Delivering sustainable quality

We define “audit quality” as the outcome when audits are executed consistently, in line with the requirements and intent of applicable professional standards within a strong system of quality management.

All of our related activities are undertaken in an environment of the utmost level of objectivity, independence, ethics and integrity.

To that end, KPMG has a Global Quality Framework (GQF) which guides how we work and how we approach the audit. It helps ensure a consistent approach with quality at its heart. In this section, we show how the GQF is helping us do this with reference to each individual component of the framework. For three of the components – Live our culture and values; Be independent and ethical; and Nurture diverse skilled teams – we have redirected to other parts of the report.

In the UK, we support our Global Quality Framework with our Single Quality Plan; a dynamic and responsive plan that monitors our response to quality-related issues which is reviewed and refreshed throughout the year. This helps us focus on the key areas we have identified that will enable us to continue to deliver sustainable quality.

Alongside this, we recognise that harnessing new technology, including AI and machine learning, is key to the future of audit, especially as audited entities integrate these technologies into their businesses. We have therefore continued to invest significantly, in the UK and globally, in building new technologies into how we work (embedded into our smart audit platform, KPMG Clara) and strengthening our alliances with major technology providers such as Microsoft.

Our focus on delivering sustainable audit quality is at the heart of our strategy, supported by our other strategic priorities: empowering our people, supporting seamless delivery, and maintaining robust growth. Our risk management principles (see Quality control and risk management section) ensure we appropriately manage risk across the firm and help to support audit quality.

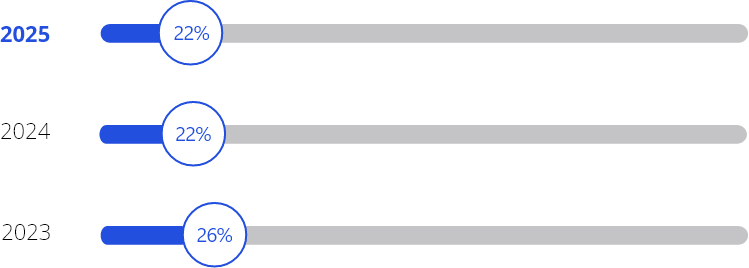

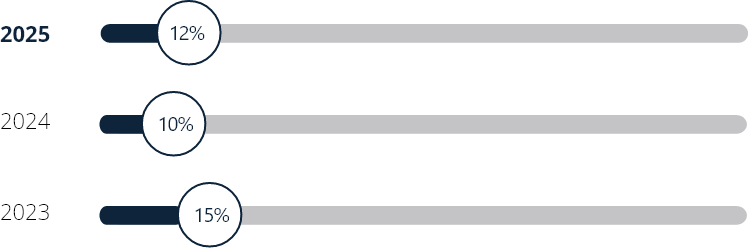

We are realising the benefits of our strategy in our audit quality journey and our average results across FRC, ICAEW and our own internal inspections over the last three years show an upward trend.

Perform quality engagements

External monitoring by our regulators

Audit quality is our number one priority, and we value the constructive input and challenge from our audit regulators through their inspection and supervision processes. We continue to work closely with them to understand their identified areas of good practice, and importantly where we need to continue to focus to ensure that we build trust and confidence in our profession and the markets.

KPMG has a number of regulators due to the types of services we provide. This includes the Financial Reporting Council (FRC), the Institute of Chartered Accountants in England and Wales (ICAEW), the Financial Conduct Authority (FCA), the Solicitors Regulation Authority (SRA), certain overseas audit regulators that the firm is registered with, and other regulatory and oversight bodies (including HM Government). We’re committed to meeting the expectations of our regulators and ensuring our regulatory engagement is based on the principles of openness, transparency, integrity and accountability.

The regulatory environment continues to evolve. Accordingly, we continually scan the horizon and prepare the firm for incoming regulatory changes. In particular, we are engaging with the FRC on projects that support its strategic objectives for 2025-2028, including its Future of Audit Supervision Strategy, End-to-End Enforcement Review and its review of how the audit market works for Small and Medium-sized Enterprises (SMEs), including how audit standards can be proportionally applied to SMEs. We remain committed to support our regulators, shaping the future of the profession.

The results from the FRC’s Audit Quality Review (AQR) inspection, as well as the ICAEW’s Quality Assurance Department (QAD) monitoring review, together with the results of our own internal monitoring programme, and those of any other regulator including the Public Company Accounting Oversight Board (PCAOB) in the US, provide an overview of our performance of quality engagements. In addition, the FRC’s Audit Market Supervision (AMS) team assesses the firm’s ongoing design and operation of our Systems of Quality Management (SoQM). The FRC’s Audit Firm Supervision (AFS) team is responsible for the overall supervision of Public Interest Entity (PIE) audit firms, drawing together the results of work undertaken by the AMS and AQR as well as other areas of the FRC.

FRC - Audit Quality Inspection and Supervision Report findings

90% of FRC inspections required no more than limited improvements

2024/25

(2023/24: 89%)

(2022/23:

74%)

91% of FTSE 350 inspections required no more than limited improvements

2024/25

(2023/24: 88%)

(2022/23: 78%)

No audits inspected required significant improvements

2024/25

(2023/24: None)

(2022/23: One)

KPMG LLP Audit Quality Inspection and Supervision (frc.org.uk)

The FRC's Audit Quality Inspection and Supervision report listed areas of good practice and aspects where improvement was required.

In individual audits, good practice included a large range of examples relating to risk assessment and planning, execution, and completion and reporting. Areas for improvement included instances relating to estimates in the valuation of investments and provisions and the audit of consolidation and other journals.

The 2024/25 inspection was the first inspection cycle where the FRC solely inspected firms under ISQM1. The FRC concluded that “KPMG has an established SoQM structure, with a robust process to identify and assess risks and the responses to these risks. The firm has strengthened its monitoring and its annual evaluation process. However, the firm still needs to improve how it monitors the operation of some responses and elements of its annual evaluation, particularly its assessment of the reliance that can be placed on remediating and mitigating actions taken.” Section 3 of the report included a section for our firm-wide SoQM, with examples of good practice and areas for improvement.

Section 4 of the report focused on the FRC’s forward-looking supervisory approach – identifying and prioritising what firms must do to enhance audit quality and resilience.

Our FRC Supervisor included good practices in respect of our Ethics Programme, noting that our:

Assessment of individual partner conduct comprises a comprehensive set of metrics, integrated into a new partner balanced scorecard and the importance of ethical conduct is reinforced at all levels of the firm.

FRC's Audit Quality Inspection and Supervision Report for KPMG LLP (2025)

Technology was also noted as a good practice:

The firm has developed a clear strategy to effectively integrate new technology solutions. The firm has been proactive in engaging with us on this and we welcome the in-depth and early engagement.

FRC's Audit Quality Inspection and Supervision Report for KPMG LLP (2025)

We have made significant investment in innovative audit techniques using AI, and a number of the audits inspected in this cycle used these methods to provide substantive evidence. We recognise that emerging technologies like generative AI are significantly influencing audit techniques, supporting the productivity of our people and driving high audit quality.

We are continuing to invest in and embrace these new technologies, upskilling our people to best utilise these capabilities.

The firm is also subject to audit quality monitoring by both the FRC and the ICAEW in relation to Local Public Audit work and NHS Foundation Trust audits. This inspection work is conducted under separate legal and regulatory requirements. The FRC publishes an annual report of the findings relating to Local Public Audit monitoring. The results of monitoring work over NHS Foundation Trusts is reported to NHS England – there is no public reporting of the results of the monitoring reviews.

ICAEW – results of monitoring review by the QAD

10 file reviews were performed by the QAD of the ICAEW

2024

(2023: 10)

(2022:

11)

100% of the files reviewed were assessed as either “Good” or “Generally acceptable”

2024

(2023: 70%)

(2022:

91%)

None of the files reviewed required significant improvement

2024

(2023: One)

(2022:

None)

KPMG LLP Audit Quality Inspection and Supervision (frc.org.uk)

The ICAEW identified good practice across almost all the files reviewed which included:

- Good internal risk assessment challenge by audit teams.

- Clear review for contradictory evidence and challenge of management where accounting estimation uncertainty was identified.

- Good use and application of testing of the operating effectiveness of key controls and of substantive analytical review procedures.

A thematic finding related to understanding the entity and clearly documenting our risk assessment was specifically highlighted across some files that the ICAEW concluded were all generally acceptable.

For a summary of the ICAEW QAD’s monitoring review findings, refer to page 11 of the KPMG LLP Audit Quality Inspection and Supervision report.

PCAOB

KPMG in the UK is subject to inspection every three years by the US PCAOB. In accordance with this cycle, the PCAOB inspected the firm in summer 2025 and we await the draft inspection report.

The firm received the final inspection report from the 2022 inspection in late 2024 with no engagement inspection observations, and responded to the report by the deadline of March 2025.

Regulatory investigations and sanctions1

Ongoing FRC matters

At the end of the financial year, there were no ongoing FRC investigations into matters announced in previous years.

New FRC matters or developments on ongoing matters during the year

In January 2025, the FRC announced an investigation into the audit of Entain plc for the year ended 31 December 2022.

FRC matters closed during the year

One matter, which related to an audit in 2021, was closed during the year. In June 2025, the FRC announced sanctions against KPMG LLP and a partner of KPMG LLP relating to the audit of the financial statements of Carr’s Group plc for the financial year ended 28 August 2021. KPMG LLP was fined £1.25m (discounted to £690,625 for admissions, early disposal and exceptional cooperation) and severely reprimanded. The partner was fined £70,000 (discounted to £38,675) and severely reprimanded. In addition, a non-financial sanction was imposed requiring KPMG LLP to review a representative sample of statutory audits involving component auditors outside KPMG’s network and report to its FRC Supervisor on whether compliance with the independence requirements in the Ethical Standard had been achieved.Subsequent to our year end of 30 September 2025, on 7 October 2025, the FRC announced sanctions against KPMG LLP and a partner of KPMG LLP relating to the audit of the financial statements of N Brown Group plc for the financial year ended 26 February 2022. KPMG LLP was fined £1.25m (discounted to £710,937 for admissions, early disposal and exceptional cooperation) and severely reprimanded. The partner was fined £90,000 (discounted to £51,187) and severely reprimanded. The FRC did not impose a non-financial sanction.

ICAEW matters

One ICAEW investigation outcome was announced during the year. This related to audits of financial statements of entities and compliance with International Standards of Auditing (UK and Ireland) by KPMG LLP.

Other regulatory matters

In March 2025, the PCAOB announced sanctions against several KPMG network firms including KPMG LLP in relation to failures to accurately disclose the participation of other accounting firms in a number of audits on PCAOB forms and in audit committee reporting of such participation in respect of some audits. The errors made by KPMG LLP were primarily as a result of the incorrect treatment of personnel borrowed from and by other KPMG firms participating in the audits in question. KPMG LLP was censured, fined a civil penalty of $600,000 and ordered to review and improve as necessary its quality control policies and procedures in respect of the reporting of the participation of other firms in its PCAOB audits.

1 Where the FRC or other regulatory body has exercised discretion not to publicise a particular inquiry or investigation, the details of such matters are not disclosed in this report.

Internal monitoring

KPMG firms have agreed to use quality monitoring and compliance programmes developed by KPMG International. These are used by KPMG firms to identify quality issues, perform root cause analysis and develop remedial action plans, both for individual audits and for their overall SoQM. The programmes evaluate:

- Engagement performance in compliance with the applicable professional standards, applicable laws and regulations, and key KPMG International policies and procedures.

- Our firm’s compliance with KPMG International policies and procedures and the relevance, adequacy and effective operation of key quality control policies and procedures.

The internal monitoring and compliance programmes also contribute to the evaluation of our SoQM operating effectiveness. These programmes include:

- Audit Quality Performance Review (QPR);

- KPMG Quality and Compliance Evaluation (KQCE) – formerly known as the Risk Compliance Programme (RCP); and

- Global Quality and Compliance Review (GQCR).

The results of the integrated monitoring and compliance programmes are communicated at local, regional and global levels (as relevant) and we establish action plans to make improvements where needed. Results are also considered by KPMG International.

Audit Quality Performance Review (QPR) programme

The Audit QPR programme is the cornerstone of our efforts to monitor engagement quality. It assesses engagement level performance and identifies opportunities to improve engagement quality.

Risk-based approach

All engagement leaders of statutory and non-statutory audits and other assurance engagements are generally subject to selection for review at least once in a three-year cycle. A risk-based approach is used to select engagements.

The Audit QPR programme is designed by the Global Quality & Risk Management team. We conduct the annual QPR programme in accordance with KPMG International QPR instructions, which promote consistency across the KPMG organisation. Responsibility for the QPR programme lies with our firm’s Risk Management Partner. Reviews are overseen by an independent experienced lead reviewer from another KPMG firm. QPR results are reported to KPMG International.

Evaluations from Audit QPR programme

Across the global organisation, consistent criteria are used to determine engagement ratings and KPMG firm Audit practice evaluations. Definitions of engagement ratings are explained below:

Compliant

When the audit work performed, the evidence obtained and the documentation compiled comply with internal policies, auditing standards and legal and regulatory requirements in all significant respects with no or only minor instance(s) of non-compliance; and key judgements concerning significant matters in the audit and audit opinion are appropriate.

Compliant - improvement needed (‘CIN’)

When the auditor’s report is supported by evidence and is not incorrect in any material respects, but the independent reviewer required additional information to reach the same conclusion as the auditor; or where supplementary information obtained as part of the audit was not sufficiently documented in the audit; or where specific requirements of our audit methodology were not embedded; or where improvements to audit procedures were identified as needed in one or more areas and such improvements were judged to be more than minor but not significant. A ‘CIN’-rated engagement is not considered an adverse quality outcome.

Not Compliant

When the auditor did not perform the engagement in line with KPMG’s professional standards and policies in a significant area, or where there are deficiencies in the related financial statements. Where appropriate, in such cases we remediate engagement files to ensure the audit evidence obtained is adequately documented and engagement teams undertake specific incremental or remedial training. In addition, engagement leaders receiving a Not Compliant rating are subject to at least one follow-up review.

Reporting

Prior to the finalisation of the review, there is a rigorous moderation process to ensure consistency of grading. A remedial action plan is created for quality audit and assurance areas in which deficiencies were identified which are considered to be significant, applicable at an engagement and a firm level. We share our findings from the Audit QPR programme through internal training tools and in periodic partner, manager and team meetings. Any issues are also emphasised in subsequent monitoring and compliance programmes to gauge the extent of continuous improvement and the effectiveness of the implementation of remedial actions. Lead engagement partners are notified when an assurance engagement on a cross-border subsidiary or affiliate of their audited entity receives a Not Compliant rating.

Our Audit QPR programme is designed to hold audit teams to quality levels that assess not only compliance with auditing standards but also adherence to internal requirements such as the performance of specified procedures or completion of specific mandated consultations. As such, teams that perform audits that are substantially compliant with auditing standards may receive a rating other than Compliant in our internal reviews. Accordingly, it is difficult to make direct comparisons between the results of our internal and external inspection processes.

