Permanent salary inflation eases to near three-year low

February survey data signalled further increases in rates of starting pay for both permanent and temporary workers, as employers raised rates of pay amid the higher cost of living and competition for highly-skilled candidates. However, the rate of salary inflation was the slowest recorded in nearly three years, with a number of recruiters noting that employer budgets were now tighter after a period of rapidly rising pay. Temp wage growth also moved further below the long-run trend level during February.

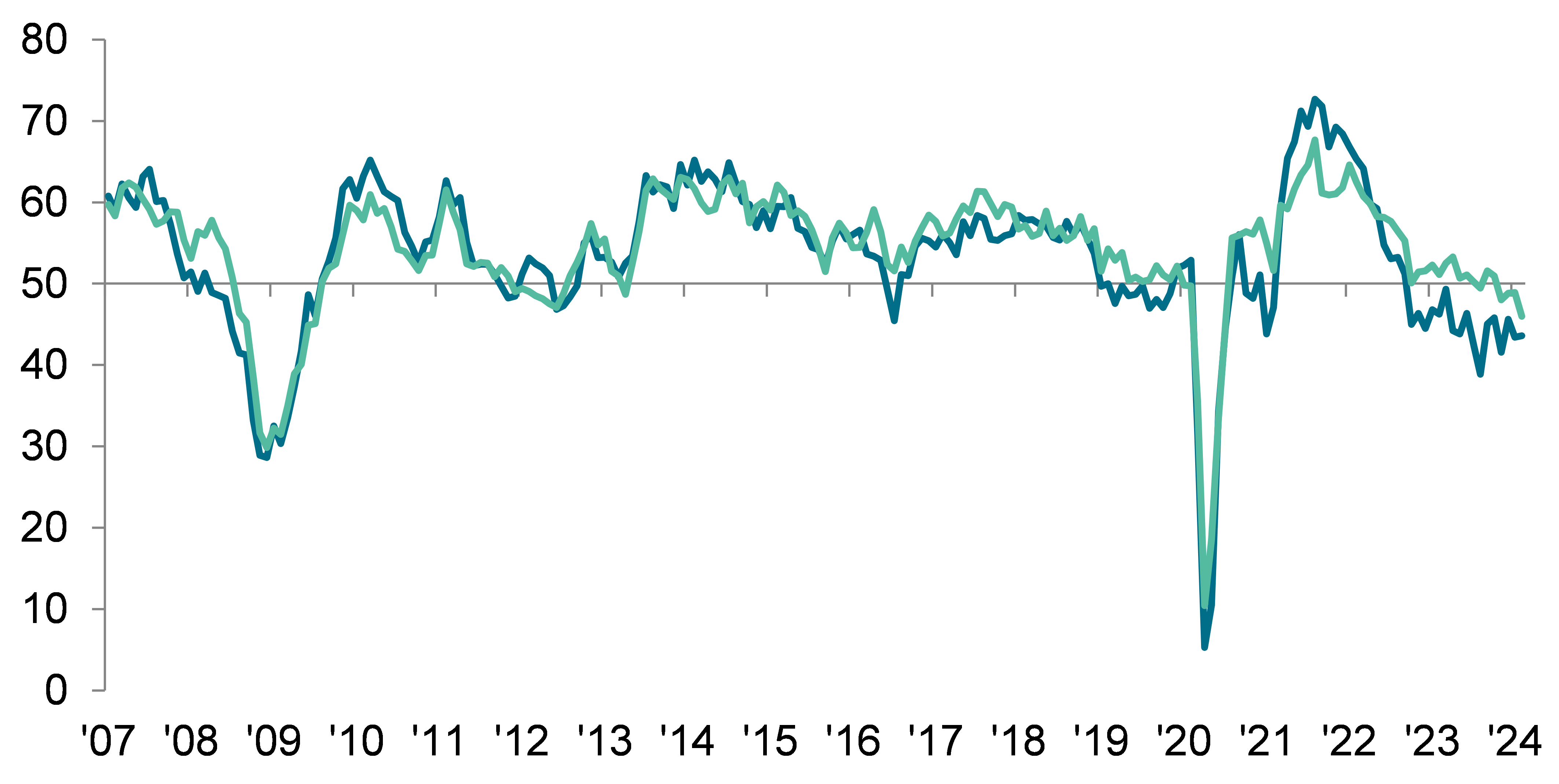

Demand for staff drops at fastest rate since January 2021

UK recruitment consultancies signalled a solid and accelerated reduction in demand for workers during February. Notably, the rate of contraction was the quickest recorded since the start of 2021, and primarily driven by a fall in permanent staff vacancies. Temporary job opportunities fell for the first time in three-and-a-half years, albeit only marginally.

Availability of workers continues to expand sharply

The availability of staff rose for the twelfth straight month in February amid reports of redundancies and a slowdown in hiring activity. Overall, labour supply expanded at a historically sharp pace, albeit one that was softer than those seen in the prior four months. Underlying data indicated that the increase in candidate availability was driven by marked upturns in both permanent and temporary candidate numbers.

Regional and Sector Variations

All four monitored English regions noted lower permanent placements midway through the opening quarter of the year, with London seeing the sharpest drop overall.

The Midlands was the only monitored English area to register an increase in temp billings during February. The quickest reduction was meanwhile seen in the capital.

Lower demand for permanent workers was registered in eight of the ten broad employment categories during February. The Retail and Executive/Professional sectors noted the steepest rates of contraction. Engineering and Nursing/Medical/Care meanwhile saw vacancies increase.

The Retail and Construction sectors led the downturn in demand for temporary workers midway through the opening quarter of the year. Of the ten surveyed job categories, only Blue Collar and Engineering noted increases in demand for short-term staff during February.

Comments

Commenting on the latest survey results, Jon Holt, Chief Executive and Senior Partner of KPMG in the UK, said:

“The impasse between economic uncertainty and hiring decisions continued into February. Chief Executives tell me they are ready to invest and grow - including taking on new staff - yet the reality is they’re being held back by the prospect of weak demand.

“Businesses would ideally have liked a Budget that drives investment, boosts economic growth and helps productivity bounce back. While it was encouraging to see measures to increase labour supply, there was limited headroom for change - only time will tell if the Chancellor’s announcements go far enough to shift the dial on the UK’s economic outlook.”

Neil Carberry, REC Chief Executive, said:

“As inflation is falling back to target earlier than expected, it’s time to get the focus on growth. This month’s survey shows the market slowing, and a concerning increase in the decline in temporary billings, to the lowest performance since the middle of 2020. Given recent news about GDP dropping, this overall picture is no surprise – but it is certainly still quite resilient by comparison with previous recessions. We know the economy has the potential to create jobs and opportunities – but it can only do that sustainably if we can get economic growth going.

“Following the Budget last week, which didn’t address some of the key drivers of growth like skills, infrastructure and reducing the cost of investment and employment, all eyes are on the Bank now. Lower interest rates will help build firm’s confidence to invest.

“The temporary labour market is the unsung hero of the economic uncertainty of recent years. It keeps the cogs of the economy turning amidst uncertainty and labour shortages – but it still needs nurturing. As we approach the General Election, businesses will be looking to politicians for commitment on this, and reforms of regulation that will support it from IR35, to regulating of the umbrella market and delivering flexibility to the Apprenticeship Levy.”

Contact