October 2025

Stress and Resilience

On 1 August the European Banking Authority (EBA) and European Central Bank (ECB) published the results of 2025 EU-wide Stress Test. As we wrote then, the Stress Test results show European banks remaining resilient through a hypothetical adverse economic scenario, with the aggregate CET 1 capital ratio falling by 370 bps to just over 12 per cent.

2026: Geopolitical stress

Around the same time, the ECB began disclosing more details of its next stress test, to be conducted in 2026. (The ECB conducts a so-called ‘thematic stress test’ on all banks under its direct supervision in the years between the biennial EBA-ECB EU-wide stress test.) At a hearing before the European Parliament Economic Affairs Committee on 15 July, Supervisory Board Chair Claudia Buch said the 2026 exercise would be a ‘reverse stress test’ focusing on geopolitical risk. The ECB has been repeatedly highlighting increased geopolitical tension as an important new factor in a changing risk environment, and has made ensuring banks’ resilience in the face of geopolitical risk a key supervisory priority.

Buch told MEPs that in 2026 the ECB will ask banks “to assess which firm-specific geopolitical risk scenarios could severely impact their solvency.” This will be conducted in the context of banks’ internal capital adequacy assessment process (ICAAP). In an interview the following day, ECB Supervisory Board member Anneli Tuominen further explained how the stress test may be run: “a bank might be asked to assume that its CET1 capital ratio decreases by 300 basis points, and then it will need to work out what kind of geopolitical scenarios could cause that to happen.”

Getting prepared

The ECB has now begun preparing the stress test methodology and templates, and is seeking industry input. The main financial metrics will be gathered in an adapted version of the Financial Projections template used for the Short Term Exercise reporting requirement. Alongside this banks will likely need to document their chosen scenario and analysis of its impact. Further instructions for this will be published in Q4, assuming the ECB sticks to the timetable for previous thematic stress tests. The test itself would then begin at the start of 2026, with the deadline for returns falling in Q2.

To prepare for the stress test, banks should review the key dependencies and vulnerabilities of their current business model. These could include concentration of lending in sectors exposed to geopolitical risks, or reliance on services or infrastructure located in potential unstable geographies. The risk of geopolitically-motivated cyber attacks could also be a factor affecting many or all banks. Banks will then need to articulate plausible geopolitical scenarios in which risks affecting these vulnerabilities crystallise to produce the loss specified by the ECB.

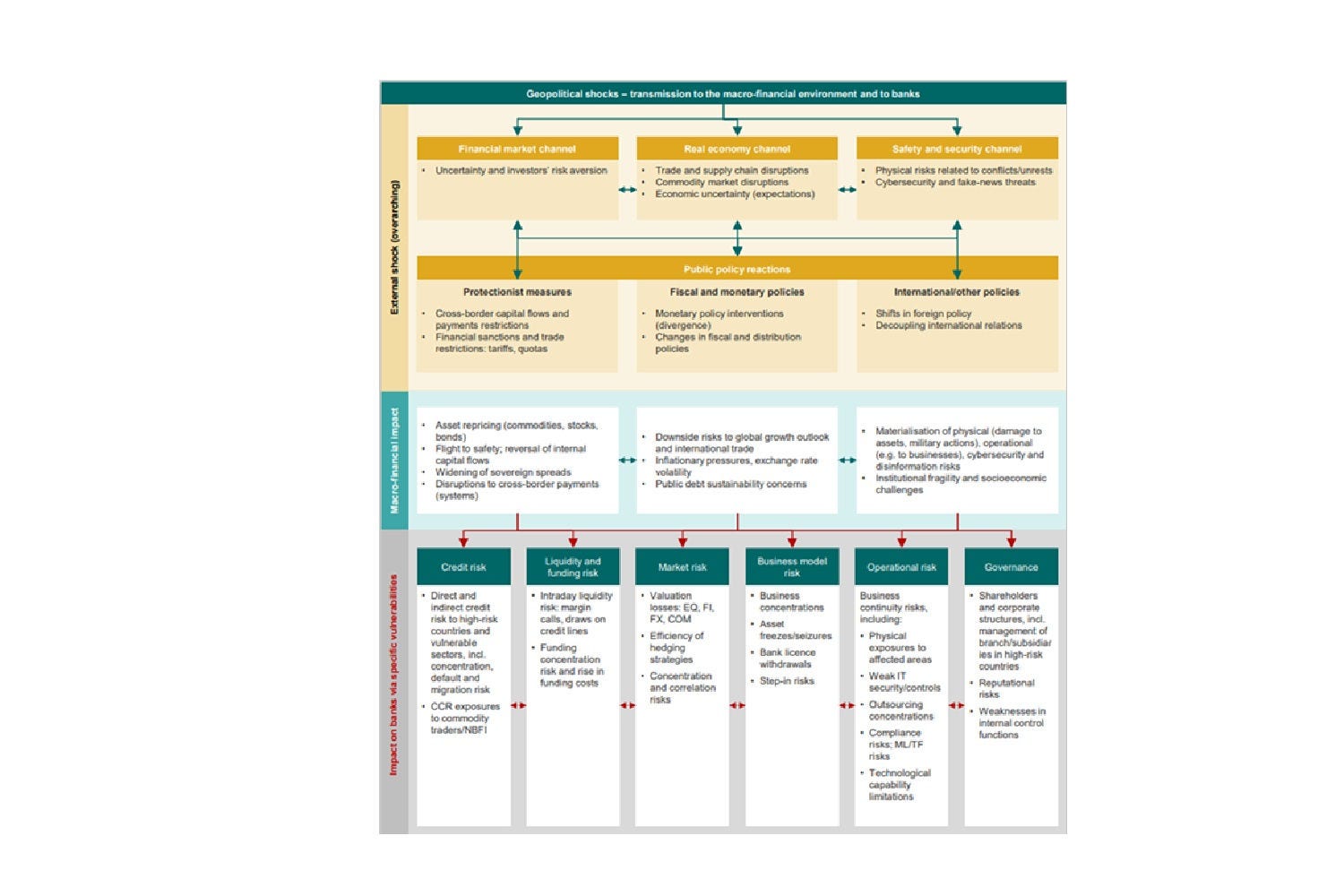

In working through their scenarios, banks should keep in mind the ECB’s framework for geopolitical risk, first published in September 2024.

Source: ECB

This framework sets out the ECB’s conception of how a geopolitical shock could be transmitted to banks - via financial market, real economy and safety and security channels – resulting in an impact on the full range of financial and non-financial risks that banks must manage (credit risk, liquidity and funding risk, market risk, etc). In their submissions, it is important that banks show supervisors that they have fully considered all of the transmission channels and risks that the ECB articulated.

Old and new tools

Stress testing has become an established part of the prudential toolkit. As Buch stated in a recent blog post, it is an imperfect but crucial tool for testing banks’ ability to withstand economic shocks. And the ECB will continue to pressure banks to improve their internal stress testing capabilities.

Yet Buch also noted that in the face of radical uncertainty about the future, banks and supervisors also need new tools to ensure banks remain safe and sound. The geopolitical reverse stress test is a new adaptation of an established mechanism. Used well, it will allow banks, and supervisors, to dig deeper into their businesses and understand their main points of vulnerability. That could provide a basis for further improvement in the quality of banks’ business strategies, risk management and operating models.