On 8 May 2025, we KPMG Norway held an external session to discuss the upcoming IFRS 18 standard, which will replace IAS 1 Presentation of Financial Statements, and will bring consequential amendments to other standards. This article summarizes the key points from the external session, highlighting the changes IFRS 18 entails, the challenges and opportunities it presents, and what firms and auditors need to be aware of during the transition.

The upcoming IFRS 18 standard

Summary

The transition to IFRS 18 presents both challenges and opportunities for preparers, users and auditors. By understanding the key changes and developing a comprehensive implementation plan, companies can ensure they are well-prepared for the new standard. The benefits of IFRS 18, including more relevant, transparent, comparable and consistent financial information, will ultimately outweigh the implementation and ongoing costs.

For assistance navigating the implementation of IFRS 18, feel free to contact us

Foundations of IFRS 18

IFRS 18 was published in April 2024 and is going to be effective for companies with annual periods starting 1 January 2027, replacing IAS 1. It culminated an effort which started in 2014 with research on ‘Performance Reporting’ by the IASB®, later renamed to ‘Primary Financial Statements” in 2015.

IFRS 18 responds to investors’ demand for more relevant information and transparency in the presentation of companies’ financial statements. They also wanted greater comparability between financial statements and more consistency on how particular financial measures are communicated.

IFRS 18 will replace IAS 1 and bring consequential amendments to other standards. The key changes include:

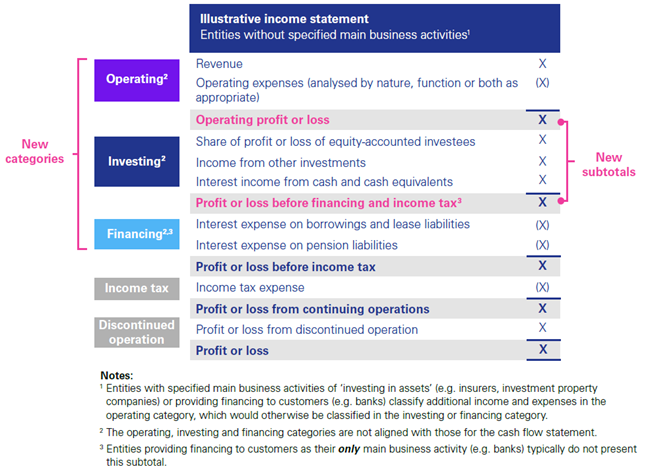

The standard now explicitly includes ‘operating profit’ as a new subtotal. In addition, income and expenses are to be classified into three new categories – operating, investing and financing. Companies with specified main business activities (new term defined in IFRS 18), classify additional items of income and expense in the operating category that would otherwise be classified in investing or financing.

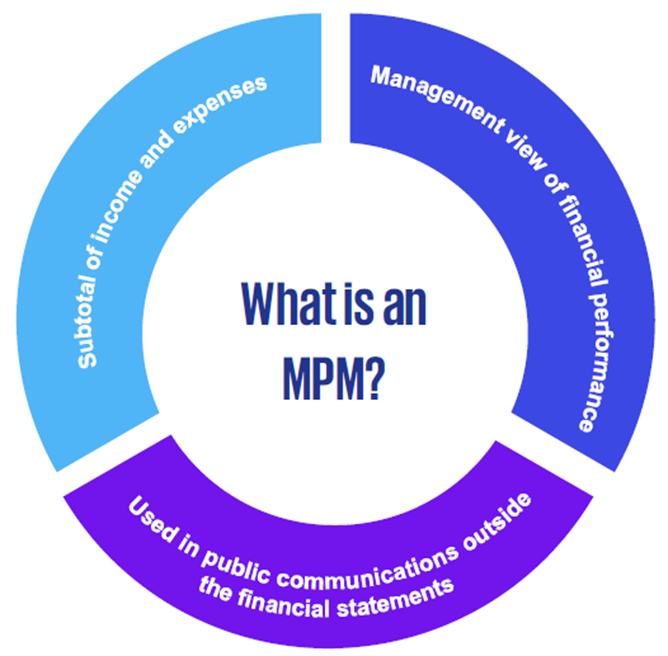

‘MPMs’ stand for ‘Management-defined performance measures’. These measures capture some, but not all ‘non-GAAP’ or ‘alternative performance measures’ (APMs). IFRS 18 now acknowledges the usefulness of this information in communicating financial performance to users and does so by requiring specific requirements for their disclosures in the notes to the financial statement.