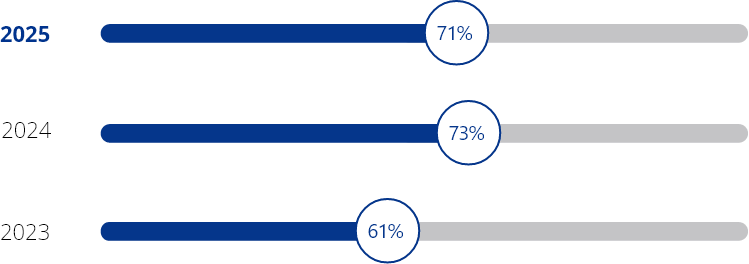

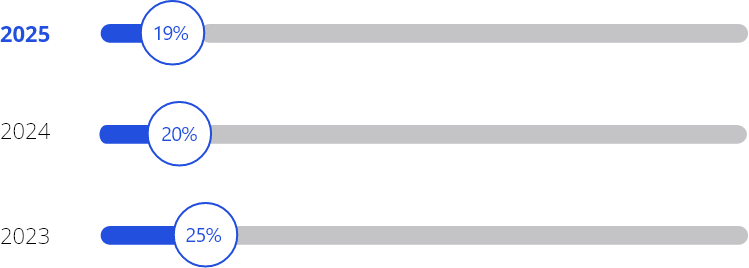

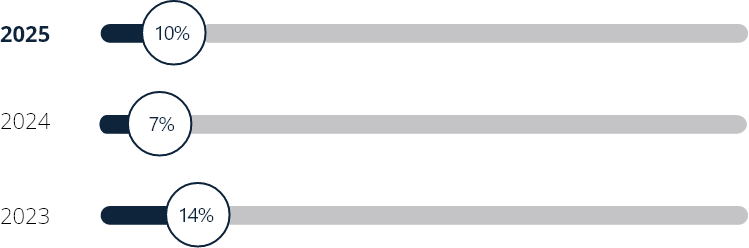

Audit and Assurance engagements

Rating / Compliant

Rating / Compliant - improvement needed

Rating / Not Compliant

Number of Audit and Assurance engagements reviewed

Percentage of engagement leaders reviewed for Audit and Assurance engagements: 35% (FY24: 36%)

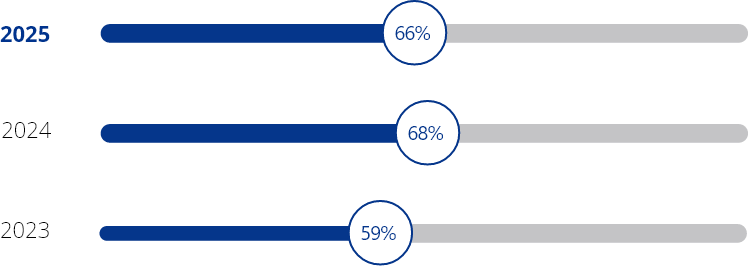

Audit engagements

Rating / Compliant

Rating / Compliant - improvement needed

Rating / Not Compliant

Number of Audit engagements reviewed

Percentage of engagement leaders reviewed for Audit engagements: 33% (FY24: 30%)

KPMG Quality and Compliance Evaluation (KQCE) programme

The KQCE programme encompasses the testing and evaluation requirements of a KPMG firm’s SoQM which are necessary to support both their compliance with ISQM1 and with the firm’s quality and risk management policies. KQCE programme requirements are mandated for all KPMG firms. The 2025 KQCE programme covers the period from 1 October 2024 to 30 September 2025.

Monitoring, remediation and evaluation of the SoQM

Monitoring activities include:

- Testing of UK member firm SoQM controls performed in the UK and overseas, and at a Network level (including general IT controls).

- Review of ‘other sources’ e.g. QPR and GQCR findings, root cause analysis, regulatory developments etc. Please see ISQM1 section in Quality Control & Risk Management, for more information.

The evaluation of the SoQM involves the identification and assessment of findings from our monitoring activities, including any deficiencies. Judgement is required to assess whether findings result in a deficiency, and the severity and pervasiveness of any deficiencies, individually and in aggregate. Those judgements include considering both the significance of findings to the achievement of quality objectives and the extent to which actions taken up to the evaluation date mitigate the effects on the SoQM. Such judgements are made by the monitoring team, overseen by the Chief Risk Officer, and the final evaluation is scrutinised and independently challenged by the Audit and Risk Committee. Our evaluation of the effectiveness of our SoQM is set out here.

Compliance testing

During the year, member firms were required to self-assess their overall levels of compliance with quality and risk management policies not in scope of the SoQM as either compliant, substantially compliant or non-compliant.

For the year ended 30 September 2025, our approach to quality and risk management policies was rated substantially compliant (defined as where significant compliance findings are not pervasive in nature and action plans to address their identified causes have either already been implemented or substantially implemented or are planned to be implemented within a timeline which will allow for compliance testing in the succeeding period).

Action plans to address the identified root causes of SoQM deficiencies and compliance findings have been developed and are in the process of being delivered. The status of remediation is monitored by the Risk and Audit Executives and the Management Committee, and is overseen by the Audit and Risk Committee.

Global Quality and Compliance Review (GQCR) programme

The GQCR programme is a KPMG International monitoring programme. Its objective is to assess a firm’s compliance with selected KPMG International policies, including those related to governance and SoQM.

Firms are selected for review using a risk-based approach which considers a number of factors, including financial conditions, country risks, results of monitoring programmes and people surveys, with each firm subject to a GQCR at least once in a four-year cycle.

The GQCR team performing the review comprises partners and managers who are independent of the firm subject to review.

The UK firm was subject to a GQCR review during 2024 when a number of opportunities for improvement were identified, including areas which were also generally identified by the UK firm’s Quality and Compliance Evaluation and other compliance and quality control processes. Most of the improvements have been completed with significant progress against those remaining and action plans in place to complete them.

- Critically assess audit evidence, using professional judgement and scepticism.

- Direct, coach, supervise and review, including Second Line of Defence and EQCR.

- Appropriately support and document conclusions.

- Consult when appropriate.

How an audit is conducted is as important as the result. Everyone at KPMG is expected to demonstrate behaviours consistent with our values and follow policies and procedures in the performance of effective and efficient audits.

How we apply this in the UK

Critical assessment of audit evidence, exercising of professional judgement and professional scepticism

We consider all audit evidence obtained during the course of the audit, including consideration of anything that is contradictory or inconsistent. This analysis requires each of our team members to exercise professional judgement, maintain professional scepticism and demonstrate appropriate challenge to obtain sufficient and appropriate audit evidence.

Professional judgement and scepticism training is embedded in our core audit technical training programme for junior staff and ongoing training and workshops for more experienced staff.

Timely senior involvement and monitoring of milestones

The engagement leader is responsible for the overall quality of the audit engagement and therefore for its direction, supervision and performance. Involvement and leadership from the engagement leader early in the process helps set the appropriate scope and tone for the audit. To reinforce this, we mandate the completion and review of audit planning activities within specified timeframes to evidence completion of the relevant planning activities.

The engagement leader reviews key audit documentation – in particular, documentation relating to significant matters arising during the audit and conclusions reached. The engagement manager assists the engagement leader in meeting these responsibilities as well as in the day-to-day liaison with the audited entity and monitoring of engagement milestones.

Involvement of our Second Line of Defence

Our Second Line of Defence team is a group made up of senior auditors which supports our higher risk engagements with a focus on public interest and listed entities. The team performs in-flight reviews of audits to improve the quality of audit execution and documentation, including effective challenge of management in judgemental areas. These senior auditors also help, throughout the audit cycle, to identify issues before they impact audit quality. This has a dual purpose: firstly, to enable coaching of teams and, secondly, to act as another level of review and challenge to help engagement teams in the delivery of high-quality audits. In addition, it informs our ongoing horizon scanning for emerging issues that may require broader responses.

Appropriate and timely involvement of specialists

Our engagement teams have access to a network of specialists, which may include involving UK specialists or those from other KPMG member firms. Our audit methodology requires the involvement of relevant specialists in the core audit engagement team when certain criteria are met or where the audit team considers it appropriate or necessary.Appropriate involvement of the Engagement Quality Control Reviewer

Our Engagement Quality Control Reviewers (EQCRs) are independent of the engagement team and have appropriate experience and knowledge to perform an objective review and challenge of the more critical and judgemental elements of the audit. The audit report can only be released when the EQCR is satisfied that all significant questions raised have been resolved.

An EQCR is appointed for the audits, including any related review(s) of interim financial information, of all listed entities, non-listed entities with a high public profile, engagements that require an EQCR under applicable laws or regulations, and other engagements as designated by the Audit Risk Management Partner or the Chief Auditor.

Ongoing mentoring and on-the-job coaching, supervision and review

To invest in building the skills and capabilities of our professionals, we adopt a continuous learning environment. We support a coaching culture throughout KPMG as part of enabling colleagues to achieve their full potential.

Our Coaching for Quality programme, which was developed with the support of external behavioural psychologists, gives colleagues the tools they need for productive coaching conversations.

New engagement leaders are also provided with an experienced mentor to support their transition into this critical role.

Appropriately supported and documented conclusions

Audit documentation records the audit procedures performed, evidence obtained and conclusions reached on significant matters on each audit engagement. Our policies require review of documentation by more experienced engagement team members.

Standardised approaches and workpapers assist our audit teams with appropriately supported and documented conclusions.

Monitoring our progress

The results of our external and internal monitoring processes can be found in ‘Activities during the year’ tab above.

Monitor and remediate

At the centre of our Global Quality Framework is continuous improvement. Our Single Quality Plan (SQP) is at the heart of this – we use it to drive measurable improvements in critical areas. It is designed to be agile to ensure that, over the course of the year, we have a clear but dynamic approach to prioritisation.

Single Quality Plan (SQP)

Our SQP supports us in evaluating information from a range of data points including our Emerging Issues process, inspection and review findings, Second Line of Defence themes, root cause analysis reporting, the Annual Risk Review, and executive meetings such as the Quality Council and Audit Executive.

We regularly assess what topics have escalated in priority or have been resolved and we track these movements on our dynamic heat map. The heat map helps us identify and keep focus on both our priority and foundational programmes. The status of these programmes can change throughout the year as we evaluate the effectiveness of actions taken using a range of specific and focused KPIs to measure success.

Priority programmes

Our priority programmes at the start of the year were:

- Root cause analysis (improving the quality and timeliness of our root cause and remediation processes).

- Engagement analytics (using data obtained through KCw to monitor the progress of our audits with the aim of accelerating work).

- Impairment (improving the consistency of audit work execution for impairment of non-financial assets).

- Close the loop (a programme focused on minimising the instances of an audit file not fully reflecting the intentions of a technical consultation or hot review comments).

- Laws and Regulations (reducing execution risk and supporting our teams in evaluating how breaches of laws & regulations should be addressed in the audit).

- Risk assessment (driving consistency in risk assessment and ensuring that our audit files clearly evidence and articulate good rationale to underpin decisions made).

- Simplification (challenging our audit processes to continue driving consistency and ensuring a positive experience in delivery for our auditors).

During the year, the Impairment, Close the Loop and Laws and Regulations programmes were transitioned to business-as-usual activities. While these areas are now embedded within standard processes, they continue to be monitored closely to identify any instances of issue recurrence. Within the Root Cause Analysis programme, our SQP focus has shifted towards remediation, with efforts concentrated on enhancing the effectiveness of remedial actions.

Foundational programmes

Our foundational programmes, which we expect to be an enduring focus as they support our ability to deliver sustainable audit quality, are:

- Culture programme initiatives (focused on embedding our culture of High Challenge, High Support consistently across the business).

- Training programme (focusing on delivering effective training that provides our people with the skills they need for both today’s and future audits).

- Technology adoption (targeted at ensuring high-quality and consistent adoption and application of both existing and new technology products).

Measuring our progress

Each month we assess our progress through a combination of progress and effectiveness KPIs which are a blend of qualitative and quantitative measures, linked to the objectives of each programme. As these measures can fluctuate during the year, we look for trends and evidence that the measures we are taking are effective. This continues to be key in ensuring we have an effective response to audit quality related issues.

Remediation – improving our root cause process

Over the past few years, we have invested in our root cause team to ensure that we learn from the findings of both internal and external reviews, have robust processes to embed best practices, and have appropriate actions plans developed to address learnings. In the current year, in order to effectively leverage from the root cause teams’ deep understanding of the underlying factors driving quality outcomes, the responsibility for remediation actions has been moved to the root cause team with a separate remediation monitoring team providing independent assessments of the effectiveness of the designed and implemented actions. Both teams have been set up to be operationally separate from audit teams and report through the Chief Auditor to the Head of Audit Quality.

The root cause team performs reviews on the findings from AQR, QAD and internal monitoring inspections. Ad hoc reviews can also be undertaken to consider audit-wide matters identified through a variety of other sources such as the firm’s Audit risk team, Office of General Counsel and the emerging issue process. The root cause team uses a variety of data points to inform interview questions and seeks to get to the bottom of why the issues occurred. We now have a stable RCA taxonomy with different levels of aggregation and disaggregation created to enable clear identification of root causes and enhance the design of targeted remedial actions. Categories have been created so that Quality Monitoring, Team Composition, Critical Mindset, Project Management and External Factors are separately identified.

The severity of root causes is assessed with the classifications being primary, secondary or contributory. Primary and secondary are subject to aggregation and reporting.

The outputs from the root cause activities are then utilised to develop appropriate responses in terms of remediation actions. The monitoring team assesses the effectiveness of these actions, proposing adjustments where they are not having the desired impact. Regular monitoring of the impact of remedial actions is a key part of our RCA programme so that we can adapt our approach as new issues arise. We apply a mix of remedial actions focusing on both firm-wide and specific engagement team actions with an overarching goal of driving a sustainable High Challenge, High Support culture. The monitoring team analyses the forms of remediation previously undertaken and the effectiveness of those actions to provide a framework to assess the likelihood of success for future actions.

In the past year we have continued to embed the improvements in the process established since 2023 and have further explored ways to drive behaviour change, including designing actions responsive to the factors that drive individuals’ behaviour as identified by utilising the soft controls model. The introduction of scalable root cause activities has enabled a targeted, timely response to a broader range of issues. The investment made in the team since 2023 has resulted in a further acceleration in timelines to respond to audit quality related matters in terms of determining root causes and designing responsive actions, and continues to increase the extent and breadth of reviews undertaken.

Monitoring: data-driven audits

The continued development of our global audit tool (KCw) has enabled us to enhance how we monitor the status of individual audits. We have developed milestones that audit teams are challenged to meet through the audit cycle with the objective of completing as much work as possible in advance of the post-year end compressed timeframe, ensuring that teams have the requisite time to stand back and assimilate their audit findings before signing their opinions. This, together with the use of data mining tools to increase real-time visibility of progress and identify the need for direct intervention to provide additional support to teams, helps ensure that the right work is being undertaken by the right people at the right time.

We are pleased with the progress made in re-phasing work across our portfolio to date, but there is more to do as we work with audited entities on improving the timeliness and quality of management information which is needed to achieve the milestones and avoid rework. Last year, we launched a new monitoring programme to proactively identify at-risk engagements and provide targeted support. We plan to continue developing this initiative in the coming year to optimise its effectiveness in identifying outliers across our entire portfolio.

- Rigorously monitor and measure quality.

- Obtain, evaluate and act on stakeholder feedback.

- Perform root cause analysis.

Integrated quality monitoring and compliance programmes enable KPMG firms to identify quality deficiencies, perform root cause analysis and develop, implement and report remedial action plans, both in respect of individual audit engagements and the overall SoQM.

