Sharper rise in overall candidate supply

The availability of candidates improved for the eighth straight month in October, and at a much sharper rate than in September. This was due to an accelerated upturn in permanent candidate numbers, as temp staff supply rose at a slightly softer (but still marked) pace. There were frequent reports that redundancies and subdued hiring activity had contributed to the latest increase in staff availability.

Starting salary inflation slips to 31-month low

Permanent starters' pay remained on an upward trend in October, though the rate of increase moderated to the weakest in just over two-and-a-half years. Nevertheless, the rate of salary inflation remained sharp and was in line with the series average. Recruiters often mentioned that employers had to up pay offers to secure suitably-skilled staff and to reflect the higher cost of living. Temp wages also increased, though the rate of growth held close to September's recent low.

Continued…

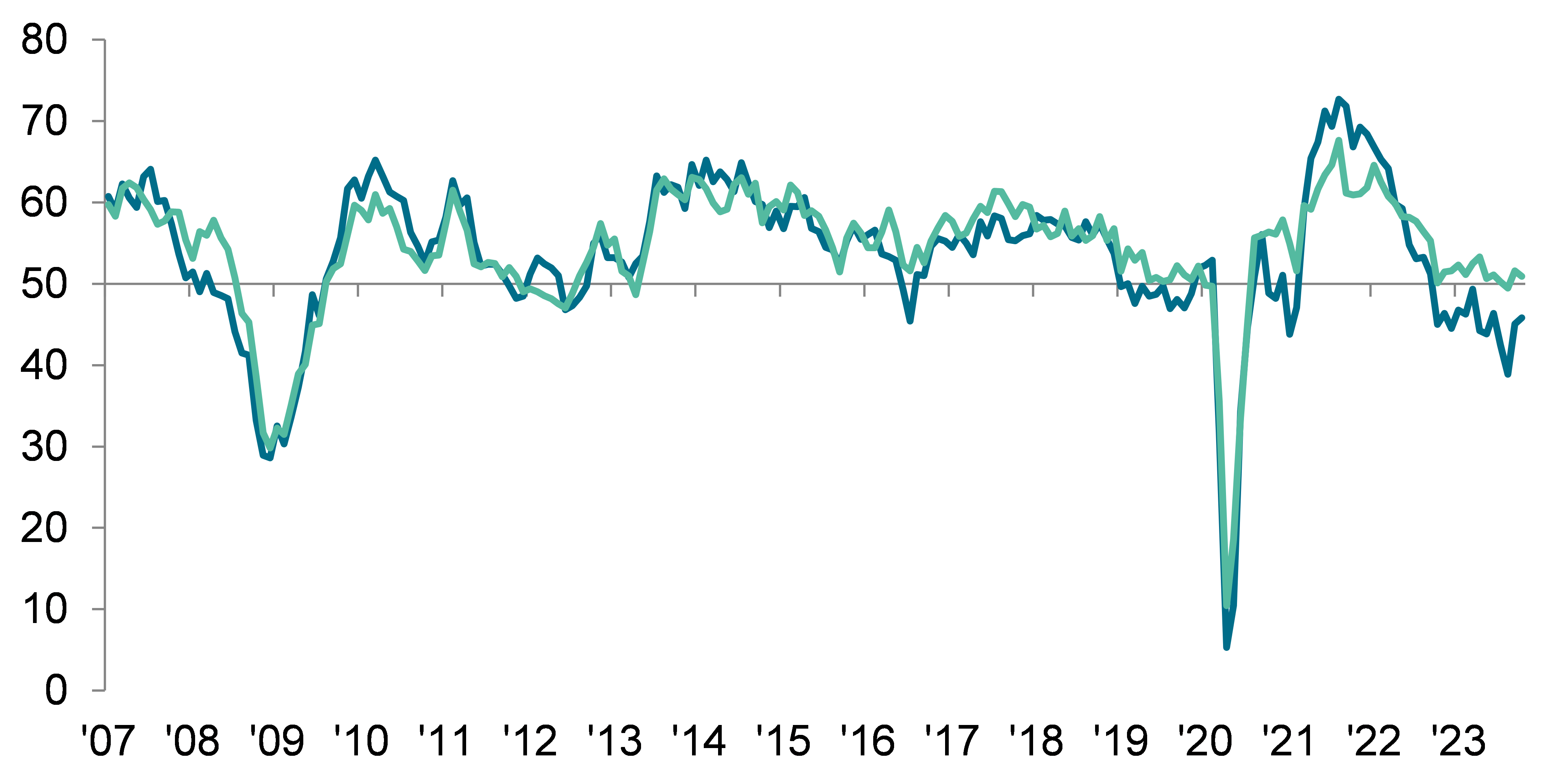

Demand for staff stabilises in October

Following a slight reduction in September, overall demand for staff stabilised in October. Underlying data highlighted that permanent vacancies fell only fractionally, while the number of temp positions increased modestly. That said, the latter marked the second-softest improvement in demand for short-term workers since January 2021.

Regional and Sector Variations

On a regional basis, London saw an accelerated and rapid decline in permanent placements that was the sharpest of all four English areas. Falls were also seen in the South and North of England, but a fractional rise was recorded in the Midlands.

Three of the four monitored English regions registered higher temp billings at the start of the fourth quarter, led by London. The North of England bucked the wider UK trend and recorded a modest reduction.

A slight increase in demand for permanent staff in the private sector helped to offset a further reduction across the public sector at the start of the final quarter of the year. Temporary vacancies continued to rise in the private sector, with the rate of growth picking up slightly from September. In contrast, demand for short-term staff in the public sector fell solidly.

Half of the ten monitored employment categories registered stronger demand for permanent workers at the start of the fourth quarter, led by Nursing/Medical/Care. The Construction and Retail sectors meanwhile saw the quickest drops in permanent staff vacancies.

Temporary staff vacancies expanded in six of the ten monitored employment sectors during October. The Hotel & Catering and Nursing/Medical/Care categories saw the strongest rates of growth. The sharpest reduction in demand was meanwhile seen for temporary Retail staff.

Comments

Commenting on the latest survey results, Claire Warnes, Partner, Skills and Productivity at KPMG UK, said:

