KPMG’s Tax Transformation services help companies to proactively design and build how they deliver tax requirements in a world where what they need to deliver is ever-changing.

We are helping companies to design leading tax functions with a focus on people, process, technology, and governance, while also seeking to address tax risk, reputation, and compliance.

Frequently seen triggers for Tax Transformation can include:

- End-to-end operations or finance transformation

- New legislative and/or regulatory requirements such as real-time reporting or e-invoicing

- ERP system changes

- Internal and/or external audit findings

- Changes in key tax or finance personnel

- Budget pressures

- Mergers and acquisitions activity

How KPMG can help

Tax Transformation starts with a clear tax vision and strategy aligned to the business objectives of the wider organisation. Our approach can help you to design and implement a leading tax operating model to enable you to realise value while you manage tax risk, reputation, and compliance.

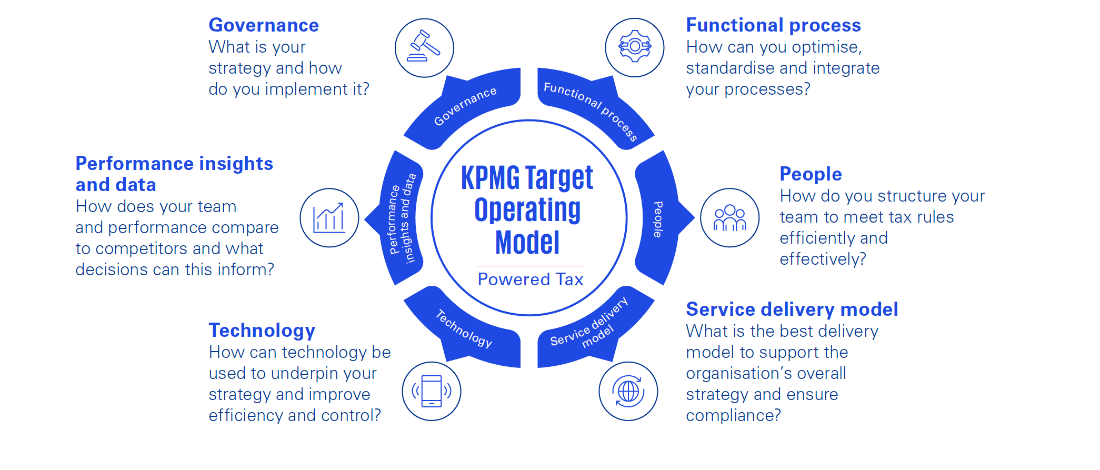

Using our Powered Tax methodology, KPMG's Tax Transformation teams can help tackling these challenges focusing on the following key areas:

KPMG's Tax Transformation services professionals help organisations actively contribute to finance transformation projects helping to ensure that tax requirements are built in and tax is positioned as an enabler. We can streamline processes and help design a sourcing model which best suits business objectives and wider organisational goals across the whole spectrum of outsourcing, in-sourcing and, co-sourcing.

We can help organisations ensure existing finance and/or enterprise resource planning (ERP) systems are properly tax sensitised to provide standardised tax determination and reporting functionality across the business, as well as put in place tools to help ensure effective Country-by-Country reporting requirements are met and enable informed strategic decisions and improve performance.

Tax Transformation - Building a Tax Function fit for the future

Our tax insights

Something went wrong

Oops!! Something went wrong, please try again

Our people

Get in touch

Discover why organisations across the UK trust KPMG to make the difference and how we can help you to do the same.