Our Chair and Chief Executive

Bina Mehta, our Chair, is responsible for leading the Board, ensuring it fulfils its responsibilities to set the tone from the top, oversee strategy and hold leadership to account. The Chair is accountable to the partners in fulfilling these responsibilities.

Jon Holt, our Chief Executive and Senior Partner, is responsible for leading the whole business of the multi-disciplinary firm and is accountable for the executive leadership’s execution of the firm’s Board-approved strategy. The Chief Executive is accountable to the Board and the partners in fulfilling these responsibilities.

Hear Jon’s reflections on 2025:

Jon Holt /

Group Chief Executive & UK Senior Partner

This Transparency Report highlights the progress we’ve achieved and the actions we’re taking to ensure our firm’s governance and culture remain strong, resilient and future-ready. In a world of rapid change and growing complexity, our purpose remains unwavering: to earn trust, deliver quality and act in the public interest.” Read more

Bina Mehta, Chair, KPMG in the UK

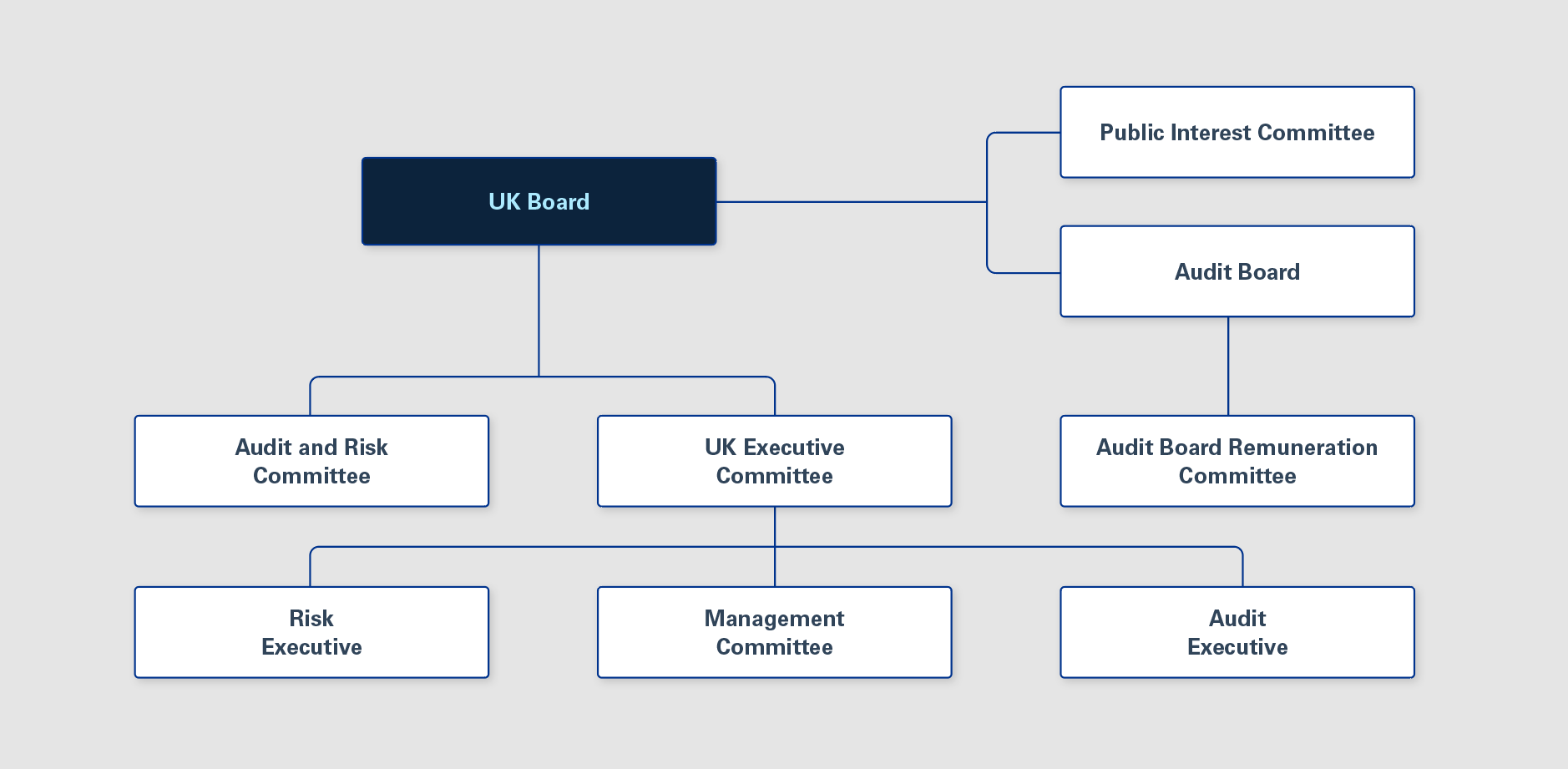

UK governance structure (as at 30 September 2025)

More information about the role, membership and activities delivered during FY25 for each of the governance forums above is provided on the pages that follow.

