Banks’ sustainability-related disclosures continue to expand with many disclosure frameworks applied. Understanding and comparing performance can therefore be a challenge.

Our 2024 benchmarking analysis of sustainability-related disclosures covers 33 major banks. We dive into sustainability topics with strategic relevance to, and clear alignment with, the banking sector. Our analysis focuses on:

- financed and facilitated emissions;

- net-zero and emissions reduction targets;

- sustainable financing;

- emissions data quality;

- customer-related programmes;

- measuring social impacts; and

- sustainability governance and business conduct.

Connectivity

The connectivity between sustainability and financial reporting continues to evolve. Climate-related risks are most often discussed in the context of credit risk management and ECL.

However, the quantified impact of climate-related risk on ECL remains relatively limited.

Financed emissions

Banks typically disclose the percentage of total loans covered by financed emissions reporting.

Most banks have set targets for financed emissions in select lending sectors.

Net-zero and emissions reduction targets

The most disclosed dependencies are data availability and quality, government policies, customer engagement and technology development.

Complaint-handling

The lack of a common approach and the use of different metrics for customer complaints make it difficult to compare performance between banks.

Business conduct

Banks disclose policies on various aspects of business conduct and governance on sustainability-related matters. The most common policies include codes of conduct and ethics, and whistleblower and remuneration policies.

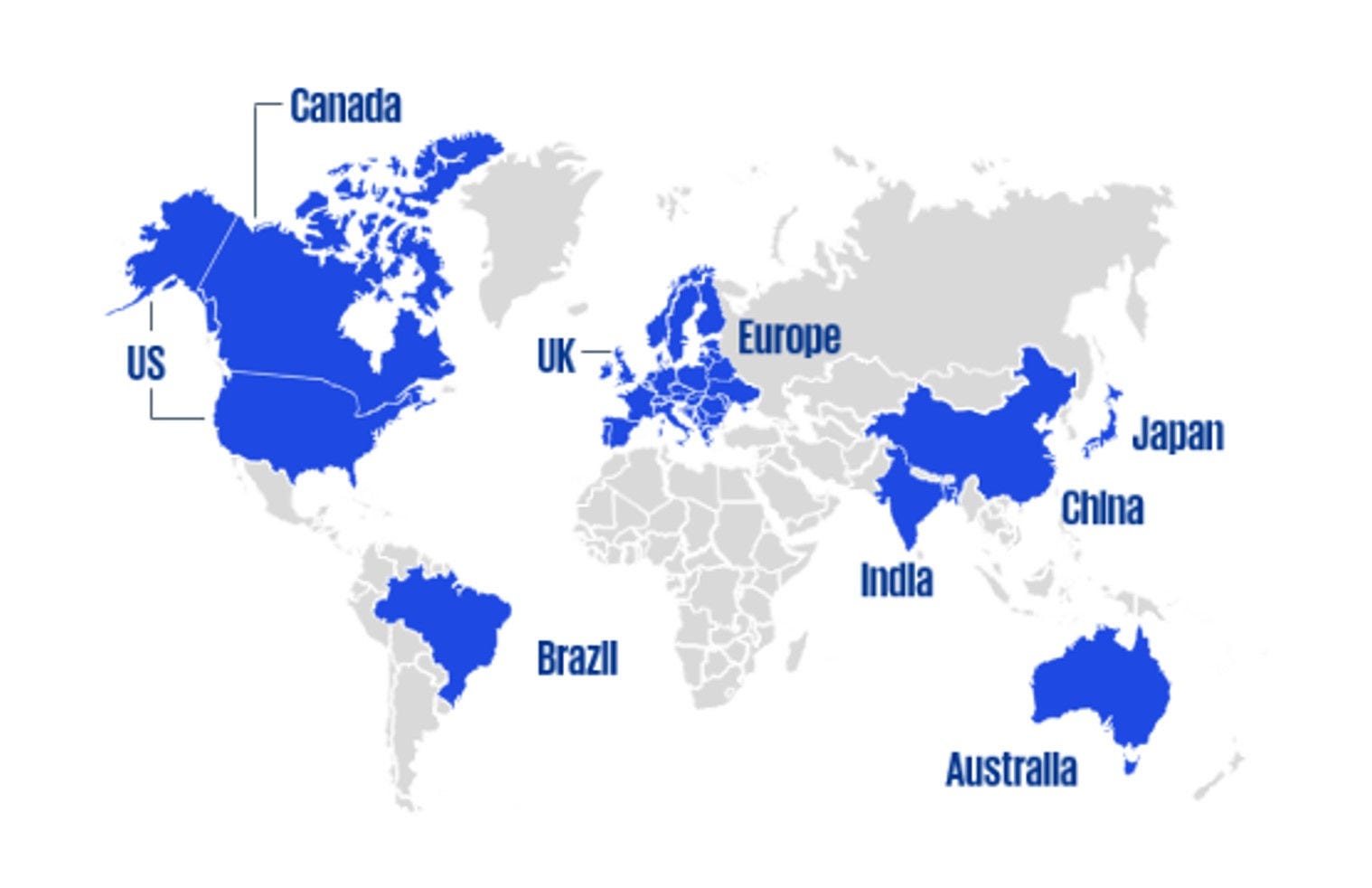

Our analysis covers 33 banks

More content

© 2026 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.