How we apply this in the UK

We focus on ensuring our work continues to meet the needs of participants in the capital markets. To achieve this goal, we employ a broad range of mechanisms to monitor our performance, respond to feedback and understand our opportunities for continuous improvement:

- Internal monitoring which includes: Audit Quality Performance Review (QPR); KPMG Quality & Compliance Evaluation (KQCE); Global Quality & Compliance Review (GQCR); and Root Cause Analysis processes.

- Engagement Quality Control Reviewers (EQCRs) and other ‘first line’ quality control processes, including in relation to legal and contracting matters.

- External monitoring which includes the findings from Audit Quality Reviews, the Quality Assurance Department and the PCAOB.

- Regulatory investigations and sanctions.

- Audited entity feedback to better understand expectations and where we can do better. Senior leadership has visibility of all feedback to identify trends and ensure appropriate response.

- Monitoring of complaints received relating to the quality of our work. These procedures are detailed on our website and are also included in our general terms of business. All formal complaints are investigated under the authority of the Chief Risk Officer.

Live our culture and values

This is at the heart of how we drive a mindset focused on quality and continuous improvement.

The People and culture section sets out in detail how we are placing a culture of “High Challenge, High Support” at the centre of our values-based approach, to help drive audit quality and create an environment of continuous improvement.

- Foster the right culture, starting with tone at the top.

- Define accountabilities, roles and responsibilities related to quality and risk management.

- Robust governance structures.

It’s not just what we do at KPMG that matters — we also pay attention to how we do it. The KPMG values are our core beliefs, guiding and unifying our actions and behaviours. Shared across all colleagues and in every country, jurisdiction and territory in which we operate, they are the foundation of KPMG’s unique culture.

How we apply this in the UK

The People and culture section sets out in detail how we are embedding these factors to help drive audit quality and create an environment of continuous improvement.

Associate with the right audited entities

To ensure we make swift, consistent and sound decisions about which entities we work with and what work we do, we apply our well-established acceptance and continuance policies rigorously. We start evaluating all prospective audited entities right from the decision to participate in a tender. Our checks cover conflicts of interest, independence and the identity and integrity of management and owners.

All new entity evaluations and evaluations with changes in risk grades are reviewed by a second partner. Engagement continuance evaluations that are medium risk or have an increased risk rating from the previous year are also subject to review by a second partner. Additionally, all new engagement evaluations, including high-risk ones and those with a decreased risk rating compared to the prior year, will be reviewed by the Audit Chief Risk Officer or their delegates. The review process may identify additional mitigations against specific audit risks such as information security and data privacy.

We reconsider whether to continue as auditor on each recurring audit within a 45-day period after concluding the previous year audit. We take into account any perceived weaknesses within the audited entity’s governance structure, control environment, finance function, culture and behaviours. We also consider any known or suspected non-compliance with laws and regulations. If there are significant risks to audit quality, we may impose conditions on our continuance as auditor.

Conditions on continuance are issued in writing to those charged with governance, allowing the engagement leader to document the issues experienced during the audit and outline necessary steps or actions required by those charged with governance. Tools have been developed to support engagement leaders in monitoring progress against these conditions. If there is little evidence of progress, the engagement leader will escalate the case to the Head of Business Risk for further consideration, which could include a formal continuance panel. We collaborate with audited entity management to agree on conditions and monitor progress against commitments.

- Follow audited entity and engagement acceptance and continuance policies.

- Accept appropriate engagements.

- Manage portfolio of engagements.

Rigorous audited entity and engagement acceptance and continuance policies are vital to being able to provide high-quality professional services.

How we apply this in the UK

We continue to evaluate all prospective audited entities before accepting them, ensuring thorough reviews of any non-audit services provided and other relevant relationships that may impact our independence. Background checks on the prospective audited entity, its key management and beneficial owners are a key focus, especially regarding the integrity of management. These checks are reassessed regularly for existing audited entities.

Both the evaluating partner and a second partner must approve the evaluation of a prospective audited entity. For high-risk entities, the Risk Management Partner is also involved. Each prospective engagement undergoes evaluation by the engagement leader in consultation with senior colleagues and Risk Management leadership as needed. Our Risk Management function reviews the engagement leader’s evaluation of the risk grading of each new engagement, and all high-risk engagements, whether prospective or recurring, require approval from the Audit Chief Risk Officer or their delegates.

Our engagement management system includes controls to ensure the acceptance process is completed appropriately. Additional safeguards are introduced to mitigate identified risks, and any independence or conflict of interest issues are documented and resolved prior to acceptance. We will decline any audit engagement if a potential independence or conflict issue cannot be resolved satisfactorily.

Audit services undergo a review for each annual recurring engagement. Ongoing monitoring allows for the re-evaluation of audited entities earlier if there's an indication of a change in their risk profile. Recurring or long-running engagements are also periodically re-evaluated.

Nurture diverse skilled teams

We are committed to being a place where diverse talent can flourish and recognise that it is the quality of our people that will ultimately determine our success.

The People and culture section explains the measures and policies we have in place to ensure we remain focused on diversity, skills and quality.

- Recruit appropriately qualified and skilled people with diversity of specialist skills, perspective and experience.

- Assign appropriately qualified teams.

- Invest in data-centric skills — including data mining, analysis and visualisation.

- Focus learning and development on technical expertise, professional acumen and leadership skill.

- Recognise quality. Provide insights, and maintain open and honest two-way communication.

- Conduct and follow up on the Global People Survey.

Across the global organisation KPMG people make the real difference and are instrumental in shaping the future of audit at KPMG. We put quality and integrity at the core of our audit practice. KPMG auditors have diverse skills and capabilities to address complex problems.

How we apply this in the UK

We are committed to equipping our people with the skills and tools they need to deliver high-quality work for our stakeholders and for the entities that we audit.

One of the key drivers of quality is making sure we assign people with the right level of skills and experience to the right engagements. This requires a focus on recruitment, development, promotion and retention of our people and the development of robust capacity, accreditation and resource management processes.

You can read more about our UK people strategy in the People and culture section.

Apply expertise and knowledge

Quality remains at the heart of our Audit Strategy and we remain committed to continuous improvement. Our KPMG Clara workflow (KCw) platform continues to be the foundational tool for delivering our audits and supports our people in executing high-quality audits and responding consistently to identified risks.

KCw is accompanied by the KPMG Audit Execution Guide (KAEG) which sets out our methodology requirements. The methodology is based on the requirements of the International Standards on Auditing (ISAs) and all member firms are required to follow it. KAEG also includes additional requirements that go beyond the ISAs and which KPMG believes enhance the quality and value of our audits.

At KPMG in the UK, we add local requirements and guidance to comply with additional professional, legal or regulatory requirements specific to the UK, our own internal policies, and to proactively respond to economic or industry events. KCw provides our audit teams with access to such requirements and industry knowledge, with smart libraries embedded within the tool. This allows for a consistent approach, tailored by industry, and focused on key audit risks. To further support our teams, standardised workpapers and guidance assist our audit teams in consistent delivery. Our UK Audit Requirements Tool supports the scalable delivery of such standardised work papers to our people in a manner that is consistent with, and complementary to, KCw.

Consistent with our Single Quality Plan, we are also focused on simplification of the resources we provide to our colleagues to best allow them to effectively execute their work.

Our approach to audit quality also has technological evolution at its heart, as further set out in the Embracing digital technology section.

Deep technical expertise and knowledge

We are committed to ensuring that audit professionals have appropriate audit, accounting and industry knowledge, experience and training. Our accreditation process enables us to ensure the right partners and employees are assigned to engagements and are licensed where necessary.

Our formal audit training programme supports the development of technical expertise and knowledge within our audit practice. It includes mandatory audit and accounting technical training, industry-specific training and risk courses. This is supported by centrally run fortnightly technical briefings, lunch and learns on new and fundamental topics, drop-in clinics and locally run sessions using centrally developed content.

