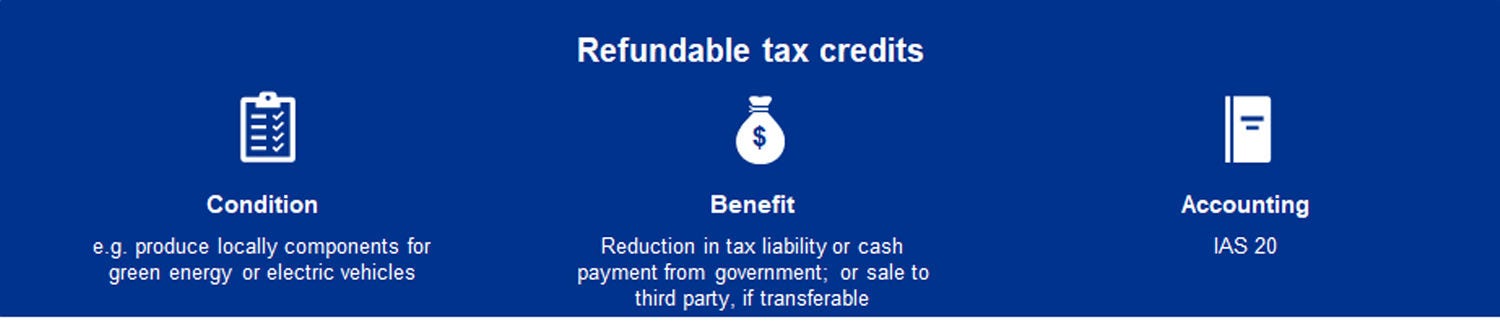

Typically, companies benefit from refundable tax credits in the form of:

- a reduction in the tax liability; or

- a direct cash payment from the government (if the company does not have a tax liability or its tax liability is less than the value of the credit).

Some refundable tax credits may also be transferable – i.e. companies can receive a cash payment from the transfer (sale) to an unrelated third party.

Your questions answered

In our view, these tax credits meet the definition of government grants and therefore should be accounted for under

IAS 20 Accounting for Government Grants and Disclosure of Government Assistance. This is the case regardless of whether:

- the tax credits are transferable; and/or

- a company expects to make a direct-pay election.

We believe that these tax credits meet the definition of government grants because they are refundable through the direct-pay election, and the amount refundable is not limited by the company’s taxable income or tax liability – e.g. a company may receive the refund despite being in a taxable-loss position. As a result, these refundable amounts are not income taxes.

Generally, no. The recognition and measurement requirements are the same for government grants related both to income and assets. However, for government grants related to assets, companies can apply two approaches to present them in the balance sheet (see Question 4). These approaches are not relevant for government grants related to income.

Applying IAS 20, a company recognises refundable tax credits when there is reasonable assurance that:

- the company will comply with the relevant conditions; and

- the tax credits will be received.

Under IAS 20, a government grant is recognised in profit or loss on a systematic basis as the company recognises as expenses those costs the grant is intended to compensate.

Tax credit relates to… | The benefit is recognised in profit or loss as… |

Depreciable asset | The asset is depreciated or amortised |

Non-depreciable asset | Conditions related to the refundable credit are met. For example, if a refundable credit relates to the purchase of land on the condition that the company constructs and operates a building on that land, then the refundable credit is recognised in profit or loss as the building is depreciated |

| Income to compensate for specific costs | The related costs are recognised as expenses |

| Income to compensate for expenses or losses already incurred, or to provide immediate financial support with no future related cost | The tax credit becomes receivable |

A company chooses a policy to present refundable tax credits related to assets by applying one of the following approaches.

- Net presentation: Under this approach, a tax credit reduces the carrying amount of the asset in the balance sheet. In the income statement, the benefit is recognised through reduced depreciation or amortisation expense.

- Gross presentation: Under this approach, a tax credit is presented separately as deferred income in the balance sheet. In the income statement, in our view a company should choose an accounting policy and apply it consistently – i.e. to present these tax credits either as income or as a reduction in the related expense.

A company chooses a policy to present refundable tax credits related to income by applying one of the following approaches.

- Net presentation: Under this approach, a tax credit reduces the related expense in the income statement.

- Gross presentation: Under this approach, a tax credit is presented separately as income in the appropriate line item in the income statement.

Answering your questions

© 2026 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.