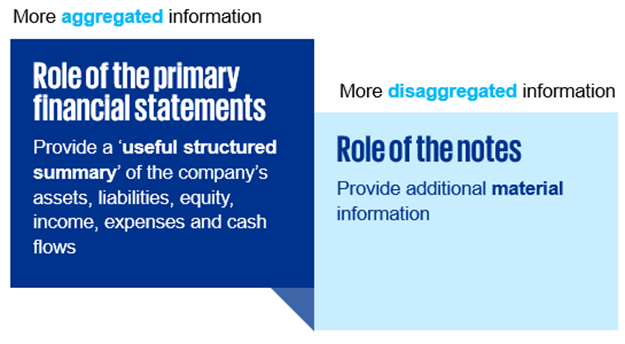

IFRS 18 brings newly defined ‘roles’ for the primary financial statements and for the notes. The primary financial statements are aimed to provide a ‘useful structured summary’ of the companies’ financial position, performance, cash flows and changes in equity. On the other hand, the role of the notes is to provide additional material information.

Additionally, IFRS 18 provides a basis for aggregation and disaggregation based on shared characteristics, and it provides further guidance for companies to provide users with labels and descriptions in a way that faithfully represent the items.

Practical considerations: Implementation Challenges and Opportunities

IFRS 18 is effective for annual periods beginning on or after 1 January 2027 and applies retrospectively. Companies will need to reconcile each line item presented in the comparative periods for both annual and interim financial statements. For interim periods in 2027, companies will need to present their income and expenses subtotals in accordance with IFRS 18, together with restated comparatives. Therefore, companies need to start assessing IFRS 18 impacts now to ensure a smooth transition during both interim and annual periods in 2027.

IFRS 18 brings wider implications for companies, requiring them to understand the ‘big picture’ to navigate its implementation effectively. Each of the key changes brought by IFRS 18 present both challenges and opportunities that require careful analysis and consideration of its wider implications. Below are examples of the potential wider implications associated with each key change introduced by IFRS 18:

Introduction of new categories in the income statement

- System modifications allocating effects to different categories (e.g. FX changes, gains and losses on derivatives).

- Update processes and routines, e.g.:

- Consolidation adjustments,

- Charts of accounts and mapping, and

- KPIs, budgeting and forecasts.

- Organisation: upskilling in new routines, and stakeholder communication.

- Potential effect in metrics used in covenants and compensation policies

- Others: changes reporting packages, digital tagging; investor communication.

Requirement to disclose certain ‘non-GAAP’ measures, known as management-defined performance measures (MPMs).

- Increased prominence and therefore scrutiny on MPMs, e.g. audit, users, regulators and other stakeholders.

- From an organisational perspective, closer alignment between investor relations, financial reporting and other teams is expected. What MPMs to include, why and how should they be calculated?

- Systems used to track and gather data necessary for MPMs.

- Routines and processes to create, remove, update and reconcile MPMs.

- «Educating» investors and other stakeholders on the new performance measures defined by management.

Enhanced guidance on how to group information within financial statements.

- Updates in systems; charts of accounts and reporting packages for increased granularity, flexibility and consistency.

- Templates for financial statements will need updating (e.g. notes). Recurrent updates explaining “other” items.

- Update processes and routines for recording and tracking nature of items going into “other”: shared vs non-shared characteristics.

- Function vs. nature of presentation of expenses is not a free choice anymore. A change may trigger updates of processes, routines and systems.

Companies should develop a detailed implementation plan, including key milestones and timelines. The roadmap should cover all relevant dimensions, such as systems, processes, investor perspectives, and stakeholder communication.

We presented a roadmap for implementation containing the following steps:

- Mobilise and scope: Be aware and make aware of the wider implications of IFRS 18 in your organisation.

- Design your model (‘impact assessment’): Bring your high-level thought to specific action and plans. Coordinate actions. What should happen when?

- Implementation: Prepare documentation supporting the new policies, including key judgements. Explore options for updating systems, processes and controls.

- Pre-live phase: Follow up pre-live issues. Complete implementation. Communicate to investors upcoming changes.

- Go live, communicate: Prepare disclosures to your financial statements and necessary reconciliations.

Practical cases

Our IFRS 18 workshop included several illustrative cases to demonstrate how IFRS 18 will reshape the categorization and presentation of financial information, including examples categorisation of income and expenses, and an example of a reclassification of a company with main business activities.

How KPMG can help

We know that the new rules in IFRS 18 can be challenging to grasp, and we encourage companies to start early in planning their IFRS 18 implementation. That’s why we’re ready to help you through the implementation process, and we can assist with:

Get in touch

Explore related resources

Presentation and disclosure – IFRS 18 – First impressions June 2024

Presentation and disclosure – IFRS 18

IFRS 18 may change future income statement and disclosures

Explore related services

ESG & IFRS-nyhetsbrev

Nyhetsbrevet som oppdaterer deg på det viktigste innen ESG & IFRS-rapportering