This year, our flagship training programme, KPMG Audit University (KAU), ran over three days and was attended by 3,056 (FY24: 3,058) Audit and IT Audit colleagues. The theme for our 2025 KAU was “Tailored learning; Technological excellence” and had a particular focus on data literacy for preparers and reviewers, FRS102 and Group audits. It also provided a range of topics for individuals to select from, to reflect their personal development needs and audit portfolio. These included: the Audit of AI, AI Transaction Scoring, Walkthroughs and Flowcharting, Impact and Influence, Presentation Skills and Commercial Conversations, as well as industry specific content. As well as linking multiple UK locations for the event kick-offs, we also ran some sessions directly with our offshore KPMG Global Services (KGS) colleagues. They had the same content as their onshore counterparts and also had some senior onshore colleagues join them to deliver some of the content directly.

Beyond KAU, the mandatory learning curriculum includes biannual updates focusing on performing an effective quality audit with different topic areas included as relevant. An Audit Quality and Risk Workshop is delivered for engagement leaders and focuses on key messages driven by internal and external monitoring findings. This content is also extended to audit managers and senior managers through live and recorded workshops.

In addition, partners and audit professionals must complete training relevant to their grade and role. This includes sector-specific training as well as training to support staff in their roles, such as working on US engagements, and has included a new global insurance curriculum this year. Completion of such training is built into accreditation requirements to work on specified engagements, which we manage through our eQualify system. Our curriculum extends beyond audit technical learning. For example, our ‘Building Trust’ risk training has this year focused on regulatory and compliance, client acceptance, our Code of Conduct, protecting information, and firm and personal independence. As well as the technical curriculum, auditors spend time on skills programmes to support their career and professional development.

The table below shows the actual average learning hours and the planned minimum mandatory learning hours for all grades in audit for FY25 and comparative data for FY24.

| FY25 | Partner/Director | Senior Manager/Manager | Other Qualified Staff | Non-Qualified Staff | Total |

| The average learning hours completed by all audit partners and staff as recorded in the learning management system during the financial year, including mandatory and elective training1 | 84 | 92 | 96 | 120 | 105 |

| Planned minimum mandatory learning hours | 49 | 57 | 61 | 77 | 67 |

| FY24 | Partner/Director | Senior Manager/Manager | Other Qualified Staff | Non-Qualified Staff | Total |

| The average learning hours completed by all audit partners and staff as recorded in the learning management system during the financial year, including mandatory and elective training1 | 90 | 84 | 90 | 77 | 83 |

| Planned minimum mandatory learning hours | 49 | 50 | 45 | 65 | 55 |

1 Average learning hours include all learning completed and recorded in our learning management system by all audit grades. This includes mandatory audit, accounting and compliance training and any other learning required for specific engagement accreditation, such as auditing and reporting under US standards. It also includes other business and skills related learning.

There is a slight reduction in average learning hours for Partners and Directors as the initial push for technical ESG learning was not required in 2025 due to the EU Omnibus decision. For Senior Managers and Managers, the increase has been a result of a new programme targeting first-year managers covering technical and non-technical content. For other qualified staff, the increase has been as a result of a full year of a new Experienced in-charge auditor programme running. The non-qualified staff have seen a large increase due to a timing difference of the Audit Foundations training for our graduate new joiners. They completed no Audit Foundations training in their first year with the firm last year, as they worked solely on their professional qualifications and then completed all elements of the Audit Foundations in their second year. This has distorted the figure for this year.

Technical support for our engagement teams

Internal consultation, both formal and informal, is a fundamental contributor to quality; it is always encouraged and is mandated in certain circumstances. We provide appropriate consultation support to audit engagement professionals through professional practice resources – this includes our Chief Auditor, Chief Accountant, DPP Accounting & Reporting, DPP Audit, and Audit Risk Management. Mandatory consultation requirements include matters such as where we identify non-compliance with laws and regulations, where a team proposes to deviate from our standard methodology, or where certain risks such as issues with going concern are identified. Consulting on issues is a fundamental part of our High Challenge, High Support culture.

The Second Line of Defence team provides coaching and technical support through their hot review programme which provides feedback on both the audit approach and the clarity of audit documentation. Our US Accounting and Reporting group (USARG) based in London provides coaching and technical support for our US engagement teams, while further technical support is also available through our International Standards Group, as well as the US Capital Markets Group based in New York for work on SEC registrants.

We also have Audit Risk Panels, led by an audit quality or audit risk management partner and supported by an experienced field partner. These enable direct challenge of the approach to the key audit issues on our highest risk audits and support the team in reaching robust conclusions on approach and timing.

Technical support is available in the business in the form of a Quality Network and sampling professionals to provide local support to audit teams for certain areas related to sampling. There is the opportunity for audit professionals in the business to be facilitators on technical courses (e.g. KAU) and they take that technical knowledge back into the business. Emphasis is also placed on the importance of coaching, both within teams and centrally, building strong teams that support each other.

Additionally, there are delivery centres and centres of excellence involved in our delivery of some specific areas of the audit, such as (but not limited to) cyber, data analysis and the audit of pensions.

- Methodology aligned with professional standards, laws and regulations.

- Standardised methodology and guidance.

- Deep technical expertise and knowledge.

- Quality and risk management policies.

Across the global organisation, KPMG is committed to continuing to build on our professionals’ technical expertise and knowledge recognising its fundamental role in delivering quality audits.

How we apply this in the UK

Consistent audit and assurance methodology and tools

- The KPMG Clara workflow (KCw) makes it easier for our people to execute high-quality audits and respond consistently to identified risks.

- The KPMG Audit Execution Guide (KAEG) sets out our methodology requirements, based on the requirements of the International Standards on Auditing (ISAs), and additional requirements that go beyond the ISAs and which KPMG believes enhance the quality and value of our audits. At KPMG in the UK, we add local requirements and guidance to comply with additional professional, legal or regulatory requirements specific to the UK and our own internal policies.

- Standardised workpapers and guidance assist our audit teams in consistent delivery.

- Embedded library content in KCw is accessible for global minimum expected substantive and risk assessment procedures, and incremental UK standardised procedures for certain topic areas, which enable our teams to apply consistent approaches where appropriate.

- KCw is also used for assurance engagements. The KPMG Execution Guide for Assurance (KEGA), UK version, is applicable for UK firm attestation assurance engagements in accordance with ISAE (UK) 3000 and if applicable ISAE 3410.

Deep technical expertise and knowledge

We are committed to ensuring that audit professionals have appropriate audit, accounting and industry knowledge, experience and training. Our accreditation process enables us to ensure the right partners and employees are assigned to engagements and are licensed where necessary.

Quality and risk management policies

KPMG International has established a quality framework across its network of member firms based on the International Standard on Quality Management (ISQM1) issued by the International Auditing and Assurance Standards Board (IAASB) and the Code of Ethics for Professional Accountants issued by the International Ethics Standards Board for Accountants (IESBA), which apply to professional services firms that perform statutory audits and other assurance and related services engagements.

The policies and associated procedures within this framework enable member firms to comply with relevant professional standards, and with regulatory and legal requirements, and help our partners and employees act with integrity and objectivity, performing their work with diligence.

KPMG in the UK supplements KPMG International’s quality framework with additional policies and procedures that address its specific business risks as well as rules and standards issued by the FRC, the ICAEW and other relevant regulators, such as the US Public Company Accounting Oversight Board (PCAOB).

Refer to: Quality control and risk management (Our quality control and risk management systems)

A globally co-ordinated project is implementing further enhancements to our processes and controls in readiness for the new quality control standard by the PCAOB, entitled PCAOB Quality Control (QC) 1000. (QC 1000), which has an effective date of 15 December 2026. This complements processes already in place following the implementation of ISQM 1.