The UK Firm merged with Switzerland on 1 October 2024, and more information about the group governance structure can be found on the website. During the year, the Group Board engaged an external party to conduct a Board Effectiveness Review, with particular emphasis on evaluating the newly established governance framework. Among the report’s recommendations was the suggestion to maintain committees at the Group level in order to minimise duplication and enhance efficiency. Implementation of these recommendations is currently underway, and further details will be provided in the FY26 Transparency Report.

Role

The UK Board is responsible for overseeing the stewardship, accountability, and leadership of the UK Firm and is chaired by Bina Mehta. It ensures that the UK Firm's strategy aligns with the Group strategy and is consistent with the public interest, oversees its implementation and holds senior leadership to account. The Board also ensures that there is a satisfactory process for managing financial, cultural, ethical, quality management, risk and reputational matters affecting the firm including compliance with laws and other regulatory obligations, particularly the Audit Firm Governance Code.

Members

As at 30 September 2025, the UK Board is made up of 7 members:

- The Chair

- The Chief Executive

- An additional Executive Board member who is nominated by the Chief Executive

- Four additional Elected Board Members, who are individual members of the UK LLP, elected by the UK Partners.

The Elected Board Members (including the Chair) are drawn from the partnership with a sufficient mix of competency, experience and independence of the day-to-day running of the firm. The Elected Members serve three-year terms, extendable up to a maximum of five years, to maintain relevant skills and breadth of experience.

The Board is attended by the Chair of the Public Interest Committee, the Chair of the Audit Board and by other Independent Non-Executives (INEs).

% Female Board members

29%

Sep 25

% Ethnic minority Board members

29%

Sep 25

% Lower socio-economic background Board members

43%

Sep 25

Role

The Audit and Risk Committee assists the Board in its oversight of current risk exposures and determination of risk appetite and strategy.

The Committee also oversees the effectiveness of the firm’s Enterprise-Wide Risk Management (ERM) Framework, the prevailing risk culture in the organisation, the firm’s capability to identify and manage new risk types, and the adequacy of risk and assurance resources for first, second and third lines of defence.

As a result of the Board Effectiveness Review, the responsibilities of the UK Audit and Risk Committee will be split between the UK Board and Group Audit and Risk Committee. Implementation of these recommendations is currently underway, and further details will be provided in the FY26 Transparency Report.

Members

The Audit and Risk Committee comprises three members. In addition to the Chair, the membership comprises two other Elected Members of the Board.

Additional members can be co-opted on to the Committee as the need arises, to help fulfil the duties and obligations of the Committee. These appointments are made by the Board on the recommendation of the Chair of the Committee.

Unless otherwise determined by the Board, the duration of appointments of members of the Committee and of co-opted members shall be for a period of up to three years, which may be extended by the Board for an additional period of two years.

Role

The purpose of the Executive Committee is to manage the day-to-day activities of KPMG LLP’s business through:

- Developing and implementing strategy, operational plans, policies, procedures and budgets

- Driving and monitoring operating and financial performance

- Assessing and controlling risk

- Prioritising and allocating resources.

The committees of the Executive comprise: Management Committee, Risk Executive and Audit Executive. Together, the Executive Committee and its sub-groups manage the day-to-day activities of the firm.

Members

The Chair of the Executive Committee is the Chief Executive. The Executive Committee comprises those senior executives as the Chief Executive may determine as ratified by the Group Nominations Committee. Unless otherwise determined by the Group Nominations Committee, the duration of appointments will be for a continuous term at the discretion of the Chief Executive.

Executive Committee Members’ roles, duties, responsibilities, goals, delegations and key accountabilities are set by the Chief Executive with consideration of the firm’s strategic goals, performance (including financial, operations and technology), people, culture ambition and risk. Reporting on performance against these objectives is provided to the Executive Committee on approximately a monthly basis.

Role

In accordance with the Audit Firm Governance Code (AFGC), the firm has a Public Interest Committee (PIC). This PIC comprises entirely of Independent Non-Executives (INEs).

The key responsibilities of the PIC are to provide comment, challenge and recommendations relevant to the public interest in the context of KPMG’s UK business. Specifically, they provide independent oversight of the firm’s policies and processes for the core objectives defined within the AFGC:

- Promoting Audit Quality (in liaison with the Audit Board)

- Securing the firm’s reputation more broadly (including its non-audit business)

- Reducing the risk of firm failure

- Fulfilling the multi-disciplinary firm’s public interest responsibilities.

