Key findings

Permanent placements fall again, but at

slower rate

Pay rates continue to rise markedly

Worker availability increases to steeper degree

Data collected May 9-24

Summary

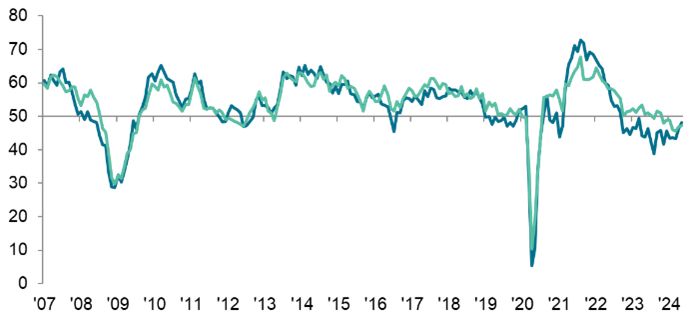

The KPMG and REC, UK Report on Jobs survey, compiled by S&P Global, pointed to another reduction in permanent placements made by UK recruitment consultants in May. Delayed decision making and a lack of demand amongst companies were reported to have weighed on recruitment activity. That said, May's fall in permanent placements was modest and eased for a second successive month to its weakest since March 2023. There was also a slower reduction in the number of temp billings, with the decline the weakest since January.

May's survey also revealed a drop in vacancy numbers, although the decline was fractional and the softest in the current seven-month downturn. Amid the high cost of living and shortages of suitable candidates, pay inflation nonetheless remained marked.

The report is compiled by S&P Global from responses to questionnaires sent to a panel of around 400 UK recruitment and employment consultancies.

May sees weaker decline in placements

Permanent staff appointments continued to fall in May, according to the latest survey of UK recruitment consultants. It was the twentieth successive month in which placements have fallen, but the latest decline was modest and the slowest since March 2023. A similar trend was seen for temp billings, with the latest contraction the weakest in four months.

There were reports that slow decision-making, a lack of vacancies and specific candidate shortages weighed on placements.

Permanent Placements Index

Temporary Billings

50.0 = no-change

Further uplift in pay rates

Amid reports of a competitive market landscape, alongside evidence of a ripple impact on base pay rates following April’s increases in the national minimum and living wages, typical starting pay for candidates rose again during May. For permanent workers, salaries were reported to have increased markedly and to only a slightly lesser extent than April’s four-month high. Temp staff saw a similar trend, with pay rising at only a slightly slower pace than in the previous month.

Staff vacancies down only slightly

Although demand for staff continued to fall in May, extending the current downturn to seven months, it did so only marginally and to the lowest degree in this sequence. Moreover, the latest fall was exclusively led by permanent workers as temp staff demand was unchanged in the latest survey period.

Staff availability rises to greatest degree since end of 2020

May’s survey revealed another steep increase in staff availability. The rate of growth was the steepest recorded by the survey since December 2020. The faster expansion in the number of people looking for work was seen for permanent job roles. Panellists noted that a mixture of redundancies, higher unemployment and reduced demand for staff led to the broad rise in candidate availability.

Regional and Sector Variations

There was a steep reduction in the number of permanent placements in the South of England. However, a return to marginal growth was seen in the Midlands.

Two English regions recorded a drop in temp billings (London and the South of England). In contrast, solid growth was seen in the Midlands and the North of England.

Of the ten broad sectors covered by the survey, just three recorded growth. The strongest increase was seen for Engineering, followed by Blue Collar. The steepest drops in demand for permanent workers were seen for Retail and Secretarial/Clerical.

Temporary staff demand rose for half of the ten broad sectors in May. The strongest growth was for Engineering followed by Blue Collar. Where vacancies fell, the most prominent decline was again seen for Retail.

Comments

Commenting on the latest survey results, Jon Holt, Chief Executive and Senior Partner of KPMG in the UK, said:

“We know our labour market is resilient. The big picture is that unemployment is historically low with the ease of filling vacancies back to pre-pandemic levels. Taken together with today’s data and expected interest rate cuts, inflation easing and increased consumer confidence over the summer, we will hopefully move towards a better economic outlook for the second half of 2024.

“But May’s data underscores the complexities in the current labour market. While demand overall remains weak due to firms still stalling on hiring decisions, the pace of decline has slowed for the third month in a row. Some sectors even saw demand growth - although a lack of skilled applicants could put further upward pressure on pay as employers compete to attract the best talent.