Assess risks to quality

We continue to refine our processes and controls to ensure we can mitigate and respond to risks which would affect audit quality. Our key control processes include:

Audit Quality Council

The Audit Quality Council is a forum for the leaders of our Audit Quality central teams and those with a role in driving audit quality activity in our Audit Performance Groups to discuss and agree on actions to implement our audit quality strategy. The Council meets monthly and receives updates from our Audit Quality central teams on their observations and activity for the month together with consideration of actions to address any emerging issues. Progress on both internal and external inspections are discussed and remedial actions from prior reviews and inspections are monitored for effectiveness. Our audit learning plan is also approved at the Quality Council on an annual basis. The meeting is chaired by the Head of Audit Quality with members of the Quality Council including the heads of the Audit Quality teams, e.g. Departments of Professional Practice, Second Line of Defence, Chief Auditor, Chief Accountant, and heads of internal and external inspections. The meeting is also attended by the Chief Risk Officer (CRO) for Audit, Audit Learning Director, Head of Culture for Audit, and the partners who lead on Quality in the Audit Performance Groups including our offshore Quality Team.

Audit Risk sub-committee

The Audit Risk sub-committee meets monthly to assess and proactively address the risks across our Public Interest Entity, Other Entities of Public Interest, and wider audited entity portfolios. The main areas considered by the sub-committee include the assessment and challenge of the safeguards and mitigations in place in response to the movement in internally calculated risk scores associated with individual audited entities and sectors; the response to the Second Line of Defence team’s assessment of individual audit engagements; updates on regulatory developments and the status of associated regulatory commitments; and the identified actions in response to entities, engagements and themes included on the capability risk watchlist. Membership of the sub-committee includes the Audit Chief Risk Officer as Chair, Head of Audit Quality, Chief Auditor, Chief Accountant, Head of Audit Regulatory Compliance, risk partners and performance group leaders from the key Audit Performance Groups across the Audit capability.

Annual review of engagement leader portfolios

The Chief Risk Officer for Audit assesses Responsible Individual (RI) workload by considering a multitude of factors including but not limited to size of portfolio, pinch points, quality metrics, significant internal roles, hours worked and sickness. These factors are weighted and red, amber or green (RAG) score ratings are then attributed to in-scope RIs. Each RI completes a questionnaire and is then interviewed by a former partner or partner outside of their Performance Group where they can discuss their RAG score, portfolio, personal wellbeing, level of support across their portfolio of engagements and any other concerns they may have. Ratings may then be adjusted based on the outcomes from the questionnaire, the interview process and subsequent discussions held with the respective Performance Group Leadership to address key findings and develop appropriate mitigations where needed. Findings are reported to Audit Risk Management and Audit Leadership, who take action as required.

Accreditation

To drive continuous improvement of audit quality, we need to have the right people with the right skills, doing the right work at the right time.

Our audit portfolio has been divided into segments based on the risk and nature of the entities subject to audit. This has resulted in three defined main accreditation segments for managers and above – Listed and Regulated, Private Capital, and Public Sector.

Each main accreditation segment is in turn made up of a number of sub-segments, enabling targeted competence and capability requirements within the overall accreditation segment.

Additional technical audit requirements apply to individual audits of certain entities. Each technical overlay has additional technical capabilities and some involve specific training over and above those of the three accreditation segments. Those technical overlays without specific training requirements are awarded at the discretion of the Audit Chief Risk Officer or Chief Auditor.

Accreditation requirements are determined at the engagement level and are driven by the sub-segment of the audited entity.

On an annual basis, all auditors from Manager to Partner are awarded Accreditation(s) on the basis of their experience and training.

eQualify software tracks whether individuals hold the accreditations needed to work on an audit in a more robust fashion. A one-stop solution to people’s accreditations, eQualify deals with audit accreditations (calculated based on hours spent on work in the sub-segments which make up Listed and Regulated, Private Capital, and Public Sector) and technical overlays, which are requirements specific to individual audited entities as discussed above. Each individual in KPMG in the UK and KGS in India has a profile in eQualify and can see at a glance what Accreditations and Audit Technical overlays they hold. They can also see if they need any further Accreditations, for which they can request a waiver which is approved by the Head of Accreditation, or technical overlays, both of which are linked to the jobs in their portfolio. If they require a new technical overlay, the detail in the overlay links directly to our Learning Management system and each person can assign themselves the relevant training without the need to consult. Once they have completed the relevant training, the technical overlay is automatically marked “green” in the entity profile on which they are working. eQualify allows engagement leaders and engagement managers to ensure that everyone requiring an accreditation on their engagement has one on a timely basis.

With effect from 5 December 2022, regulations introduced by the FRC have required all audit engagement leaders who sign UK public interest entity audits to be registered on the PIE Auditor Register (PAR). Our accreditation process supports our assessment of those engagement leaders registered to audit UK PIEs. As at 30 September 2025, the firm had 104 Responsible Individuals included on the PAR.

Audit risk panels

Audit risk panels are held at planning and completion stage on certain higher-risk engagements to challenge the audit team on their key judgements and planned audit approach. These panels are held prior to key communications with audit committees and include a review of the planned communications and financial statements (including the audit report). Each panel is chaired by an audit quality partner and supported by an experienced field partner and includes key members from the engagement team as well as the Second Line of Defence reviewer, where applicable. Actions coming from the panel are monitored by the panel chair and in previous years have included to delay signing, to consult further with a technical expert, to adjust the audit approach, or to challenge further the clarity of disclosures in the annual report. In a recent survey of engagement teams, an overwhelming majority found them a useful process for challenging and refining their approach.

Second Line of Defence “hot reviews”

Our Second Line of Defence team is a coaching function that provides challenge and support to selected audit teams to enhance audit quality. It seeks to mitigate execution risk in the most significant areas of the audit for relevant engagements by evaluating and providing feedback on both the audit approach and the clarity of audit documentation. We have continued to develop our Second Line of Defence function in the current year. Notable developments this year included:

- Delivering additional hot reviews targeted at supporting staff in our offshore delivery centre.

- Refining our hot review methodology to remove mandatory review areas and instead further enhance the risk-based approach on which the scope of the reviews are performed.

- Following piloting in the previous year, we have implemented a new programme of topic reporting using functionality within our Second Line of Defence IT tool that allows deeper analysis of the quality themes identified by Second Line of Defence reviewers. This analysis is used as an input to our Emerging Issues process to inform ongoing investment in quality improvements.

Our Second Line of Defence reviewers provide monthly reporting to Performance Group Leaders with an assessment of the engagements they are supporting and a RAG rating of the risks facing the engagement team from a resourcing or quality point of view. The RAG rating alerts the Performance Group Leaders to the need to take remedial action to mitigate any delivery risks.

Pre-issuance review of annual reports by the Department of Professional Practice

For listed or high-risk entities, an independent review of the annual report is carried out by the Department of Professional Practice prior to the audit report being signed. This review aims to identify and resolve instances of material non-compliance with reporting requirements and areas where disclosures are unclear or could be improved.

The final element of the pre-issuance review is necessarily conducted when a final draft of the annual report is available, which typically occurs towards the end of the audit process. However, for the highest-risk engagements, pre-issuance review teams are allocated early in the audit cycle to encourage discussion of accounting and reporting matters with the reviewer throughout the course of the audit. We also encourage all audit teams to hold upfront planning discussions with their pre-issuance reviewer to help minimise the number of issues identified late in the audit process.

We continue to encourage entities to progress their annual reports earlier to facilitate pre-issuance reviews on an earlier draft of the document. Where this is not feasible, the pre-issuance reviewer can review individual disclosure notes where these are new or considered by the audit team to be higher risk.

This year we have continued to develop our pre-issuance review guidance and process to further support audit teams and enhance the quality of the audit. This includes additional training for reviewers on how to effectively identify significant issues and assess their materiality, and further refinements to the process to promote constructive dialogue between the reviewer and the audit team.

