Sharper rise in candidate availability

The latest survey showed that faster increases in the supply of both temporary and permanent workers drove the sharpest upturn in overall labour supply since December 2020. There were frequent reports that redundancies and hiring freezes had underpinned the latest improvement in staff availability.

Salary inflation edges lower, but remains marked overall

Competition for skilled candidates and the increased cost of living continued to place upward pressure on rates of starting pay during July. Salaries for newly-placed permanent workers rose sharply, despite the rate of inflation slipping to the lowest since April 2021. Temp pay meanwhile increased at the softest pace in 29 months, albeit solidly overall.

Continued…

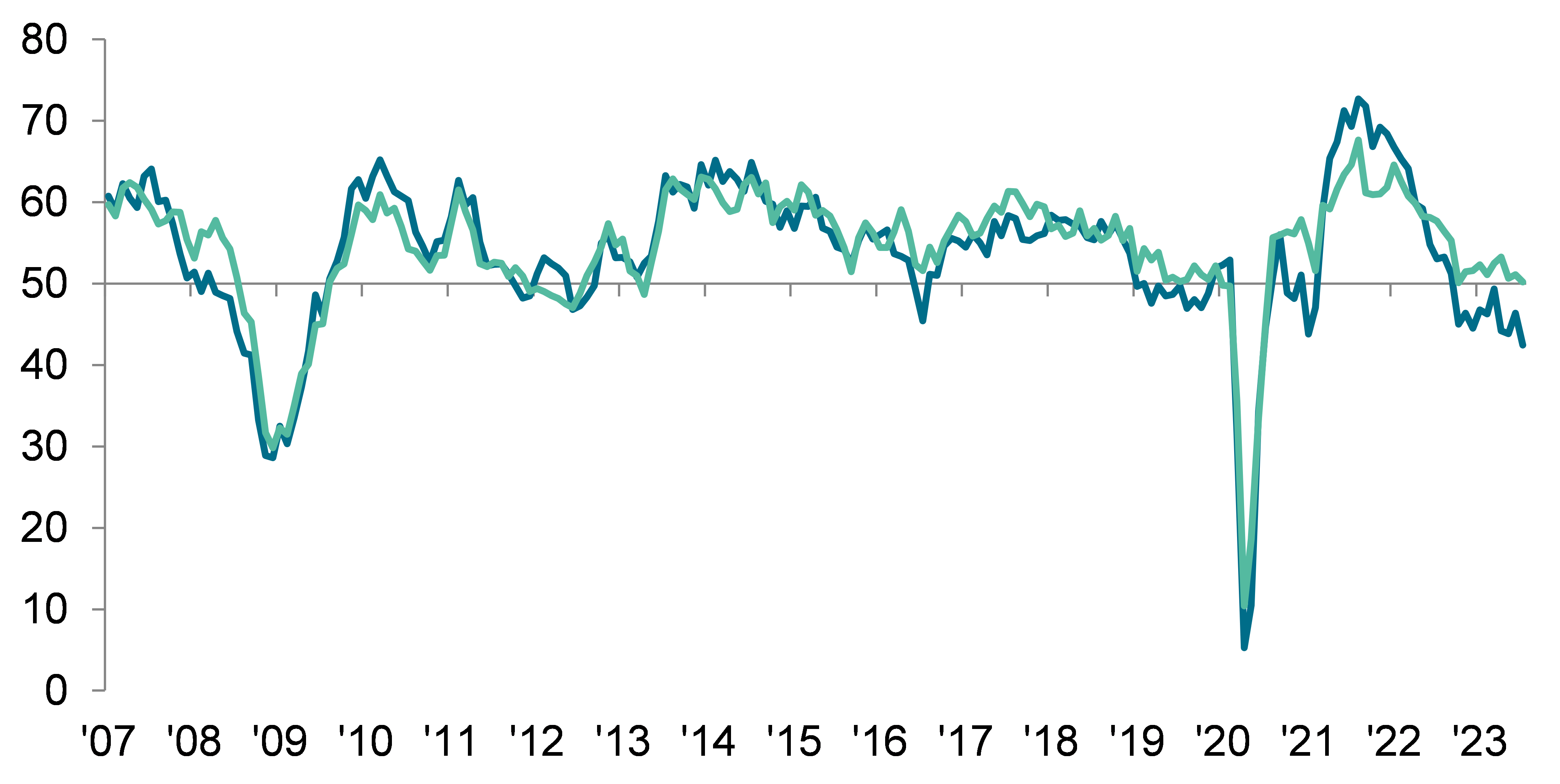

Overall vacancies expand at slowest rate in 29 months

Growth of demand for staff continued to moderate at the start of the third quarter. Notably, total vacancies increased at the slowest pace in 29 months, and one that was well below the series trend. The latest upturn in demand for permanent workers was the weakest seen over the current period of recovery that began in March 2021. Concurrently, the rate of short-term vacancy growth was among the slowest recorded over the past three years.

Regional and Sector Variations

All four monitored English regions posted a decline in permanent placements, led by London.

Divergent trends were seen for temp billings, which rose in the Midlands and London, but fell in the North and South of England.

The latest survey highlighted slightly stronger increases in demand for staff in the private sector, but rates of vacancy growth cooled in the public sector. The strongest overall upturn in demand was signalled for temporary workers in the private sector. Meanwhile, the weakest increase in vacancies was seen for short-term roles in the public sector, which rose only marginally.

Demand for permanent workers increased across the majority of monitored sectors during July. Blue Collar topped the rankings, closely followed by Hotel & Catering. However, demand for permanent staff in the IT & Computing and Secretarial/Clerical sectors weakened.

Hotel & Catering saw by far the steepest upturn in demand for temp workers of all ten categories in July. Strong rates of vacancy growth were also noted for Engineering and Blue Collar personnel. The Construction and Secretarial/Clerical sectors saw modest drops in demand.

Comments

Commenting on the latest survey results, Claire Warnes, Partner, Skills and Productivity at KPMG UK, said:

“The latest survey results reflect the current Summer weather – damp, but with some possible bright skies on the horizon.

“Recruiters told us that their clients aren’t yet confident enough in the economic outlook to commit to permanent hires, leading to the steepest pace of decline in placements since June 2020. Conversely, the growth in billings for temporary workers weakened last month as job hunters hold out for permanent roles.

“Businesses are also still freezing hiring, with some redundancies, which led to the sharpest upturn in labour supply since December 2020. This is good news for recruiters who have an even larger pool of candidates to place, but with the number of vacancies available increasing at the slowest pace for nearly two and a half years, supply and demand are once again off balance.

“For job seekers, the ongoing competition for skilled workers and cost of living pressures are keeping starting salaries high, making it an attractive time to move roles, though they may be cautious about doing so.

“To rebalance the labour market and aid economic recovery, more focus on reversing the deepening skills gap would be a step in the right direction.”

Neil Carberry, REC Chief Executive, said:

“The jobs market overall remains fairly robust, with vacancies and pay still rising and unemployment low but there is a sense in today’s report that the economy will need some growth soon to sustain this positive picture. Permanent hiring has been slowing all year. To some extent this is normalisation as the post-pandemic boom abates – but it is also driven by uncertainty. This is seen in the scale of companies reshaping themselves while hiring in other areas – recruiters report that the quickest rise in labour supply since the pandemic has been driven by an increase in redundancies. But it is also obvious in the way firms are relying on temporary labour to keep things going in uncertain times. Temping keeps people in work when firms are uncertain about the future path of the economy – it is a huge UK success story.

“Hiring overall is still at a good level, and some sectors remain under pressure from significant labour shortages, including hospitality and construction – so there is opportunity out there for job seekers. But today’s report emphasises again that sustained positivity in our labour market rests on economic growth and investment in the UK. A proper industrial strategy that tackles the big issues we face and which fully encompasses workforce thinking around skills, transport, access to work and immigration is long overdue.”