Insurers’ sustainability-related disclosures continue to evolve in a landscape of new reporting standards and increasing investor expectations.

At the same time, insurers are reporting in a context of more frequent and extreme weather-related events affecting both the insurance industry and society.

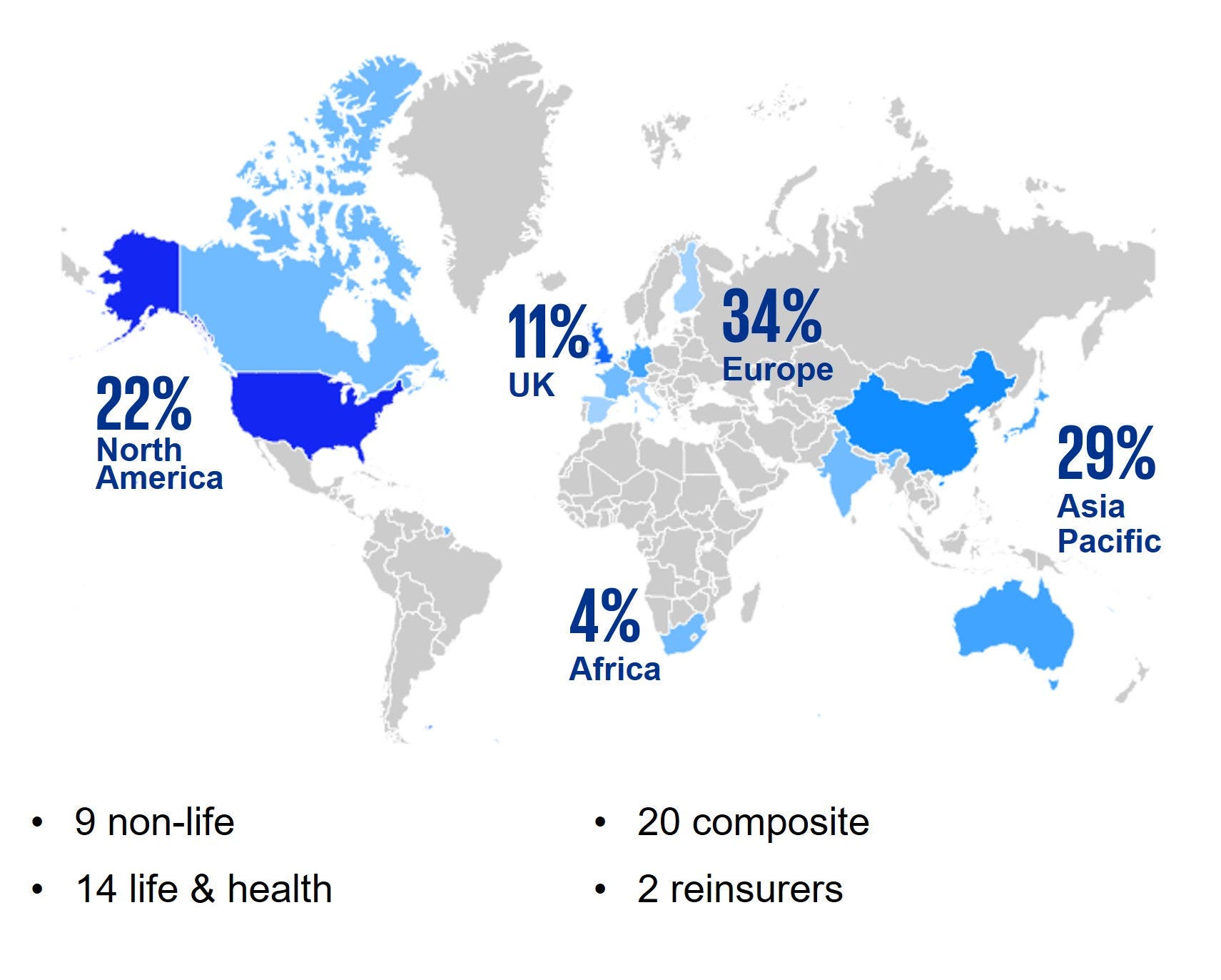

Our 2024 benchmarking analysis of sustainability-related disclosures covers 45 major insurers. It focuses on five key areas for insurers in their sustainability reporting:

- transition and extreme weather action plans;

- financed and insurance-associated emissions;

- nature and biodiversity-related disclosures;

- consumers and end-users; and

- business conduct.

Synchronised reporting

Synchronising disclosures helps to improve the coherence and connectivity of reporting. Insurers in the EU, the UK, Australia and China are most likely to publish their financial and sustainability reports simultaneously.

Transition plans

Transition plans, based on an understanding of underlying pathways and associated risks, are essential to achieving net-zero goals. More insurers are publishing transition plans – up from 34 percent in our 2023 analysis.

Financed and insurance-associated emissions

Insurers face difficulties in sourcing reliable data for financed and insurance-associated emissions. More than two-thirds disclose data challenges.

Nature- and biodiversity-related disclosures

Nature and biodiversity are gaining attention in insurers' risk management policies. Those that acknowledge potential impacts of investment on nature and biodiversity are incorporating biodiversity themes into their investment policies and strategies.

Business conduct

European insurers reporting under the Corporate and Sustainability Reporting Directive (CSRD) are the most likely to disclose quantitative metrics and targets. The most common corporate governance and business conduct disclosures are attendance rates for training programmes, the executive gender balance and complaint levels.

Our analysis covers 45 insurers

More content

© 2026 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.