(This article was published on 26 November 2024 and updated on 26 November 2025)

Companies typically use the discounted cash flow (DCF) technique to calculate the recoverable amount. The rate applied to discount the cash flows is based on a market participant's view of the asset (or cash-generating unit (CGU)) – for both value in use (VIU) and fair value less costs of disposal (FVLCD).

[IAS 36.55–56, A16, IFRS 13.B14(a)]

In our experience, the most common approach to estimating an appropriate discount rate is to use the weighted-average cost of capital (WACC) formula. One component of the WACC is the cost of equity, which is typically calculated using the Capital Asset Pricing Model (CAPM). Climate-related matters may affect two inputs that are used to calculate the cost of equity using the CAPM – the alpha and beta factors. [IAS 36.A17(a), Insights 3.10.300.30].

For a more detailed discussion on how to reflect the impact of climate-related matters on the discount rate, see our article What’s the impact on the discount rate used in testing non-current assets for impairment?

Your questions answered

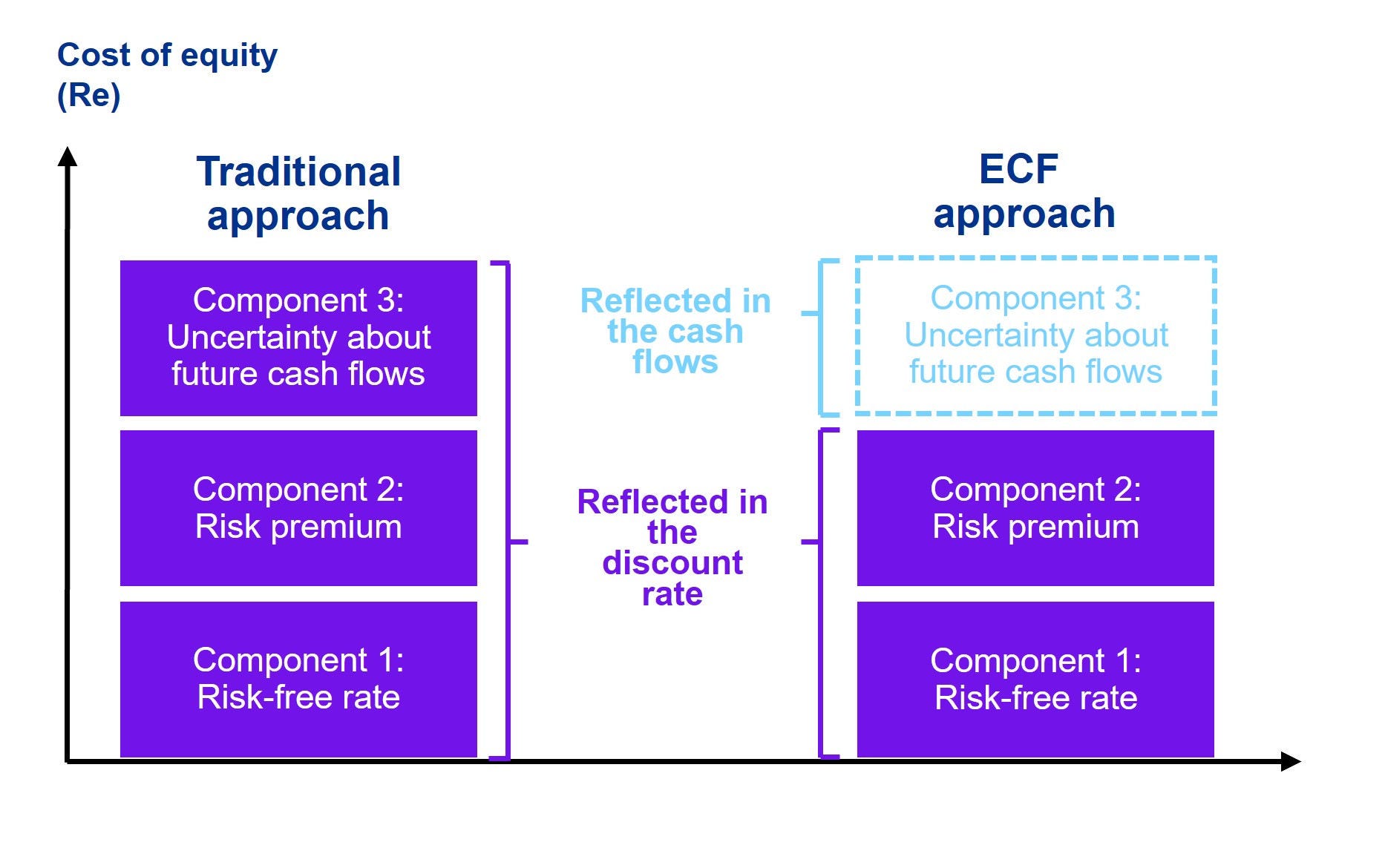

Under the traditional approach, an adjustment is made for any cash flow uncertainty not captured in the single cash flow projection. This adjustment is made to the WACC through the alpha factor in the cost of equity.