Emerging Issues process

The Emerging Issues (EI) process is a standard reporting framework which captures emerging audit quality issues, evaluating common emerging issues identified across our technical teams, findings from internal and external quality reviews, and other external sources. Actual or potential emerging issues are identified from a number of sources including audit leadership, field auditors, the Audit Centre of Excellence (ACE) and audit quality monitoring activities (on both live and completed engagements). In addition, other potential emerging issues are identified from third party sources such as FRC announcements, press comments and other regulatory announcements. This allows us to capture an inventory of possible emerging issues, based on the activities of ACE and more widely across the audit practice. The EI process aggregates themes, prioritises them and provides mitigating responses to the audit practice in a timely manner.

The Chief Auditor presents a monthly summary discussion paper at the Audit Quality Council (AQC) for approval of the proposed actions. Root Cause Analysis (RCA) will be used to investigate selected issues where more detailed insight is needed before a response can be developed and deployed. This complements the existing RCA process focused on quality review findings.

The EI framework is designed to capture emerging issues and deliver timely responses to them. However, we recognise that, from time to time, a faster reaction may be needed. For example, issues may arise that are considered by the AQC to be of sufficient significance (i.e. they relate to a matter that audit teams more generally need to be aware of in short order to ensure audit quality) as to require a more immediate response, or an interim response while a longer-term solution is developed. These urgent escalations will either be in the form of communication in the DPP Bulletin or via an immediate communication from relevant audit leadership if an even swifter response is required.

We monitor the effectiveness of actions taken through existing monitoring processes in liaison with the action owners.

- Identify and understand risks to delivering quality and implement effective responses.

The quality of a KPMG audit rests on our SoQM and KPMG’s global approach to ISQM 1 emphasizes consistency and robustness of controls within KPMG firms’ processes.

How we apply this in the UK

Our key quality control processes include:

- Audit Quality Council

- Audit Risk sub-committee

- Annual review of engagement leader portfolios

- Accreditation

- Audit risk panels

- Second Line of Defence “hot reviews”

- Pre-issuance review of annual reports by the Department of Professional Practice

- Emerging Issues process

Iterative risk assessment process (iRAP)

In line with the KPMG Global SoQM Methodology, KPMG in the UK conducts an iterative risk assessment process (iRAP). This continuous process, overseen by those with operational responsibility for the SoQM and the Audit Executive, looks at a range of internal and external sources to assess whether there are any additional risks relevant to the SoQM that may require the implementation of additional controls or formal inclusion of existing controls within it. Once identified, controls are subject to monitoring and evaluation activities.

Under ISQM1 we are required to evaluate the effectiveness of our system of quality management on an annual basis.

Embrace digital technology

We are thoughtful and deliberate in our approach to applying technology to every KPMG audit. By applying a set of outcome-focused principles, we ensure that the technology we deploy has a clear purpose – supporting audit quality, generating actionable insights, creating capacity for both auditors and management, and enabling continuous innovation and improvement in the audit process.

In its recent Audit Quality Inspection and Supervision report (2025), the FRC highlighted our “clear strategy to effectively integrate new technology solutions”. We have made significant investment in innovative audit techniques using AI and are pleased to see this being recognised.

We continue to invest heavily in technology and work hand in hand with major technology alliance partners including Microsoft and Databricks to ensure we stay at the cutting edge.

KPMG Clara

KPMG Clara is our single global digital audit platform, used by just under 7,000 auditors to support the delivery of all audit opinions in the UK every year. Clara embeds technology across the audit, deploying capabilities to improve collaboration, workflow, automation and analytics – all enhanced by AI. KPMG Clara is built on secure, cutting-edge cloud technology and provides us with a foundation that we continually build and innovate upon. A few examples of what we have delivered in 2025 include:

- Collaboration – Updates to enhance the experience and streamline collaboration, helping our teams work with our audited entities more efficiently.

- Workflow – This year, we embedded an AI “quality coach” agent directly within Clara’s audit workflow, enabling our teams to get real-time feedback and suggestions to improve the quality of their work.

- Automation and Analytics– KPMG Clara AI Transaction Scoring has now supported the delivery of over 1,000 audits in the UK. This uses advanced AI and statistical techniques to power routines, analysing 100% of transactional data and providing evidence over areas such as point-in-time revenue and operating expenses. This capability was recently expanded to include identification of high-risk journal entries, resulting in a more targeted testing approach, deeper insights and enhanced quality.

Artificial intelligence

In line with our 2024 mission to put AI in the hands of every auditor, for use on every audit, we have made clear progress. Thousands of auditors now use Microsoft 365 Copilot daily to support productivity, and generative AI is embedded directly into audit workflows through KPMG Clara AI.

Two examples in KPMG Clara are:

- Flowcharting and walkthroughs: AI helps us to assess prior year documentation in preparation for walkthrough meetings, document our understanding from walkthrough meetings, and automatically generate process flowcharts, including identification of process risk points, relevant systems and controls.

- Analysing the annual report: AI supports our assessment of the company’s annual report and accounts by drafting responses to disclosure checklist questions and analysing the sentiment of each sentence of the annual report, to support our assessment of the fair, balanced and understandable criteria.

Alongside deploying new technology, we are equipping our professionals with the expertise they need to realise the potential of AI. Over the past year, our change and enablement programme has included training in prompt engineering, responsible and ethical use of AI, and drop-in clinics with technology alliance partners such as Microsoft e.g. our Microsoft CoPilot flight school series. These initiatives foster an ”AI-first” mindset and help our people embrace the latest technology. Our methodology and governance continue to evolve, enabling us to unlock the transformative benefits of artificial intelligence for our business, audited entities and the audit profession.

Our focus is now expanding to agentic AI that can intelligently reason, plan and then facilitate actions. Trust is fundamental, so we are prioritising transparency and human-in-the-loop validation to guide our approach; this allows us to embed AI into our procedures, processes and teams, unlocking greater productivity and opportunities for greater transformation.

Technology skills

Alongside the right technology, the right skills are vital. Our 2025 KPMG Audit University, a three-day residential training programme, built on previous years in establishing a digitally fluent audit workforce. Our focus this year has been data literacy, building an AI-first mindset, and training our auditors in how and when to use the right innovative solutions.

We also continue to increase our engagement with audited entity management and Audit Committees. Over the past year we have held over 40 events with audited entities in our KPMG Ignition facility, where working in a collaborative, technology-enabled environment allows us to bring to life how the technology works, how our auditors apply it, and what this means in the context of an entity’s data.

- KPMG Clara: our intelligent global audit platform – powered by AI.

- Standards-driven audit and assurance workflows, delivering global consistency.

- Data analytics, automation and AI enabled audit delivery.

- Upskilling our people in technology, AI and data literacy.

At KPMG, we use advanced technology and AI to improve the quality of our audits and provide insights that matter.

With our bold innovation strategy, we work across our global network of member firms and with alliance partners to bring the latest technology to our people and are equipping teams with the skills and knowledge to use the tools effectively.

How we apply this in the UK

We are embracing the transformative power of technology to elevate audit quality.

Central to this is KPMG Clara, our intelligent global audit platform, that integrates AI, automation and analytics into every stage of the audit – enabling smarter collaboration, deeper insights and continuous innovation.

Generative AI tools, including Microsoft 365 Copilot and KPMG Clara AI, are helping our teams work more efficiently by supporting everyday tasks and embedding intelligence directly into audit workflows.

Alongside the technology itself, we continue to invest in upskilling our people to promote technology literacy and drive optimal usage of the tools available.

Communicate effectively

Stakeholder engagement

Building trust with our stakeholders is increasingly important as we navigate a complex and evolving corporate reporting ecosystem. Engaging with different groups allows us to share insights and developments, actively participate in matters impacting our profession and contribute to their solution, and understand users’ expectations of our reporting. For example, we actively engaged with regulators, government, professional bodies, investors and audit committee chairs on the UK’s audit and corporate governance reforms.