November 2025

On Tuesday, 18 November, the European Central Bank (ECB) published its updated supervisory priorities for the years 2026-2028. As in previous years, the update is based on an extensive evaluation of the key risks and vulnerabilities facing significant institutions under its direct supervision. It also takes into account the advancements achieved in addressing priorities from previous years, alongside the findings of the 2025 Supervisory Review and Evaluation Process (SREP), which were published on the same day. The ECB also published their methodologies for some elements of the SREP, including their supervisory methodology 2025, thereby continuing their recent move towards more transparency of their supervisory processes.

The priorities once again start with a relatively positive tone: the ECB states that eurozone banks continue to report robust capital and liquidity positions, low levels of non-performing loans and historically strong profitability, despite the unprecedented challenging macro-financial and geopolitical backdrop. This resilience reflects not only strengthened prudential and supervisory frameworks since the global financial crisis, but also banks’ progress in cleaning up legacy asset quality issues and bolstering buffers over recent years.

At the same time, the ECB again emphasises that uncertainty remains elevated. As in prior year, the ECB references persistent geopolitical tensions, the potential for renewed macro-financial shocks, and shifting trade and policy dynamics that all increase the risk of abrupt, severe disruptions. The ECB therefore calls on banks to remain vigilant, regularly reassess the implications of geopolitical developments for their risk profiles and be prepared for tail-risk scenarios that may materialise more quickly than in the past.

As we noted in last year’s priorities, the ECB highlights the increasingly “cross-cutting nature” of geopolitical shocks. Thus, geopolitical risks would be part of both “prioritised and regular supervisory activity”, meaning that supervisors will embed geopolitical risks in their day-to-day work with banks.

Building on this holistic approach, the ECB calls for banks to further strengthen their efforts to address material shortcomings that have already been identified by supervisors in previous cycles. Unsurprisingly, risk data aggregation and risk reporting (RDARR) is again explicitly highlighted, as is the need for full alignment with the ECB’s expectations for climate- and nature-related (C&N) risks. The ECB also stresses that banks must ensure that governance, internal controls and data capabilities evolve in line with the growing complexity of emerging risks, including those arising from new technologies and changing operational-resilience demands. At the same time, the ECB underscores the continued importance of strengthening digitalisation strategies and enhancing the management of risks associated with advanced technologies. In particular, the ECB notes the accelerating adoption of artificial intelligence (AI) and the rapidly expanding reliance on third-party providers for critical services. Supervisors will therefore deepen their scrutiny of ICT risk management, cyber resilience, third party risk management arrangements and the implementation of digital-transformation strategies across banks of all sizes.

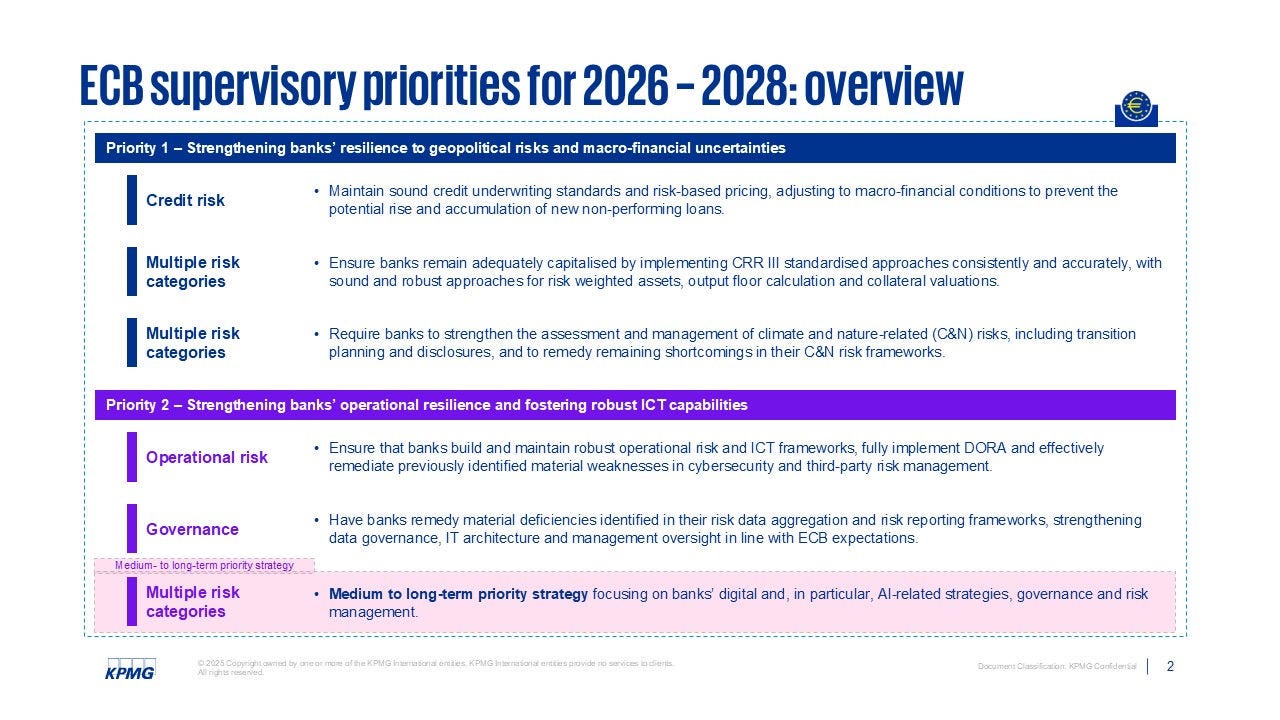

Against this background, the ECB priorities for 2026-2028 are twofold. Both priorities address a specific set of vulnerabilities – which the ECB has named “prioritised vulnerabilities” and for which dedicated strategic objectives have been set and work programmes have been developed, as was the case in prior year We have summarised both priorities and the associated vulnerabilities below: