Permanent staff pay growth lowest in over three years

Starting pay levels for both permanent and temporary workers continued to increase during March. Higher pay generally reflected efforts to attract better candidates. However, amid an upturn in candidate supply, rates of pay growth continued to slide. Overall, permanent staff salaries rose at the weakest rate in over three years, whilst for temp wages the increase was the slowest in four months. In both instances, growth rates were also below their respective survey trends.

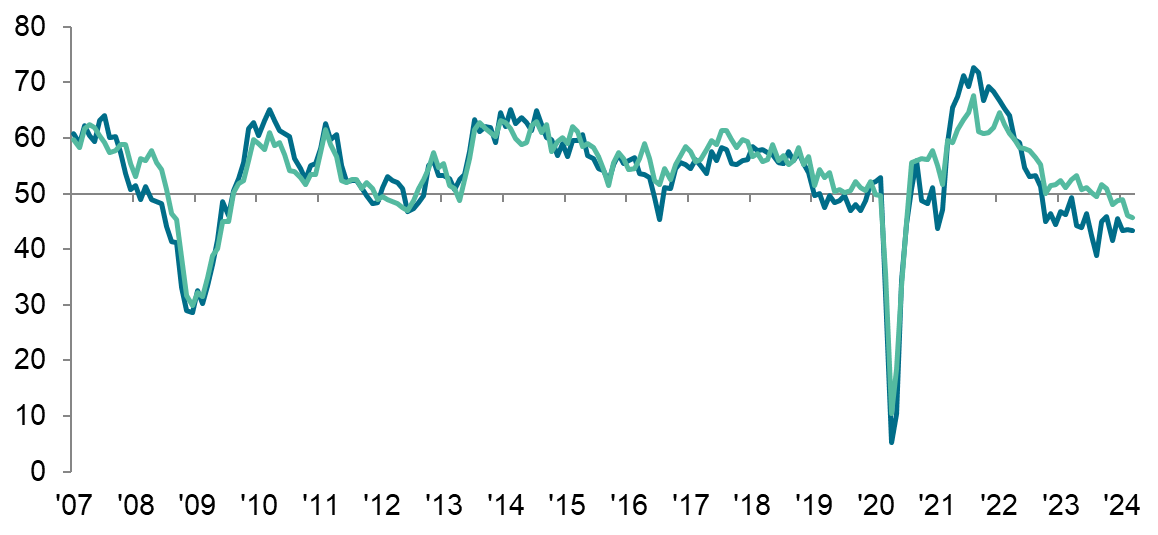

Further decline in staff demand signalled

Latest data showed that demand for all workers fell for a fifth successive month in March. Although the rate of contraction was softer than in February, it remained historically marked. Permanent staff demand continued to fall at a noticeably faster rate than for temp workers, which again fell only marginally.

Labour supply continues to increase during March

March saw a rapid and accelerated increase in the availability of staff. Latest data marked the thirteenth successive month that growth has been registered, and the latest rise was the steepest recorded since last November. Higher volumes of redundancies and cost cutting at firms reportedly led to an increase in candidate availability. Permanent and temporary staff availability both increased sharply.

Regional and Sector Variations

There were reductions in the number of permanent placements across all four monitored English regions in the latest survey period. The sharpest contraction was recorded in the South of England.

The downturn in temporary billings was common across all four English regions, with the steepest decline recorded for London.

In March, eight out of ten broad sectors covered by the survey experienced a drop in demand for permanent vacancies, the exceptions being Engineering and Blue Collar. The sharpest fall in demand was recorded in the Retail category, followed by IT & Computing.

Temporary vacancies increased for Blue Collar, Engineering and Hotels & Catering workers in March, with solid growth rates recorded in each instance. Like permanent vacancies, the steepest downturn in demand for temporary staff was seen for Retail.

Comments

Commenting on the latest survey results, Jon Holt, Chief Executive and Senior Partner of KPMG in the UK, said:

“Persistent economic uncertainty has led to many business leaders delaying major investment decisions and relying on savings for growth during the first quarter of the year. But they are optimistic about the outlook improving.

“And while March’s survey data indicates ongoing weak demand in the labour market with a sharp rise in candidate availability, relatively low levels of UK unemployment together with falling inflation could pave the way for economic recovery.

“There are still headwinds, but it’s time for the UK economy to get its groove back - and UK businesses will be ready when the Bank of England makes its interest rate cuts. This may not lead to an instant rebound, but confidence to invest will increase, improving demand, and the economic outlook should start moving in the right direction.”

Neil Carberry, REC Chief Executive, said:

“Economic growth has been sidelined for too long and must be at the heart of this year’s General Election campaign. Today’s data shows the economy in a holding pattern waiting for inflation and interest rates to ease, so that firms can get to investing. The decline in permanent placements has been steady for some months now, with temporary recruitment still robust, if falling back from the record highs of 2022/3. Employers appear to be leaning on temporary work while they are uncertain about the path of the economy.

“The data here should support a decision by the Bank of England’s Monetary Policy Committee to loosen its grip on growth in the near-term future. Pay growth has slowed significantly, and is now below the survey’s long-term average for new permanent roles. Some sectors – like the bellwether firms in construction – need a clear signal. In other areas, particularly engineering, demand remains high, emphasising the importance of a new approach to skills from governments across the UK, led by reform of the Apprenticeship Levy. The uptick in the need for blue collar staff may be a sign of consumer confidence starting to return – but it also emphasises again how labour shortages may constrain growth when it returns. A proper industrial strategy, with a meaningful and practical workforce element to it, is long overdue.”

Contact