(This article was published on 24 July 2024 and updated on 10 September 2025)

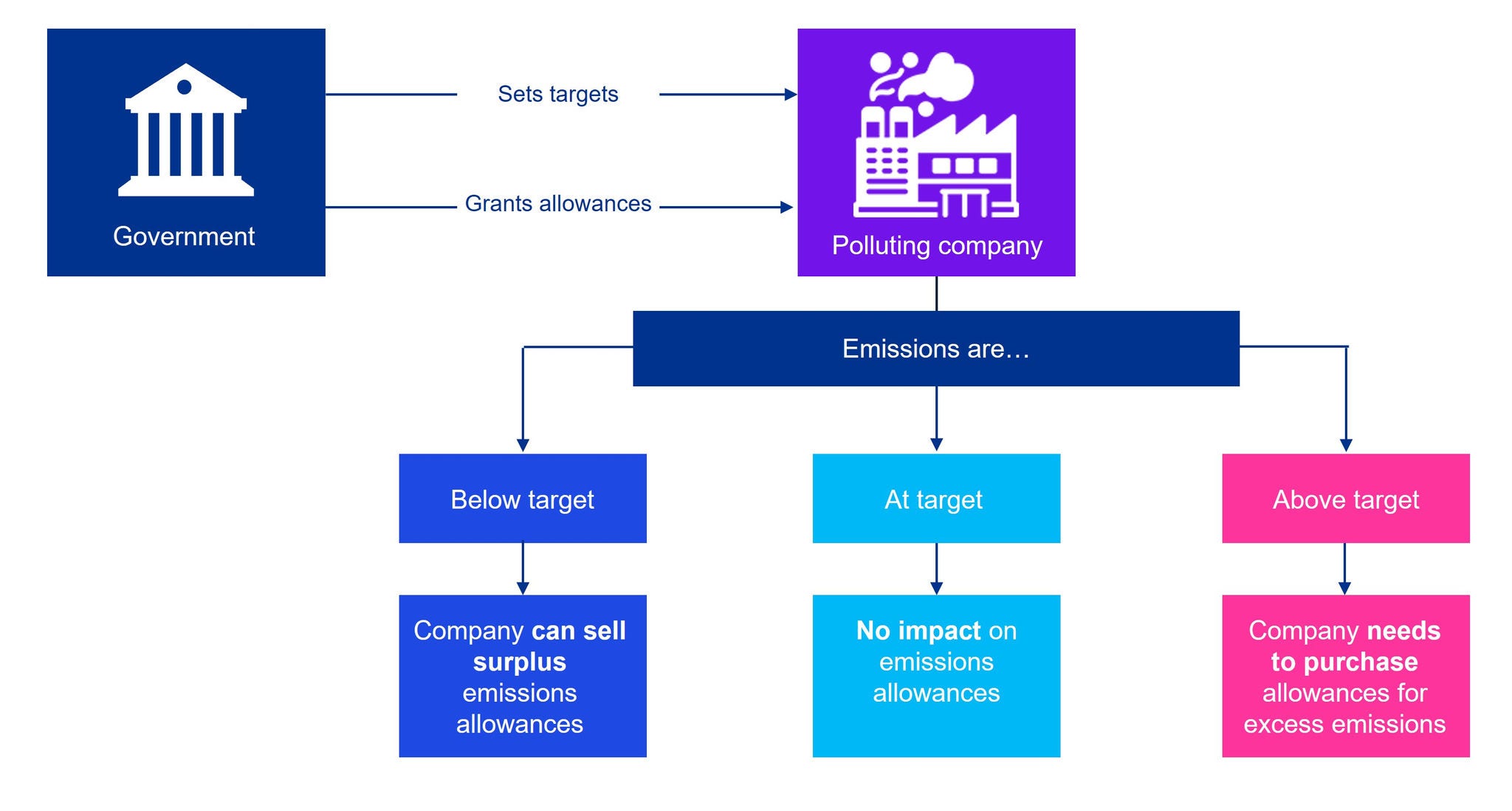

Certain jurisdictions operate a cap-and-trade scheme. Under such a scheme, a company is allowed to emit pollutants within a specific limit set by the government for a specified period over which emissions will be measured (compliance period). For emissions within the allowed limit, the government typically grants the related number of emissions allowances to the company. After the end of the compliance period, the company is required to surrender the number of emissions allowances matching emissions during that period. A company can trade emissions allowances with other parties to ensure that it has enough to match its emissions.

Either – a company needs to choose an accounting policy.

IFRS® Accounting Standards do not provide specific guidance on accounting for emissions allowances received in a cap-and-trade scheme. In our view, a polluting company participating in a cap-and-trade scheme should choose an accounting policy, to be applied consistently, to account for emissions allowances based on one of the following approaches.

- As intangible assets: Under this approach, a company considers that emissions allowances are identifiable non-monetary assets that do not have physical substance and therefore meet the definition of an intangible asset.