In contrast, under the expected cash flow (ECF) approach (see Cash flow projections: Question 3), the uncertainty about the future cash flows is considered in estimating the cash flows and the probabilities attached to them. If this is the case, then the cost of equity would not include a risk premium for this uncertainty.

Therefore, the WACC used under the ECF approach is usually lower than under the traditional approach. The diagram below highlights the differences between the traditional and ECF approach. [Insights 3.10.220.40–90]

If the uncertainty of future cash flows is very low, then the single cash flow estimate used in the traditional approach may be very similar to the expected cash flows under the ECF approach. In this case, the WACC under both approaches would also be very similar.

The beta factor reflects the risk of the industry or sector in which the CGU operates, relative to the market risk as a whole (systematic risk). Systematic risk is macroeconomic in nature and reflects the general risk that all companies in the industry or sector are exposed to. Climate-related risks such as the future price of carbon or customers’ sensitivity to climate-related factors may apply to the whole industry or sector and, in such cases, should be reflected in the industry beta if their effects are significant.

The beta factor is typically estimated based on the betas of comparable companies in the relevant sector or industry. If climate-related matters are significant, then they are considered when identifying comparable companies. [Insights 3.10.300.140]

Companies in the same industry can have significantly different exposures (or degrees of exposure) to climate-related matters. This is because of, for example, differences in their location, the applicable legislation and their strategies – some companies are proactive, others are not. A company needs to consider this when identifying comparable companies.

For example, in some jurisdictions, large public oil and gas companies are increasingly diversifying away from purely extractive activities and selling assets that emit high greenhouse gas levels; small private companies may be less likely to do so.

Beta is a medium-term measure – it is typically based on historical data over a two- to five-year period. A five-year beta factor may not (fully) reflect climate-related matters – e.g. in markets where companies have recently started providing climate-related information. Climate-related risks that are industry-wide and significant may be reflected in the beta factor; this depends on whether the risks are priced by the market and the time span over which the beta is measured.

For the interaction of the beta factor with the alpha factor, see Question 3.

An alpha factor reflects a CGU-specific risk premium that may need to be added to the cost of equity when a CGU is determined to carry additional risk – i.e. risk that cannot be attributed to market risk (unsystematic risk) that would affect a market participant’s required rate of return.

To assess whether the alpha factor could be affected, a company considers circumstances in which an alpha factor may need to be included for the WACC to reflect the rate of return required by a market participant. For example, the following circumstances may be considered.

| Circumstance | Potential effect on the alpha factor |

The CGU having a distinctive climate-related strategy which is significantly different from those of the comparable companies and not reflected in the calculated beta | The impact of the company’s strategy is reflected in the expected cash flows. Nevertheless, the WACC may also be affected. A market participant may require a higher return if the company’s strategy is not expected to significantly reduce the impact of industry-wide climate-related physical or transition risks, unlike the strategies of industry peers. If this is not reflected in the beta then an alpha factor may need to be added. |

The industry beta not sufficiently reflecting the return required for bearing the industry-wide climate-related risks | A market participant may require a higher return if the industry beta is calculated based on historical data from markets where companies have only recently started providing climate-related information. |

The CGU being significantly exposed to physical risks (e.g. storms or flooding) which the group of comparable companies are not | Although these risks are reflected in the cash flow projections, a market participant may require a higher return as compensation for bearing the higher uncertainty associated with the significantly increased likelihood and severity of possible negative outcomes. |

In the examples above, an adjustment to the WACC through the alpha factor is appropriate if it can be supported. Such adjustments need to be carefully considered to avoid double counting of risks.

To avoid double counting, a company needs to consider whether climate-related matters have been reflected elsewhere before adjusting the discount rate. A proposed adjustment to the discount rate for climate-related matters could already be reflected, directly or indirectly:

- in the cash flows; or

- in other components of the discount rate. [IAS 36.A15, IFRS 13.B14(b)]

Significant climate-related matters that are industry-wide may be reflected in the beta factor. For example, the automotive industry is significantly impacted by climate-related matters as a result of the influx of hybrid and electric vehicle competitors. Therefore, the industry beta factor may reflect this. If climate-related matters are reflected in the industry beta factor, then including or adjusting the alpha factor for the same climate-related matters would result in double counting.

Another example is when the alpha factor contains a premium for size risk. This premium considers smaller companies to be more risky than larger ones – e.g. because they are less likely to have the resources and expertise to mitigate climate-related risks or to take advantage of climate-related opportunities. As such, size premiums may implicitly account for some climate-related matters.

© 2026 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.