Within the governance of KPMG in the UK, it is important for the INEs to remain in a position of independence from the leadership decision making of the firm and outside its chain of command. As such, although they may vote on recommendations as a PIC, they do not carry votes on the Board or its other Committees. Notwithstanding this, the INEs have access and a full opportunity to question and challenge KPMG in the UK at both the Board and Board Committee level. They are also able to comment on the activities of KPMG in the UK to external stakeholders, including our regulators, in an objective and dispassionate way in furtherance of their public interest role.

Members

Pursuant to the AFGC and under its terms of reference, the Public Interest Committee comprises at least three INEs. As at 30 September 2025, the PIC comprised six INEs. The Chair of the PIC is an INE appointed by the Chair (in consultation with the Group Board Chair) and approved by the UK Board. The INEs of the PIC are appointed for a term of up to three years, with the option for this to be renewed by the Board for an additional two terms of three years each, subject to a maximum of nine years in aggregate.

The Chair of the PIC remains unchanged as at 30 September 2025.

Role

The Audit Board oversees the Audit practice, in terms of its operations, processes and controls. Its role involves overseeing the stewardship, accountability and leadership of the Audit practice providing clear sighted counsel on the implementation of the strategic direction of the Audit practice and alignment to its Vision, Values and Purpose. This includes overseeing the strategy and internal investment needs of the Audit practice in furtherance of audit quality, inputting to the firm’s response to audit-related regulation and monitoring the discharge of KPMG’s public interest obligations to investors and other key stakeholders, such as regulators and audited entities.

The Audit Board also makes recommendations to the UK Board on the adequacy of the firm’s approach for meeting the principal objectives in the Audit Firm Governance Code as they relate to the Audit practice. It reviews the firm’s responsiveness to challenges in the audit profession specifically in relation to audit quality, actual or perceived conflicts of interest, independence, the attractiveness of the Audit profession, and regulatory objectives including the Principles for Operational Separation.

The Chair of the Audit Board also attends meetings of the UK Board.

Members

The Audit Board comprises six members as at 30 September 2025, four of whom are Independent Audit Non-Executives (“ANEs”), including the Chair. Two of the ANEs are also an INE. The remaining two members are Partners and Elected members of the Board.

One ANE who is also an INE came to the end of their tenure on 30 September 2025. As at 1 October 2025, there were therefore three ANEs, including the Chair.

The Chair of the Audit Board remains unchanged as at 30 September 2025.

Role

The Remuneration Committee ("RemCo") is chaired by an ANE and all members of the RemCo are ANEs. The Committee’s role is to oversee the policy and processes for Audit partner remuneration, as well as to oversee the criteria and selection processes for both Audit partner promotion and the designation of Responsible Individual (RI) status.

Members

Role

The Risk Executive provides the Executive Committee with appropriate oversight, governance and outcomes in relation to (i) risk management and (ii) reputation issues (including, but not limited to, legal, regulatory and conduct issues). The Risk Executive also supports the Management Committee to manage operational, financial and people risk by providing oversight of the key risks in those areas.

The Risk Executive makes decisions, oversees implementation and provides guidance and assurance to the Executive Committee and the Board that the firm is acting within its agreed risk appetite and is achieving its strategic outcomes in relation to the following matters:

- Meeting or exceeding all relevant legal, regulatory, ethics and independence and compliance requirements

- Improving relationships and building trust with regulators, clients and other stakeholders

- Effectively monitoring and addressing threats and challenges to the Firm’s brand and reputation.

Members

Role

The Management Committee supports the Executive Committee in its implementation of the strategy and policies of KPMG in the UK and its subsidiaries to manage the day-to-day business of the UK Firm.

Members

Role

The Audit Executive manages the day-to-day activities of the Audit practice of the firm through developing and implementing strategy, operational plans, policies, procedures and budgets; driving and monitoring operating and financial performance; promoting and role-modelling a strong culture that supports audit quality; assessing and controlling risk; and prioritising and allocating resources.

The Audit Executive makes decisions, oversees implementation and reports to the Board (through the Executive Committee) and to the Audit Board, providing assurance that the firm is acting within its agreed risk appetite and is achieving its strategic outcomes in relation to Audit.

Members

Role

The Group Nominations Committee comprises of the Group Chair, the Senior Elected Member of the Group Board and one other Elected Group Board Member. Appointments to the Group Nominations Committee are made by the Group Board and members terms coincide with their terms as Group Board Members (i.e. three years with an option to extend for an additional two years).

The role of the Group Nominations Committee is to oversee the appointment process for all Board appointments within the Group as well as Executive Leadership appointments. The Group Nominations Committee also assists the Group Board in the appointment of the Board Chair, the CEO and Executive Committee members.

During the year, the Group Nominations Committee oversaw the appointment process of two new UK Board members. The Group Nominations Committee also reviewed and ratified the composition of the Executive Committees in the Group. To ensure compliance with the requirements of the Audit Firm Governance Code the Committee is attended by the Chair of the UK Board where the matter concerns a UK appointment and the Chair of the Public Interest Committee is a standing invitee to all meetings.

Members