1 This guide refers to investment tax credits throughout as tax credits.

Governments around the world often use tax incentives to deliver on their public policies. Tax incentives may involve complex rules and raise challenging accounting questions. A key consideration is which accounting standard applies to a specific tax incentive.

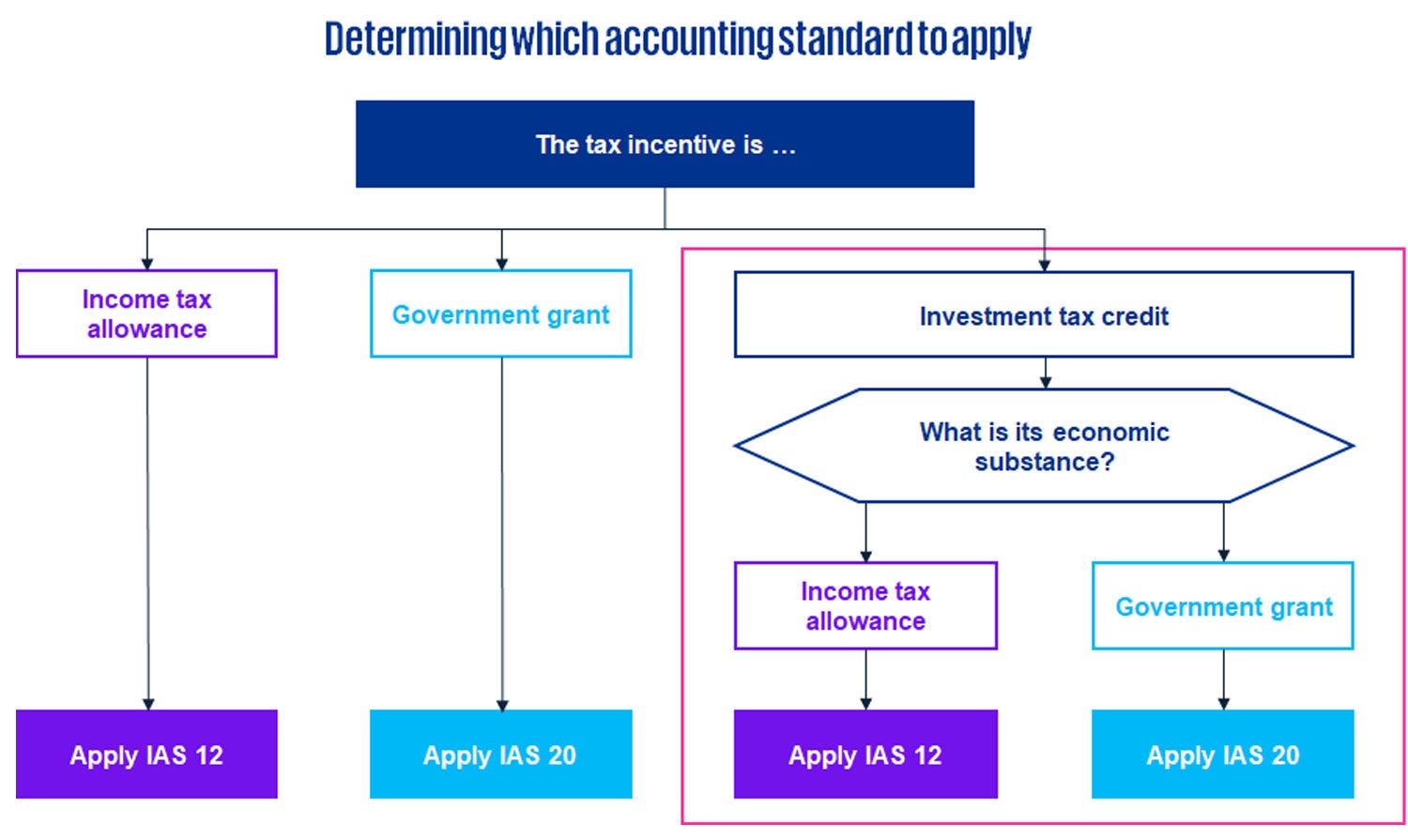

For tax incentives that meet the definition of an income tax, a company applies IAS 12 Income Taxes. For those that meet the definition of a government grant, a company applies IAS 20 Accounting for Government Grants and Disclosure of Government Assistance. Most challenges relate to the accounting for investment tax credits1, which are specifically scoped out of IAS 12 and IAS 20.

Despite this, companies generally account for tax credits using IAS 12 or IAS 20 by analogy. This is because tax credits are typically government incentive schemes delivered through the tax systems. In our view, in determining which accounting standard to apply, a company should assess the economic substance of the tax credit. This assessment requires a company to apply judgement to its specific facts and circumstances. Once a company has determined which standard to apply to a specific type of tax credit, it should apply it consistently from period to period. The recognition, measurement, presentation and disclosure of the tax credit will depend on the accounting standard applied, and may differ in some cases.

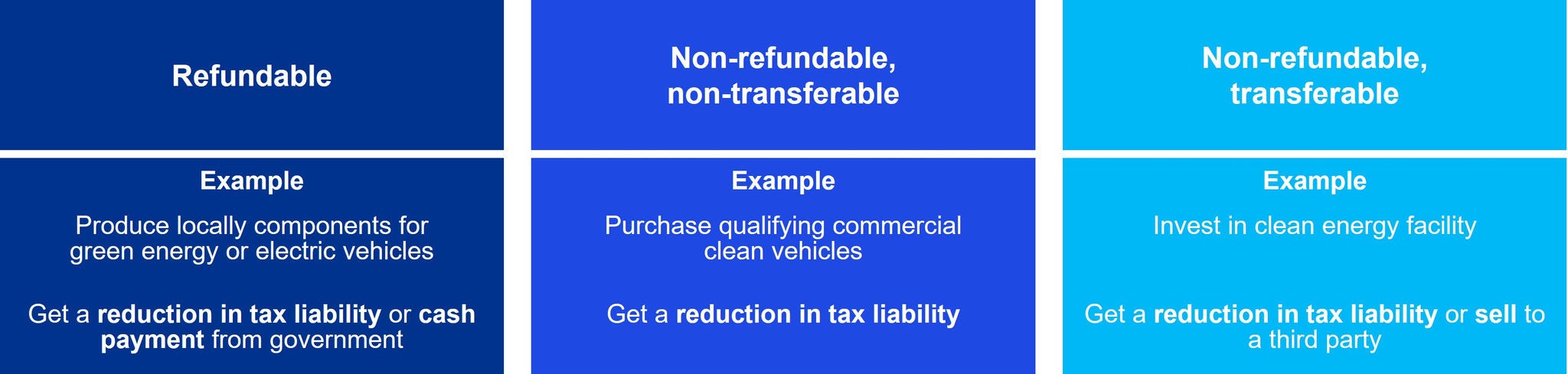

This guide focuses on the following three types of tax credits, and addresses:

- how to determine which accounting standard to apply; and

- what this means for the accounting and presentation in your financial statements.

Answering your questions

© 2026 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.