- As inventories: Under this approach, a company considers that emissions allowances are effectively an input to be consumed in the production process, similar to inventories.

We believe that this accounting policy choice should be applied regardless of whether emissions allowances are bought or received from the government. We also believe that it may be applied to emissions allowances or carbon credits purchased to comply with other types of mandatory schemes.

On the date on which there is reasonable assurance that the company will comply with the specified conditions and the emissions allowances will be received.

Cap-and-trade schemes typically grant a number of emissions allowances in relation to a compliance period. Under some schemes, the relevant government might have identified a date by which it will determine and announce the allocation of the allowances for the next compliance period. This date might be before the date from which companies are entitled to their allowances and the date on which they are actually issued. For example, a national government announces that by 14 December 2024 it will determine the allocation of allowances to be issued on 28 February 2025. The grant is conditional on the company being in business on 1 January 2025 to receive its allowances. In our view, provided that there are no other conditions attached to the grant, the company should recognise the government grant and the related asset on 1 January 2025.This is because this is the date on which there is reasonable assurance that the company will comply with the condition attached to the grant and that the grant will be received.

This depends on the accounting policy for government grants (see Question 6).

If a company receives emissions allowances from a government, then it may apply the guidance for government grants. A non-monetary government grant may be recognised either at:

fair value, which is determined at the measurement date in accordance with IFRS 13; or

a nominal amount, which is often zero. [IAS 20.23]

This depends on whether a company accounts for emissions allowances as intangible assets or inventories.

Intangible assets

A company that accounts for emissions allowances as intangible assets subsequently applies the general requirements for intangible assets.

Revaluation model: If the allowances are accounted for using the revaluation model for intangible assets, then any balance on the revaluation reserve in respect of the allowances that is derecognised when the company settles its obligation under the scheme may be transferred directly to retained earnings within equity. This accounting treatment precludes any reclassification of fair value increments related to the allowances to profit or loss when the company settles its obligations under the scheme.

Cost model: If the company accounts for its allowances under the cost model, then any difference between the carrying amount of the asset and the liability is recognised in profit or loss on settlement of the obligation.

For many allowances traded in an active market, no amortisation is required because the condition of the asset does not change over time and the residual value will therefore be the same as cost. As a result, the depreciable amount will be zero.

If the market value of the allowances falls below its cost or other indicators of impairment exist, then the general impairment guidance in IAS 36 is followed to determine whether the assets are impaired.

Inventories

If a company accounts for emissions allowances as inventories to be consumed in the production process, then the general requirements for subsequent measurement under IAS 2 apply.

Emissions allowances are often interchangeable.

IFRS® Accounting Standards are silent on how a company should determine the carrying amount of such assets – e.g. to calculate a gain or loss on disposal. In some cases, it is feasible to identify and track the specific units sold or transferred – e.g. when the units have unique identification numbers. Conversely, if it is not feasible to identify and track the specific units, then in our view, a company should apply the guidance for determining cost formulas for inventories by analogy under the hierarchy for selecting accounting policies. We believe that a reasonable cost allocation method may be used – i.e. average cost or first-in, first-out. A company should apply the elected accounting policy consistently.

A company may apply the guidance for government grants in IAS 20.

In our view, if an allowance is received from a government for less than its fair value, then the company should choose an accounting policy, to be applied consistently, to recognise the resulting government grant at either:

fair value (as the difference between the fair value of the allowance and the consideration paid, if any); or

the nominal amount paid for the allowance.

IAS 20 notes that fair value is the usual approach for non-monetary grants.

The grant is recognised as deferred income and recognised in profit or loss on a systematic basis over the compliance period, regardless of whether the allowance received continues to be held by the company. Disposals of allowances or changes in their carrying amount – e.g. because of impairment or write-downs to net realisable value – do not affect the manner in which grant income is recognised.

As an alternative to the deferred income approach, we believe that a company may present an allowance net of the deferred government grant. [IAS 20.23]

Recognising a non-monetary government grant at the amount paid (often zero) would result in no liability being recognised if:

the liability is measured at the carrying amount (zero) of the related assets; and

the company does not exceed the emissions target.

This depends on whether the allowances are classified as intangible assets or inventories.

- Intangible assets: The company applies the derecognition requirements in IAS 38 and does not recognise revenue. [IAS 38.113]

- Inventories: In our view, income from the sale of surplus emissions allowances should not be recognised as revenue unless it arises in the ordinary course of the company’s activities. Judgement is required, based on the company’s specific facts and circumstances, to determine whether the sale of surplus emissions allowances arises in the ordinary course of its activities. We believe that in exercising this judgement the company should consider its business model, including its strategy, publicly provided information, budgets and management’s analysis. It could also consider the frequency of the transactions. [IFRS 15.A]

This page references specific IFRS® Accounting Standards – see our glossary for the full list of standards.

Related content

© 2026 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.