UK fintech investment down 34% in 2023, but remains the European lead

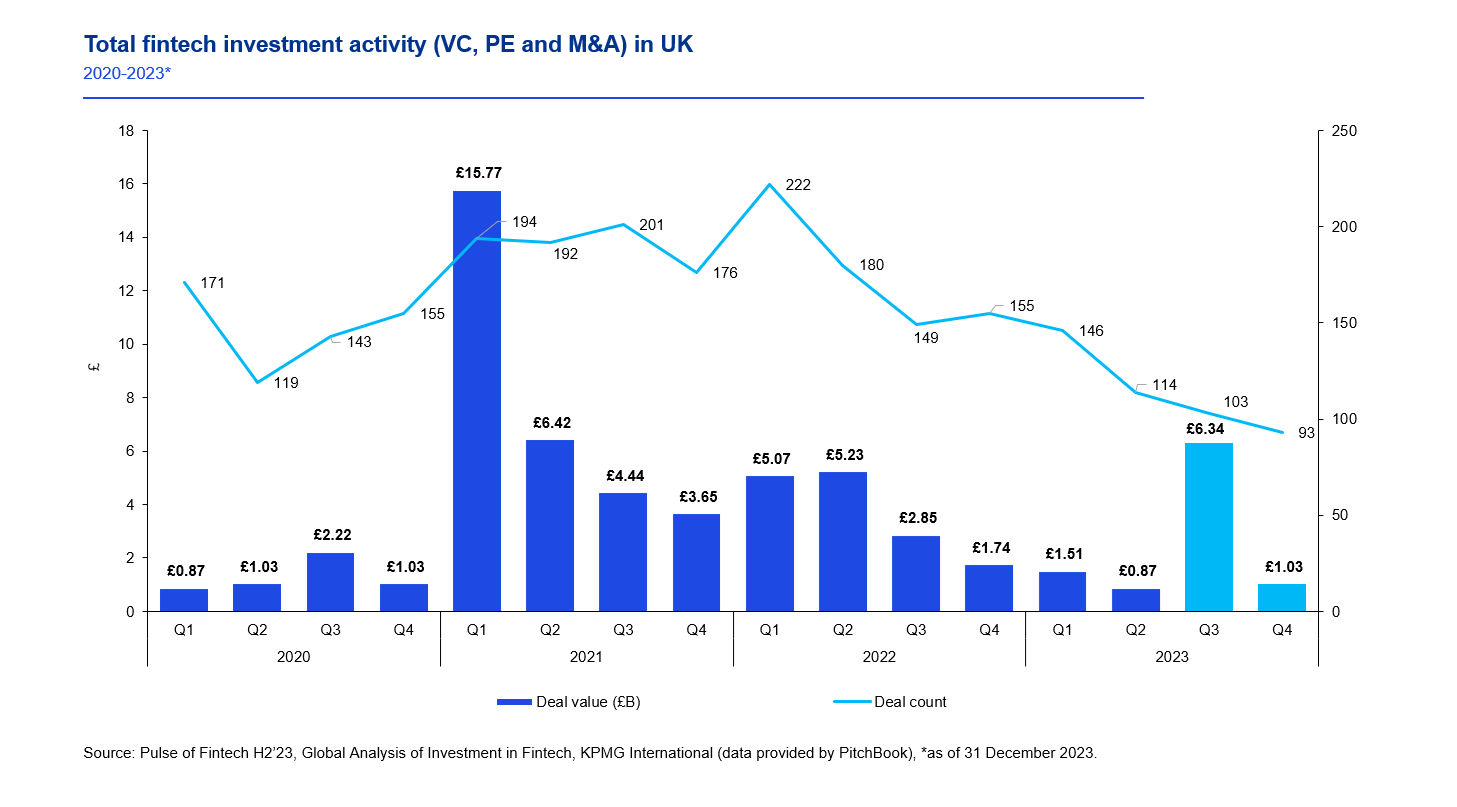

- Total UK fintech investment dropped to £9.75bn in 2023, down 34% from £14.82bn in 2022.

- 456 UK M&A, Private Equity and Venture Capital fintech deals were completed in 2023, down from 706 in 2022.

- British fintechs are still attracting more funding than those in France, Germany, China, India, Brazil and Canada combined.

- The largest fintech deal in Europe in 2023 was the £5.47bn PE raise by UK-based Finastra.

- Dealmakers remain cautious, but areas of interest such as buy now, pay later solutions remain appealing.

Geopolitical and economic uncertainty, fuelled by events including the conflicts in Ukraine and the Middle East, the high interest rate environment, and tight liquidity across regions, resulted in a significant decline in fintech investment across the world. UK fintech investment in 2023 was at the lowest level since 2020, when the impact of the Covid-19 pandemic caused investment to drop substantially to £5.15bn. If we remove 2020 as an outlier year, UK fintech investment in 2023 was at its lowest level since 2017 (£8.89bn).