“The jobs market is facing a cyclical challenge – there are people out there who want to work, and there’s a decent availability of candidates, but they often do not have the right skills for the roles on offer. This means higher starting salaries are still being offered as businesses compete in the ongoing battle for talent.

“And while the rate of decline in permanent placements is the weakest since June – this follows more than a year of cautious hiring due to economic uncertainty and means many businesses are unable to commit to long-term strategies and instead are having to focus on the here and now, by employing temps. The sharper rise in available candidates is good news for recruiters, but this comes at the expense of employers who are making more redundancies as they tighten budgets due to ongoing high inflation.

“Looking across sectors, healthcare as ever is experiencing a mismatch in supply and demand - there are fewer clinical professionals available to manage a very busy service as we head into winter. While permanent workers are the panacea, this is where temporary contracts continue to provide the means to deploy skilled staff at short notice, but at a higher cost.

“With a weak economic outlook for the months ahead, employers will be hoping next year will bring the expected easing of inflation so they can focus on delivering growth for their businesses.”

Neil Carberry, REC Chief Executive, said:

“In many ways, the labour market is marking time waiting for the brakes to be taken off growth by the Bank of England. While permanent hiring is now declining more softly, temporary hiring continues to pick up the slack – with billings gently growing for most of this year on the back of rising wages. While the rate of pay growth has now returned to more normal parameters, it is still strong, especially in sectors where staff remain in short supply. That sectoral split is ever more pronounced, with challenging sectors like construction and IT sitting in a very different place to hospitality and healthcare, which continue to be affected by shortages. Looking to the Autumn Statement, businesses and Government need to be aware that the return of growth will reveal shortages more widely – action on skills, welfare-to-work programmes and immigration reform will be needed to prevent a return to growth being squandered.”

Neil Carberry added:

“Healthcare providers are ramping up their hiring ahead of the winter, but candidate supply is short. Agency medical staff are keeping wards open and getting patients treated - they need a bit more support from Government. Reforming capped on-framework agency rates so pay for temps working on-framework can rise for the first time in four years will save Government money as they will end up using far fewer emergency shifts, and it will reward a part of the NHS workforce that is too often overlooked.”

Contact