How does your tax function stack up?

Seasoned tax leaders in the energy and natural resources sector make key decisions every day to evolve their tax function and keep pace with evolving pressures, disruptive technological advancements, heightened compliance obligations and more — all while seeking to demonstrate value within the organization and beyond.

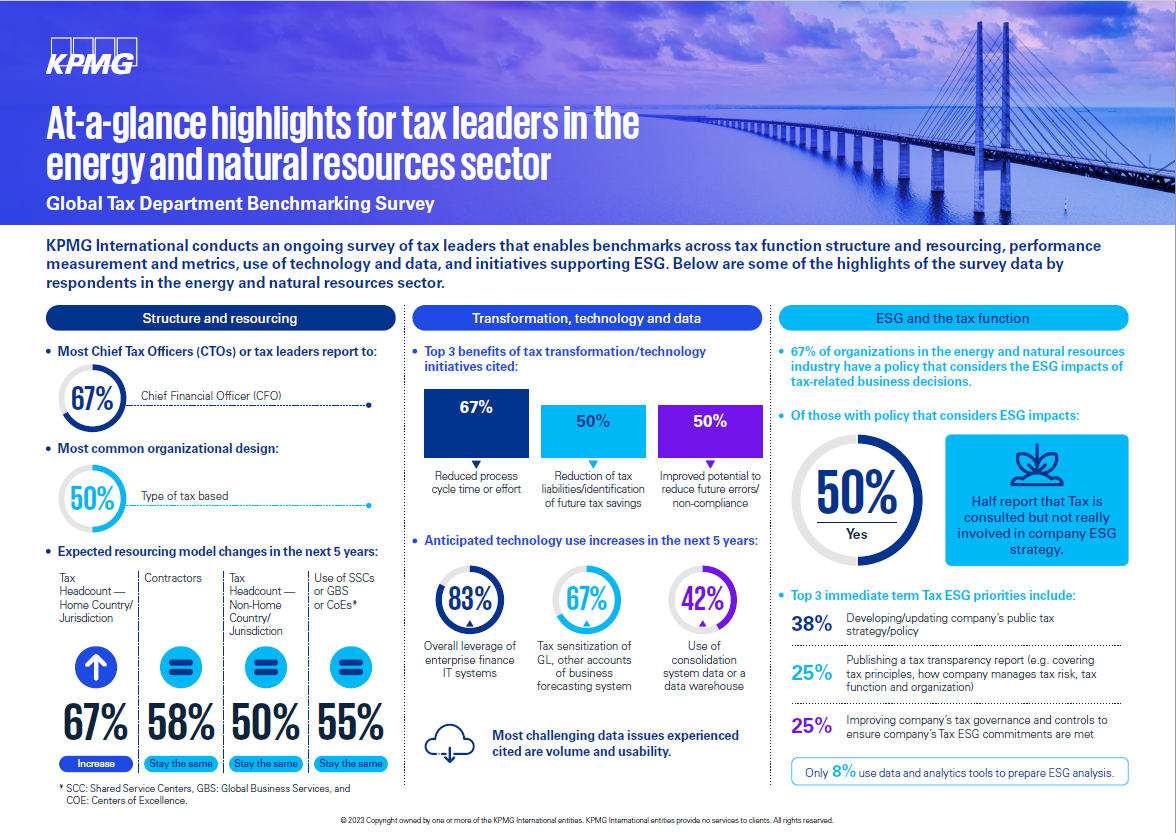

Benchmarking against comparable energy and natural resources tax functions can be a powerful tool for reflecting on your organization's current position and planning how to prepare for the future. To help, KPMG International conducts an ongoing survey of the tax functions in multinational organizations around the world. The data gained offers insights into tax functions globally and how they are evolving in their structure, governance, priorities and performance measures, through the use of technology and more.

In this at-a-glance summary, we provide a look at some of the key findings relating to tax function structure and resourcing, transformation, technology and data, and ESG from survey respondents in the energy and natural resources sector.

KPMG perspective:

It is unsurprising that the nearly 75% of respondents in the ENR Sector have indicated that their organisation have an ESG policy with regard to the tax impacts of business decisions. The ESG agenda impacts no sector more than ENR – with the world still predominately relying on fossil fuels to the tune of 80% of energy supplies. As we move towards decarbonisation, the sector is rapidly scaling up investments in clean renewable energy solutions, carbon capture and the focus of more mining for critical minerals has never been greater. It follows that ENR companies are therefore prioritizing their strategic tax policy with an ESG lens, public transparency around tax and economic contributions, improved tax governance and ensuring that tax risks are managed.

Tax is expected to be continually increase in complexity with more tax reform, increased revenue authority disputes and audits post-pandemic and BEPS Pillar 2 significantly impacting 73% of respondents. 45% of Heads of Tax feel the primary role of the Tax Function is align to the organisations strategic goals and create value. As a result internal tax teams are expected to increase in size both in the home country and abroad in the future.

There is a clear recognition that technology will play an increasing role in how tax functions operate over the next 5 years whether this be through leverage of the enterprise and finance system, some specific tax sensitization of the GL or use better data management. Technology however is not without its challenges given the volume of data and usability within bespoke tax systems.

Carlo Franchina

Global ENR Tax Leader,

KPMG Australia