IRIS Software Group by Leonard Green.

Pulse of Fintech H1 2024

Hannah Dobson, Partner and UK Fintech Lead, discusses the latest global and UK fintech market developments.

Key insights from the EMEA region

Fintech investment in EMEA dropped to £8.8bn in H1’24, falling from £14.8bn in H2’23 amid continued geopolitical uncertainty and a high interest rate environment that has kept interest in large deals fairly muted. As previously mentioned, the UK saw the largest share of fintech funding in the region.

Fintech-focused Venture Capital investment in EMEA showed resilience in H1’24 compared to other regions, likely helped by small increases in investment in the UK, Germany, Nordics and Ireland.

Regulation remains a key focus in EMEA, particularly in the EU, with a focus on new and upcoming legislation on AI and Crypto. B2B focused fintechs are also attracting investor attention in the region, driven by their ability to produce recurring revenues.

As we progress into H2’24, we expect large financial institutions and fintechs to leverage AI to drive operational efficiencies and cost reductions. In addition, we predict a growing focus on AI-driven regtech and cybersecurity solutions including areas such as fraud prevention.

Key insights from the EMEA region

Fintech investment in EMEA dropped to £8.8bn in H1’24, falling from £14.8bn in H2’23 amid continued geopolitical uncertainty and a high interest rate environment that has kept interest in large deals fairly muted. As previously mentioned, the UK saw the largest share of fintech funding in the region.

Fintech-focused Venture Capital investment in EMEA showed resilience in H1’24 compared to other regions, likely helped by small increases in investment in the UK, Germany, Nordics and Ireland.

Regulation remains a key focus in EMEA, particularly in the EU, with a focus on new and upcoming legislation on AI and Crypto. B2B focused fintechs are also attracting investor attention in the region, driven by their ability to produce recurring revenues.

As we progress into H2’24, we expect large financial institutions and fintechs to leverage AI to drive operational efficiencies and cost reductions. In addition, we predict a growing focus on AI-driven regtech and cybersecurity solutions including areas such as fraud prevention.