“Business confidence is ready to bounce back. And as well as counting on a more dovish Bank of England, ahead of the General Election CEOs will be closely following all parties’ policy commitments as they consider their plans for future growth.”

Neil Carberry, REC Chief Executive, said:

“The jobs market looks like it’s on its way back, with clear improvements over last month on most key measures, especially in the North and Midlands. While permanent hiring remains weak, these are the best numbers we have seen in more than a year, and the temp billings number has also improved.

“There is potential energy stored in the economy, as employers are feeling more confident. Political certainty and falling interest rates should add to lower inflation and help this turn into movement over the course of the rest of the year. REC members report that clients are ready to hire, but hesitant. These numbers suggest that caution may be starting to abate.

“Pay growth remains steady, reflecting both settlements made by employers for their staff, but also the substantial National Minimum Wage rise in April.

“No attempt to drive growth will succeed without the next government addressing people issues within its first 100 days. This must include reform of the Apprenticeship Levy to cover high-quality, modular training, and a long-term cross-departmental strategy to tackle labour and skills shortages, owned by the Cabinet Office but delivered locally. As the specialists in jobs, recruiters are ready to help, whoever wins on July 4.”

Contact

KPMG

Tanya Holden

Deputy Head of Media Relations

+44 (0) 7874 888656

REC

Hamant Verma

Communications Manager

T: +44 (0)20 7009 2129

S&P Global

Andrew Harker

Economics Director

S&P Global Market Intelligence

T: +44 (0)1491 461 016

Sabrina Mayeen

Corporate Communications

S&P Global Market Intelligence

T: +44 (0) 7967 447030

Methodology

The KPMG and REC, UK Report on Jobs is compiled by S&P Global from responses to questionnaires sent to a panel of around 400 UK recruitment and employment consultancies.

Survey responses are collected in the second half of each month and indicate the direction of change compared to the previous month. A diffusion index is calculated for each survey variable. The index is the sum of the percentage of ‘higher’ responses and half the percentage of ‘unchanged’ responses. The indices vary between 0 and 100, with a reading above 50 indicating an overall increase compared to the previous month, and below 50 an overall decrease. The indices are then seasonally adjusted.

Underlying survey data are not revised after publication, but seasonal adjustment factors may be revised from time to time as appropriate which will affect the seasonally adjusted data series.

For further information on the survey methodology, please contact economics@spglobal.com.

Full reports and historical data from the KPMG and REC, UK Report on Jobs are available by subscription. Please contact economics@spglobal.com.

About KPMG UK

KPMG LLP, a UK limited liability partnership, operates from 20 offices across the UK with approximately 18,000 partners and staff. The UK firm recorded a revenue of £2.96 billion in the year ended 30 September 2023.

KPMG is a global organisation of independent professional services firms providing Audit, Legal, Tax and Advisory services. It operates in 143 countries and territories with more than 273,000 partners and employees working in member firms around the world. Each KPMG firm is a legally distinct and separate entity and describes itself as such. KPMG International Limited is a private English company limited by guarantee. KPMG International Limited and its related entities do not provide services to clients.

About REC

The REC is the voice of the recruitment industry, speaking up for great recruiters. We drive standards and empower recruitment businesses to build better futures for their candidates and themselves. We are champions of an industry which is fundamental to the strength of the UK economy. Find out more about the Recruitment & Employment Confederation at www.rec.uk.com.

About S&P Global

S&P Global (NYSE: SPGI) S&P Global provides essential intelligence. We enable governments, businesses and individuals with the right data, expertise and connected technology so that they can make decisions with conviction. From helping our customers assess new investments to guiding them through ESG and energy transition across supply chains, we unlock new opportunities, solve challenges and accelerate progress for the world.

We are widely sought after by many of the world’s leading organizations to provide credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help the world’s leading organizations plan for tomorrow, today. www.spglobal.com.

Disclaimer

The intellectual property rights to the data provided herein are owned by or licensed to S&P Global and/or its affiliates. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without S&P Global’s prior consent. S&P Global shall not have any liability, duty or obligation for or relating to the content or information (“Data”) contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon. In no event shall S&P Global be liable for any special, incidental, or consequential damages, arising out of the use of the Data.

This Content was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global. Reproduction of any information, data or material, including ratings (“Content”) in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content.